- Ethereum price has formed an inverted head and shoulders pattern.

- The Average True Range (ATR) has dropped to January lows.

- The fear and greed index has moved to the neutral point.

Ethereum price remained in a consolidation phase on Wednesday even as Bitcoin jumped to $30k. It has been in a tight range in the past few days even after several important ecosystem news. ETH was trading at $1,847, was a few points above this month’s low of $1,802.

Fear and greed index cools

Ethereum and other cryptocurrencies have gone nowhere since the first week of July as demand for coins waned. Data published by The Block showed that the volume of cryptocurrencies traded in centralized exchanges (CEX) dropped to the lowest level since 2021. The same is true with the volume of ETH traded, which has dwindled recently.

Ethereum price reacted mildly to the decision by PayPal to launch a new stablecoin known as PYUSD. This coin has been built in Ethereum and analysts believe that it will have a positive impact in Ethereum’s ecosystem.

PayPal’s stablecoin will likely see strong growth in the coming years because of the company’s reputation. There is a likelihood that inflows in the coin will rise to over $40 billion in the next two years.

The stablecoin is a simple way for the company to make money as other parts of its business slows. It will do that by investing the funds in corporate and sovereign bonds. For example, Tether is making over $1 billion in profits every quarter as interest rates rise.

Ethereum price has waved as the fear and greed index remains at the neutral point of 50. In most cases, BTC and ETC coins tend to waver when the index is in a neutral level of between 40 and 60.

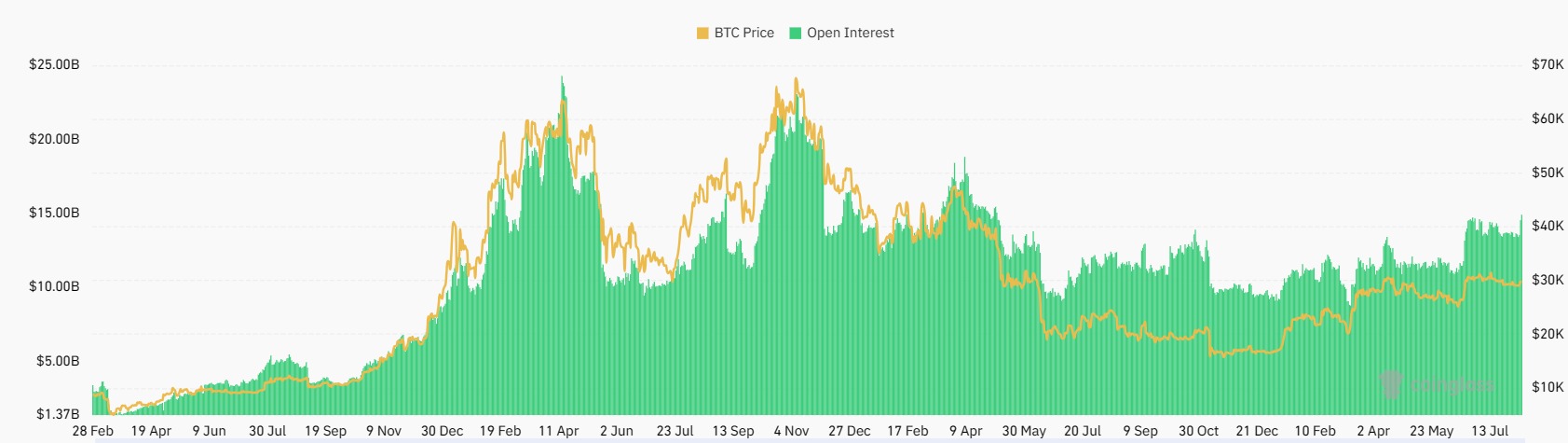

Additional data shows that Ethereum’s open interest in the futures market has remained in a consolidation phase in the past few weeks. This interest rose to over $14.53 billion on Tuesday, with most of them being in Binance, Bybit, CME, and OKX.

Ethereum price prediction

The daily chart shows that the ETH price has moved sideways in the past few days. A closer look shows that it has formed an inverted head and shoulders pattern whose neckline is at $2,023. In price action analysis, this is usually a bullish sign.

Ethereum price has moved to the 25-day and 50-day moving averages while the Average True Range (ATR) has moved to the lowest level since January 14th. ATR is the most popular indicator of volatility in the market.

Therefore, there is a likelihood that the ETH price will have a bullish breakout, with the next level to watch being at $2,023.