Global spending on AI projects is rising, with the banking sector taking the lead in investments. According to BanklessTimes.com, banking services poured over $20.6 billion in AI investments in 2023.

The site’s financial analyst, Elizabeth Kerr, comments,

“The diverse application of AI technologies- including machine learning and NLP can drive meaningful results for banks, promising to enhance employee and customer experiences while improving productivity and cutting back on operating costs.”

Global AI Investments

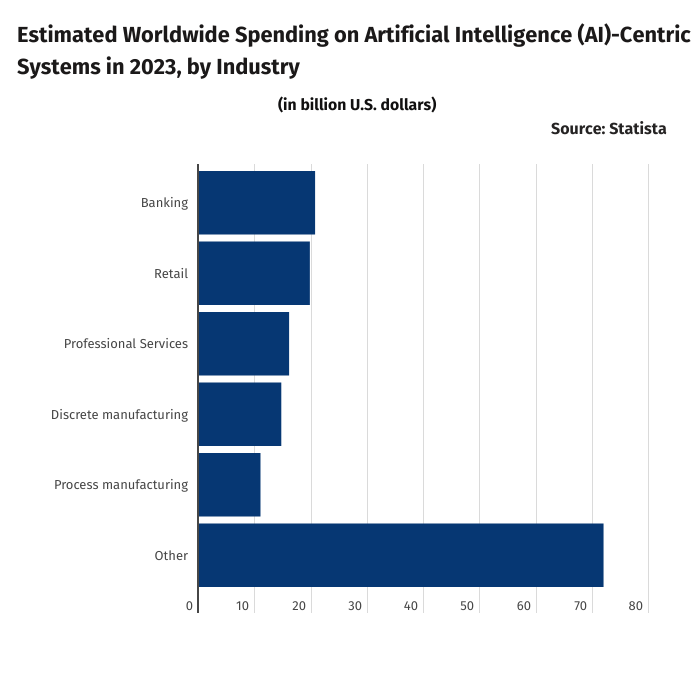

Investments in AI-centric systems accounted for over $154 billion in 2023 across all industries. The financial sector’s assets in AI were the highest across all industries, with the world’s largest banks collectively making over 92 new investments in AI startups. One of the more significant investments in AI startups was BNP Paribas’ multi-year partnership with Mistral AI, Europe’s top competitor to Open AI. This partnership gave BNP access to Mistral’s customised models.

Following the finance sector, retail investors invested $19.7 billion, while professional services ranked third, investing over $16.02 billion. Trailing them were discrete manufacturing and process manufacturing, whose investment values were $15 billion and $11 billion, respectively.

Banks AI Acceptance

Capital One had the highest artificial intelligence readiness index in 2023, earning an impressive score of 90.91. JP Morgan Chase followed with 89.48, seeing its infusion of IndexGPT to provide matches for stocks and investment themes.

Royal Bank of Canada ranked third, with an overall score of 73.66, while TD Bank and ING rounded out the top five with 60.5 and 45.46, respectively.

Citi and HSBC followed with 37 scores, with HSBC having more than 30% open AI roles than its immediate European competitors between October 2023 and April 2024.

Future Banking AI Investments

According to Citigroup analysts, generative AI could help banks add over $170 billion by 2028, highlighting the impressive benefits attached to AI. McKinsey Firm also came up with a similar projection; only it estimated higher profits. The firm estimated that banks using AI tools could receive additional earnings ranging from $200 billion to $340 billion.

Statista also estimates that banks’ AI investment trail will hit $45 billion in 2024 and close to $100 billion by 2027, representing a 29% CAGR from 2023 to 2027.

A report by Accenture also predicted that the finance sector could receive five-fold the number of transactions it receives with the help of AI tools, hinting at the higher profitability of AI projects.