The Financial Conduct Authority (FCA) is likely to face an expensive legal battle over its regulatory rejection for crypto-asset activity, as the number of businesses temporarily denied permission to operate significantly increases.

FCA’s temporary permissions regime demands that companies engaging in cryptocurrency should register with FCA and meet strict money-laundering conditions.

That said, most of the businesses that have met these requirements and applied for permission to operate are yet to gain approval. So far only 22 businesses have been listed on the regulator’s register as of yesterday.

That means nearly 90% of businesses have been either been rejected or withdrawn, forcing them to stop any digital asset-related activities right away.

Binance didn’t make the cut

Binance, a regulated crypto trading platform for users who want to buy, sell, or trade Bitcoin and other coins, is among the many businesses that didn’t make the cut.

And as they await their fate, other crypto exchanges (that were in operation before the 10th of January, 2020) were permitted to continue doing business — much to the detriment of the likes of Binance.

Legal and technology experts now warn of a looming “expensive” court battle against the regulator. Companies with deep pockets will likely appeal FCA’s actions as more appeals over the rejection mount.

With FCA’s temporary permissions regime expiring March next year, the regulator could end up in front of a judge sooner rather than later.

Companies likely to challenge the FCA in Upper Tribunal

Doug Robinson, Simmons & Simmons law firms managing associate for dispute resolution, decried the FCA’s delay in granting permissions saying it could adversely affect business in the long term.

“Some of these businesses could have received lots of investment from their founders or shareholders, and have been operating sometimes for 18 months while they’re waiting to hear whether they’ll be registered or not.”

Robinson further stated that going the legal way is inevitable.

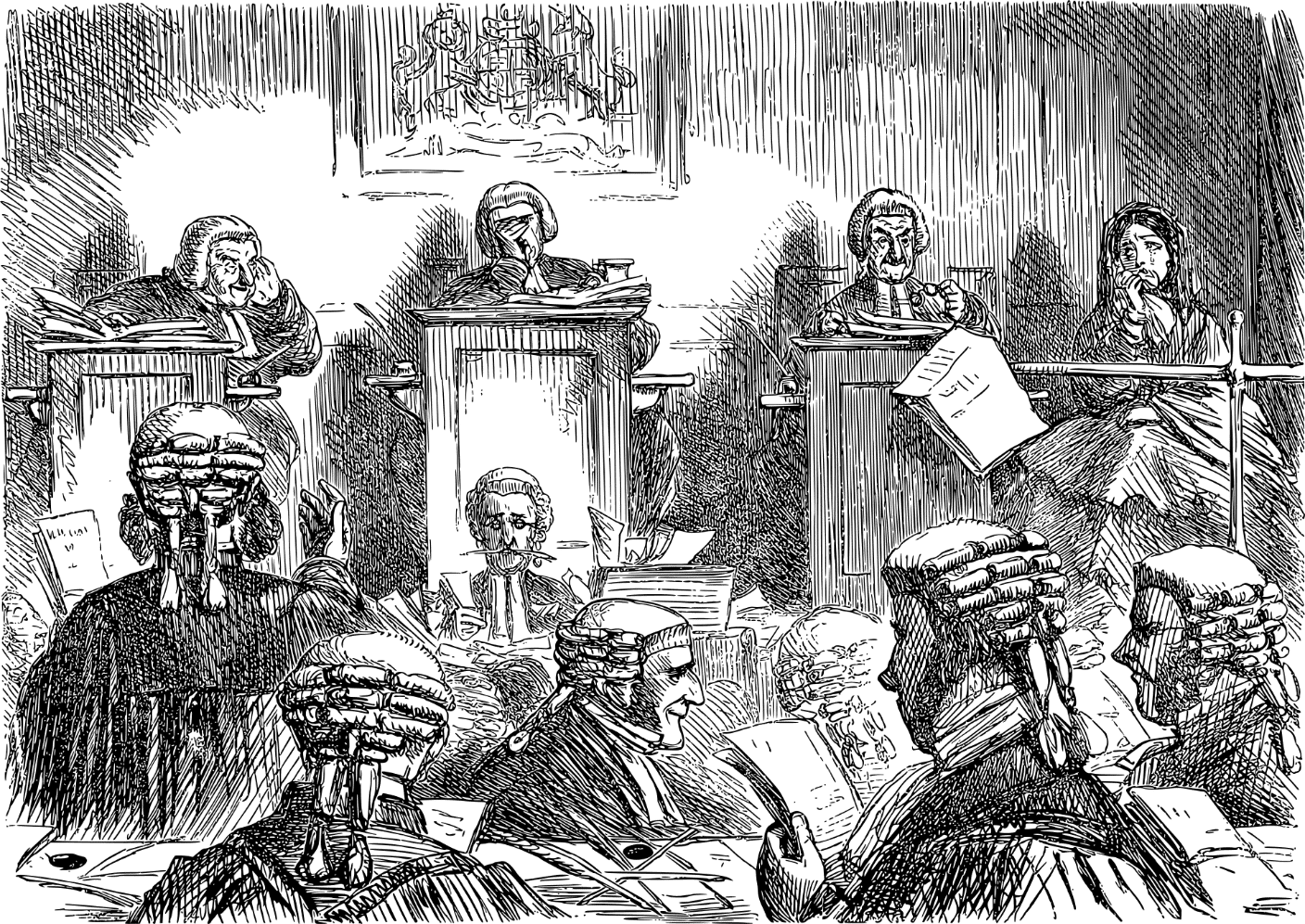

“[Businesses] could ultimately, if they had to go all the way, end up before the [Upper] Tribunal in a public courtroom challenging the decision the FCA has come to.”

Robinson continues:

“While a challenge of that nature is very difficult for a firm to do … I do think someone may [challenge the FCA’s actions] simply because of what is at stake for them and their business.”

Changpeng Zhao, CEO of Binance, said (concerning FCA’s actions) that “it would certainly be unhelpful for [the regulator] if the tribunal were to disagree with the decision they had reached”.

FCA is yet to comment on the matter.