Since launching 12 years ago, Bankless Times has brought unbiased news and leading comparison in the crypto & financial markets. Our articles and guides are based on high quality, fact checked research with our readers best interests at heart, and we seek to apply our vigorous journalistic standards to all of our efforts.

BanklessTimes.com is dedicated to helping customers learn more about trading, investing and the future of finance. We accept commission from some of the providers on our site, and this may affect where they are positioned on our lists. This affiliate advertising model allows us to continue providing content to our readers for free. Our reviews are not influenced by this and are impartial. You can find out more about our business model here.

Binance Review 2025

Binance is one of the largest cryptocurrency exchanges in the world, offering access to over 400 supported cryptocurrencies. It supports spot, futures, and derivatives trading with highly competitive maker/taker fees starting at just 0.1%. Designed for both retail and institutional traders, Binance has earned a reputation for its robust liquidity, expansive trading tools, and innovative features.

The platform operates regionally through regulated entities in key markets like the US, EU, UK, and Australia. This localisation helps Binance comply with varying international regulations while maintaining access to a unified trading experience.

While its interface requires more learning time than platforms like Coinbase or eToro, Binance has implemented interface improvements aimed at making the platform more accessible to newcomers while maintaining tools for advanced traders.

Key Takeaways

-

Maker/taker fees start at 0.1% and drop with volume and BNB holdings.

-

Supports over 400 cryptocurrencies worldwide (165+ in the US)

-

Includes cold storage (90% of funds), SAFU fund (~$1B), 2FA, and address whitelisting.

-

Full-featured iOS/Android apps with advanced charts and order types.

-

Offers staking, NFT marketplace, margin and futures trading, and yield products.

- What is Binance?

- Pros and Cons of Binance

- Is Binance a Good Exchange to Use in 2025?

- Account Opening & Verification

- User Experience & Platform Design

- Fees Breakdown

- Safety & Regulation

- Trading Features & Tools

- Supported Cryptocurrencies

- Wallet & Custody Options

- Deposits & Withdrawals

- Learning & Research Tools

- Customer Support Experience

- Geographic Access & Licensing Per Region

- Reputation & Real-World Reviews

- Tax & Legal Compliance

- Staking & Yield Options

- Advanced Trading Tools

- Expert Verdict

- FAQs

Investing in cryptocurrency involves significant risk, including the potential loss of principal. This is not investment or financial advice, and should not be construed as a recommendation. Binance does not offer CFDs to U.S. persons. Availability of features and cryptocurrencies varies by region and is subject to local regulations. Tax obligations may apply depending on your jurisdiction. Please conduct your own due diligence before investing in digital assets.

What is Binance?

Binance is a global cryptocurrency exchange founded in 2017 by Changpeng Zhao and Yi He that has grown to become the world’s largest digital asset trading platform by volume.

It processes over $150 billion in daily transactions across spot and derivatives markets, offering superior liquidity for most cryptocurrency pairs. Binance operates through multiple regional entities to meet local regulations, with Binance.US serving American customers.

Beyond trading services, Binance has developed a comprehensive ecosystem including the BNB Chain blockchain, Binance DEX decentralized exchange, Binance Labs venture capital division, and extensive educational resources.

Pros and Cons of Binance

✅ Pros

- Competitive fee structure with a 0.1% base maker/taker rate and multiple discount tiers.

- High liquidity across most trading pairs and markets.

- Integrated ecosystem including staking, NFT marketplace, and lending products.

- Advanced trading tools, including detailed charting, API access, and 100+ indicators.

- Regular platform updates with new features and supported crypto assets.

- Access to various fiat on-ramp options across different regions.

❌ Cons

- Fragmented user experience across different regional platforms (global, US, Australia).

- Complex interface with significant learning curve despite recent simplification efforts.

- Uncertain regulatory status in some jurisdictions with shifting compliance requirements.

- Higher customer support response times during periods of high market volatility.

- Limited phone support options compared to traditional financial platforms.

- High withdrawal fees for certain cryptocurrencies.

- Platform has experienced security breaches in the past, though customer funds were covered.

Is Binance a Good Exchange to Use in 2025?

Binance remains a strong option for experienced cryptocurrency traders in 2025. Its primary advantages include industry-leading liquidity, competitive fees starting at 0.1%, and access to over 400 cryptocurrencies. The exchange offers advanced trading tools, extensive market pairs, and a comprehensive ecosystem including the BNB Chain and decentralized exchange options.

However, Binance isn’t ideal for absolute beginners due to its complex interface and feature density. Regulatory concerns persist in certain jurisdictions, with regional versions like Binance.US offering different features and compliance frameworks. Security has improved following past incidents, though users should still implement proper security measures.

For traders who prioritize asset selection, advanced functionality, and competitive fees over simplicity, Binance may be suitable despite requiring more time to learn than simpler alternatives.

Account Opening & Verification

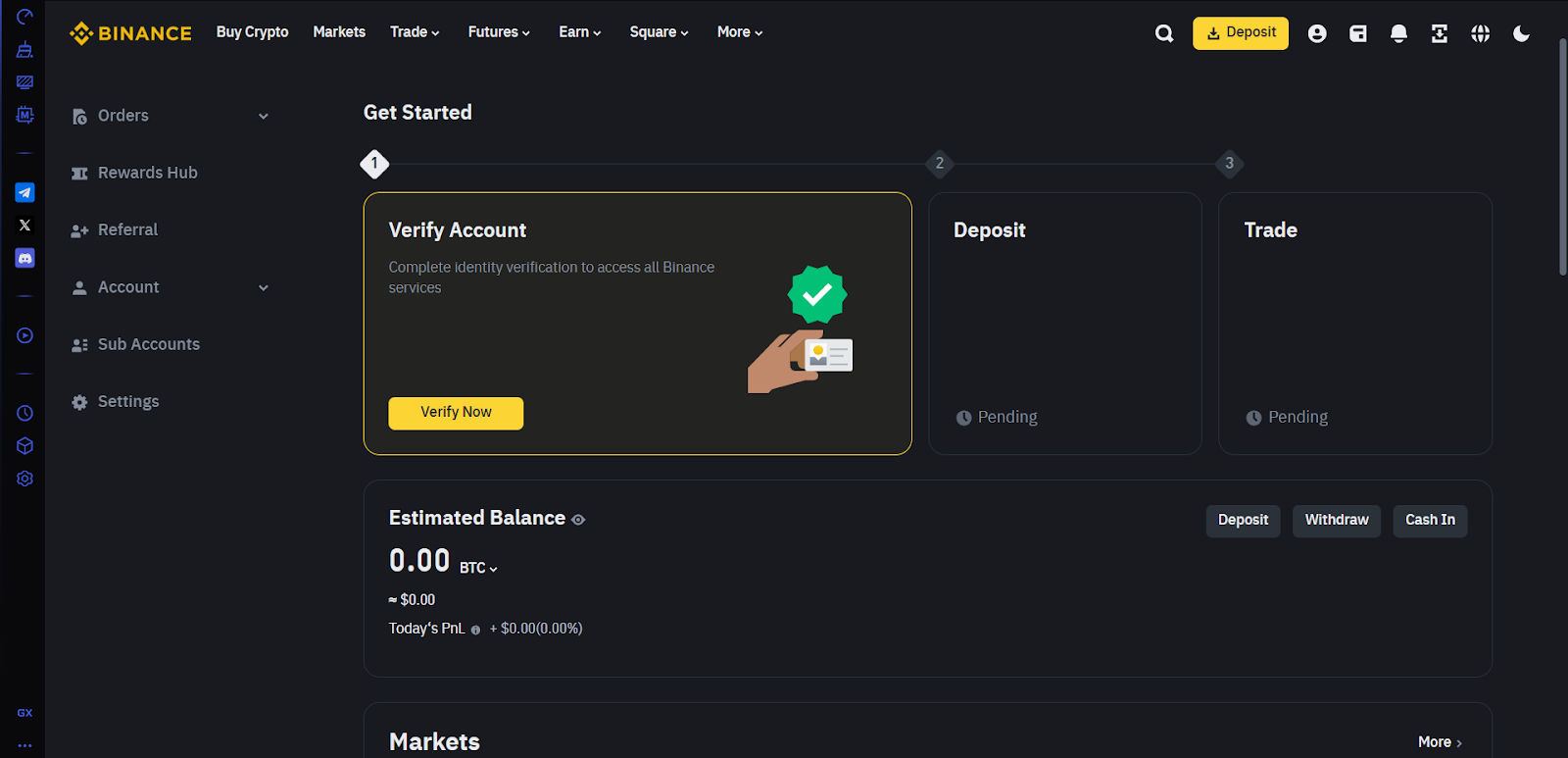

Creating a Binance account is quick and easy, with a streamlined registration process requiring email verification and password setup. The platform allows immediate access to basic functions but implements a tiered verification system to unlock higher deposit/withdrawal limits and enhanced features.

