The iShares Bitcoin ETF (IBIT) and the SPDR Gold Trust (GLD) are two leading exchange-traded funds (ETFs) that provide investors access to two alternative assets: Bitcoin and gold. They are all giant funds with GLD having over $54 billion in assets and IBIT having $3.9 billion. This article will compare the two and explain the better buy.

IBIT vs GLD: supply dynamics

IBIT, like other spot Bitcoin ETFs, is a relatively new fund that has become highly popular among investors. It is a relatively cheaper fund with an expense ratio of 0.25%, which is much more affordable than the Grayscale Bitcoin Trust (GBTC), which charges 1.50%. The fund is intended to track the price of Bitcoin, the biggest cryptocurrency in the world.

GLD, on the other hand, has been in the industry for over 20 years. In this period, it has accumulated over 841 tons of gold that are valued at over $54 billion. This makes it the biggest gold-focused ETF in the financial market. Therefore, GLD and IBIT are designed to track the performance of their respective assets.

First, IBIT is a better investment because Bitcoin is seen as a digital version of gold. The two have some similarities. For example, gold and Bitcoin are rare assets, with the latter having a supply limit of 21 million. While gold has an unlimited supply, the reality is that it has become difficult to find new mines in the past few years. And existing mines are getting more challenging to mine.

Bitcoin is also becoming a tough asset to mine. Data shows that mining difficulty and hash rate have jumped to a record high. And the situation will continue when halving happens in April. Halving reduces the number of Bitcoins that miners get for solving complex problems.

Therefore, in this case, IBIT is a better fund because Bitcoin’s supply is capped at 21 million coins. Of these almost 17 million have been mined and others have been lost. This leaves a few coins in circulation at a time when demand is rising.

Historical performance

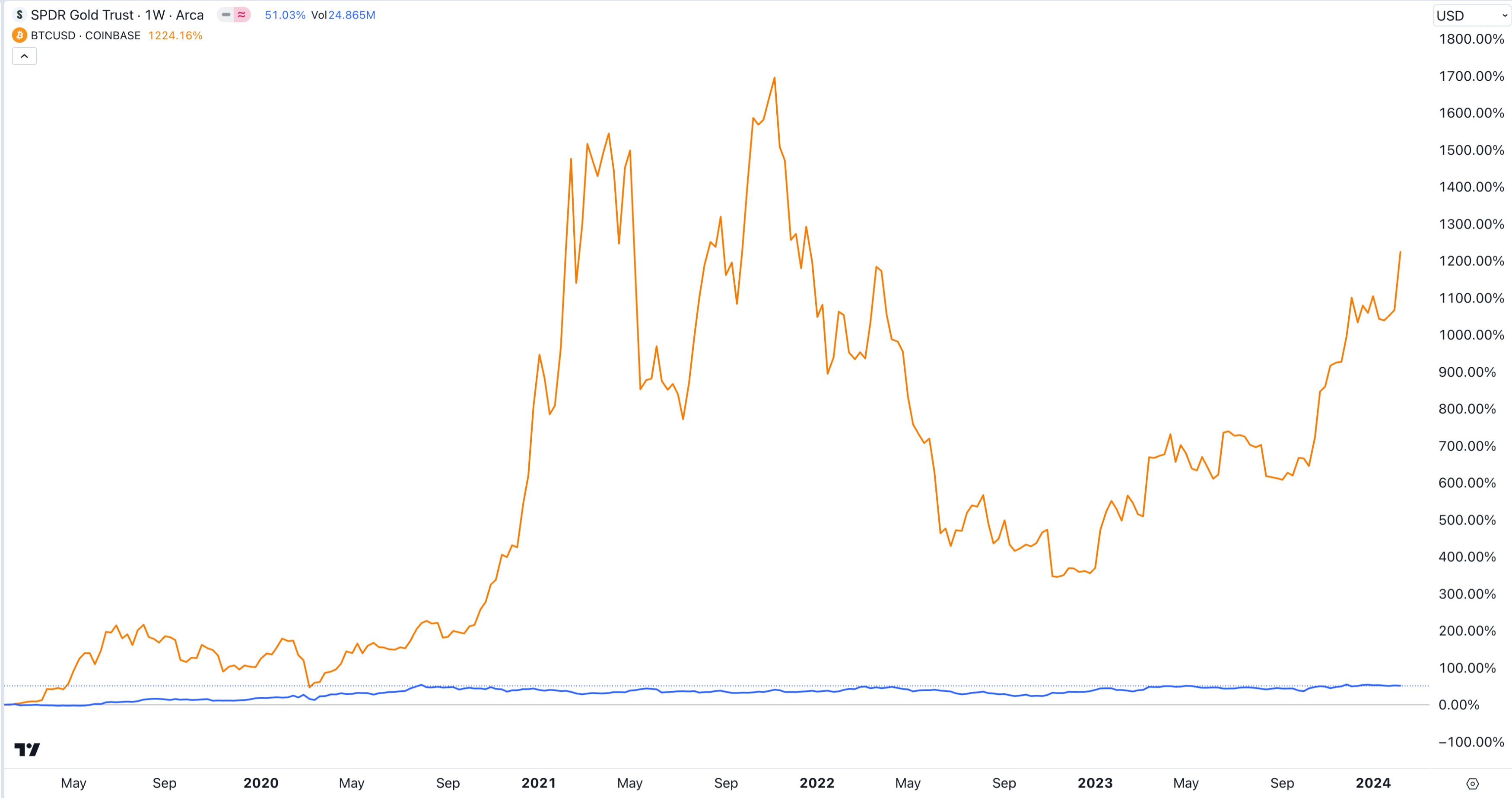

IBIT is a new ETF, meaning that we cannot compare it directly with GLD. Instead, since it is designed to track BTC, we can compare the two. Historically, Bitcoin has done better than gold. For example, in the past 12 months, BTC has jumped by 120% while the GLD ETF is up by less than 10%. The same is true in the past five years when the two have risen by 1,200% and 90%.

Bitcoin has outperformed gold primarily because of retail investors. Therefore, with eleven Bitcoin ETFs, there is a likelihood that the next phase will be driven by institutional investors who are sitting on trillions of dollars in assets.

Notably, Bitcoin has outperformed gold in a highly difficult market. In the past fifteen years, Bitcoin has been trashed by the likes of Warren Buffett, Charlie Munger, and Jamie Dimon. It has been banned in China, the second-biggest economy in the world.

Further, several companies like Celsius, FTX, Mt. Gox, and Voyager Digital have all gone bankrupt, lowering confidence among investors. While Bitcoin dropped after these collapses, it always bounces back.

Which is a better buy?

Therefore, while gold has been a good investment in the past centuries, I believe that Bitcoin is a better investment. Sure, it has its volatile moments such as when it crashed from $67,000 in 2021 to $15,500 in 2022 but history suggests that it always bounces back.

For example, a person who invested $10,000 in Bitcoin in January 2014 and held it has over $312k. Similarly, a person who invested a similar amount of money in the SPDR Gold ETF now has less than $30,000. As such, while historical performance is not always a good predictor of the future, there is a likelihood that Bitcoin will continue doing well.