- The Grayscale Bitcoin Trust has had significant outflows in the past few weeks.

- ProShares Bitcoin Strategy Fund (BITO) has also shed assets in the past 2 weeks.

- These outflows are happening as investors move to cheaper alternatives.

The Grayscale Bitcoin Trust (GBTC) and ProShares Bitcoin Strategy ETF (BITO) are shedding assets as investors move to relatively cheaper alternatives in the industry. Despite these outflows, the two funds are still popular among investors and hold billions of dollars in assets.

GBTC outflows are continuing

Data compiled by ETF.com shows that GBTC has had outflows in the past three weeks straight. On a positive side, the pace of outflows has declined recently. GBTC shed $1 billion in assets last week after shedding $2.6 billion in the previous week and $2.1 billion a week earlier. It has lost over $5.7 billion so far, bringing its assets under management to over $20 billion.

GBTC assets declined mostly because of the FTX Estate, which has been selling these assets in a bankruptcy court. This trend will likely continue after Gemini, a crypto lender, filed to sell over $1.8 billion in these funds. Still, in a recent note, analysts at Needham noted that this outflow will likely start to slowdown soon. The report said:

“We believe outflows driven by FTX and arbitrage funds should be nearing their end, as it is now estimated that the entire FTX position of 22M shares has been sold, and arbitrage funds would have exited soon after the discount closed.”

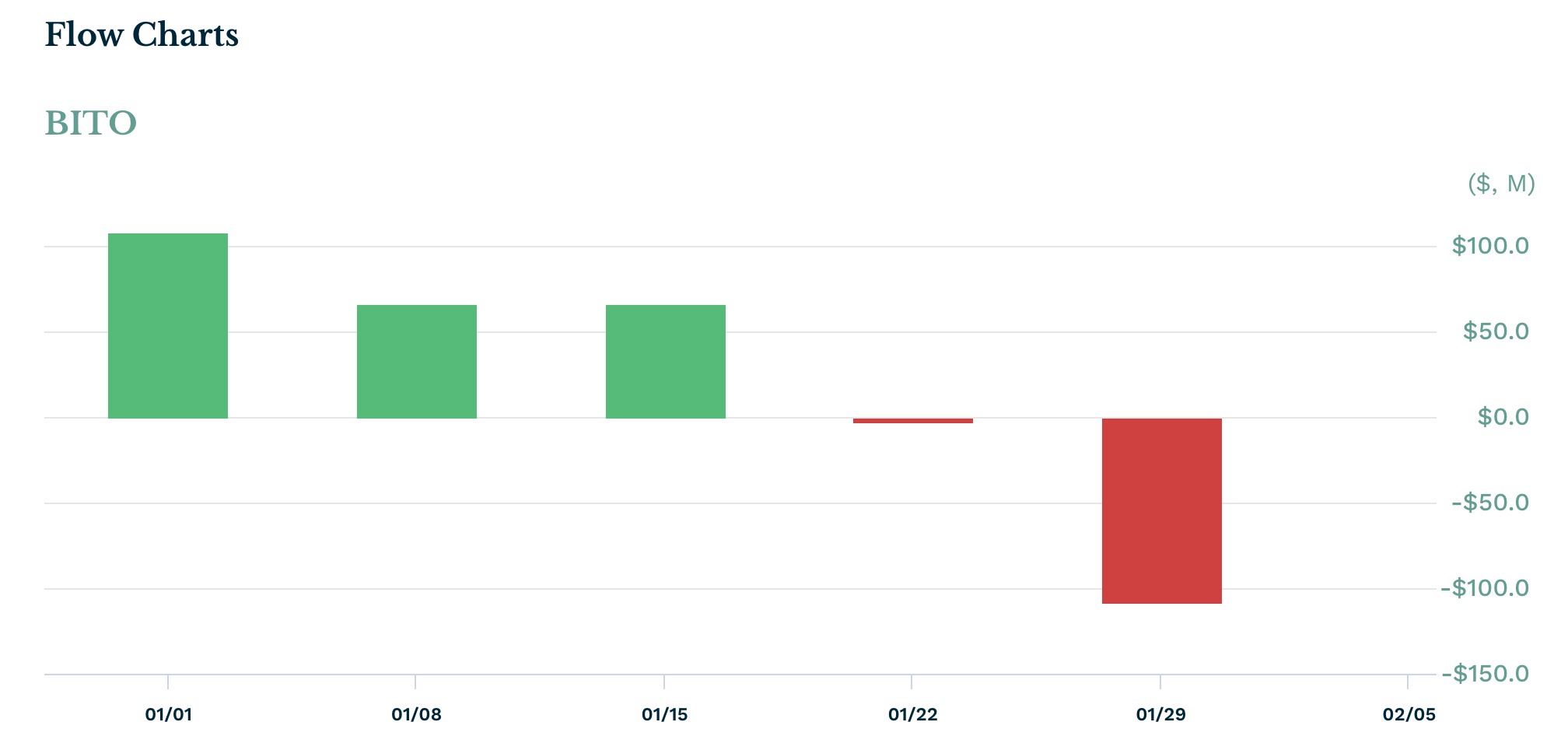

BITO has shed assets for two weeks

Meanwhile, the ProShares Bitcoin Strategy ETF (BITO) saw its biggest weekly outflow last week as it shed assets worth over $108 million. It had lost assets worth about $3.1 million a week earlier. Still, unlike GBTC, BITO has had over $129 million in inflows this year.

It makes sense that BITO and GBTC are seeing outflows because of their costs. GBTC has an expense ratio of 1.50% while BITO’s ratio stands at 0.95%. These are huge numbers since the average expense ratio of an American ETF is less than 0.30%.

The expense ratios mean that a $100k invested in GBTC will cost $1,500 per year. A similar amount invested in BITO will cost $950 annually if the Bitcoin price remains unchanged. This is weird since you can avoid these fees by just buying and holding Bitcoins in a cold wallet.

It is also weird because there are cheaper alternatives. For example. The $3.1 billion iShares Bitcoin Trust (IBIT) has an expense ratio of 0.12% while the Valkyrie Bitcoin Fund (BRRR) has no expense ratio of zero for the first six months. The same is true with Cathie Wood’s ARKB ETF.