Basic verification requires personal information, identity document submission (passport, driver’s license, or government ID), and facial verification. The process usually takes 0-1 hour, though high-volume periods occasionally extend this timeline to 1-2 business days. The platform supports automated verification in most regions, reducing the manual review time.

Advanced verification (required for higher deposit and withdrawal limits) may include uploading proof of address and a brief video interview in certain jurisdictions. US users face more stringent requirements through Binance.US, including SSN verification and additional compliance checks.

Corporate accounts require business documentation, beneficial ownership information, and enhanced due diligence checks that typically take 3-5 business days to complete.

User Experience & Platform Design

Binance offers a comprehensive but complex trading interface with multiple chart options, order types, and customizable layouts. The platform maintains separate interfaces for beginners (Binance Lite) and advanced traders, though even the simplified version presents a steeper learning curve than many competitors. Navigation requires familiarization with cryptocurrency-specific terminology and trading concepts.

Web Interface

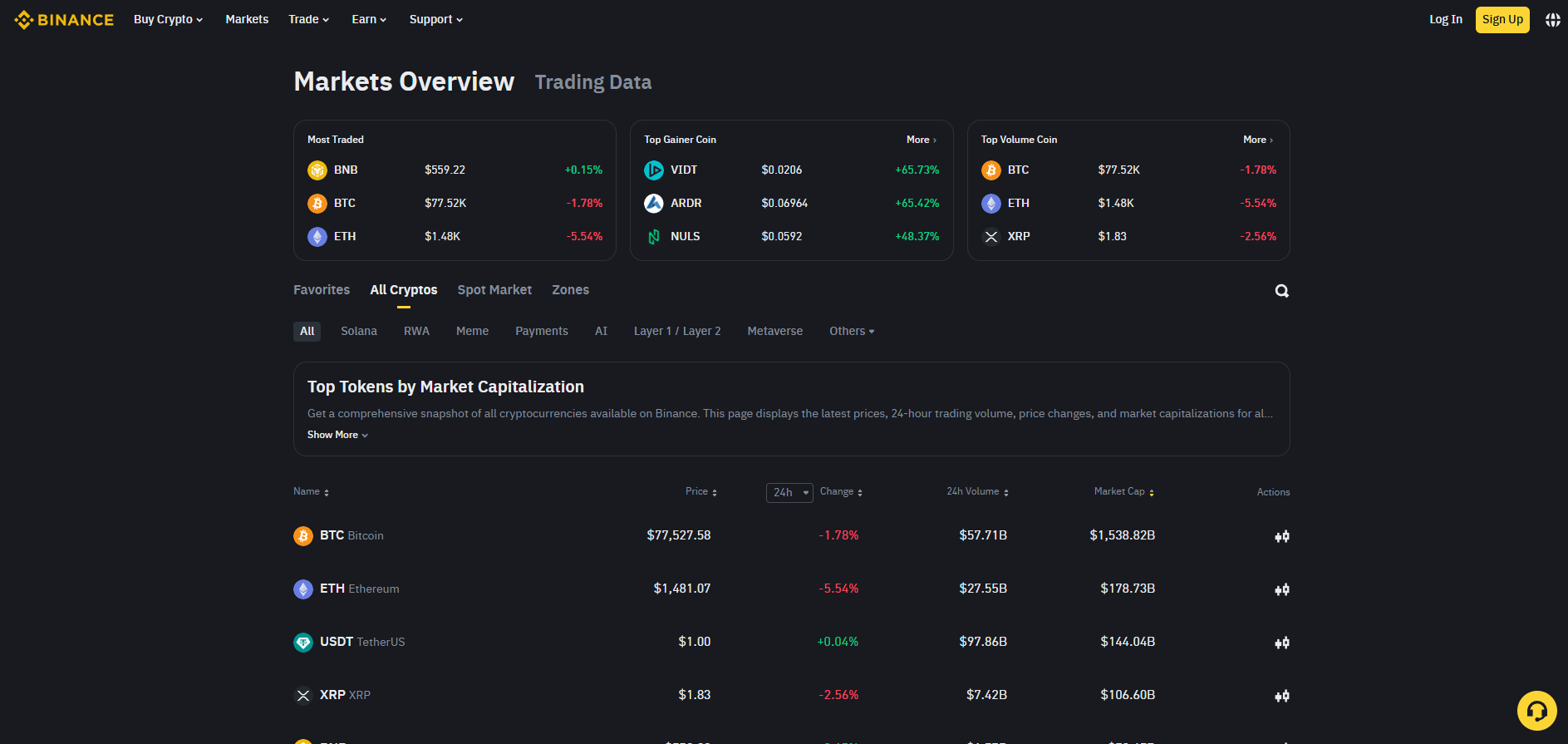

Binance’s web platform delivers professional-grade functionality through a modular interface that adapts to user experience levels. The dashboard presents market overviews, watchlists, and account information, while the main trading interface offers multiple customization options, including light/dark modes, grid layouts, and adjustable chart parameters.

The trading screen displays the order book, price charts, and execution panel simultaneously. Advanced features include depth charts, trade history, and customizable technical analysis tools with over 100 indicators.

The platform supports multiple order types, including market, limit, stop-limit, OCO (one-cancels-the-other), and trailing stops. The chart functionality resembles dedicated analysis platforms like TradingView, with drawing tools, indicator overlays, and multi-timeframe analysis.

We discovered that Binance’s interface customization is extensive compared to other centralized exchanges. As such, users can save multiple workspace configurations, create custom indicators, and develop personalized trading dashboards. However, this flexibility comes at the cost of a steep learning curve. It took approximately 2-3 days of regular use to fully understand the platform and its available options.

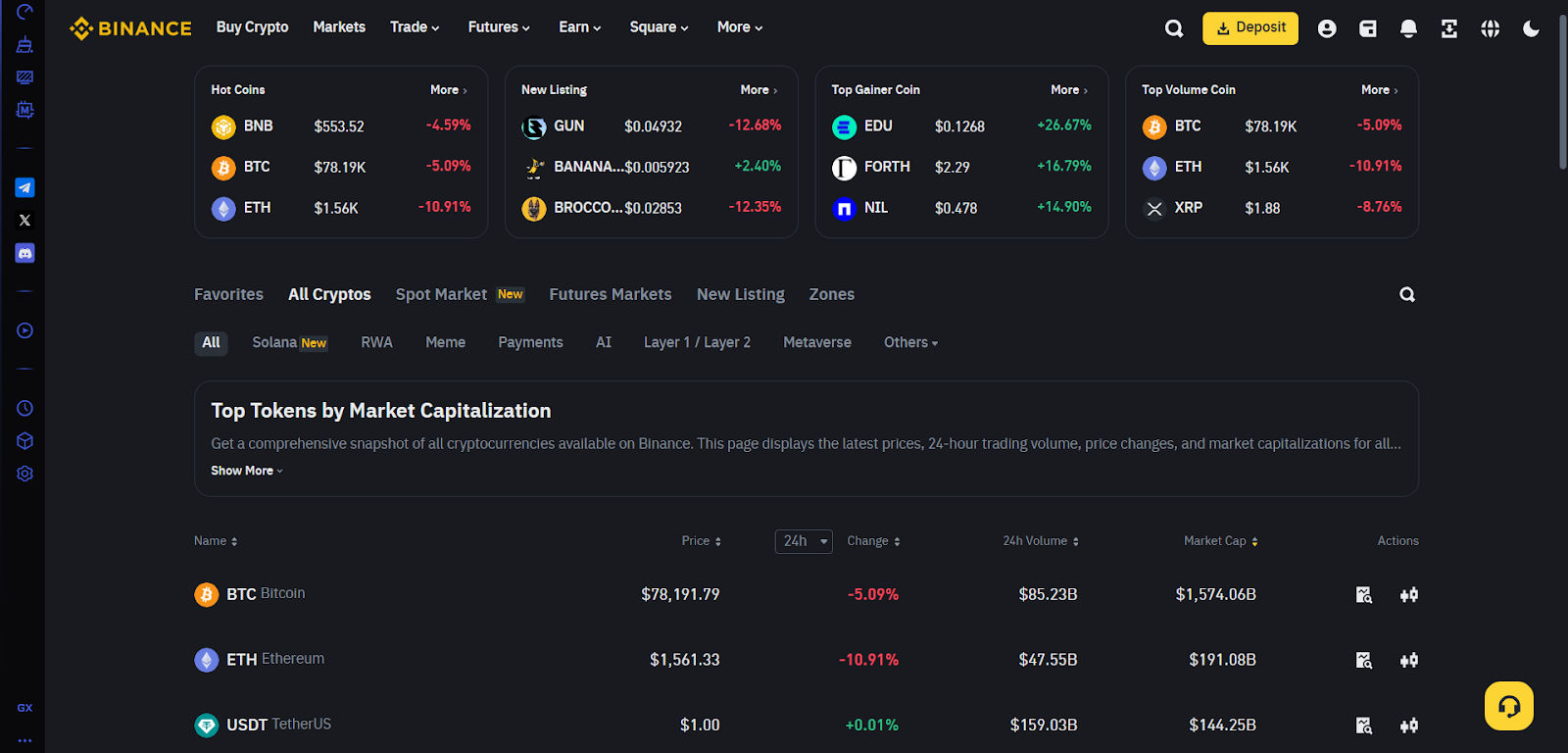

Binance’s desktop trading interface showcases the “Markets Overview” dashboard, featuring live token rankings by market cap, most traded assets, top gainers, and high-volume coins. The platform also enables filter-based exploration by crypto categories such as DeFi, AI, RWA, and Metaverse.

