Polygon price continued its downtrend this week as cryptocurrencies continued to underperform the broader market. MATIC token was trading at $0.403 on Friday, a few points above its 2022 low of $0.3178.

Polygon has lost market share

MATIC has crashed by over 86% from its highest point on record, underperforming coins like Ethereum and Bitcoin. The most likely reason for this is that the network has continued to lose market share in the layer-2 industry.

A good example of this is in the Decentralized Finance (DeFi) industry, where Polygon has dropped to position nine in ranking. It has over $811 million in total value locked (TVL), down from $10 billion a few years ago. It also has over $1.9 billion in stablecoin market cap.

At its peak, Polygon was one of the top four in terms of assets after Ethereum, BNB Chain, and Tron. It has now been passed by other layer-2 networks like Arbitrum, Base, and Blast, which have over $2.6 billion, $1.24 billion, and $849 million.

Polygon has also lost market share in the Decentralized Exchange (DEX) industry. Data shows that it is the sixth-biggest chain among DEXes after Ethereum, Solana, Arbitrum, BNB Chain, and Base. It handled $725 million in the last seven days compared to Arbitrum’s $4.9 billion.

The same trend has happened in other areas. For example, Polygon does not have a big market share in the Decentralized Public Infrastructure Network (DePIN) industry that is now dominated by Solana.

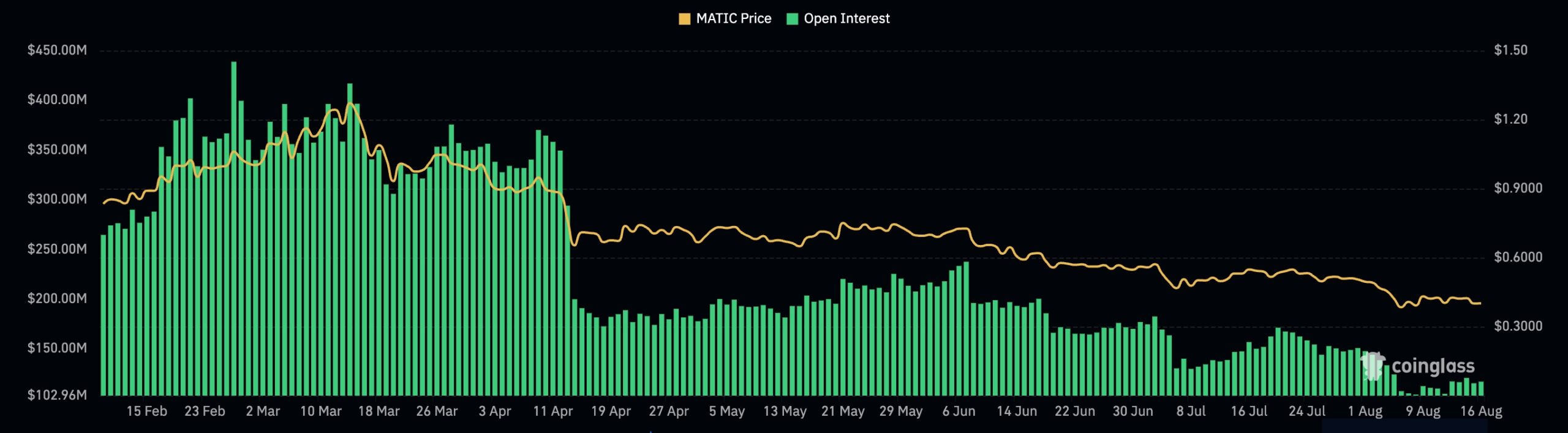

Meanwhile, data by TokenTerminal shows that Polygon has also been overtaken in terms of fees as it does not rank in the top 20 this year. Base, on the other hand, has collected fees worth $55.5 million. Demand for the token has also dropped in the futures market as the open interest has dried up.

Polygon price nears key support

Looking at the weekly chart, we see that the MATIC price has been in a steep sell-off in the past few weeks. This drop happened as the token formed a double-top pattern at $1.3028 and whose neckline was at $0.4895. In most periods, this is one of the most bearish patterns in the market.

The token has now dropped below the neckline at $0.4895 and is nearing the key support at $0.3176, its lowest point on record. Some analysts believe that this is the best time to accumulate the token.

Besides, the accumulation and distribution indicator has remained at an elevated level. Also, it has formed a small doji pattern, a popular reversal sign.

While this could be a good time to accumulate, there is a risk that the downtrend could continue, especially if the price drops below the support at $0.3175. Such a move would mean that bulls have prevailed and see it drop to the next key support at $0.250.