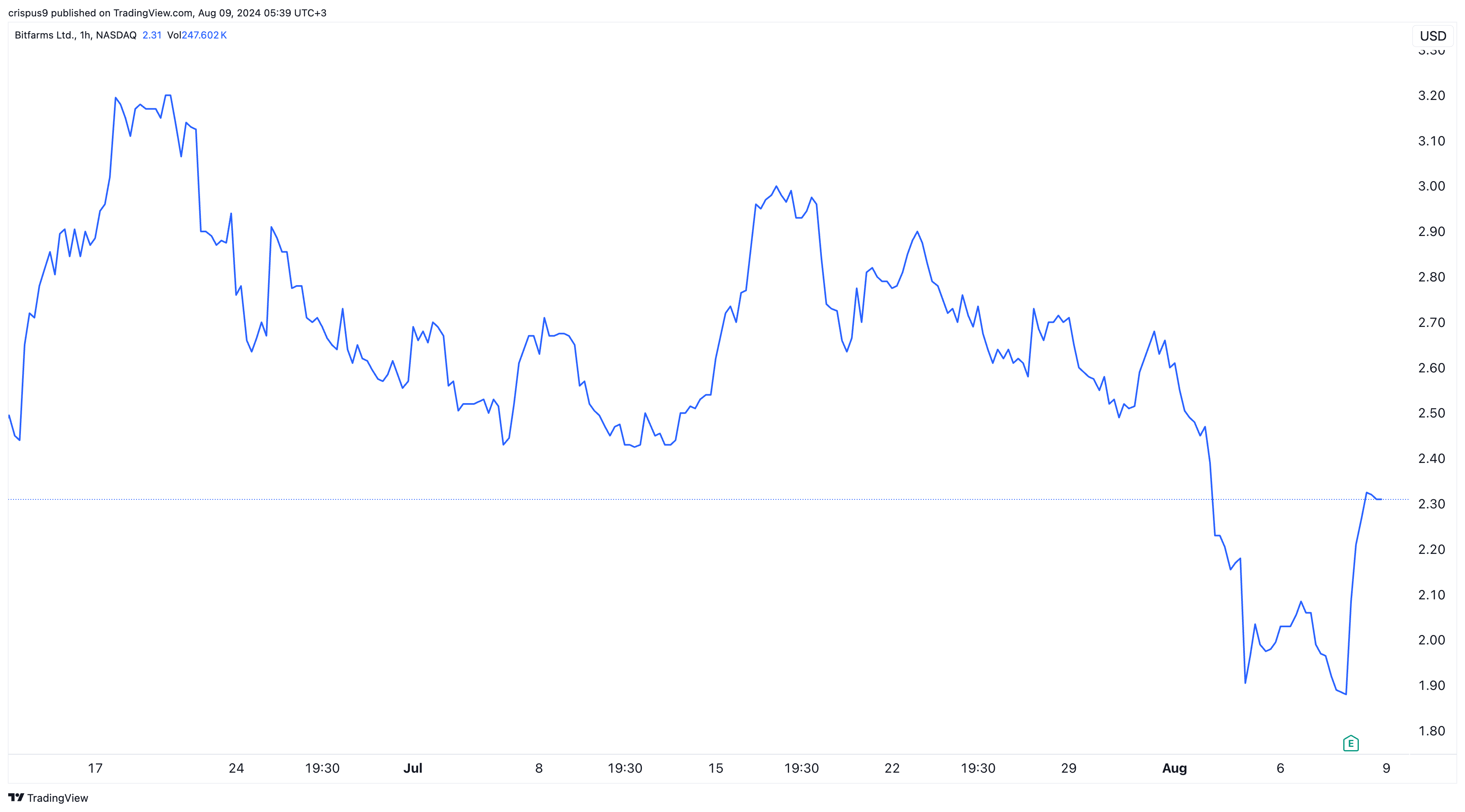

Bitfarms (BITF) stock bounced back this week after the company published its quarterly financial results and after Bitcoin rallied. After bottoming at $1.65 on Monday, the stock has rebounded by almost 40% to $2.30.

Other Bitcoin mining stocks have also crawled back in the past few days. CleanSpark jumped to over $12, up from Monday’s low of $9.38 while Marathon Digital (MARA), Riot Platforms (RIOT), and Iris Energy have all jumped by over 35% from their lowest point this week.

Bitfarms stock rises after earnings

The main catalyst for the BITF stock recovery is that Bitcoin has recovered modestly and moved above $62,000. This is a strong rebound for a coin that bottomed at $49,100 earlier this week.

Bitcoin’s recovery was mostly because of investors buying the dip after it formed a hammer candlestick pattern on Monday. There is also a close relationship with its current wedge pattern and the one it formed in the last bull market in 2020.

Bitcoin mining stocks do well when the coin is rising because it boosts their balance sheets and profit margins. Bitfarms holds 905 Bitcoins, meaning that the coin’s rally from $49,100 to $62,000 has pushed its balance sheet’s valuation up by over $11 million.

Bitfarms also jumped after the company’s latest financial results. Its revenue came in at $42 million, down by 16% from the first quarter and up by 17% from the same period in 2023. Its gross profit rose to $21 million while its net loss of $27 million was better than expected.

A key number in its financial results was the total cash cost of mining Bitcoin, which rose from $27,900 in Q1 to $47,300 in Q2 because of April’s halving event.

Riot Platforms has been pursuing Bitfarms

These results came at a time when the company has attracted the attention of Riot Platforms, one of the biggest Bitcoin mining firms in the industry. Riot made a bid for the company in April and has acquired a substantial stake.

Riot Platforms believes that growing through acquisitions is a good approach, especially now that the cost of mining Bitcoins has risen substantially in the past few months.

Bitfarms stock is also doing well because of the ongoing performance in the stock market where most global indices have bounced back. In the US, the Dow Jones rose by 683 points on Thursday while the Nasdaq 100 jumped by 465 points. This rebound means that these indices have erased their Monday losses.