- Algorand price rallied as its DeFi total value locked (TVL) surged.

- Most DeFi protocols have added over 10% to their ecosystem in the past 30 days.

- However, on-chain metrics point to significant ecosystem growth.

Algorand price has made a spectacular comeback since December as its ecosystem booms. The ALGO/USDT price soared to a high of $0.2596 this week. This price was its highest point since November 21. At its peak level this year, Algorand was up by over 55% from its December lows.

Algorand DeFi TVL rises

Algorand’s DeFi ecosystem is doing well in 2023. A good way to measure this performance is to consider the amount of money deposited in the ecosystem, also known as the total value locked (TVL). Data compiled by DeFi Llama shows that the amount locked in the ecosystem has risen from last year’s low of $96 million to about $250 million.

AlgoFi, a hub for trading, borrowing, and lending crypo tokens, is still the biggest name in Algorand’s ecosystem. Its platform shows that the 24-hour trading volume rose to more than $441k. At the same time, the TVL has jumped by 98% in the past 30 days and by 10% this week.

The other main top performer in the past 30 days was Tinyman, a DEX that has a platform for trading tokens. Like AlgoFi, the TVL in its ecosystem has risen by over 85% to over $11.6 million. Algorand now has 9 protocols with over $1 million worth of assets.

Find out how to buy Algorand.

However, despite all this, on-chain metrics on Algorand are not all that encouraging. According to IntoTheBlock, only 4% of all Algorand’s holdings are currently profitable. Also, most of ALGO’s coins or 77% are held by large holders. This means that a few entities have a unique ability of moving the coin.

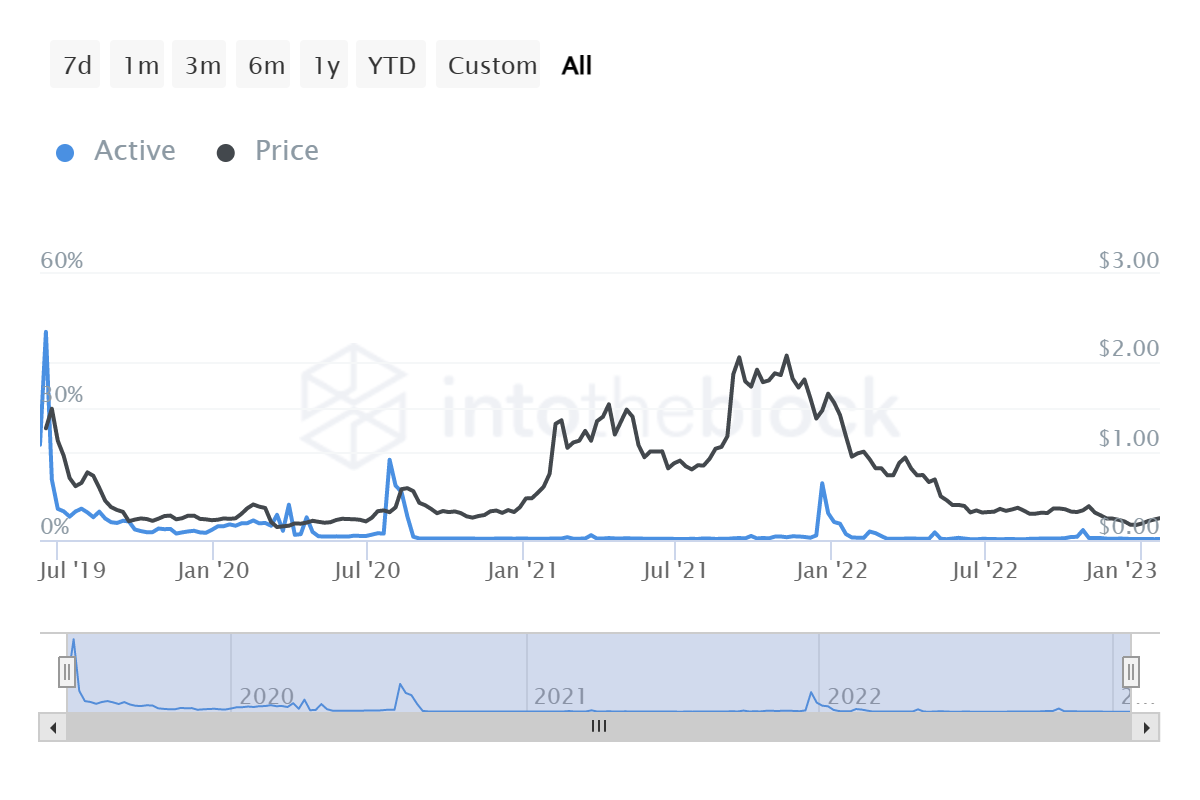

Other numbers are not good as well. For example, the number of daily active addresses in the ecosystem has crashed to 32.6k. At its peak, it had over 130k active addresses. The active address ratio has plunged to just 0.21% as shown below.

Another reason why the ALGO price has jumped is that the network hired Jessicah Tsai Chin, the former Facebook CMO as their marketing partner.

Algorand price forecast

Last month, I accurately predicted the current Algorand rally citing the inverted head and shoulders pattern. The 4H chart shows that the ALGO price has been in a strong bullish trend in the past few days. As it rose, the token has been supported by the dots of the parabolic SAR and the Ichimoku cloud. The Supertrend indicator has also been in the green area for the most part.

However, the coin has formed a rising broadening wedge pattern that is shown in yellow. In price action analysis, this pattern is usually a bearish sign. Therefore, there is a likelihood that the coin will soon have a bearish breakout as sellers target the psychological level at $0.20, which is about 20% below the current level.