The biggest story in the financial industry is the ongoing collapse of the Japanese yen. The USD/JPY soared to a record high of 160 on Monday morning as concerns about the easy money policies continued. Yen has crashed by over 60% in the past few years.

Meanwhile, the BTC/JPY pair remained stuck at 10,000,000, where it has been stuck at since July. This price is a few points below the year-to-date high of 11,060,350.

Japanese yen crash

The Japanese yen has been the worst-performing currency in the developed world this year. It has moved from 101.20 at the start of the Covid-19 pandemic to over 160. The same trend has happened against other major currencies like euro, sterling, and the Australian dollar.

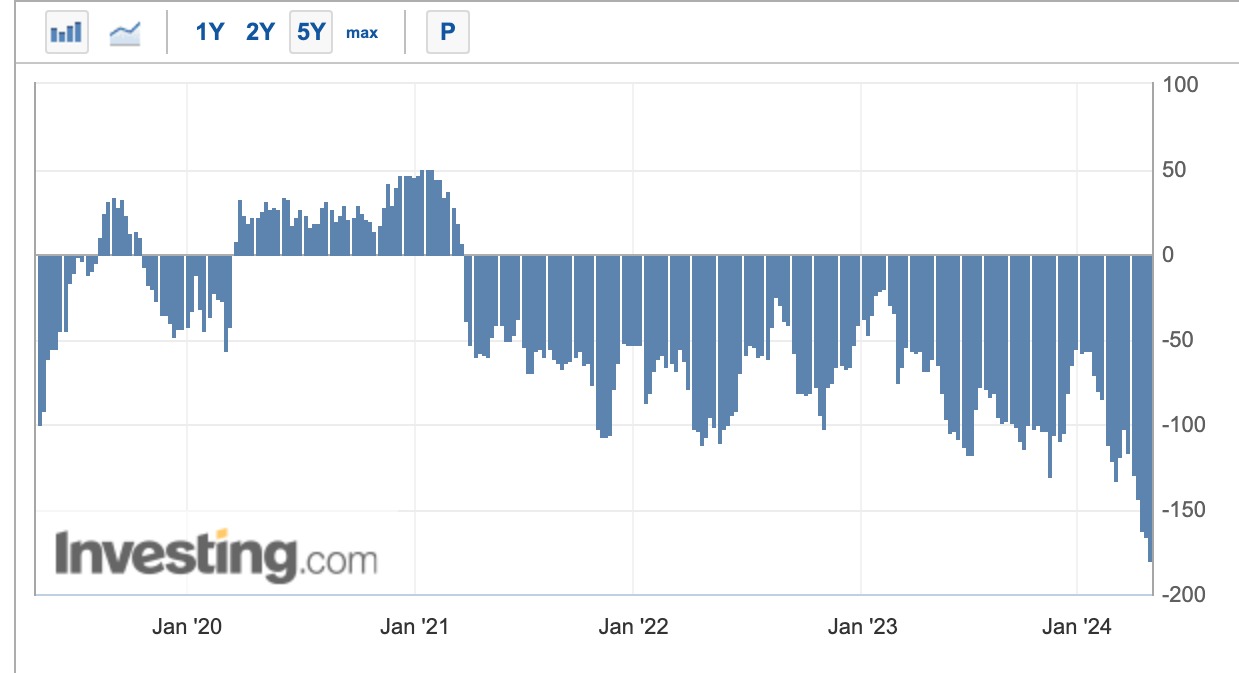

There are three main reasons why the Japanese yen has collapsed. First, hedge funds and other speculators have been highly negative on the currency. The Commitment of Traders (CoT) report published by the CFTC has shown that speculators have been negative on the currency since 2021, as shown below.

Second, the JPY currency has plunged because of the actions of the Bank of Japan (BoJ), which has been an outlier in monetary policy. While other central banks hiked rates in the past few years, the bank decided to maintain interest rates lower for longer.

Rates have remained in the negative zone for years. This ended in March when the bank delivered a 0.10% rate hike. Last Friday, the BoJ left interest rates unchanged and hinted that they would remain like that for a while.

As a result, the Japanese yen has become a popular currency for trade. Carry trade is a situation where traders borrow from low-interest rates countries to invest in high-rate places like the United States.

Third, there are serious concerns about the Japanse economy, which is the most leveraged in the developed world. It has a debt-to-GDP ratio of 250%. Most of these funds are held by the BoJ. As such, any more rate hikes would make it difficult for the country to service its debt.

Implications for Bitcoin and crypto

Analysts believe that the performance of the Japanese yen is exactly what is wrong with fiat currencies. Unlike the Japanese yen, Bitcoin has a fixed supply of 21 million and it is quickly running out.

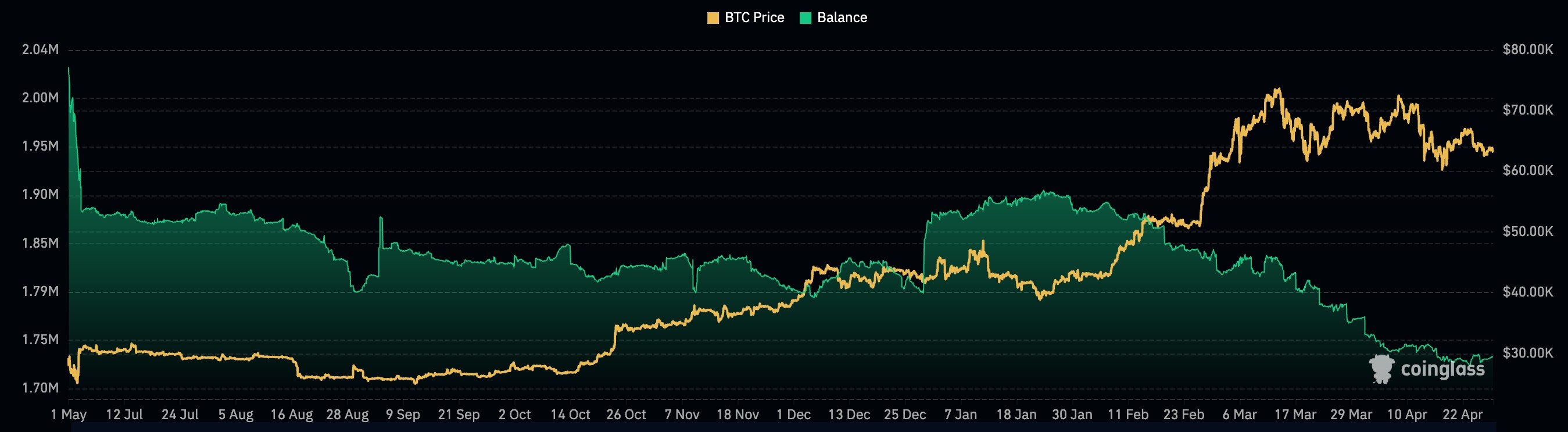

Over 19.6 million coins have already been mined and millions more have been lost forever. At the same time, the supply of Bitcoin tokens in exchanges has also crashed, as shown below.

As such, many analysts believe that Bitcoin is a better alternative to fiat currencies as the global debt crisis continues.

To be clear: Japan is not the only currency in trouble. In the United States, public debt is rising by over $1 trillion every three months. As such, at some point, the Fed will need to keep interest rates low to reduce the amount the government pays in interest.

In the near term, however, the BTC/JPY pair will react to the performance of the BTC/USD pair since the two have a close correlation.