Since launching 12 years ago, Bankless Times has brought unbiased news and leading comparison in the crypto & financial markets. Our articles and guides are based on high quality, fact checked research with our readers best interests at heart, and we seek to apply our vigorous journalistic standards to all of our efforts.

BanklessTimes.com is dedicated to helping customers learn more about trading, investing and the future of finance. We accept commission from some of the providers on our site, and this may affect where they are positioned on our lists. This affiliate advertising model allows us to continue providing content to our readers for free. Our reviews are not influenced by this and are impartial. You can find out more about our business model here.

Cheapest Cryptocurrency Exchanges

Cryptocurrency exchanges make buying crypto accessible. However, they can also eat into your profits through hidden fees. To help you avoid expensive platforms, we have picked out the cheapest cryptocurrency exchanges to use in 2024.

These platforms charge low fees for deposits, trading, withdrawals and account management. Keep reading for our take on each platform and how to get started.

- The 5 Cheapest Crypto Exchanges in 2024

- What Is a Cryptocurrency Exchange?

- What Fees Are There When Buying Cryptocurrencies?

- What Is the Difference Between Cryptocurrency Exchanges and Brokers?

- What Is a Centralized and Decentralized Exchange?

- Cheapest Ways to Pay for Cryptocurrencies

- What Are the Cheapest Cryptocurrency Exchanges in 2024?

- Cheapest Bitcoin Exchanges Compared

- What to Consider When Choosing the Cheapest Crypto Exchange?

- How to Get Started With a Cryptocurrency Exchange?

- Where Can I Use Cryptocurrency Exchanges?

- Alternative Ways to Buy Cryptocurrencies

- Final Thoughts

- FAQs

- Read More About Crypto Trading & Exchanges

The 5 Cheapest Crypto Exchanges in 2024

| Coinbase | – User-friendly interface – Native crypto wallet – Earn interest on your crypto – Low account minimum | Beginners looking to trade large-cap coins. |

| eToro | – Access stocks and crypto in one place – Copy the trades of experts – Regulated by global bodies – Access Bitcoin Spot ETF | Investors who want to buy crypto and stocks. |

| Kraken | – Cold wallet storage – Trade with leverage up to 5x – Advanced traders can access – Kraken Pro with sophisticated trading tools – Over 200 cryptocurrencies available | Advanced traders who are interested in margin trading. |

| Crypto.com | – Excellent mobile app – Users can receive trading discounts by holding CRO – Native decentralized wallet – Over 250 cryptocurrencies available | Traders who want to manage their portfolio on their mobile phones. |

| Binance | – Over 500 cryptocurrencies available – Extensive range of educational materials – Automated trading | Users who are looking to build a diverse portfolio with lots of different cryptos. |

What Is a Cryptocurrency Exchange?

A cryptocurrency exchange is a digital marketplace that lets traders purchase and sell coins. The exchange connects buyers and sellers through their platform and applies a fee for their service. Also, some of these platforms have multiple trading pairs for each cryptocurrency, making it easier to invest with fiat currency and altcoins.

The exchange can provide multiple order types: market, limit, and stop-loss. This gives investors more choices regarding the price they buy cryptocurrencies.

What Fees Are There When Buying Cryptocurrencies?

Cryptocurrency exchanges apply different fees for using their services. Investors can find this information by looking at the exchange’s fee structure page. Here’s a list of the main costs users will run into:

Maker and Taker Fee:

-

Most exchanges apply maker and taker fees on all trades. This means you’ll pay a small percentage fee on top of the sell or buy order. Also, your trade volume can impact the amount you’ll pay as most platforms use a tier system. A maker is someone who creates liquidity by placing a limit order, while a taker is someone who takes liquidity out of the market by placing a market order.

Deposit Fee:

-

Some payment methods can apply a fee for transferring funds into your account. For example, some exchanges have percentage fees for using a credit card to transfer fiat currency. Other payment methods may incur a flat fee. Bank transfers are typically the cheapest payment method, while some platforms may also support less common methods like PayPal or Skrill. Most platforms don’t charge for crypto deposits, but they may for fiat deposits. Eightcap is one of the few platforms that doesn’t charges for any deposits.

Withdrawal Fee:

-

After buying crypto, some investors transfer their coins to a private wallet, where they’ll encounter a withdrawal fee. This is usually paid with the token being withdrawn from the platform. However, the fee amount varies between coins due to the blockchain type. If you want to withdraw fiat, this also tends to incur a withdrawal fee, which may be a percentage or a flat fee.

