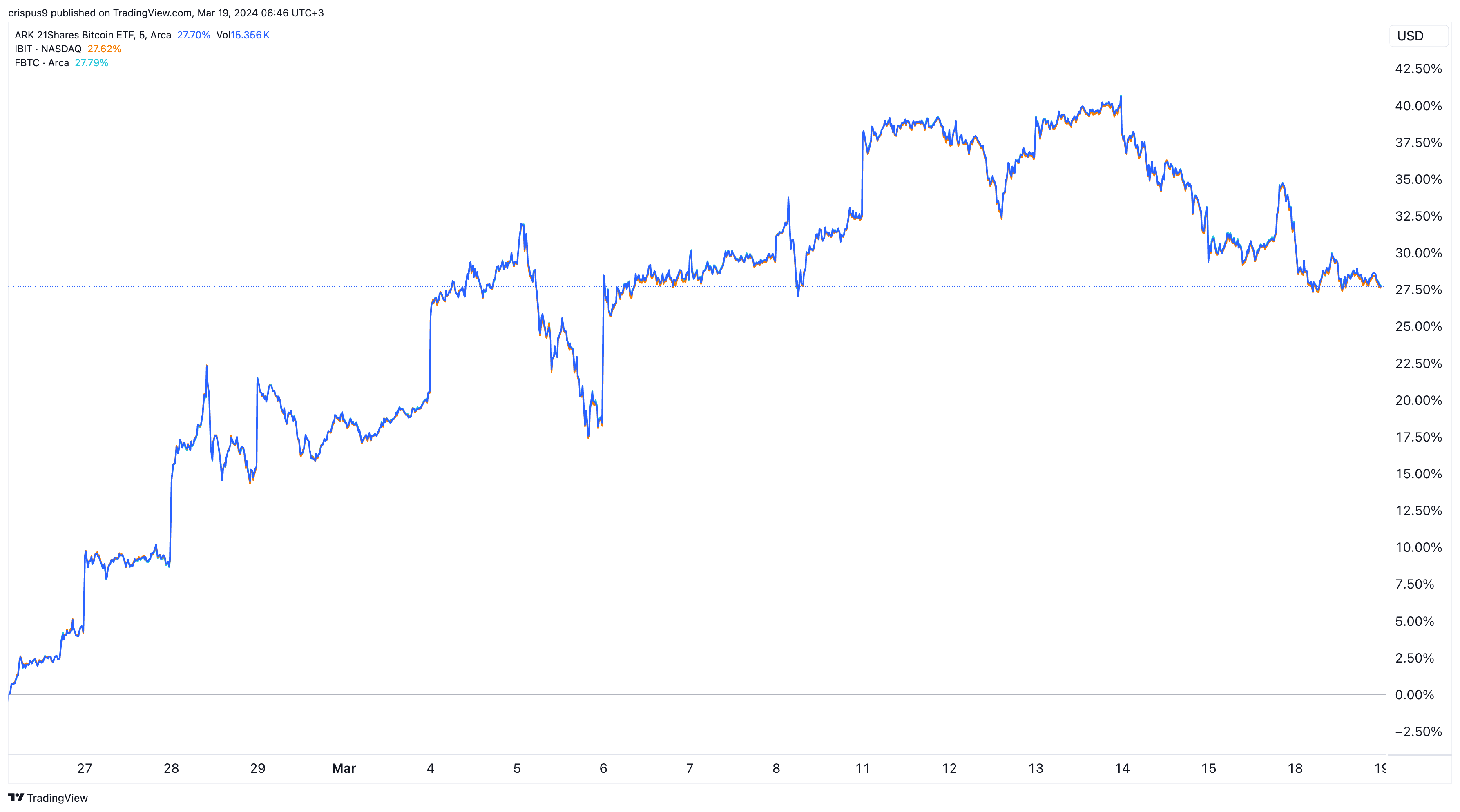

The Ark 21Shares Bitcoin ETF (ARKB), iShares Bitcoin Trust (IBIT), and the Fidelity Wise Origin Bitcoin ETF (FBTC) have come under intense pressure in the past few days as the recent bull run faded.

Bitcoin ETFs are crashing

The three funds, which track the price of Bitcoin, have all retreated sharply after peaking to their record highs last week. They have fallen by almost 10% from their all-time highs and the trend may continue when the market opens on Tuesday if Bitcoin continues plunging.

Bitcoin has retreated sharply in the past few days. After soaring to over $73,000 last week, Bitcoin has dropped below $66,000. The total market cap of all cryptocurrencies has slipped to over $2.6 trillion.

The main catalyst for these ETFs this week will be the actions of central banks. On Tuesday, the Reserve Bank of Australia (RBA) left interest rates unchanged as was widely expected.

The big news came from the Bank of Japan (BoJ), which delivered its first interest rate hike in 17 years. It also moved from negative interest rates, which have been around since 2016.

The Federal Open Market Committee (FOMC) will start its meeting on Tuesday and then deliver its decision on Wednesday. This meeting is happening at a time when inflation is not falling as fast as was widely expected.

Data released last week showed that the headline and core inflation remained above the 3% in February. Inflation jumped sharply as the prices of key services like rent and insurance remained stubbornly high. Energy prices have all crawled back recently.

Therefore, the Fed will likely deliver a hawkish pause. This is where it will leave rates unchanged and signal that it was not in a hurry to start cutting them.

In January, most analysts were expecting the Fed to start cutting rates in March. This changed after the January meeting. There are signs that hopes of a June rate cut are fading.

Bitcoin volatility remains

All this means that Bitcoin may go through substantial volatility in the coming days. Technically, it had difficulties rebounding above $68,000 on Monday.

Therefore, I suspect that the ongoing shakeout in the crypto industry will continue for a while, leading to low prices. In this case, the IBIT, FBTC, and ARKB could continue falling in the next few days.

Still, there are hopes that a rebound will happen soon. For one, Bitcoin halving will happen in April, which could lead to more gains before it happens. Also, despite the retreat, there is still ETF inflows at a time when the Bitcoin supply is running out.

Meanwhile, analysts are still upbeat about the price of Bitcoin. In a note on Monday, analysts at Standard Chartered said that Bitcoin could surge to $150k by end of the year. They expect that the coin will hit $250k in 2025. The Stanchart analyst has been highly accurate in the past few months.

Therefore, I believe that the IBIT, FBTC, and ARKB are good long-term investments, judging by their past performance, as I wrote here.