Comparing the iShares Bitcoin Trust (IBIT) and the Schwab US Dividend Equity (SCHD) ETF looks like an apples-to-oranges comparison. IBIT is a fund that tracks Bitcoin, a relatively new asset class that is often seen as being volatile.

SCHD and IBIT attract different investors

SCHD, on the other hand, tracks about 100 slow-growing American companies like Amgen, Texas Instrument, Lockheed Martin, PepsiCo, and Chevron. Most of its companies operate in sectors that are often seen as being boring like financials, health care, consumer defensive, and industrials.

SCHD and IBIT attract different types of investors. IBIT and other Bitcoin ETFs like FBTC, ARKB, and GBTC attract risk-aggressive investors. SCHD is popular among income-focused investors because of its strong dividend growth reputation. It has grown its dividends for 12 years and has a CAGR of almost 12% in the past five years.

Yet, as I have written before, it makes sense for ETF investors to embrace diversification across various fund types. Experts recommend having at least three ETF baskets in a portfolio: growth, dividend, and risk-on.

A growth ETF is one made up of fast-growing companies, especially those in the technology sector. Think of companies like Nvidia, AMD, Shopify, and CrowdStrike. Historically, growth funds like the Invesco QQQ and iShares US Tech ETF (IYW) tend to outperform the broader market.

Dividend and value ETFs like SCHD, Vanguard High Dividend Yield Index Fund (VYM), iShares Core Dividend Growth ETF (DGRO) are loved because of their record of giving out payouts every month or quarterly.

A risk-on ETF has the potential to generate strong returns in the long term but has some elevated risks. In addition to Bitcoin ETFs, the other alternatives are funds like covered call ETFs like TSLY, NVDY, and JEPI.

SCHD vs IBIT ETFs

The case for IBIT for SCHD investors

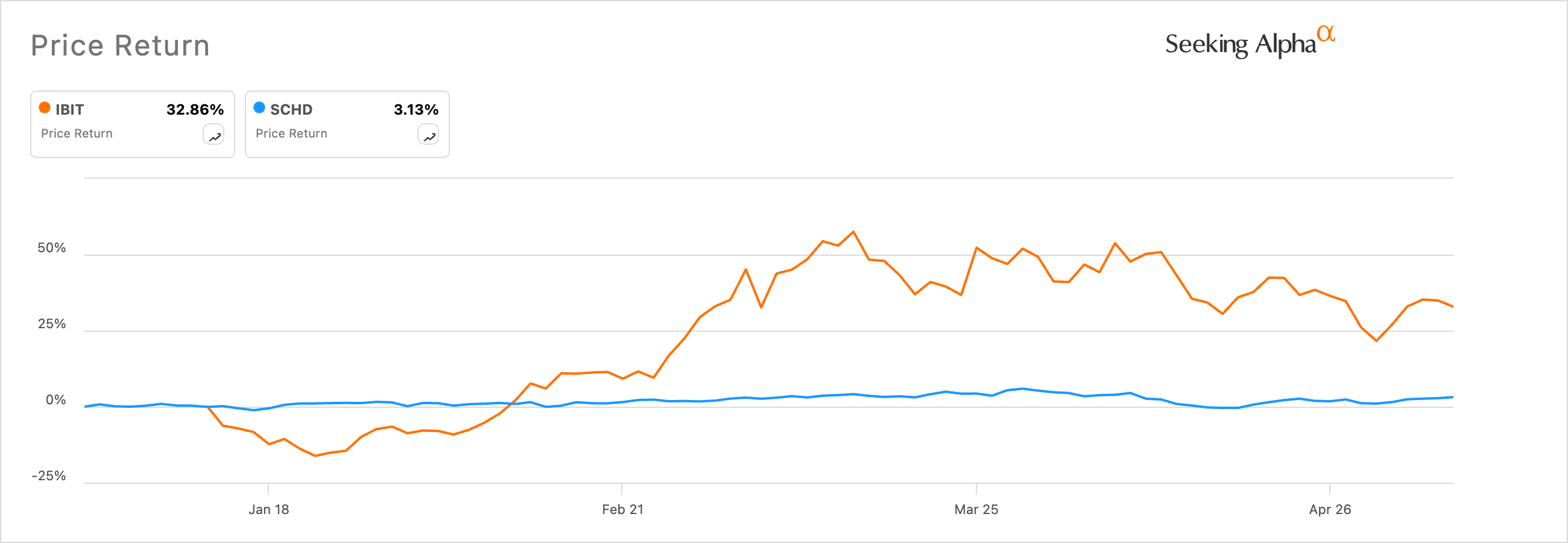

I believe that it makes sense for SCHD ETF investors to invest in an ETF like IBIT. For one, while the SCHD is a popular fund, its historical returns have not been all that good. Data shows that its total return in the past 12 months stood at 14.37%.

In the same period, mainstream funds like Invesco QQQ and SPDR S&P 500 have jumped by over 25%. Bitcoin, on the other hand, has soared by over 120% in the same period. Looking at the five years, Bitcoin has soared by over 890% while SCHD’s total return was almost 50%.

Past performance is not always a good indicator of what to expect in the future. However, what is clear is that the SCHD tends to have its down moments as we saw in 2023 when it had no meaningful growth.

Therefore, as I wrote in November last year, SCHD investors should consider diversifying their portfolios. In this, they can invest in IBIT or other spot Bitcoin ETFs and other mainstream funds like QQQ and SPY.

Besides, analysts are still bullish on Bitcoin as its supply runs out. Data shows that the volume of Bitcoin in exchanges has dropped sharply recently. Bitcoin mining difficulty has soared after halving while most investors are moving to alternative assets.

In a recent CNBC interview, Tom Lee of Fundstrat noted that Bitcoin could still soar to $150k this year. Standard Chartered analysts also believe that the coin could jump to over $100k in the next few months.