Spreads:

-

This is a hidden fee that some platforms apply. For example, Bitcoin could cost $39,000, but the exchange’s trading interface will show $40,000. Therefore, you’ll be buying less crypto with your money if the exchange doesn’t offer accurate real-time prices. Brokers charge a spread, as well as some exchanges like Coinbase. However, there is no spread added on Binance or Coinbase’s Advanced Trade feature. In addition, Many cryptocurrency enthusiasts often debate the merits of Binance vs. Coinbase, as both exchanges offer diverse trading options and user-friendly interfaces for buying, selling, and storing digital assets.

What Is the Difference Between Cryptocurrency Exchanges and Brokers?

Cryptocurrency exchanges connect buyers and sellers. When you place a buy order on an exchange, it goes into the order book, where it is matched with a corresponding sell order. The exchange charges a trading fee for facilitating this trade. When you buy on an exchange, you will own the coins you buy, and exchanges often provide features such as wallets, staking, and lending.

There is no order book to see on a broker, as when you place an order, the broker takes your order to the market and fills it for you. The broker acts as a middleman between you and the market, for which it charges a spread and/or commission. Furthermore, some brokers only offer derivative products, which enable you to speculate on the price of crypto without actually owning it.

What Is a Centralized and Decentralized Exchange?

Centralized Exchange:

-

Centralized cryptocurrency exchanges (CEXs) are run by a company that dictates the platform’s available coins and investment opportunities. These applications let investors deposit fiat currencies and convert them to coins. Also, most CEXs require completing a KYC process to comply with laws and regulations. Therefore, centralized platforms are not an anonymous method of buying cryptocurrencies.

Decentralized Exchanges:

-

On the other hand, decentralized exchanges (DEXs) let users buy and sell coins without revealing their identities. DEXs do not own their coins and connect buyers with sellers. Moreover, decentralized exchanges make their money by applying a small fee on all trades, which is later sent to the contract address. Finally, these platforms are built on the blockchain and use smart contracts to operate.

Cheapest Ways to Pay for Cryptocurrencies

Centralized Payment Methods

Debit and Credit Cards:

-

These options are the easiest to use and widely available on crypto exchanges. The deposit fees vary between platforms, but it could be worth using this option for convenience. Simply input your details, and you’re good to go. Also, the platform can save your information, making it easy to deposit next time.

e-Wallets:

-

Services like PayPal are a great option because they are straightforward to use. Some exchanges let you connect e-Wallets, so you won’t need to waste time writing in your information.

Bank Transfer:

-

Although bank transfers are slower, they have the lowest transfer fees. Moreover, users can utilize SWIFT, SEPA, and ACH to transfer money faster. However, international payments may take longer to complete.

Anonymous Payment Methods

Crypto ATMs:

-

When using a crypto ATM, you’ll simply provide your wallet address and pay with cash or card. However, some crypto ATMs charge exorbitant fees, so you should check the smallprint first.

P2P:

-

Some platforms facilitate exchanges directly between users. This method is riskier and more prone to scams. Therefore, you should always hold your payment in escrow and only release it once the seller releases your coins.

Prepaid Cards:

-

Users can buy prepaid cards online and at local retail stores. They work like regular bank cards but do not require attaching your identity to them. However, they have a limited amount they can hold, making it difficult to buy significant amounts of crypto.

What Are the Cheapest Cryptocurrency Exchanges in 2024?

Binance

|

Minimum Deposit |

$10 |

|

Deposit Fee |

Up to 1.8% |

|

Withdrawal Fee |

Up to 1.8% |

|

Trading Fee |

Up to 0.1% |

Binance is the largest cryptocurrency exchange with over 120 million users worldwide. It offers hundreds of coins to trade at incredibly low fees. These fees can be reduced by 25% if you hold Binance’s native BNB token. The platform has multiple trading interfaces that are tailor-made for beginners and experts.

Furthermore, Binance offers their clients multiple investment opportunities like Binance Earn, staking, and liquidity farming. Also, they have recently added NFTs to the platform for those who are interested.

Key Features

-

Binance is the biggest crypto exchange with over 120 million users.

-

The platform has recently launched an NFT marketplace.

-

After buying coins, clients can participate in staking and liquidity farming.

-

Binance provides several trading platforms that have different tools.

-

The exchange offers hundreds of coins with multiple trading pairs.

- KYC process is easy and fast

- Offers small and high market cap coins

- The platform is available in multiple languages

- Holding the BNB token reduces trading fees by 25%

- Binance is not an anonymous method of buying cryptocurrency

- The US version has fewer coins and features

- Customer support is slow

How to Get Started

-

Step 1: Create an account with Binance and verify your identity

-

Step 2: Deposit money into the account using one of the methods Binance provides

-

Step 3: Then open the trading interface and select a cryptocurrency you want to purchase

-

Step 4: Input the number of coins you want to receive and click the buy button

Coinbase (Advanced Trade)

|

Minimum Deposit |

$50 |

|

Deposit Fee |

Up to 2.5% |

|

Withdrawal Fee |

Up to 2.5% |

|

Trading Fee |

Up to 0.6% |

Coinbase is the best exchange for beginners due to its easy-to-use interface, educational resources, and security features. The platform offers advanced trading features that are intuitive and offer much smaller fees compared to the simple trading features. Although the trading interface seems complicated, users can watch a quick tutorial to get to grips with the platform.