Mobile App Experience

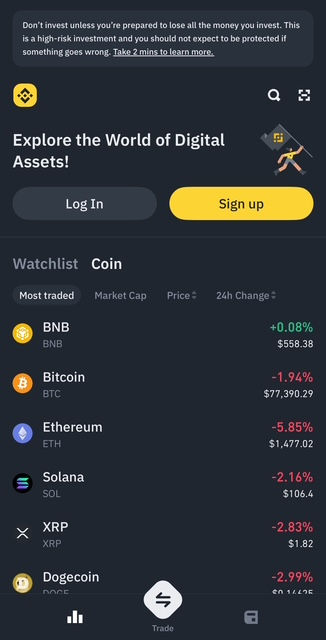

Binance’s mobile application maintains near-complete feature parity with the web platform while optimizing for smaller screens. Available on both iOS and Android devices, the app consistently ranks among the highest-rated crypto trading applications with 4.5+ star ratings across both app stores.

The mobile interface organizes functionality into five primary sections: Home, Markets, Trades, Futures, and Wallets. The trading interface adapts automatically to device orientation, displaying expanded charts in landscape mode while maintaining order entry functionality. Real-time price alerts, customizable watchlists, and portfolio tracking enable on-the-go management of trading strategies.

The app further implements industry-grade security features, such as biometric authentication (fingerprint/face recognition), device authorization, and withdrawal address whitelisting.

During our review, the app performed efficiently on mid-range and premium devices, with minimal battery impact during background price monitoring. Users can configure push notifications for trade executions, price movements, security alerts, and account activity.

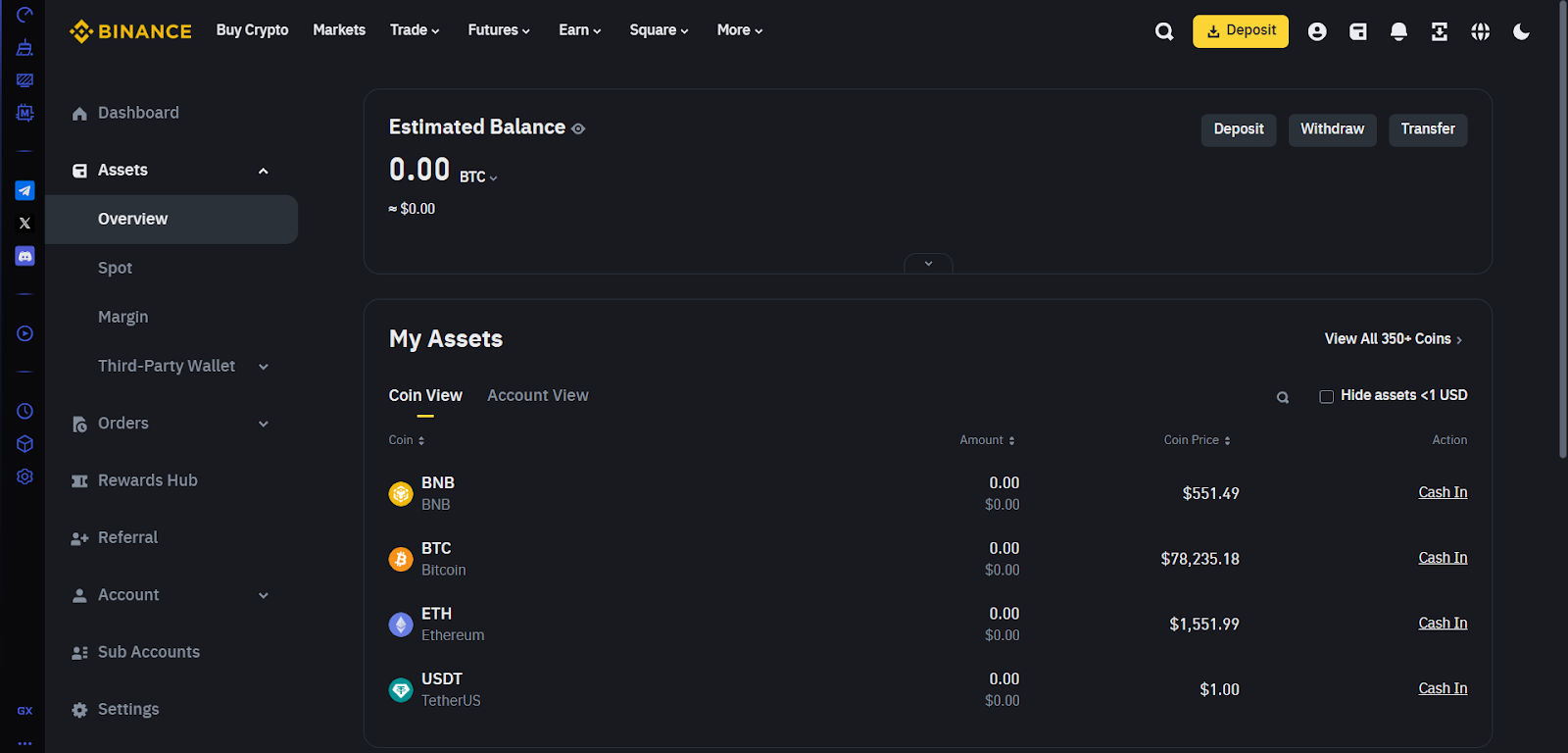

The Binance mobile app home screen provides real-time price data, a user-friendly interface for market exploration, and a high-risk investment warning for new users. Top cryptocurrencies like BNB, Bitcoin, and Ethereum are displayed alongside 24-hour performance metrics.

Fees Breakdown

Binance employs a volume-based tier structure for trading fees. If your 30-day trading volume is less than $1 million and/or your Binance coin (BNB) is equal to or greater than zero, your trading fee starts at 0.1% for both maker and taker orders. This base rate is much lower than that of many other competitors, but several discount mechanisms can reduce costs further. For instance, holding BNB provides a 25% fee reduction, while high-volume traders can access maker/taker rates for as low as 0.011% or 0.023% in the top VIP tiers.

| Fee Type | Amount | Notes |

| Spot Trading (Base) | 0.1% maker/taker | Further reduced with BNB and volume |

| Futures Trading | 0.08%/0.08% | Additional discounts available for high volume |

| Withdrawal Fee (Crypto) | Varies by asset | Network fee + small processing fee |

| Deposit Fee (Crypto) | Free | No charges for any cryptocurrency |

| Fiat Deposit (ACH/Bank) | Free to 0.5% | Varies by region and payment method |

| Credit Card Purchase | 1.8% to 3.5% | Higher than bank transfers |

| Conversion Between Stablecoins | 0% | Discounted trades between USDT, BUSD, USDC |

Spot trading fees are consistent across most cryptocurrency pairs, though some newer or low-liquidity tokens may have slightly higher fees. Margin trading fees are similar to that of spot trading. However, margin traders can expect additional interest on borrowed funds, with rates varying based on prevailing crypto market conditions.

Futures trading fees follow a similar tier structure but start slightly lower at 0.02%/0.05% (maker/taker) for most contracts.

Non-trading fees include cryptocurrency withdrawal charges that vary by network (typically approximating the blockchain transaction cost), while crypto deposits remain free. Fiat withdrawal fees vary by payment method and region.

According to the Binance fiat fee structure, bank transfer fees may range from 1-5% of the transaction. Notably, the platform doesn’t charge inactivity fees, and conversion between stablecoins is often discounted or free.

Safety & Regulation

Binance operates through multiple entities with varying regulatory statuses across different jurisdictions. The platform’s regulatory approach has evolved significantly, with dedicated regulated entities now serving major markets. Binance.US operates under MTL (Money Transmission License) in most US states, while the Australian and EU operations have secured appropriate local registrations.

For asset protection, Binance implements a comprehensive security framework, including the Secure Asset Fund for Users (SAFU), which allocates a portion of trading fees to an emergency insurance fund currently valued at nearly $1 billion. Approximately 90% of user cryptocurrencies are stored in air-gapped cold wallets with multi-signature authentication, while hot wallets maintain strict withdrawal limits and real-time monitoring.

Users can access security features such as mandatory two-factor authentication, anti-phishing codes, device management, IP and withdrawal address whitelisting, and advanced API permissions.

