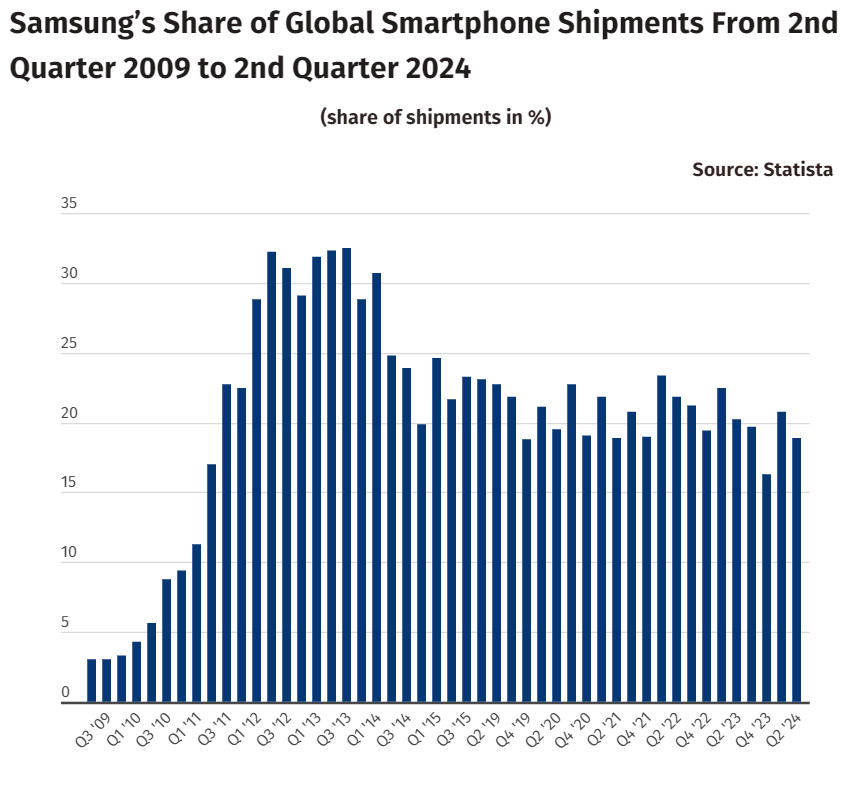

Samsung has been a significant player in the smartphone market. However, its market share has decreased significantly over the last ten years. In Q2 2024, Samsungs global smartphone market share was 18.9 percent, which is quite a drop from its dominant position in the early 2010s. According to BanklessTimes.com, Samsung’s global smartphone shipment share decreased from 30.7% at the beginning of 2014 to 18.9% in Q2 2024.

BanklessTimes Financial expert Elizabeth Kerr commented on the data: “Samsung’s decline in market share highlights a significant shift in the global smartphone landscape. This reduction underscores the increasing competition from other manufacturers and changing consumer preferences.”

Historical Context and Market Evolution

The smartphone landscape has undergone transformations since 2009. Over 10 decades ago, Nokia held half of the smartphone market share but saw it shrink to around three percent by 2013. Throughout these changes, Apple and Samsung have consistently remained significant contenders.

Samsung’s introduction of the Galaxy series in 2009 played a role in solidifying its position in the market. By the second quarter of 2012, Samsung’s market share had risen to 32.2 %—a growth rate unmatched by any competitor. This expansion helped Samsung maintain its lead as the major player, in the market for several years.

Recent Trends and Market Challenges

Recently, Samsung has faced growing challenges to its market position. In 2023, the Korean tech company shipped around 226.6 million smartphones, grabbing a 19.4% share of the global market. However, this figure marked a significant drop from its previous peak performance.

The beginning of 2024 also saw US smartphone shipments decrease by 8% year over year. This decline was influenced by a surge in shipments during Q1 of 2023, which was driven by delays in delivering iPhone 14 Pro and Pro Max models because of factory closures related to COVID-19.

The price segment below $300 has also faced challenges due to the growing popularity of 5G smartphones, as many manufacturers have moved away from this price category.

Jeff Fieldhack, Counterpoint’s Research Director for North America, noted, “Carriers saw declining upgrade rates and equipment revenues again in Q1 2024, showcasing the continued weak demand for smartphones in the market. Despite this, Apple maintained a robust market share of 52% during the quarter, while Android shipments, particularly in the sub-$300 range, faced ongoing declines.”

Maurice Klaehne, Senior Analyst, highlighted that “Overall Android shipments decreased YoY, with the market’s low end seeing consolidation and fewer new product launches due to the transition from LTE to 5G.”

However, Samsung showed resilience. With the early launch of the S24 series, Samsung experienced its best Q1 performance in four years, boosting its market share to 31%, the highest since Q1 2020.

Looking Forward

As we progress into 2024 there is uncertainty on the horizon. Some analysts predict that market recovery may not be seen until Q3, with potential boosts from growth and new product launches. Despite challenges from factors and low upgrade rates the incorporation of GenAI features in iPhones could spark fresh interest and demand.

While Samsung maintains a significant presence in the smartphone market, its market share has dwindled considerably over the past decade. As the industry evolves, the company encounters opportunities and obstacles to sustaining its position.