The government of South Korea has levied an additional fee on crypto operators. Major cryptocurrency operators like Upbit, Bithumb, and Coinone must now pay a supervisory charge as part of the recently imposed Virtual Asset User Protection Act.

Local media reports suggest that the biggest exchanges are expected to charge a fee based on operating income, projected to be approximately 300 million won ($219,992).

Crypto operators will be charged under the Virtual Asset User Protection Act

South Korea has been trying to implement and pass various laws for the virtual asset sector. On July 18th, the country enacted its first crypto regulatory framework. The new regulations are centered on providing safety nets for cryptocurrency investors.

The Virtual Asset User Protection Act was also formally enacted on July 18, 2023. Following this, a year-long grace period was granted to improve the regulation’s specifics.

Meanwhile, the act applies more stringent regulations to digital asset exchanges. South Korean service providers are legally required to store at least 80% of user cryptocurrency deposits in cold storage, apart from their own money.

Operators in South Korea might see fallen user base

When Bitcoin prices hit an all-time high in the first half of 2021, almost 10% of South Korea’s population invested in cryptocurrencies. The number nearly doubled the year before when the country saw its first crypto bubble. According to estimates, South Korea has the third-largest cryptocurrency market worldwide.

However, the number might soon decline. Crypto operators in the country are projected to face a downturn due to the strict laws that the government is imposing.

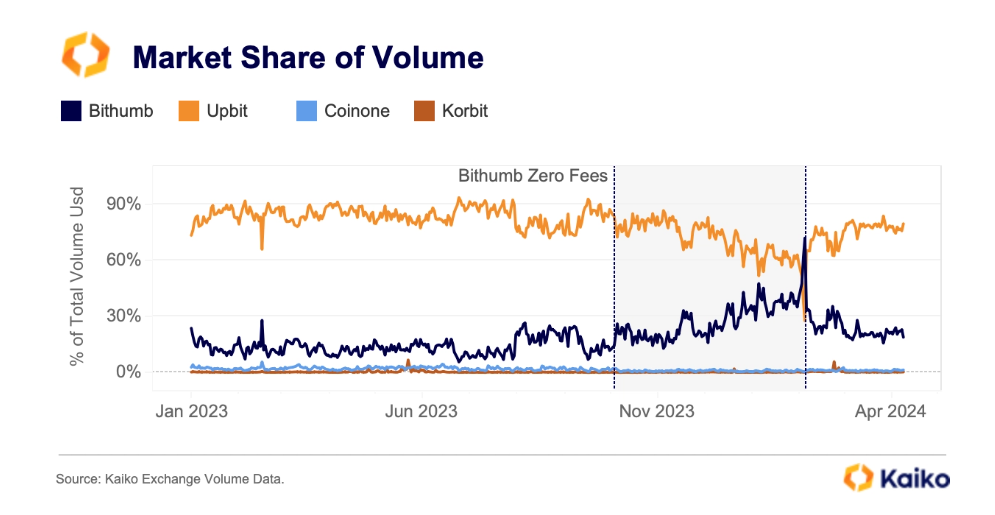

Due to South Korea’s stringent cryptocurrency laws, trade volume for crypto operators has also decreased, and people are seeking less riskier assets. By 2025, 12.41 million users are expected to be part of the cryptocurrency sector in South Korea. This phenomenon has resulted in most crypto operators charging heavy fees to their users.

By 2024, the South Korean cryptocurrency market is expected to generate US$855.2 million in sales.

However, according to research by Statista, it is anticipated to decrease at a compound annual growth rate (CAGR) of 3.72% from 2024 to 2025, with a total revenue projection of US$823.4 million by then.

The average revenue per user in the sector is projected to reach US$69.2 in 2024.