The platform has experienced two notable security incidents (2019 and 2022), though affected users were compensated through the SAFU fund. These incidents highlight the importance of maintaining proper security practices when using any cryptocurrency exchange, including Binance.

Trading Features & Tools

Binance provides a comprehensive set of trading tools for retail and institutional traders. The platform supports essential order types, including market, limit, stop-limit, OCO (one-cancels-the-other), plus advanced orders like trailing stops and post-only orders.

Charting capabilities include over 100 technical indicators, multiple timeframes from 1-minute to monthly, and customizable drawing tools for detailed market analysis.

For pro traders, Binance offers additional specialized tools such as automated trading bots and TWAP (time-weighted average price) execution for larger orders to minimize market impact. The platform also provides detailed market data, including orderbook heatmaps, trade history, and funding rates for derivatives.

The platform also provides robust API access, including WebSocket and REST (Representational State Transfer), which allows developers to access real-time data and manage their accounts.

During testing, we found the API documentation comprehensive and well-maintained, with code examples for multiple programming languages and regular updates to reflect platform changes.

Supported Cryptocurrencies

Binance offers one of the most extensive selections of cryptocurrencies in the industry, with over 400 tokens available on the international platform. Major assets include Bitcoin (BTC), Ethereum (ETH), Binance coin (BNB), Solana (SOL), and Cardano (ADA), alongside a wide range of DeFi tokens, stablecoins, and emerging projects. The platform typically adds a few tokens monthly after thorough technical and compliance reviews.

Cryptocurrency availability varies significantly by region due to regulatory requirements. Binance.US currently lists over 165 cryptocurrencies, while the Australian and European platforms offer around 350+ tokens. New asset listings often experience high volatility during their initial trading periods, though the platform has implemented qualifying periods and trading restrictions to reduce potential manipulation.

All major cryptocurrencies can be traded directly against USDT, BUSD, and USDC stablecoins. At the same time, select top assets offer fiat trading pairs in USD, EUR, GBP, and other local currencies, depending on the region.

Cross-pair trading (e.g., ETH/BTC, BNB/BTC, and BNB/ETH) enables direct exchanges between cryptocurrencies without requiring an intermediate stablecoin step. Traders should note that these pairs typically have lower liquidity than those traded against stablecoins.

The table below highlights a few cryptos available for trading on Binance Exchange.

| Top Cryptocurrencies | DeFi Tokens | Stablecoins | Meme Coins |

| Bitcoin (BTC) | Uniswap (UNI) | Tether (USDT) | Dogecoin (DOGE) |

| Ethereum (ETH) | Aave (AAVE) | USD Coin (USDC) | Shiba Inu (SHIB) |

| BNB | Compound (COMP) | Binance USD (BUSD) | Pepe (PEPE) |

| Solana (SOL) | Curve (CRV) | DAI | Floki Inu (FLOKI) |

| XRP | SushiSwap (SUSHI) | TrueUSD (TUSD) | BONK |

Wallet & Custody Options

Binance operates primarily as a custodial exchange, meaning the platform controls the private keys for assets held on the exchange. Users receive a dedicated deposit address for each supported cryptocurrency, with funds stored in Binance’s institutional-grade wallet infrastructure. While this centralized approach simplifies the user experience, it requires trusting the platform with asset custody.

For users who prefer self-custody, Binance integrates directly with its native wallet (Binance Wallet), which supports thousands of cryptocurrencies across multiple blockchains. Assets can be transferred to the wallet at reduced costs compared when transferring to external wallets.

Binance Wallet also provides full control of private keys, offers staking options to earn yields on your assets, and provides advanced multi-party computation for unparalleled security.

Withdrawal from Binance to external wallets typically takes minutes for most cryptocurrencies, though some networks may experience longer confirmation times during periods of congestion.

The platform supports multiple blockchain networks for certain assets. For example, USDT can be withdrawn via Ethereum (ERC-20), Tron (TRC-20), or BNB Smart Chain (BEP-20), allowing users to optimize for lower fees or faster transfers depending on their needs.

Deposits & Withdrawals

There are various options for funding your Binance account, and they vary by region or regulatory status. Crypto deposits are processed almost instantly, with confirmations determined by the respective blockchain network. After a few network confirmations, the tokens become available in the dedicated wallet provided by Binance.

The platform supports deposits across multiple networks for compatible assets (such as USDT on Ethereum, Tron, or BNB Smart Chain). This allows users to optimize for lower fees or faster confirmation times.

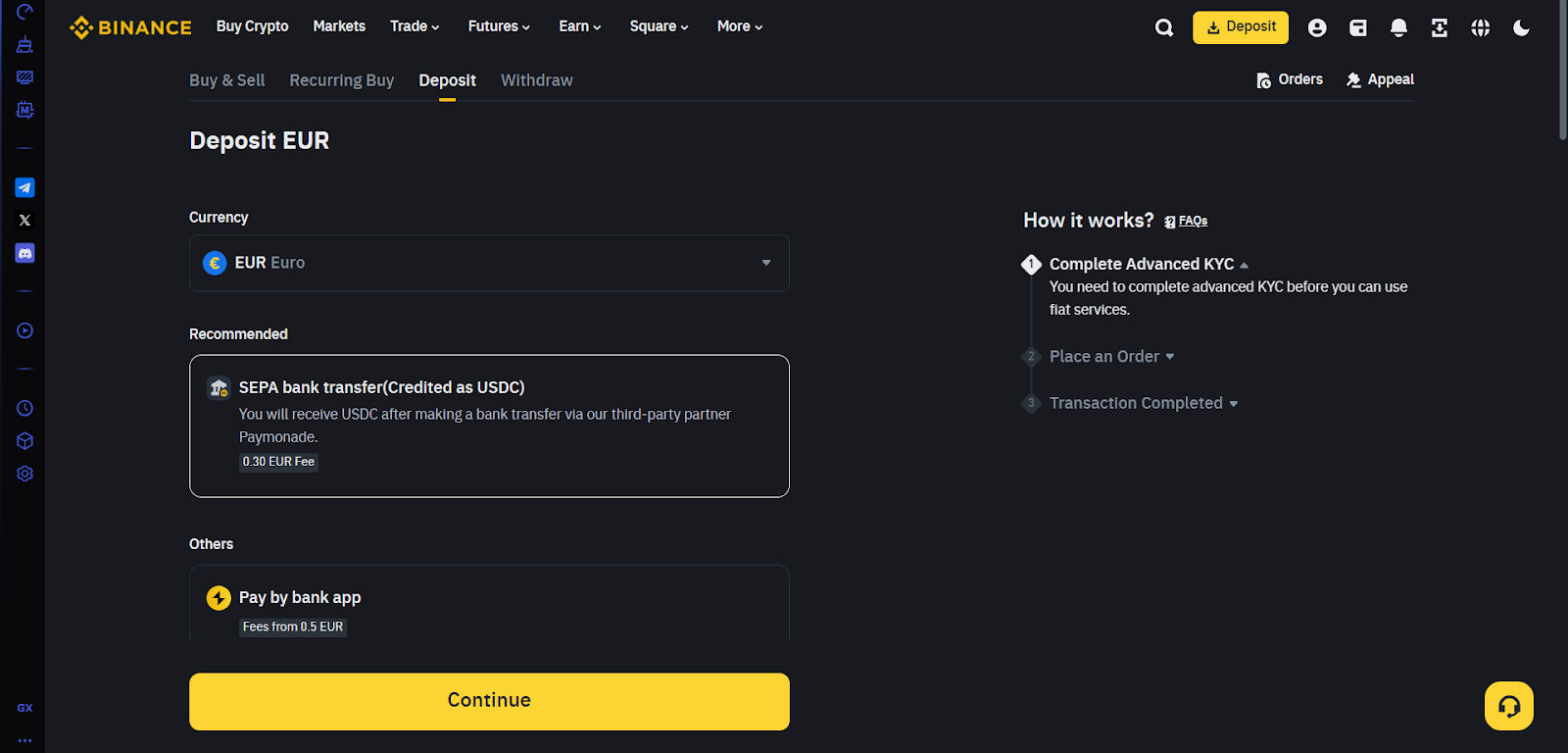

Fiat deposit methods include bank transfers (ACH/SEPA), credit/debit cards, and various local payment services, depending on your region. Bank transfers typically take 1-2 business days to process with minimal fees (for example, depositing in Euros requires a fee of 1 EUR). Card (Visa/Mastercard) purchases incur higher fees of up to 2% but are completely instant.

Notably, Binance has expanded local payment integrations significantly, now supporting options like Pix in Brazil, UPI in India, and OSKO in Australia.

Withdrawals follow similar channels. Depending on the blockchain confirmation times, crypto transfers are typically processed within minutes. Fiat withdrawals via bank transfer can take 1-5 business days, depending on banking networks and region, with fees ranging from $0-15.

Withdrawal limits increase with verification level—basic verified accounts can withdraw up to $50,000 or its equivalent daily, while advanced verification enables limits of $1,000,000 or more for institutional clients. During high-volatility periods, the platform occasionally implements brief withdrawal delays as a security measure.

