Gold and bitcoin prices have been in the spotlight this week as the volatility continued. Bitcoin initially soared to the resistance point of $70,000 and then suffered a harsh reversal to below $64,000 on Thursday. Gold, on the other hand, rose to $2,440 as it approached the all-time high of $2,485.

US public debt soared to $35 trillion

The case for investing in bitcoin and gold became stronger as the US public debt crossed the important point of $35 trillion. According to the US Debt Clock, the total debt was $35.01 trillion, the equivalent of $103,844 per citizen.

The debt-to-GDP ratio has risen from 52.60% in 1960 to 122.5% today, and the rally is expected to continue regardless of who wins the presidency. Donald Trump added over $8 trillion to the public debt, while Joe Biden added $4 trillion.

Democrats’ approach to reducing the public debt is to hike taxes, especially for the rich. Donald Trump has vowed to implement more tax cuts. Republicans, on the other hand, want to cut welfare spending, which Democrats resist.

The implication of all this is that the US could become what Japan has become in the past few years. Japan, a country with a GDP of over $4.9 trillion, has accumulated almost $10 trillion in debt.

As a result, the Bank of England (BoE) has struggled to hike interest rates. While it hiked by 25 basis points on Wednesday, they remain sharply lower than in other developed countries like the US and the UK.

The other implication is that the Japanese yen has crashed over time. It recently dropped to 161.76 against the US dollar, down from 101 in 2020. Its lowest point this year was its lowest level in over three decades.

The Fed could find itself in a similar situation in the future, struggling to hike interest rates even when inflation rises.

Bitcoin and gold as safe havens

Therefore, the potential US dollar crash could make Bitcoin and gold more valuable. Gold has always been seen as the best asset to invest in when there are macroeconomic risks. Indeed, gold has jumped by over 50% from its lowest point in 2022.

According to Larry Fink, the head of Blackrock, Bitcoin is now viewed as digital gold, meaning that it could do well as the US dollar falls.

MicroStrategy is a unique asset. While it is a technology company, it is widely known for its role in the crypto industry, where it is the biggest Bitcoin holder in the world.

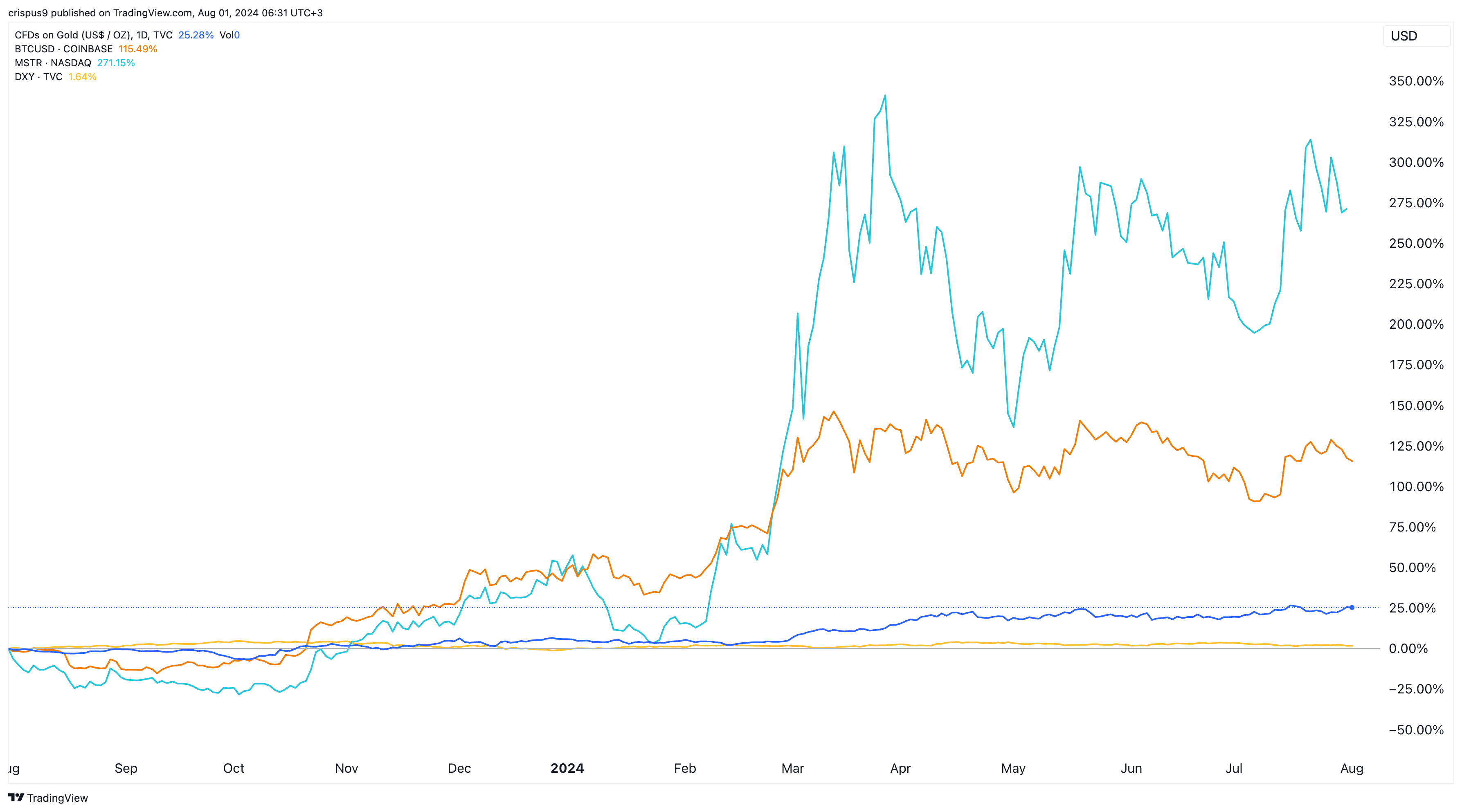

MSTR is a good asset to buy if the price of Bitcoin rises over time. Historically, MSTR stock outperforms Bitcoin when the latter rises and vice versa. This year, it rose by over 160% while Bitcoin rose by about 60%.