Crypto market might be done with its bad phase, with many in the industry hoping for a recovery soon. A report by Bybit in partnership with BlockScholes highlights that the latest Option Volatility shows that crypto market’s worst time might be over.

Crypto market crash in tandem with global markets

The poorer-than-expected nonfarm payroll report on August 2, 2024, led to a significant sell-off of crypto and other volatile assets. But unlike previous double-digit crashes, this most recent one hasn’t seen the same level of forced deleveraging or high volatility levels.

The cryptocurrency market has once again shown how sensitive it is to overall economic conditions by responding swiftly to unsatisfactory job data. However, compared to earlier significant sell-offs in the cryptocurrency market, the impact of this most recent decline seems to be less pronounced.

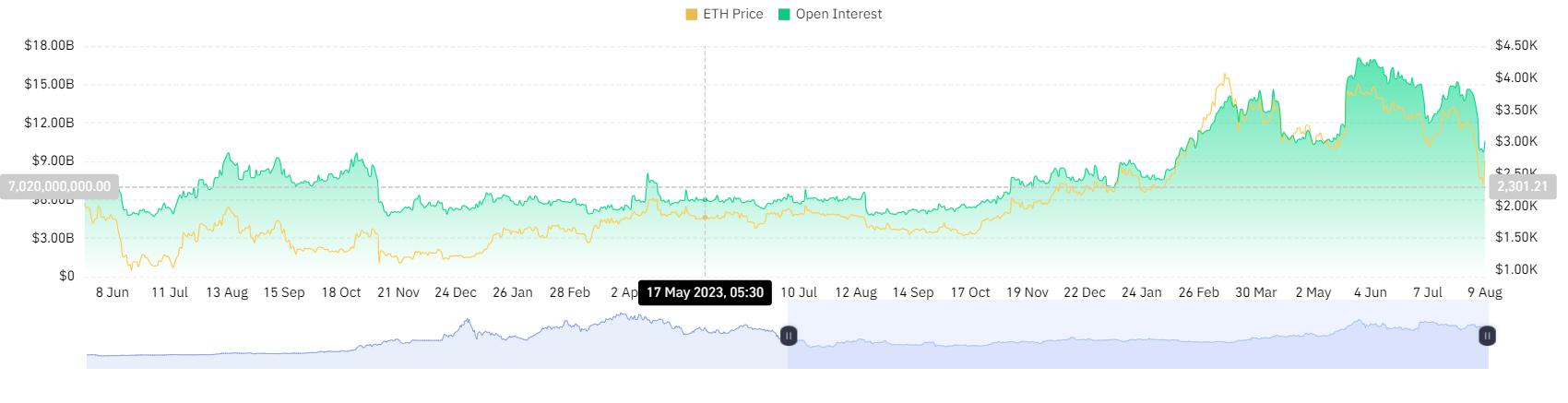

ETH Futures Open Interest show positive trading

Unexpectedly, despite the bloodbath in the overall crypto market, ETH Futures Open Interest stayed consistent. Though trading volume surged during last week’s sell-off, futures open interest stayed relatively steady compared to perps, indicating that futures investors had unwound their leverage after the Nashville incident.

The sharp drop in open interest observed in the perpetual swap contracts for ETH and BTC is consistent with the current price sell-off. This implies that amid the sell-off, traders hurried to close leveraged long positions, which is why transaction volumes on August 5, 2024, reached their highest points for the month.

Crypto market implied volatility still under control

The rapid sell-off in the spot market has caused volatility to surge, but implied volatility hasn’t increased to the same extremes. This shows that the options markets are now slow to factor in future volatility. In fact, expectations for Bitcoin volatility haven’t increased as much as they have since July.

The term structure has flattened considerably during the recovery, but it hasn’t moved as sharply as it did in earlier rapid spot market moves, including the extremely leveraged positions that accumulated before to the debut of the BTC Spot ETF in January 2024. Still, the term structure has quickly inverted at the front end.