The table below summarizes the deposit and withdrawal times as well as the fees for different methods.

| Method | Deposit Time | Deposit Fee | Withdrawal Time | Withdrawal Fee |

| Cryptocurrency | Network dependent | Free | Network dependent | Varies by network |

| Bank Transfer (ACH/SEPA) | 1-3 business days | Free to 1 EUR | 1-5 business days | $0-15 |

| Credit/Debit Card | Instant | ~2% | N/A | N/A |

| Third-party Payment | Same day | Varies by method | 1-3 business days | Varies by method |

Learning & Research Tools

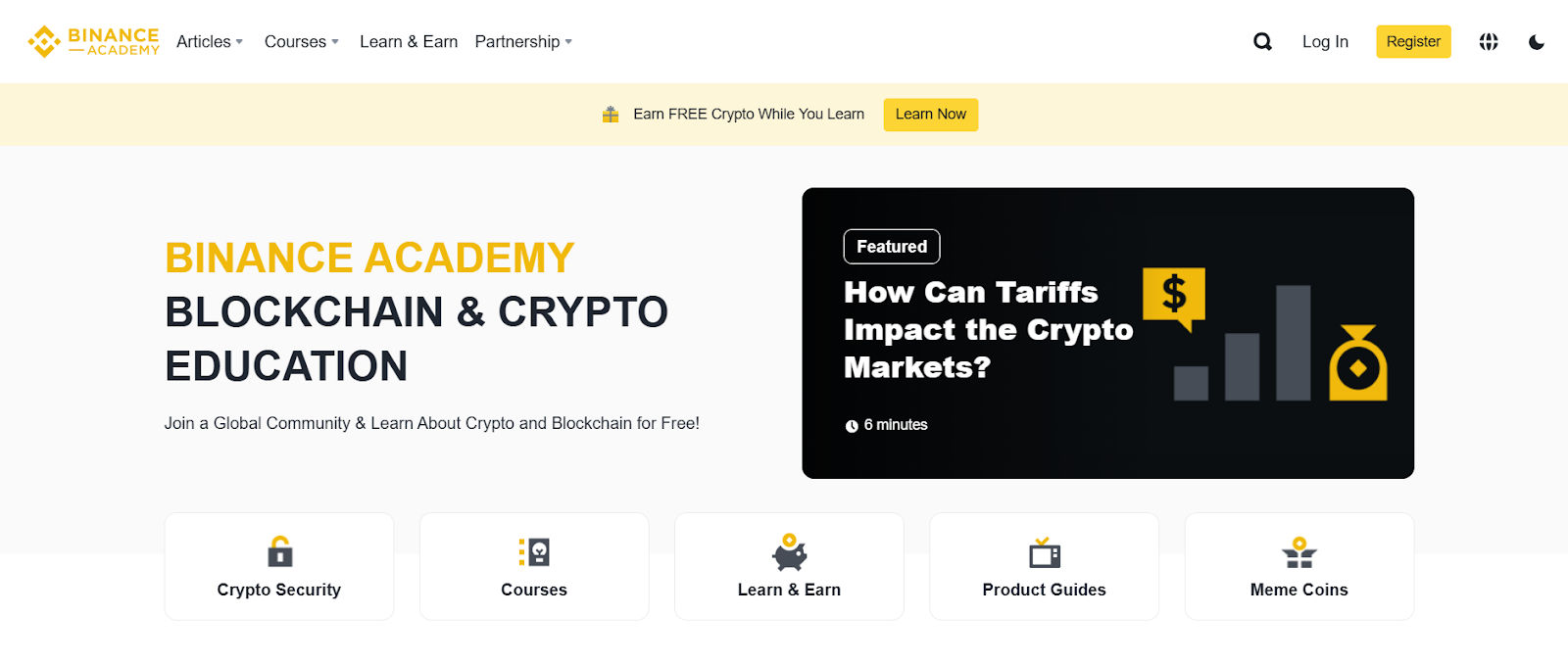

Binance has developed one of the most comprehensive educational ecosystems in the cryptocurrency industry through Binance Academy. This free resource provides structured learning paths for beginners and pro traders, covering cryptocurrency fundamentals, trading strategies, security practices, and blockchain technology. Content formats include written guides, video tutorials, interactive quizzes, and webinars, all available in multiple languages.

The platform’s research arm, Binance Research, produces detailed reports on cryptocurrency projects, market trends, and technical developments. These institutional-grade analyses include tokenomics evaluations, consensus mechanism breakdowns, on-chain metrics, and comparative studies between competing protocols. Our evaluation found these reports particularly valuable for understanding fundamental projects’ value beyond short-term price movements.

The Academy also provides trading-focused education, including skill development through Binance’s demo trading environment, which provides $100,000 in virtual funds for risk-free practice. Technical analysis courses cover chart pattern recognition, indicator usage, and risk management strategies specific to cryptocurrency markets.

Advanced topics include futures trading mechanics, options strategies, and algorithmic trading concepts. The platform frequently hosts live trading workshops led by professional analysts, with recordings available afterward through the Academy portal.

Customer Support Experience

Binance offers support through multiple channels, including live chat, a ticket system, and an extensive help center. Response times vary significantly based on market conditions and query complexity. For basic account questions, automated AI assists, and self-service options typically resolve issues within minutes. Technical problems or compliance questions may take several hours during normal trading periods to get resolved.

Live chat support operates 24/7 with an initial AI triage before human agents step in when needed. During our review, the average wait time ranged from 2-15 minutes depending on the time of day, with most straightforward queries resolved in a single session.

The ticket system provides more comprehensive support for complex issues, with response times averaging 4-24 hours. VIP users receive priority support with dedicated account managers and significantly faster response times.

The multilingual support team covers over 18 languages, including English, German, French, Italian, Chinese, and Japanese. Notably, the English support consistently demonstrates the most comprehensive technical knowledge.

Self-service resources include detailed FAQ sections, step-by-step guides, and troubleshooting flows for common issues. The platform’s community forums also serve as an unofficial support channel where experienced users often provide guidance for other traders.

Geographic Access & Licensing Per Region

Due to differing regulatory frameworks, Binance’s availability and features vary significantly across regions. The international platform (Binance.com) serves over 180 countries with its full suite of services, though certain features may be restricted based on local regulations. Users can generally determine their access level through IP detection or by selecting their jurisdiction during registration.

In the United States, Binance.US operates as a separate entity with Federal Money Services Business registration and state-specific money transmitter licenses. This platform offers a reduced feature set compared to the international version, lacking certain derivative products and some token listings. At the time of writing, Binance.US is available in all US states except Alaska, Hawaii, Maine, New York, Texas, and Vermont due to local regulatory requirements.

European users access Binance through entities registered with various national authorities, including licenses in France, Italy, Spain, and Poland, plus the pan-European MiCA (Markets in Crypto-Assets Regulation) framework compliance implemented in 2024. The United Kingdom platform operates under the FCA (Financial Conduct Authority) registration for cryptocurrency activities.

Asia-Pacific regions have dedicated entities including regulated operations in Australia, Singapore, and Japan, each with country-specific compliance measures and feature limitations.

The table below highlights the regions, regulatory entities, limitations, and available cryptos available in different jurisdictions.

| Region | Regulatory Entity | Feature Limitations | Available Cryptocurrencies |

| International | Binance Holdings Ltd | Varies by user location | 400+ |

| United States | BAM Trading Services (Binance.US) | No futures, limited lending | 165+ |

| European Union | Binance Europe Services Ltd | Complies with MiCA restrictions | ~250 |

