- Jupiter was the best-performing DEX on Monday as its volume jumped.

- Other Solana DEXes like Orca and Raydium also had higher volumes.

- The surge was because of the Wen airdrop which is seeing substantial hype.

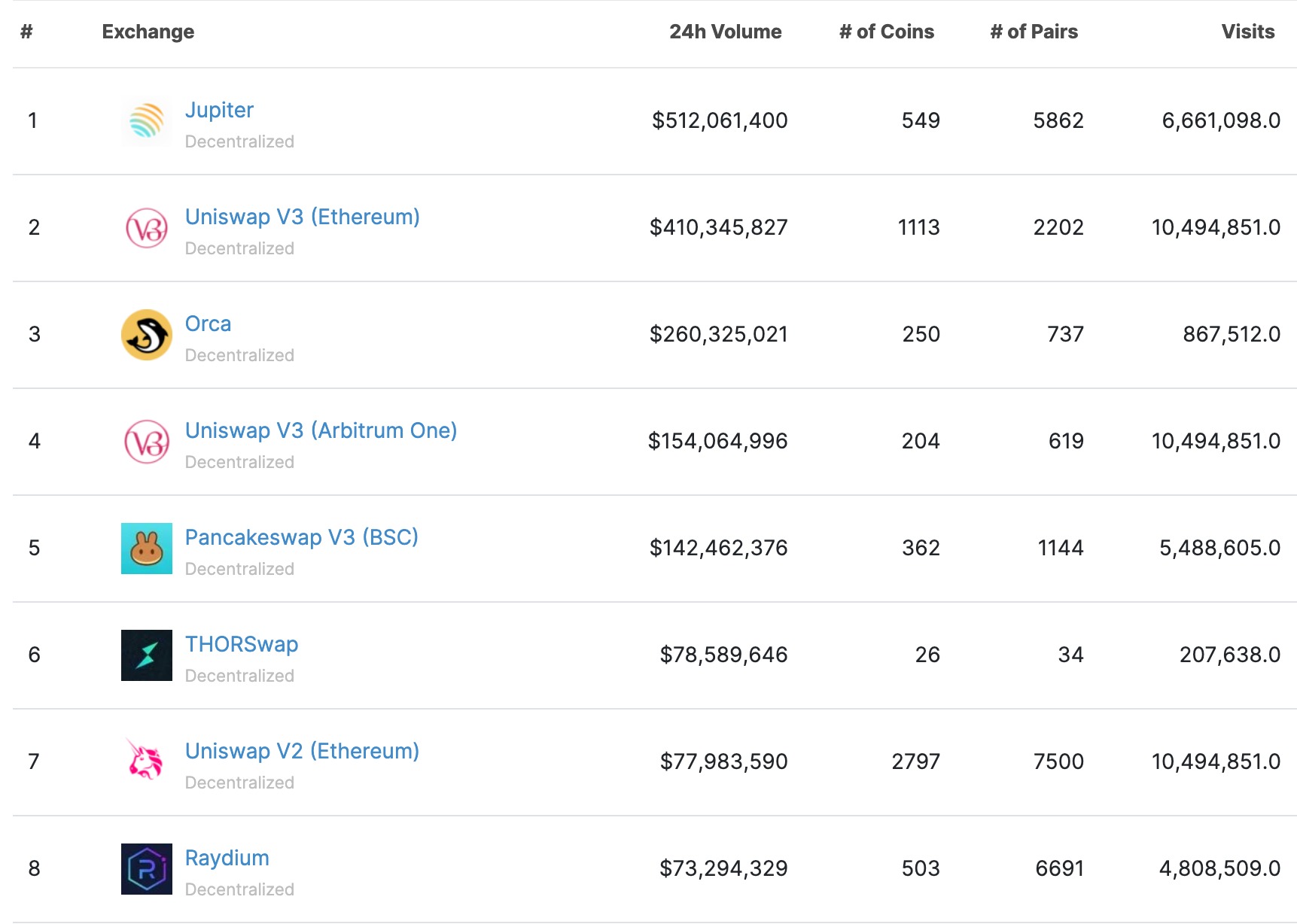

Decentralized Exchanges (DEX) in the Solana ecosystem like Jupiter, Orca, and Raydium are doing well as investors focus on the Wen airdrop. Data compiled by CoinGecko shows that Jupiter was the best-performing DEX between Sunday and Monday as its volume surged to over $512 million. This volume was much higher than that of other popular DEXes like Uniswap and dYdX.

Jupiter is not the only Solana exchange that is thriving. The same data shows that Orca was the third-best-performing exchange in the same period, processing over $260 million in transactions. Raydium, which is smaller than the two networks, handled over $73 million in the past 24 hours.

This performance also led to a strong performance of these exchanges’ tokens. Orca’s token has surged by over 33% from its lowest point this year. Similarly, Raydium’s RAY has also jumped by over 28%. Jupiter’s JUP token is yet to start trading. Most importantly, Solana price has surged in the past four straight days and is hovering near its highest point since January 18th.

The main reason for this jump is the Wen airdrop, which is open to people using Solana Mobile and people who have used Jupiter in the past six months. In most cases, Solana DEXes do well when hype surrounds one of its top tokens.

In December, we saw the volume in these exchanges surge because of Bonk, which is still the biggest memecoin in Solana’s ecosystem with over $749 million in market capitalization.

Still, looking across multiple chains shows that Uniswap is still the market leader in the DEX industry. Its Ethereum’s V3 version handled over $410 million while its Arbitrum network had $154 million. Uniswap V2 Ethereum transacted over $77 million in volume. The other most active DEX networks in the industry are PancakeSwap, THORSwap, Vertex, and Trader Joe.