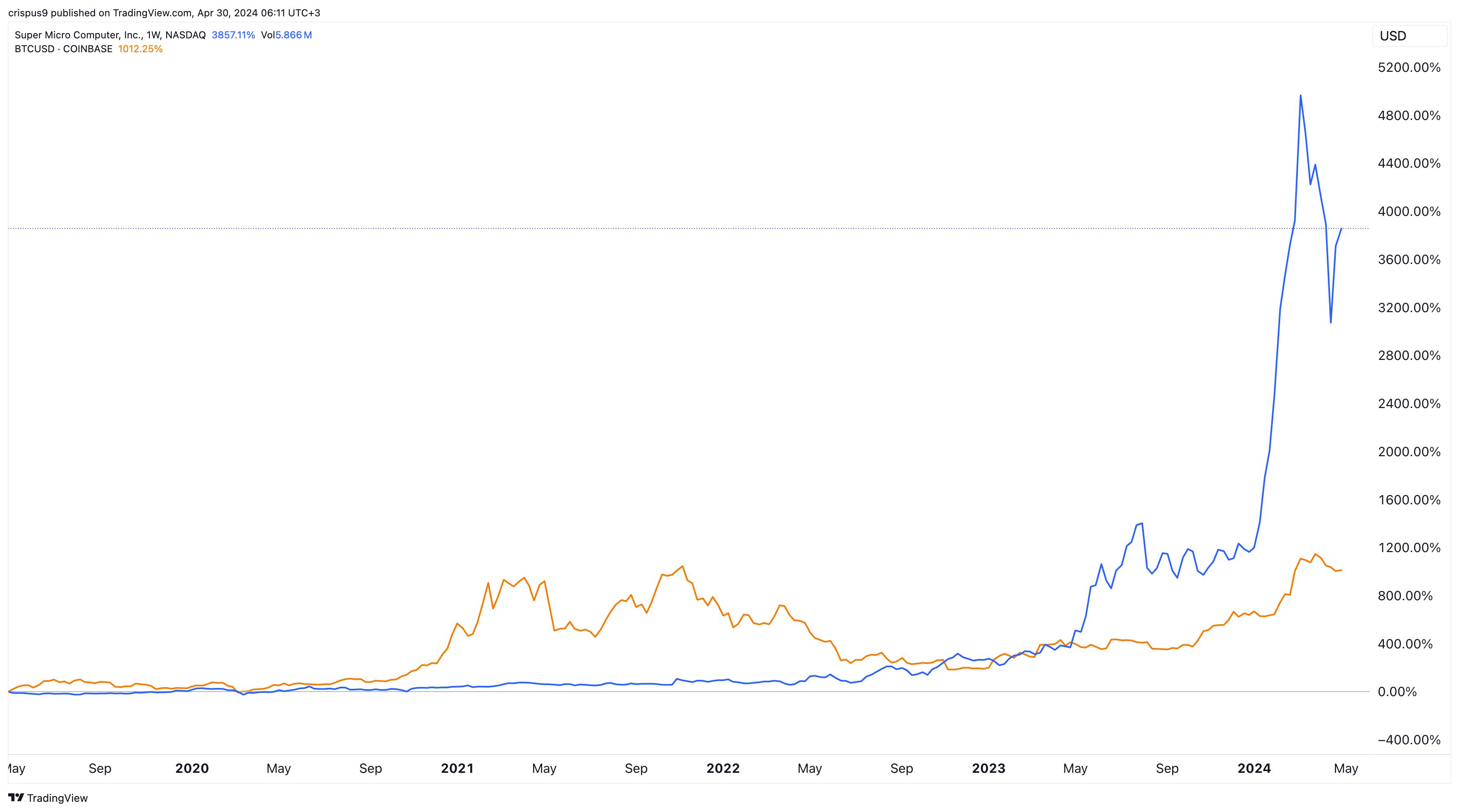

Super Micro Computer (SMCI) stock price is beating Bitcoin and the broader market as investors focus on its revenue and profitability growth. It has surged by more than 750% in the past 12 months while Bitcoin has risen by 127% in the same period.

Super Micro Computer earnings ahead

The same trend happened in the past five years as the stock soared by almost 4,000% while SMCI jumped by less than 1,200%. SMCI stock price is up by 220% while Bitcoin has spiked by about 42% this year. This performance has brought its market cap to over $50 billion, making it one of the biggest semiconductor companies in the world.

SMCI stock vs Bitcoin

Super Micro Computer’s stock has done well because of its growing revenue and profits amid the ongoing artificial intelligence (AI) boom. Its annual revenue has jumped from $3.5 billion in 2019 to over $7.13 billion in the last financial year.

At the same time, its annual profit rose from about $71 million to over $640 million and analysts expect that this growth will continue. Data by Yahoo Finance expect that its annual revenue will soar to over $14.6 billion and $21 billion in 2024 and 2025.

The next important catalyst for the SMCI stock price will be its quarterly earnings which will come out on Tuesday. Analysts expect its revenue will come in at $3.9 billion, a big jump from the $1.2 billion it made in the same quarter in 2023.

Therefore, these numbers mean that SMCI is not as expensive as most analysts believe because it is growing faster than rivals. The company has a forward PE ratio of 42.7, which is higher than the sector average of 27. It also has a price-to-earnings-to-growth (PEG) ratio of 0.78.

What is clear, however, is that Super Micro is valued to perfection, meaning that it needs to continue having this revenue and profitability growth. In the past, companies like Nvidia have maintained their pricey valuations for many years.

Bitcoin lacks a clear catalyst

Meanwhile, Bitcoin and other cryptocurrencies are lacking a clear catalyst that will push its price higher in the near term. Besides, the main drivers of the last bull run have already happened.

The Securities and Exchange Commission (SEC) has approved spot Bitcoin ETFs while the halving event has already happened. At the same time, Bitcoin demand by institutions has started falling as shown by ETF outflows.

Still, most analysts believe that Bitcoin is a good long-term investment as they compare it to digital gold. Supply and demand metrics support this view since the number of Bitcoins that are yet to be mined stands at less than 1.4 million. Also, as I wrote here, the number of Bitcoin in exchanges has dropped sharply recently.

Bitcoin also has a track record of doing well as its price surged from less than $1 in 2009 to over $63,000 today. As such, there is a likelihood that it will continue rising in the next decades. Standard Chartered analysts see Bitcoin rising to $100k this year while Cathie Wood believes that it can go up to $1 million in the next few years.

The bottom line

SMCI and Bitcoin have been great investments in the last few years as they have beaten key market indices like the S&P 500 and Nasdaq 100. The most immediate catalyst for the SMCI stock is the upcoming quarterly results. If the company continues firing on all cylinders, there is a likelihood that the stock will continue its bull run.

Bitcoin, on the other hand, is expected to remain under pressure in the short term amid the ongoing ETF outflows and lack of a catalyst. In the long term, as we have seen in the past, Bitcoin will likely bounce back.