| United Kingdom | Binance Markets Limited | FCA-compliant offerings | 350+ |

| Australia | Binance Australia Pty Ltd | AUSTRAC-registered services | 350+ |

| Singapore | Binance Singapore Pte Ltd | MAS-regulated offerings | ~180 |

Reputation & Real-World Reviews

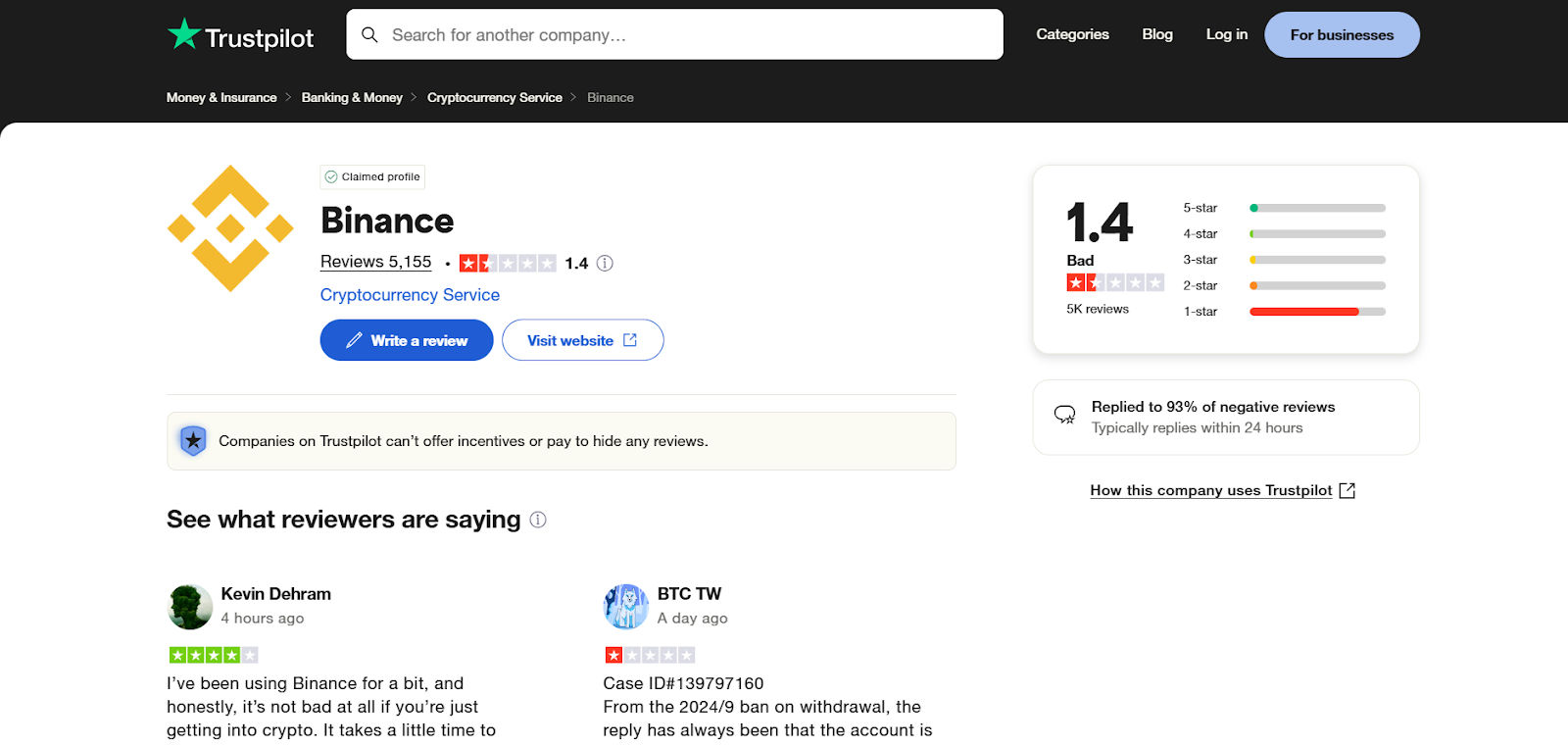

Binance maintains a Trustpilot rating of approximately 1.4 out of 5, based on 5,000+ user reviews. Positive feedback predominantly highlights the platform’s competitive fee structure, extensive cryptocurrency selection, and advanced trading capabilities. Critical reviews frequently mention slow customer support response during peak periods, account verification delays, and occasional withdrawal processing issues.

The platform actively engages with user feedback across review sites and social media, responding to most public complaints with resolution tracking. Community sentiment analysis from Reddit, Twitter, and specialized cryptocurrency forums reveals generally positive technical assessments from experienced traders who appreciate the platform’s liquidity and feature depth. On the other hand, newer users occasionally express frustration with the learning curve required to utilize advanced features.

Recent security measures and regulatory adaptations have improved institutional perception, with several major asset managers and traditional finance entities now engaging with the platform. The exchange’s transparency initiatives, including regular proof-of-reserves publications and third-party auditing, have addressed some historical trust concerns. However, the platform’s complex regulatory history continues to create occasional uncertainty, particularly during periods of increased regulatory scrutiny in major markets.

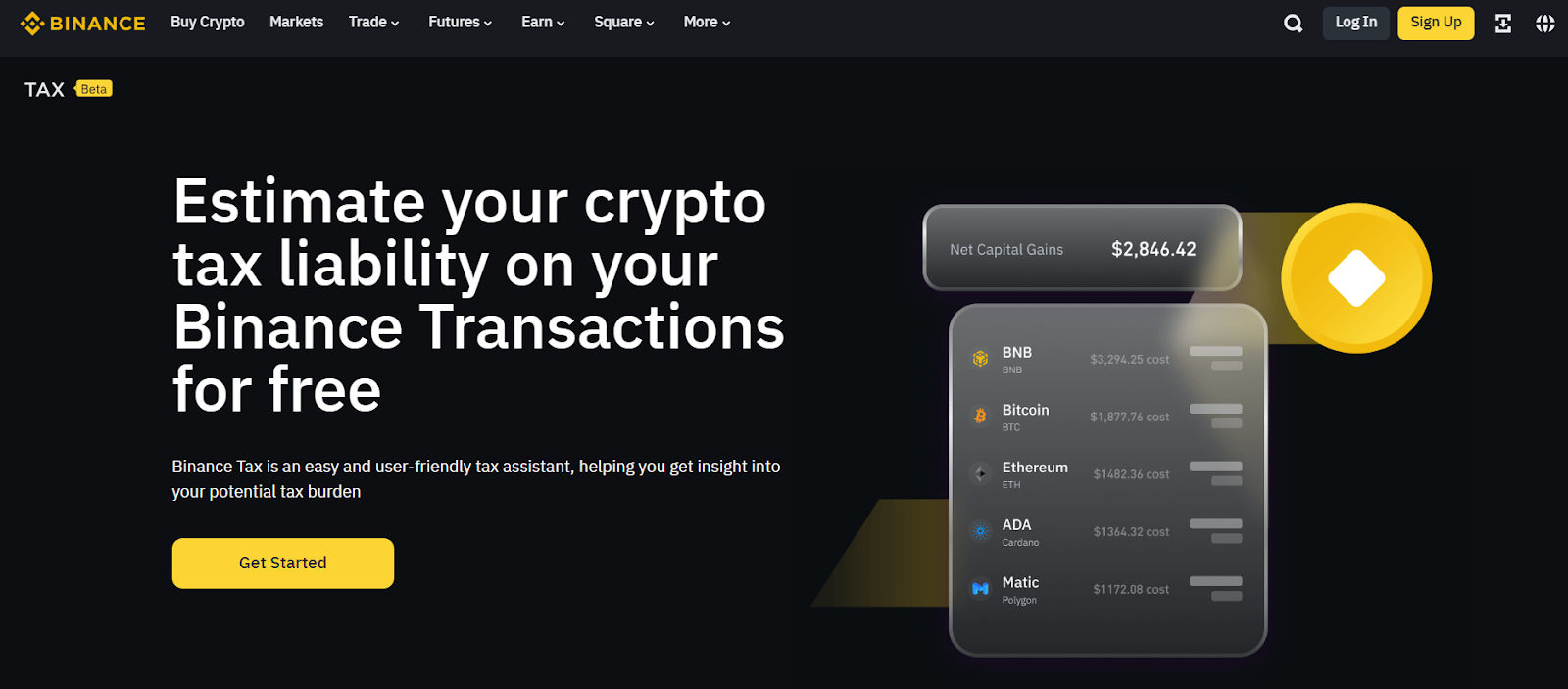

Tax & Legal Compliance

Binance provides annual tax reporting tools to help users meet their obligations, though this can vary by region. The Binance Tax tool generates users’ trading records in CSV format compatible with cryptocurrency tax software like CoinTracker, Koinly, and TaxBit. These records include all trading activities, conversions, staking rewards, and other taxable events with timestamps and pricing information.

For users in territories with automatic tax reporting requirements, like the United States, Binance implements the necessary infrastructure to generate required documentation (including forms 1099-MISC for qualifying users).

The platform doesn’t provide tax advice but maintains detailed guidance on tax obligations and reporting processes for major jurisdictions. Advanced reporting features include cost-basis tracking, realized/unrealized gain visibility, and categorized transaction histories to simplify tax preparation.

Compliance measures extend beyond tax reporting to include thorough AML/KYC (Anti-money Laundering/Know Your Customer) processes, transaction monitoring, and collaboration with law enforcement agencies when legally required.

The platform has implemented travel rule compliance for large transfers, suspicious activity reporting mechanisms, and enhanced due diligence for high-value accounts. These reflect Binance’s dedication to sustainable regulation-compatible operations across its global footprint.

