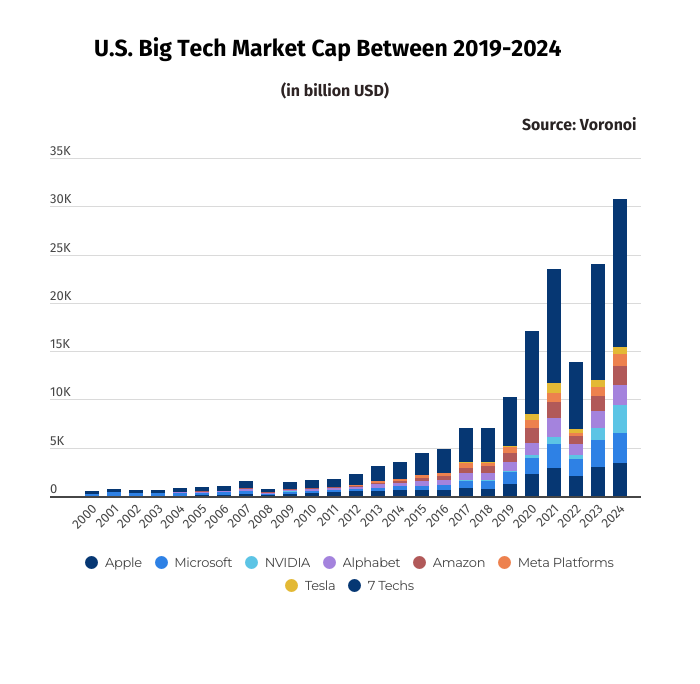

- Magnificent 7 tech stocks have soared in value, adding over $10 trillion to their market capitalization in just five years.

- The tech stocks have risen from $5.13 trillion in 2019 to $15.4 trillion in July 2014.

In the post:

- Magnificent 7 tech stocks have soared in value, adding over $10 trillion to their market capitalization in just five years.

- Tech stocks rose from $5.13 trillion in 2019 to $15.4 trillion in July 2024.

The Magnificent 7 Stocks have capitalized on market momentum to reach new market highs. As per BanklessTimes.com, their aggregate worth increased from $5.13 trillion in 2019 to $15.4 trillion by July 2024.

“The top tech stocks in the US reaped profits fueled by investor and consumer optimism surrounding AI-driven innovations,” says Elizabeth Kerr, the site’s financial expert.

The Magnificent 7 Stocks

Though Apple entered the AI space later than its rivals, the American multinational corporation is presently the most valuable firm. It has more than doubled its market cap from $1.3 trillion in 2019 to an impressive $3.4 trillion in 2024

Apple’s smartphone segment yields the highest revenues, accounting for over half of the total profits. However, its service segment has expanded lately, generating significant revenue increases. It brought in an astounding $23.87 billion in Q2 of this year alone.

Microsoft is the second-largest company behind Apple, with a market capitalization of $3.1 trillion, up from $1.2 trillion five years ago. The company’s remarkable forays into cloud infrastructure, AI, and gaming have spurred a large growth spurt.

Next in line is Nvidia, whose market cap has soared to $2.878 trillion from $144 billion in 2019. The revenue generated by its AI GPU processors plays a critical role in this growth. As more companies show interest in high-performance chips like the RTX series, Nvidia stands to benefit significantly.

The Alphabet company, valued at $2.11 trillion, thrives on its advertising and cloud computing presence. Amazon follows it with a market capitalization of $1.95 trillion, driven by its success in e-commerce and cloud services supported by its logistics and technology strategies.

Meta, with a market cap of $1.21 trillion, remains a media and digital advertising player despite various challenges. Meanwhile, Tesla, valued at $0.74 trillion, continues to lead the way in vehicles and renewable energy solutions.

What Could Slow the Magnificent 7’s Growth?

The regulatory debate jeopardizes the dominance of these tech stocks. The Biden administration has been especially assertive to control tech giants like Google and Meta. They have relied heavily on aid from federal agencies, like the Federal Trade Commission and Federal Communications Commission, which have already proposed several regulations. Most of these proposed rules, however, have the potential to hinder the performance of these industry leaders in technology.

Additionally, most of the magnificent 7 stocks have seen notable growth declines, as evidenced by the most recent Q2 earnings report, which indicates that the AI frenzy is abating. For instance, Microsoft dropped by 10% and Amazon by more than 14%, hinting at further declines if the frenzy completely dies.