Black Monday was trending on Monday morning as risky assets like stocks and cryptocurrencies plunged. In Japan, the Nikkei 225 and Topix indices, which hit their all-time high earlier this year, moved into a bear market, falling by over 20% from the YTD high.

Sea of red in stocks and crypto market

The same trend was happening in other Asian, European, and United States markets. Dow Jones, S&P 500, and Nasdaq 100 futures dropped by over 250, 65, and 400 points, respectively. The DAX, CAC 40, and FTSE 100 indices in Europe were down by over 1%.

A wave of red has also swept through the cryptocurrency market, as Bitcoin crashed for five consecutive days, reaching a low of $52,386 on Monday morning. It has dropped by over 26% from its peak level this year.

Ethereum and other altcoins have done much worse, with most falling by over 10% in the past 24 hours.

Peter Schiff warns on Bitcoin ETFs liquidations

Amid this sell-off, there are fears that Bitcoin ETFs will have a 15% down gap when the market opens on Monday. Unlike Bitcoin, which trades 24/7, these ETFs trade like stocks and are open Monday through Friday. As such, they tend to be highly volatile on Monday as they consider weekend events.

In an X post on Sunday, Peter Schiff, a well-known crypto skeptic, warned that the sell-off would trigger mass ETF liquidations as investors rushed out. He also warned of a potential crypto black Monday, which seems to be happening already.

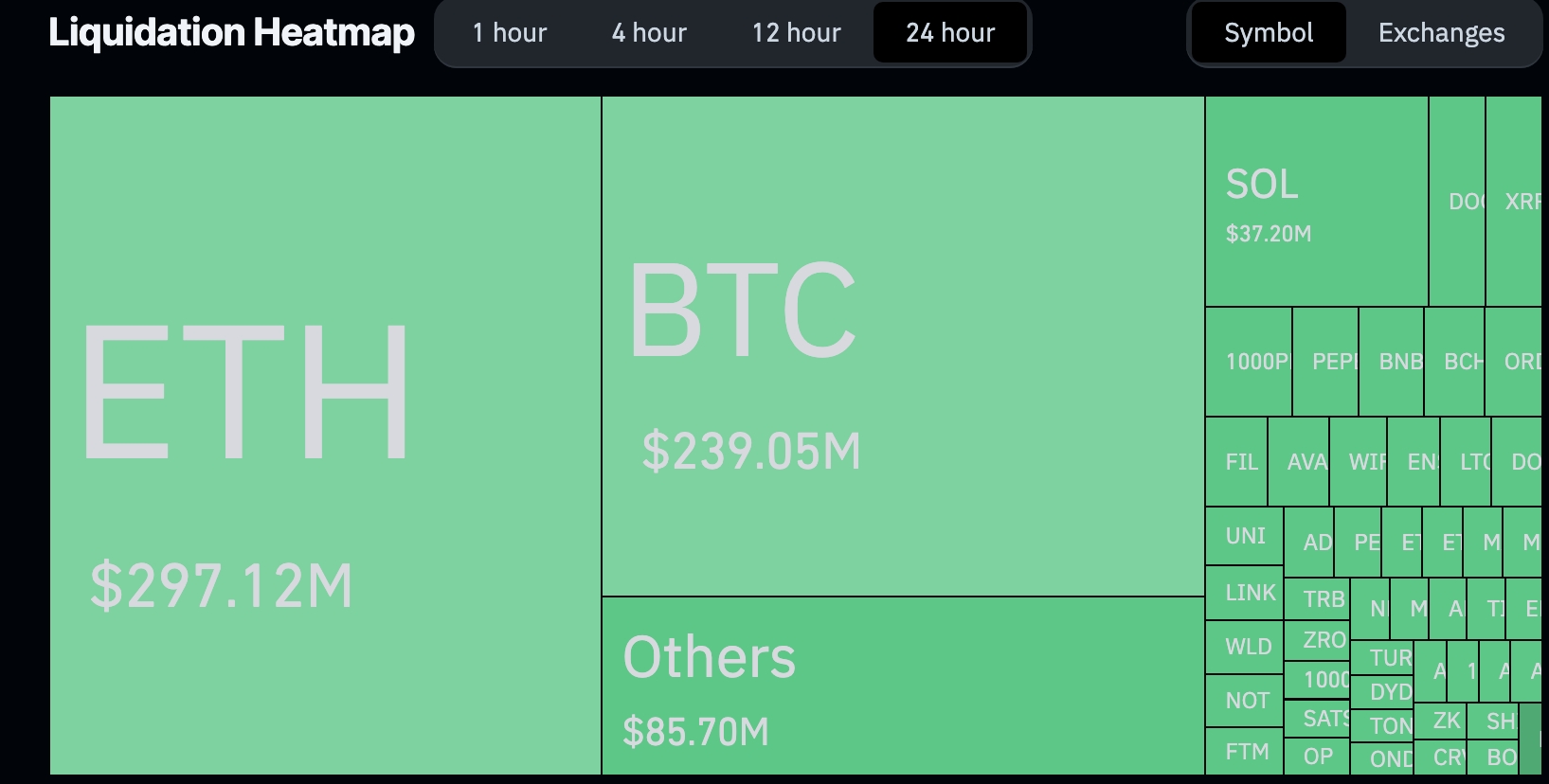

Crypto liquidations have jumped sharply in the last 24 hours. Data by CoinGlass shows that tokens worth over $802 million have been liquidated as most traders. Most of the liquidations happened in Ethereum ($296 million) followed by Bitcoin ($238 million), and Solana ($37 million).