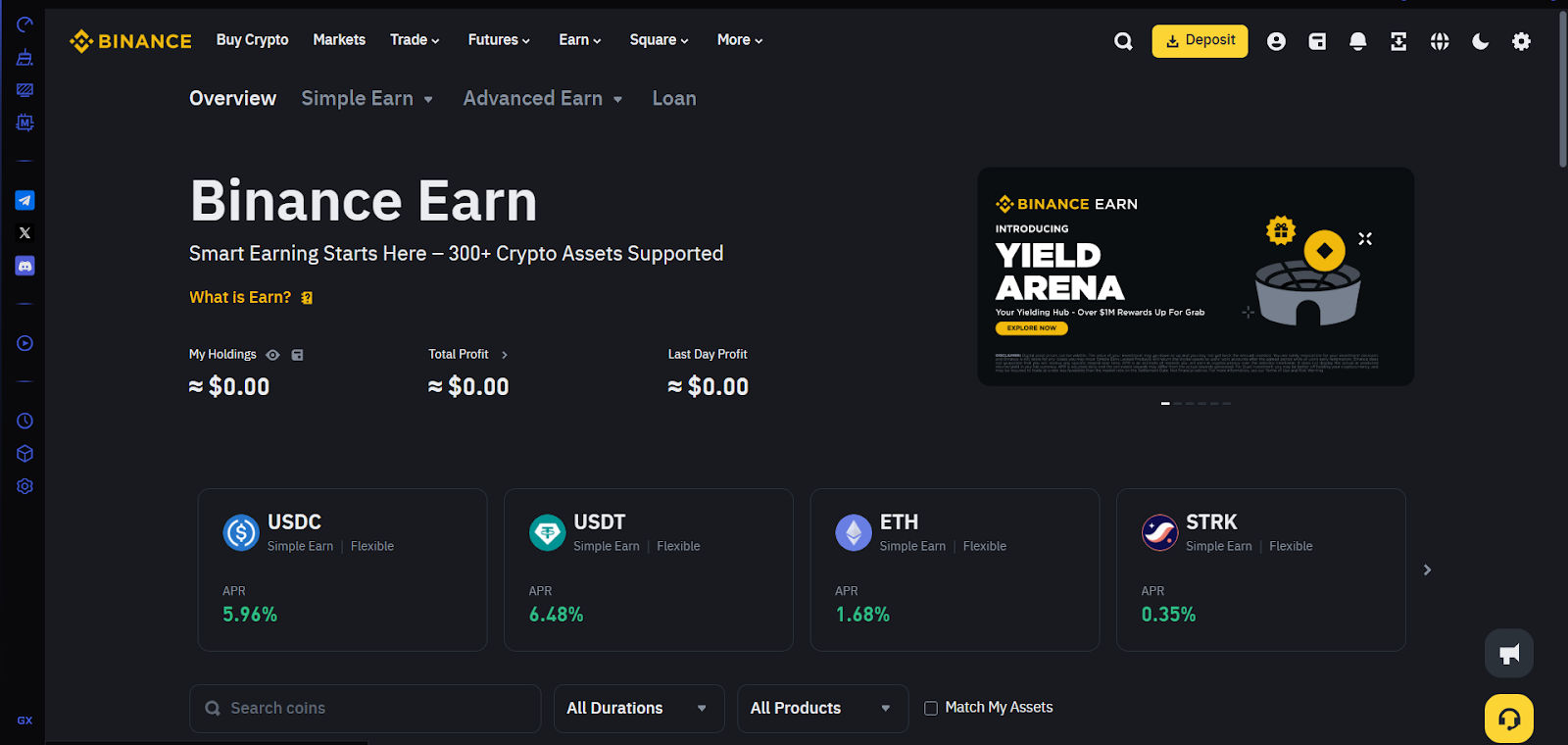

Staking & Yield Options

Binance offers multiple passive income options for cryptocurrency holders through its Binance Earn platform. Simple staking allows users to earn network validation rewards on proof-of-stake assets, including Ethereum (ETH), Solana (SOL), Polkadot (DOT), and Cardano (ADA).

Unlike dedicated staking platforms, Binance simplifies the process with one-click delegation and automatic reward distribution, typically paid daily or weekly, depending on the asset.

Flexible savings products provide variable interest on cryptocurrencies without lock-up periods, allowing instant redemption while earning yields typically ranging from 0.5-20% APR (Annual Percentage Rates).

Fixed-term savings offer higher returns (generally 1-10% APR) for commitments ranging from 7 to 120 days. The platform also supports liquidity farming through Binance Liquid Swap, allowing users to earn trading fees and BNB rewards by providing liquidity to trading pairs.

Advanced yield products include dual investment options that combine cryptocurrency holdings with options strategies to generate enhanced returns in exchange for accepting some price risk. These structured products appeal to experienced users comfortable with potentially receiving settlements in an alternate currency based on market movement.

It’s vital to note that all yield rates are updated dynamically based on market conditions, network parameters, and platform liquidity requirements.

Here are the average APR ranges for various staking options on Binance.

| Product Type | Lock Period | Typical APR Range | Minimum Investment | Risk Level |

| Flexible Savings | None | 0.5-5% | Varies by asset | Low |

| Locked Staking | 30-120 days | 2-20% | Varies by asset | Low-Medium |

| DeFi Staking | Varies | 1-40% | Varies by asset | Medium |

| Liquid Swap | None | 1-30% + fees | Varies by pair | Medium |

| Dual Investment | 7-90 days | 5-80% (conditional) | $100 equivalent | Medium-High |

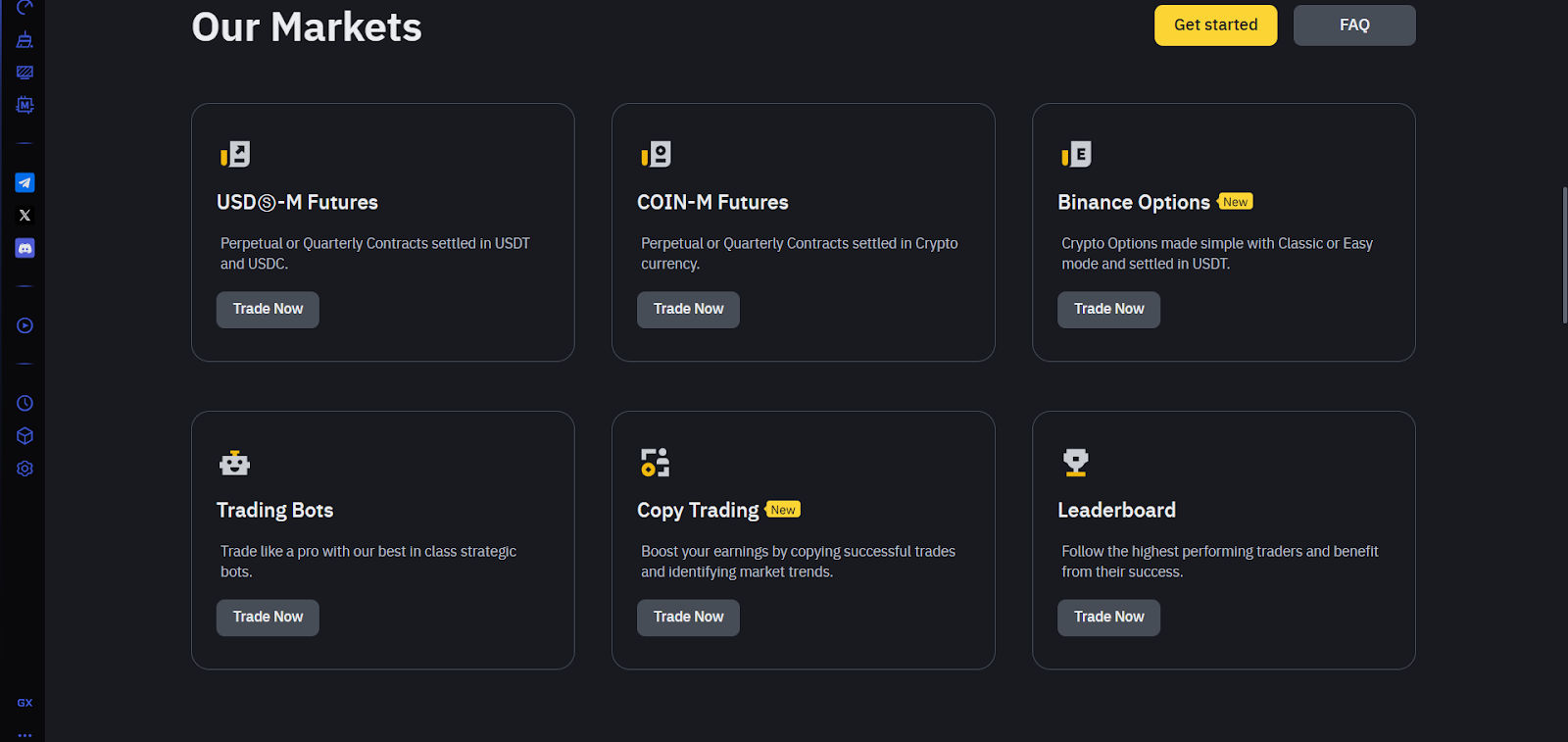

Advanced Trading Tools

Binance caters to professional and institutional traders through specialized tools beyond the standard platform. Binance Futures provides leveraged exposure to cryptocurrency markets with up to 125x multipliers on select contracts, supporting both USDT-margined and coin-margined perpetual and delivery contracts.

