- 52% affluent Asian investors hold some form of digital asset

- Accenture expects the figure to rise to 73% by end of 2022

- An average of 7% of portfolios consist of digital assets

Over half of the affluent investors in Asia (52%) held digital assets like cryptocurrencies, stablecoins, and crypto investment funds in the first quarter of 2022 and the figure could reach 73% by the end of this year, according to a report.

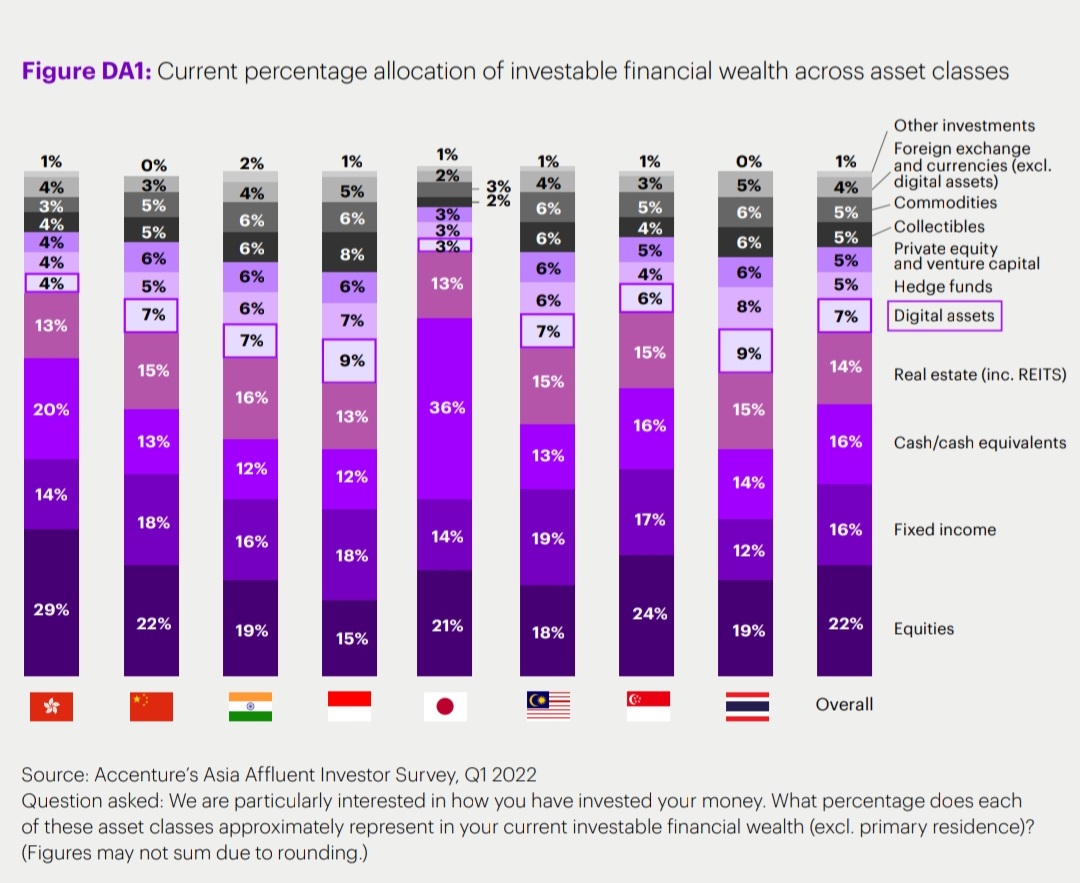

According to a research report compiled by Accenture, digital assets are a top-five asset class for investors in Asia, with affluent investors, on average, allocating 7% of their portfolio to digital assets—more than forex, commodities, or collectibles.

Wealth management firms losing opportunity

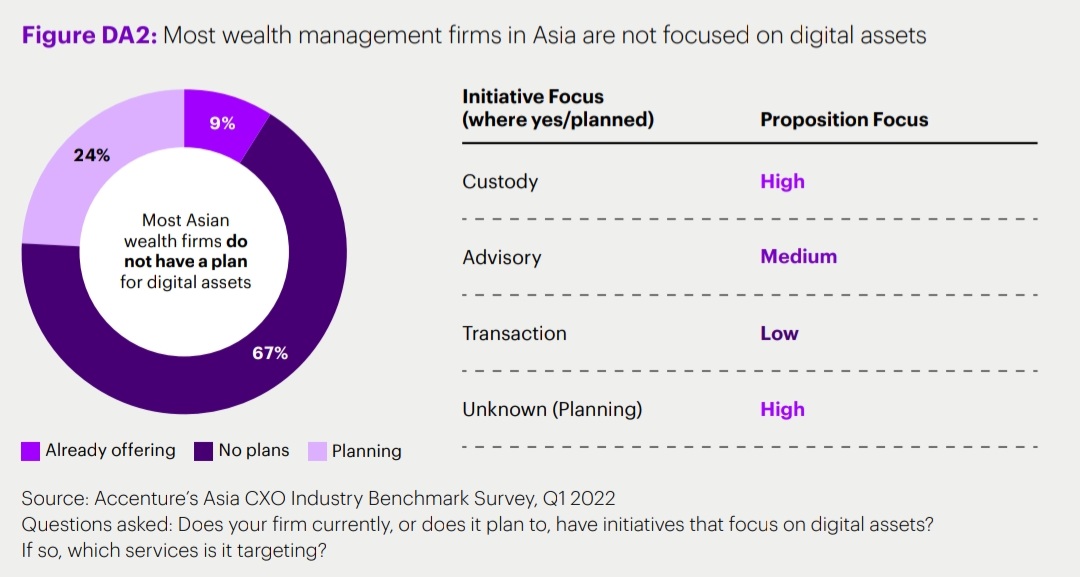

The report, called “The Future of Asia Wealth Management,” further states that for wealth management firms, digital assets are a $54 billion revenue opportunity, that most are ignoring.

“Yet two-thirds of wealth management firms in Asia have no plans to offer any form of digital asset proposition. This lack of engagement by firms means many clients are seeking advice about digital assets on unregulated forums, including peer-to-peer advice on social media,” the report states.

Wealth management firms holding back for various reasons

Among firms’ barriers to action are a lack of belief and understanding of digital assets, a wait-and-see mindset, and—given that launching a digital assets proposition is operationally complex.

Clients want their firms to support their digital asset pursuits. While cryptocurrencies and custody support are important, clients want their firms to go even further and offer an advisory-led proposition that includes all these digital asset types, the report states.

Nicole Bodack, Accenture’s Capital Markets industry group lead for Growth MarketsInvestors are looking for new products and advisory services as they grapple with market volatility, longer life expectancies, and the plethora of investment information available online.

“To reimagine the client experience and differentiate themselves in key areas, including digital assets and ESG, wealth managers will need to find a balance in their advisory offerings between effective human relationship-management and smart, automated systems that can generate insights for clients and financial advisors,” Bodack says.

Digital assets are a rare, clear industry

Digital assets represent a rare, clear industry white space with a significant business opportunity, the report further stated, adding that there is no excuse for firms to lack a strategy and plan to enter this space.

“To succeed, firms need to first ask themselves questions in five key areas that could shape their digital assets proposition: clients; products and services; competition; value-chain ownership; and regulatory constraints,” it stated.

Accenture conducted the survey among over 3,200 clients across China, Hong Kong, India, Indonesia, Japan, Malaysia, Singapore, and Thailand.

The company defines an affluent investor as anyone that manages investable assets of between US$100,000 to $1 million.