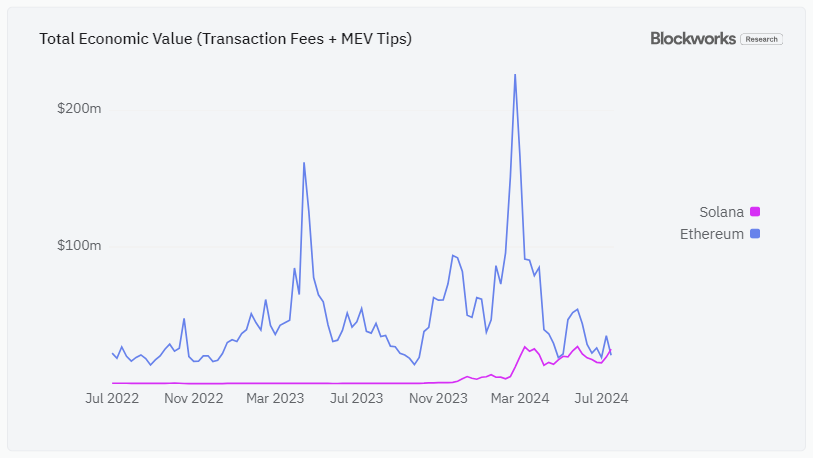

At the end of July, Solana passed the Ethereum Mainnet in weekly total fees for the first time, recording revenue of approximately $25 million compared to $21 million for Ethereum.

Incessant bouts of memecoin trading have aided Solana throughout 2024. Platforms such as Moonshot and Pump.fun, which run on the Solana network, largely host these trades, and crypto bots facilitate them.

Blockworks Research reported that Solana’s total value locked has reached $5.5 billion. It has more than tripled since the beginning of 2024. The leading blockchain topped $5.5 million in daily total fees on July 28, a record for the network in the past three months.

Crypto bots cause severe congestion on Solana

Data from Dune reveals that 75.3% of non-vote transactions on Solana failed on April 4. These transactions involve the movement of SOL between various accounts on the blockchain.

Critics took the news as an opportunity to argue Solana was not as scalable as claimed. The increased usage coincided with high levels of congestion.

Blockchain supporters pointed out that the unique users and trading volume had increased tenfold, arguing that periods of extreme congestion were normal. Memecoin trading interest mainly drives the uptick in failed transactions. Some of their themes are questionable.

How crypto bots manipulate the market

Rampant bot activity on Solana slows down processing and increases transaction fees. There are thousands, if not millions, of memecoin launches on Solana, all of which are automated. In April, Solana developers even released an update to address the congestion.

This wasn’t the only measure Solana took. In June, it eliminated a group of validators from its delegation program because they were reportedly involved in sandwich attacks.

Crypto bot issues are not unique to Solana. They affect all profitable crypto trends. One of their most popular uses is for MEV or maximal extractable value. The Ethereum Mainnet and other blockchains don’t process transactions chronologically. Validators make orders with higher transaction fees a priority.

Validators insert transactions when there is a lucrative opportunity in the transaction queue, so they get in on the trade first. They might add transactions preceding and succeeding large orders to profit from anticipated price changes. This extra profit is an example of MEV.

It can take a lot of time to sift through all the transactions in the waiting line before they are recorded on Solana or another blockchain. This is why operators use crypto bots. They save time by automatically scanning for MEV opportunities.

Why eradicating crypto bots on Solana is impossible

Cryptocurrency trading is extremely competitive, and split-second transactions can determine profitability. Market makers rely on bots, which maintain accurate asset prices and ensure orders go through. Bots execute algorithms to ensure price maintenance and liquidity across various markets.

Market maker Kairon Labs’ cofounder Mathias Beke told Cointelegraph that humans cannot achieve microsecond optimization. He shared that Kairon Labs would have to hire 200 people to operate properly without bots.

Bots automate launches, but at what cost?

Solana’s meme coin frenzy might have cooled from its peak at the beginning of the year, but it’s far from over. Around 2,600 new meme coins launched in the week leading up to July 19, but 19,000 new tokens launched in one week in February.

Widespread bot activity continues to power the Solana memecoin scene. Some automation features allow users to launch coins on Pump.fun and other platforms, artificially inflating trading volumes by automating trading on many wallets. One wallet on Solana held more than 3,500 different cryptos, mostly memecoins.

Bots scan trends to automate memecoin launches but often bypass critical steps, such as conducting audits or properly deploying smart contracts. Industry experts do not recommend using bots to launch memecoins without audits and other checks. This can lead to risks and unethical practices, tarnishing the industry’s reputation.

Blockchain records of the above-mentioned wallet’s activities reveal that it’s creating new coins at an exponential rate, eliminating the liquidity of the other tokens it has created at the same time. This is a common sign of a rug pull.

The wallet’s consistent, rapid token minting and liquidity removal activities seem illegitimate. At the same time, legitimate bots that are critical in managing liquidity prove a platform is taking its product seriously.