Users can take advantage of the platform’s advanced risk management features which include cross and isolated margin modes, adjustable leverage, and a comprehensive liquidation insurance fund.

Options trading enables precise position management and advanced strategies through European-style settlement contracts with standardized expirations. The platform supports both call and put options across varying strike prices, allowing for complex strategies like covered calls, protective puts, and spreads. The Options Calculator helps traders evaluate potential outcomes based on price movements, volatility changes, and time decay.

Institutional services include the Binance Institutional platform with OTC trading desk access, API connectivity with higher rate limits, and VIP market maker programs. Portfolio margin accounts allow cross-collateralization between positions, reducing overall margin requirements for diversified strategies.

During volatile periods, these advanced tools proved particularly valuable for maintaining precise position management and executing complex strategies that would be impossible on more basic platforms.

Expert Verdict

Binance provides a feature-rich cryptocurrency trading environment with competitive base fees of 0.1% and access to hundreds of digital assets. While the platform offers tools for various experience levels, its complex interface presents a significant learning curve for beginners despite recent simplifications.

The exchange’s fragmented regulatory approach creates inconsistent experiences across regions, with some jurisdictions having limited functionality. Though Binance has strengthened security measures including the SAFU fund, past breaches highlight persistent risks in centralized exchanges.

Ultimately, Binance may suit traders prioritizing asset selection and advanced tools over simplicity, but requires careful consideration of regional restrictions, security practices, and comfort with complex trading interfaces. As with any cryptocurrency platform, users should evaluate whether Binance’s specific feature set addresses their particular trading requirements.

| Area | Rating |

| User Experience | 4.2/5 |

| Fees | 4.8/5 |

| Security | 4.6/5 |

| Crypto Selection | 4.9/5 |

| Educational Resources | 4.5/5 |

| Overall Score | 4.6/5 |

FAQs

Is Binance regulated?

Yes, Binance operates through separate legal entities that are regulated in various jurisdictions. For example, Binance.US is registered as a Money Services Business (MSB) with FinCEN in the United States and holds Money Transmitter Licenses in most states. In Europe, Binance complies with MiCA regulations and holds national registrations in countries like France, Italy, and Spain. The UK operations are conducted under FCA registration for crypto asset activities. Other regulated entities exist in regions such as Australia (AUSTRAC), Japan, and Singapore (MAS). Regulatory status and available services vary by country, and users should verify local compliance before trading.

How secure is Binance?

Binance implements institutional-grade security protocols, including cold storage for 90% of user assets, mandatory two-factor authentication, advanced anti-phishing protections, and the SAFU insurance fund (currently around $1 billion) to protect against potential breaches.

The platform also conducts regular security audits, penetration testing, and maintains a bug bounty program for vulnerability reporting. Despite two historical security incidents, affected users were fully compensated with no permanent losses.

Is Binance good for beginners?

Yes, Binance is a good option for beginners because it has a user-friendly interface, a plethora of educational resources and live customer support services.

What are Binance’s trading fees?

Binance uses a maker-taker fee model starting at 0.1% for both maker and taker orders on standard spot trading. Fees decrease based on users’ 30-day trading volume and BNB holdings, reaching as low as 0.011%/0.023% for high-volume traders.

Additional discounts are available through referral programs and promotional events. Futures trading fees start slightly lower at 0.08%/0.08% (maker/taker), while margin trading incurs additional interest costs based on borrowed assets.

Can I withdraw cryptocurrency from Binance to my own wallet?

Yes, Binance allows withdrawals to external wallets for all supported cryptocurrencies. The platform typically supports multiple networks for compatible assets (like USDT on Ethereum, Tron, or BNB Chain), enabling users to optimize for lower fees or faster transfers.

Withdrawal fees vary by cryptocurrency and network, generally approximating the blockchain transaction cost plus a small processing fee. New withdrawal addresses require verification and may be subject to a 24-hour security hold for first-time use in line with the platform’s anti-scam measures.

How long does verification take on Binance?

Depending on system demand, basic verification (identification verification) usually takes 10 minutes to 24 hours to complete. Advanced verification requiring proof of address may take 1-3 business days during normal periods.

Corporate account verification involves a more extensive documentation review and typically requires 3-5 business days. Verification timelines may extend during periods of high market activity or for users from high-risk jurisdictions requiring enhanced due diligence.

Is Binance available in the United States?

Yes, but through a separate platform called Binance.US, which offers fewer cryptocurrencies (approximately 160 vs. 400+) and features than the international version. Binance.US operates under US regulations with state-specific money transmitter licenses.

Currently, residents of New York, Vermont, Hawaii, Alaska, Maine, and Texas can’t access the platform due to local regulatory requirements.

What’s the minimum deposit on Binance?

Binance doesn’t impose a minimum deposit requirement for cryptocurrency funding. Fiat deposit minimums vary by method and region: bank transfers typically start at $20 equivalent, while card purchases may have minimums of $15-50 depending on the payment processor and currency. Some promotional staking or savings products may have their own minimum participation thresholds, generally starting at $10-100 equivalent, depending on the asset.

How does Binance compare to Coinbase?

Binance offers significantly lower fees (0.1% base rate vs. Coinbase’s 0.5-3.99%), more cryptocurrencies (400+ vs. 240+), and more advanced trading features than Coinbase. However, Coinbase provides a more intuitive interface for beginners, stronger regulatory clarity in Western markets, and more seamless fiat on/off ramps for US users.

In addition, Binance is great for active traders seeking deep liquidity and advanced tools, while Coinbase better serves first-time buyers prioritizing simplicity over cost.

Does Binance report to the IRS?

No, but Binance.US provides required tax reporting to the IRS (Internal Revenue Service) for US customers, including Forms 1099-MISC for users who meet reporting thresholds. The international platform implements similar reporting obligations for users in countries with automatic tax reporting requirements.

All users can download comprehensive transaction histories compatible with tax preparation software. Note that even without direct reporting, most jurisdictions require self-reporting of cryptocurrency transactions regardless of exchange reporting.

What payment methods does Binance accept?

Binance accepts various payment methods depending on your region, including bank transfers (ACH/SEPA/Faster Payments), credit/debit cards (Visa, Mastercard), and numerous local payment providers. The international platform supports over 100 different fiat currencies through integration with regional payment processors.

Additional options include third-party services like Simplex and Banxa, P2P trading between users, and cash deposits through local partners in select markets.

How do I stake crypto on Binance?

Staking on Binance requires navigating to the “Earn” section of the platform, selecting “Staking,” and choosing between flexible or locked staking options for supported assets. Most major proof-of-stake cryptocurrencies (Ethereum, Solana, Polkadot, etc.) are available with varying reward rates.

The process requires just a few clicks, with rewards typically distributed daily or weekly depending on the asset. Unstaking periods vary from immediate (for flexible staking) to several days or weeks for certain locked staking options.

Is Binance safe from hacks?

While no exchange can guarantee absolute security, Binance has implemented robust protections that have proven effective since its last security incident in 2022. The platform’s security infrastructure includes the SAFU insurance fund, which successfully reimbursed users after previous incidents, cold storage for most assets, regular security audits, and advanced monitoring systems.

Notably, enabling all available security features such as hardware 2-FA, anti-phishing codes, and withdrawal address whitelisting further enhances individual account security.

What happens if Binance goes bankrupt?

Binance maintains clear asset segregation between company operational funds and user deposits, which are held in separate wallets. The platform has implemented proof-of-reserves verification allowing public confirmation that user assets are fully backed.

In the event of bankruptcy, customer assets would generally be treated as customer property rather than company assets under most jurisdictions where Binance operates regulated entities. The SAFU fund provides additional protection against potential insolvency scenarios.

Is Binance legit or a scam?

Binance is a legitimate cryptocurrency exchange operating since 2017 with regulated entities in multiple jurisdictions. It processes over hundreds of billions in daily trading volume and serves millions of users worldwide. While Binance has faced regulatory challenges in certain markets, it has consistently worked toward compliance by obtaining appropriate licenses and establishing regulated regional entities.

The company maintains transparent operational practices including regular proof-of-reserves verification and third-party audits of user funds. Its longevity, regulatory efforts, and response to security incidents (fully compensating affected users) demonstrate legitimacy despite occasional regulatory friction in some regions.

Which countries are Binance banned or restricted in?

As of April 2025, Binance faces complete bans or significant restrictions in several jurisdictions. The platform is unavailable in China following the country’s comprehensive cryptocurrency ban. In the United States, the separate Binance.US entity cannot operate in New York, Vermont, Hawaii, Alaska, Maine, and Texas due to state-specific regulatory issues.

Other regions with varied restrictions include Nigeria (limited banking integration), Turkey (payment processing limitations), and India (regulatory uncertainty). Some European countries impose additional compliance requirements under MiCA regulations, though full service remains available. Users should verify the current status for their specific location as regulatory situations evolve frequently.

Contributors