- Many Emerging Market currencies are getting worthless.

- Lebanon, Kenya, Ghana, and Nigerian currencies have crashed.

- Countries are facing massive US dollar shortage.

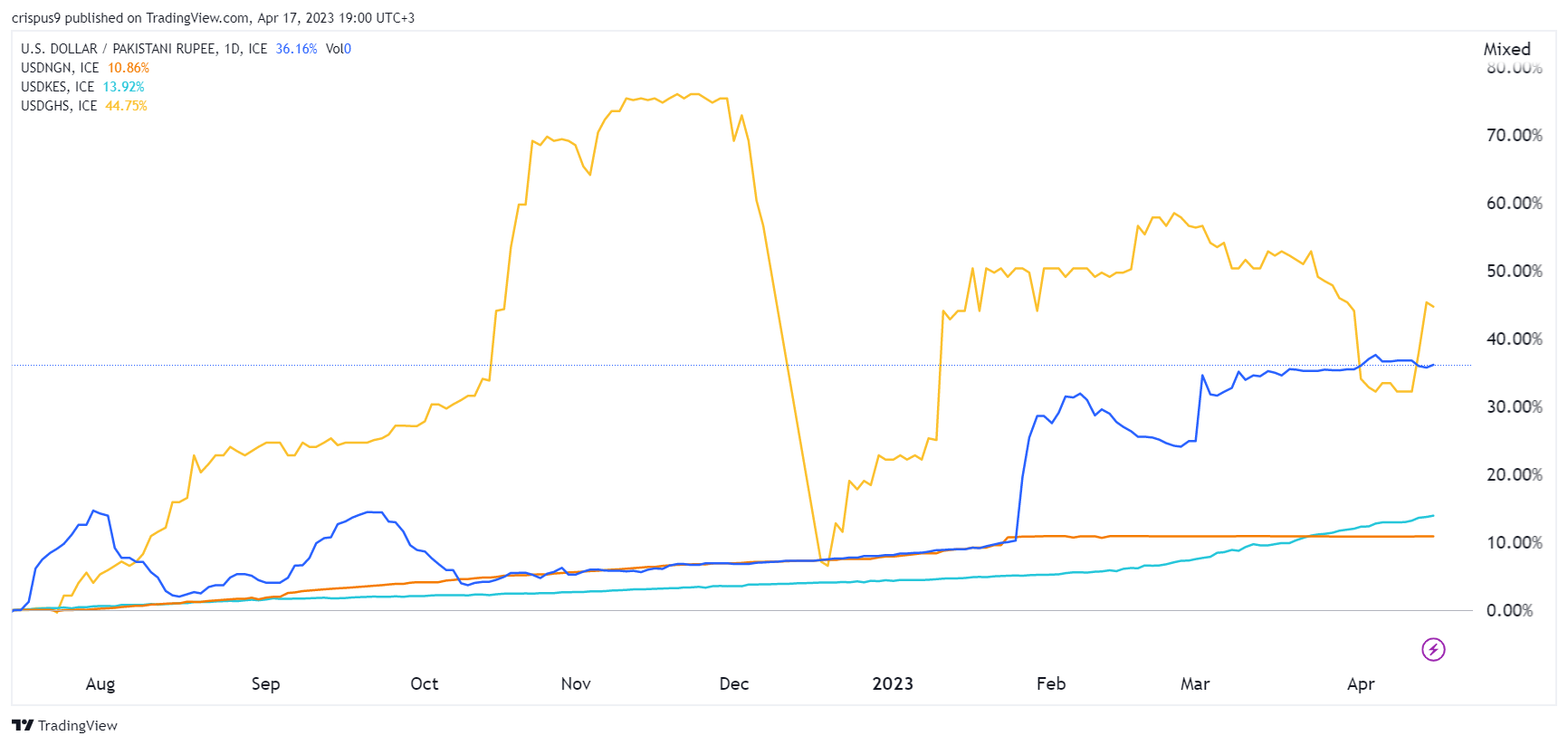

Developing countries are in trouble as a major dollar shortage leads to a major currency devaluation. Most emerging and frontier countries have seen their currencies drop to multi-year lows even as the US dollar index (DXY) has dropped by over 14% from its 2022 highs. Therefore, some analysts believe that stablecoins like USD Coin and Tether (USDT) to be better alternatives.

Pakistani rupee, Lebanon pound crash

Many countries in the developed countries have seen the biggest currency devaluation in modern times. For example, in Lebanon, the pound has lost all its value as the country’s economy has collapsed. Once pegged at 1,500 to the USD, the currency is now exchanging hands at over 150k.

The same trend is happening in Pakistan, where the rupee was trading at 280 against the USD dollar. It has crashed by over 147% from its highest point in 2019. Meanwhile, in Kenya, the shilling is trading at 150 against the USD dollar. It was trading at 65 in 2008.

The same trend is happening in Nigeria, where the naira has crashed to 460. In the unofficial exchanges, the NGN was trading at over 700. In Zimbabwe, the currency has lost value even as demand for its key minerals like lithium and nickel has risen.

These countries are struggling mostly because of their dire economic situation. For one, countries like Sri Lanka, Ghana, and Pakistan are about to default on their international obligations.

At the same time, the aggressive tightening by the Federal Reserve has made the US dollar scarce as investors move away from these risky markets.

Read more: How to buy Tether.

Are stablecoins better alternatives?

Some analysts believe that stablecoins are better alternatives for people in these countries. A stablecoin is a cryptocurrency that is backed by a fiat currency than the US dollar. Some of the most popular stablecoins are USD Coin and Tether.

These stablecoins are seen as better alternatives because they are backed to the US dollar. As a result, when their currencies crash, these users can be cushioned because of the safety of the USD.

There are benefits of holding stablecoins vs the fiat dollar. For one, some stablecoin transactions are usually cheaper than those offered by fiat currencies. Further, some money transfer companies have suspended their services to several endangered countries like Pakistan and Nigeria.

Further, stablecoins are usually faster than fiat currencies in some instances. Additionally, stablecoins are less volatile than popular cryptocurrencies like Bitcoin and Ethereum.