Crypto liquidations | Source: CoingGlass

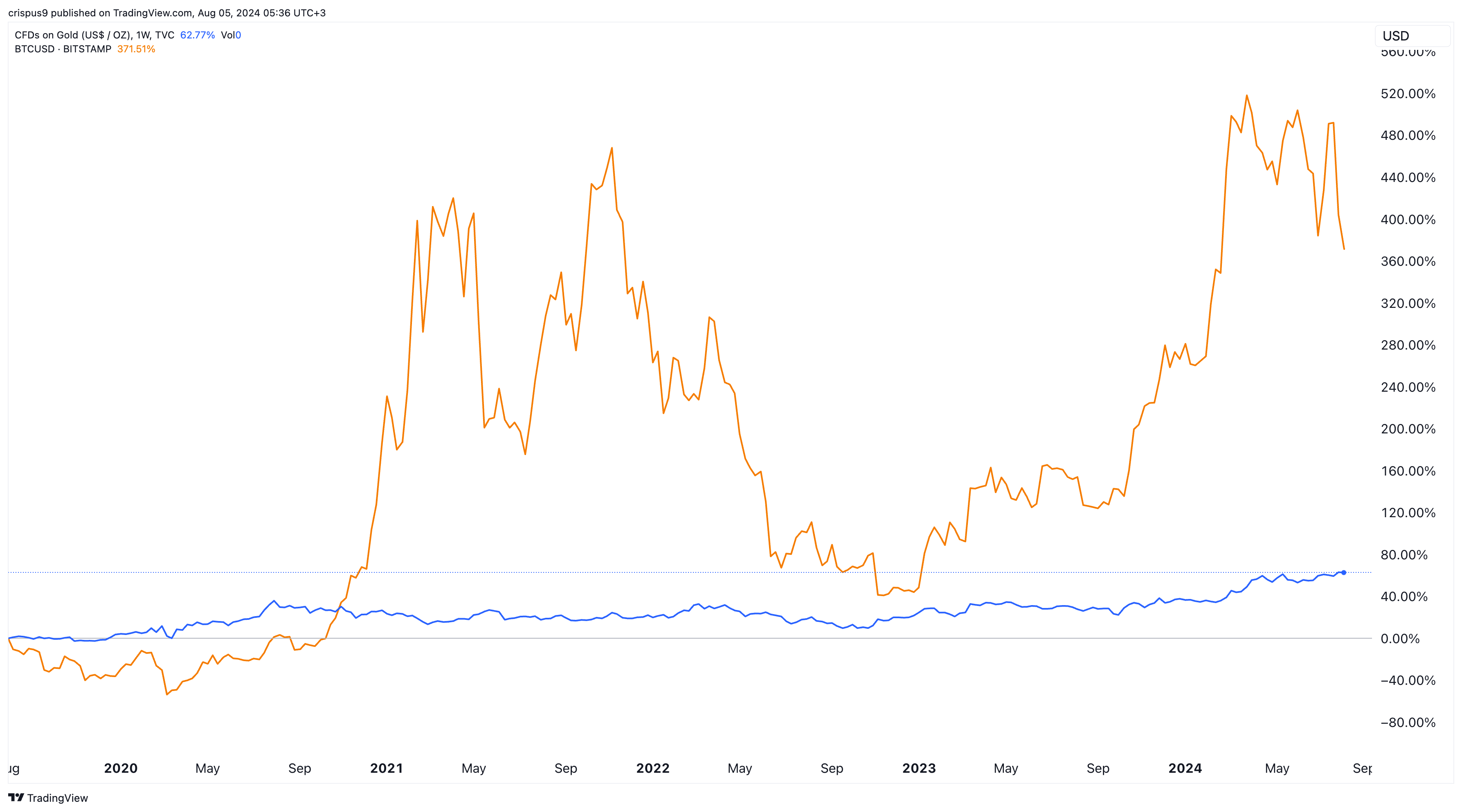

Peter Schiff has always been bearish on Bitcoin, which he believes is worthless. Instead, he has maintained a bias towards gold. His prediction about gold has been accurate this year as it has remained above $2,440 and is sitting near its all-time high.

However, in the long run, Bitcoin has fared better than gold. As shown above, the Bitcoin price has risen by over 360% in the past five years, while gold has risen by less than 80% in the same period. BTC is also up by 23% this year, while gold has risen by less than 20%.

Still, there are two potential positive catalysts in the crypto industry. First, the ongoing crash is not an isolated event, with other assets in a strong freefall. In most cases, as we saw in 2020, 2022, and 2009, stocks tend to bounce back over time, which will benefit digital currencies.

Second, the ongoing market crash, coupled with the weakness in the US economy, could trigger a Fed intervention. Some analysts call for the Fed to deliver a jumbo rate cut, as we saw during the Covid-19 pandemic. If that happens, then more money could start moving to riskier assets like stocks.