Bakkt Holdings (NYSE: BKKT) stock price continued its downward trend this week after the company implemented a stock split and as it revealed its earnings date. It crashed to a new low od $6.30, a massive drop from where it was in 2021. Its market cap has crashed from over $1 billion to about $81 million.

Crypto sell-off intensifies

Bakkt and other crypto-related companies plunged hard this week as the price of most digital currencies retreated. Bitcoin crashed below the crucial support level of $60,000 and settled at $57,000.

Other altcoins had a steeper crash, with Solana moving to $129 and Internet Computer falling to $12. This crash happened as investors waited for the next catalyst now that the SEC has already approved Bitcoin ETFs and the halving event has happened.

Bakkt Holdings and other companies in the crypto industry does well when Bitcoin is and other digital coins are performing well.

Meanwhile, BKKT has dropped as investors question whether it will survive in the long term. The company has already delivered a going concern warning as its cash burn continue and its growth slows.

The most recent financial results showed that Bakkt’s revenues jumped to $214 million from $204 million in the third quarter. It had made just $15 million in the same quarter a year earlier.

Bakkt also narrowed its loss from $98.9 million in Q4’22 to $26.7 million in Q4’23. For the year, the company’s revenue rose to $780 million, mostly because of its acquisition of Bakkt Crypto. Its annual loss narrowed to $225 million.

Analysts expect that the company’s revenue for the first quarter came in at $17.9 million, a 37% increase from the same period in 2023.

The biggest challenge for Bakkt is that its balance sheet is not healthy after the company blew over $2 billion in funds. It ended Q4 with $70.2 million in cash and short-term investments, down from $239 million a year earlier.

These funds mean that the company will need to boost its balance sheet, especially if its loss-making trajectory continues. It has already been highly dilutive to its shareholders. For example, its outstanding shares in December 2023 stood at 274 million and by March 15th, the firm had 321 million shares.

Bakkt stock price forecast

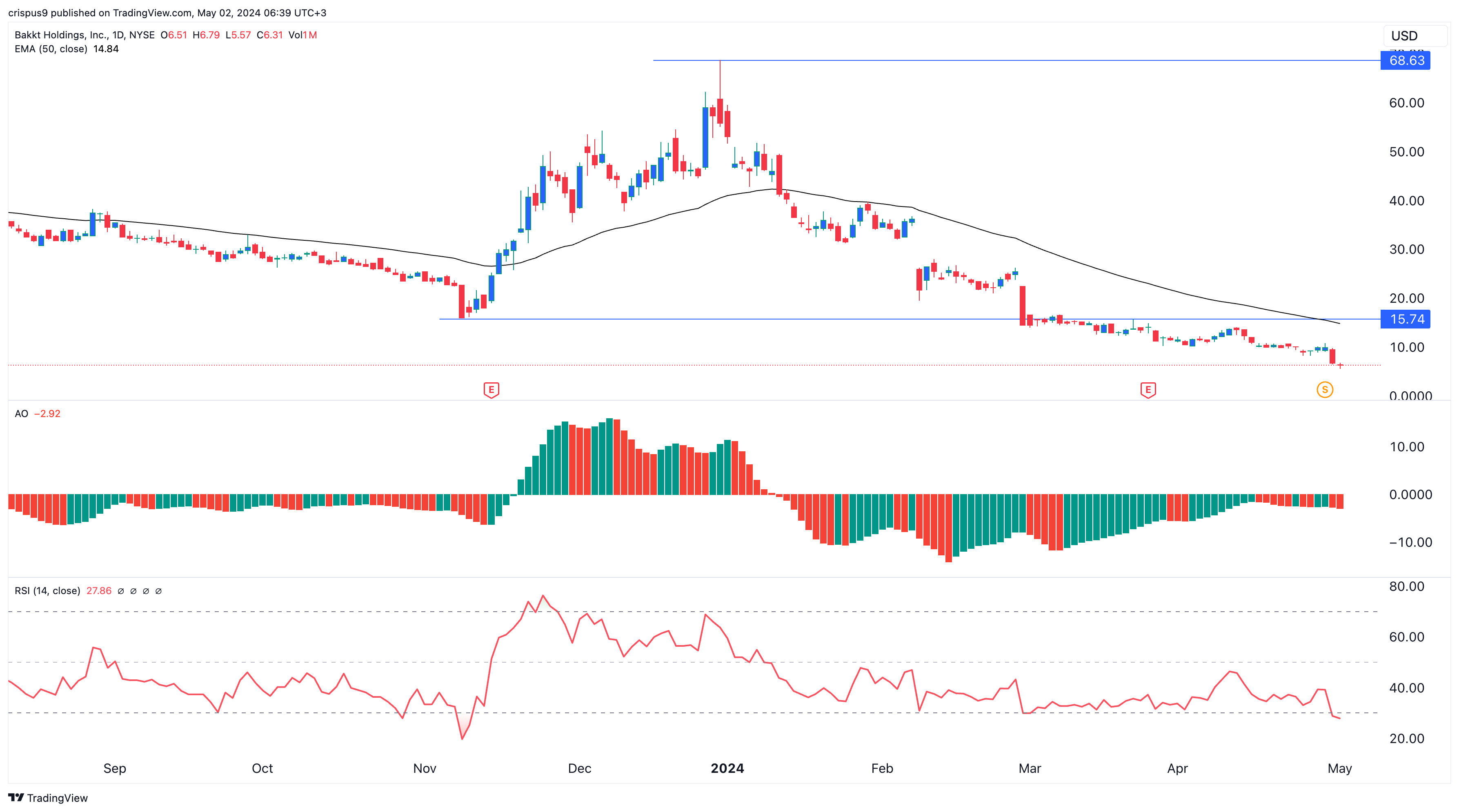

Turning to the daily chart, we see that the BKKT share price has been in a strong bearish trend in the past few months. It has retreated from December’s high of $68 to about $6.3. It has moved below the crucial support level at $15.74, its lowest level in November 2023.

The stock has crashed below all moving averages while the Awesome Oscillator has remained below the neutral level since January. At the same time, the Relative Strength Index (RSI) has dropped below the oversold level.

Therefore, the outlook for the shares is extremely bearish ahead of its earnings on May 14th. If this happens, my view is that its stock will likely drop to the important support level at $4. This trend will accelerate if the crypto prices continue falling.