Bitcoin, Ethereum, and Stacks prices made a strong bullish breakout in the overnight session, triggering a wave of shorts liquidations in the industry. Ethereum soared above $3,200 while Bitcoin jumped above $56,000 for the first time in over two years. Stacks (STX) roared back above $3 as the rally gained momentum.

Shorts are getting wrecked

Cryptocurrency short sellers are getting wrecked as the industry remains in an excited mode. A proof of this is the fact that the fear and greed index has jumped to the greed zone of 75. In most periods, cryptocurrencies tend to shine when there is a sense of greed in the industry.

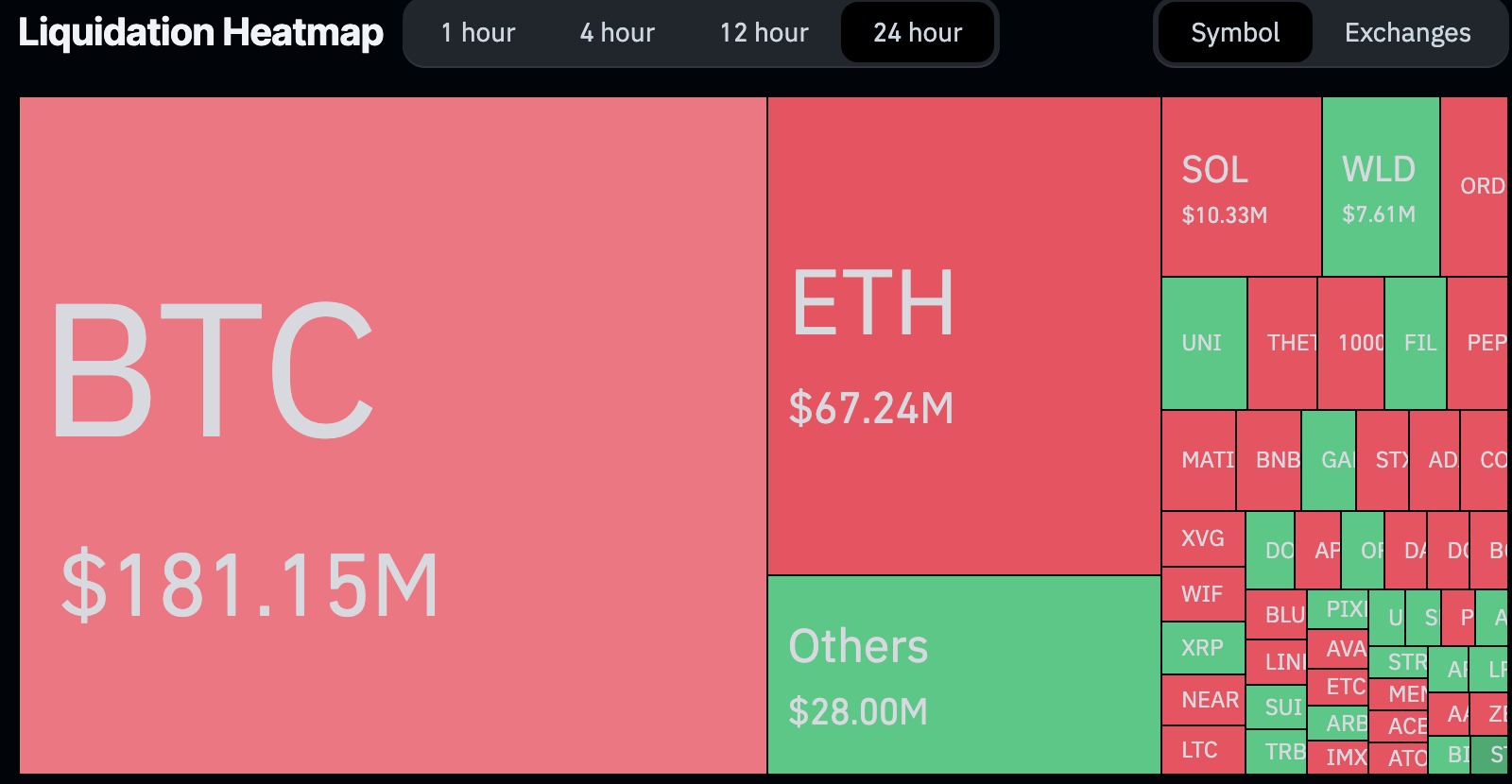

Data compiled by CoinGlass shows that shorts liquidations have soared in the past 24 hours. Bitcoin shorts worth over $181 million were liquidated and the trend may continue in the coming days as the rally continues. This was the highest liquidation figure in months.

The same situation happened in Ethereum, where shorts worth over $67 million were liquidated in that period. Additionally, the total Stacks liquidated stood at almost $1 million.

For starters, liquidations happen when brokers or exchanges like Binance, Coinbase, and OKX are forced to close positions or demand more cash. For example, in this case, if you were short Bitcoin, chances are that the position will be crashed now that it has risen by almost 10% in the past 24 hours.

Shorts liquidations are usually seen as a positive sign in the crypto industry because they ease the selling pressure. Many affected short-sellers also tend to change their tune and go long, which increases demand in the industry.

Bitcoin price had formed a bullish pattern

The ongoing Bitcoin price surge is in line with what I predicted on Monday. In that article, I noted that the coin had formed a bullish flag pattern, which is one of the most popular continuation signs. The flag was nearing the confluence level when the bullish breakout happened.

This rally is mostly because of the Bitcoin industry’s ongoing supply and demand mismatch. On the one hand, demand is rising substantially as many investors embrace spot Bitcoin ETFs. For one, the iShares Bitcoin ETF has added over $6 billion in assets. Similarly, the Fidelity and Ark Invest ETFs are also adding assets.

Bitcoin’s supply in exchanges is not growing as fast while the upcoming halving is set to make it difficult for miners to produce more coins. Therefore, there is a likelihood that Bitcoin will continue soaring in the coming weeks as investors target its all-time high of $69,000.

Stacks is rising because of its role in the crypto industry since the network aims to supercharge the adoption and performance of Bitcoin. It is the biggest layer 2 network for the network.

Meanwhile, Ethereum price has roared back as investors focus on the upcoming ETF approval. Many investors believe the SEC will ultimately approve a spot Ethereum ETF using Bitcoin as a precedent. Eight companies, including VanEck and Franklin Templeton, have applied for a spot ETH ETF.

The only challenge is that the SEC does not like Ethereum, which it sees as a security because of its staking features. Staking allows Ethereum holders to generate a monthly return. The SEC questions how those returns are calculated and who determines the final figure.