While the trading fees are much lower for Coinbase Advanced Trade, you’ll still have to deposit and withdraw through the main site, which could incur higher fees, depending on your location and payment method. Moreoever, When comparing Coinbase vs Gemini, one can see that both platforms offer simple and secure methods for deposit and withdrawal, yet their transaction fees, speed, and user interfaces can vary significantly, making it essential to choose based on personal preference and investment goals.

Key Features

-

Advanced charting and trading options.

-

2-step authentication and cold storage for coins.

-

Stop-loss and limits orders.

-

Earn free crypto in the Learning Rewards section

- Low fees that vary between 0% and 0.60%

- The platform has amazing security and stores funds on cold wallets

- The trading interface supports market, stop-loss, and limit orders

- Deposit and withdrawal fees can be significant

- Customer support is slow due to the high volume of users

How to Get Started

-

Step 1: Go to the official CoinBase website and create an account.

-

Step 2: Complete the KYC process to lift withdrawal restrictions.

-

Step 3: Then deposit funds into the account via bank transfer, card or cryptocurrency.

-

Step 4: After, click the Trade tab at the side and select Advanced at the top.

-

Step 5: Select the trading pair for the crypto you want to buy and the currency in your account.

-

Step 6: Choose a market or limit order and enter the amount you want to buy.

-

Step 7: Review the order and click the buy button to acquire the coins.

KuCoin

|

Minimum Deposit |

$5 |

|

Deposit Fee |

1 GBP/EUR |

|

Withdrawal Fee |

1 GBP/EUR |

|

Trading Fee |

Up to 0.1% |

KuCoin is a large crypto exchange that claims 1 in 4 investors use their platform. The exchange offers basic trading options, margins, and futures. After buying coins, KuCoin provides several investment options such as staking, lending, and liquidity pools.

Moreover, KuCoin has ultra-low fees for trades that range from -0.005% to 0.1%. The fees depend on your trading volume in the past 30 days. Also, you can receive discounts on fees by holding the KuCoin token (KCS).

Furthermore, the platform offers a huge range of cryptocurrencies with various trading pairs. In addition, users can participate in launch pads and buy into projects at the early stages.

Key Features

-

KuCoin has exchange fees of -0.005% to 0.1% depending on your past 30-day trading volume

-

The platform claims 1 in 4 crypto investors use KuCoin

-

KuCoin has multi-factor authentication and encryption to protect users’ money

-

Investors can purchase coins anonymously since the KYC process is not required

-

KuCoin has various investment options for users

- Incredibly low fees compared to other platforms

- Great selecting of cryptocurrencies

- Users can earn interest in their crypto by participating in staking programs

- Poor reviews by previous investors

- Not licensed in the United States

How to Get Started

-

Step 1: Open the official KuCoin website and sign up

-

Step 2: Complete the KYC process if you want to lift withdrawal restrictions. Unverified accounts are restricted to withdrawing 5 BTC daily

-

Step 3: Deposit fiat currency or crypto into your account and open the trading interface

-

Step 4: Select the coin you want to purchase and the amount

-

Step 5: Lastly, click the buy button to complete the trade

Kraken

|

Minimum Deposit |

$10 |

|

Deposit Fee |

Up to $5 |

|

Withdrawal Fee |

Up to $35 |

|

Trading Fee |

Up to 0.26% |

Kraken is a brilliant choice for new and experienced crypto investors looking for low fees. There are several methods of making free deposits, and the trading fees are fairly competitive. Also, the platform supports hundreds of altcoins so clients can diversify their portfolios.

Furthermore, Kraken lets users enable 2-step authentication to increase their security. Clients can also lock their account at any moment if they think it was breached. Finally, the platform offers a great selection of staking programs where users can earn interest in their holdings. In fact, when comparing cryptocurrency exchange platforms, the option of staking on Kraken provides a unique benefit to investors, setting it apart in the debate of Kraken vs Gemini, where the latter might lack similar staking opportunities.

Key Features

-

The platform has low fees that are reduced depending on your 30-day trading volume

-

Kraken supports 200+ cryptocurrencies

-

Kraken uses world-class security to prevent hacks and users’ funds from getting stolen

-

The platform has 24/7 customer support that has low queue times

-

The learn section lets beginners understand the fundamentals of investing

- Kraken has a user-friendly interface

- The platform has high liquidity that lets users trade at market rates

- Excellent security

- Competitors support more altcoins than Kraken

- Kraken has a low score of 2.1 stars on Trustpilot

- Must buy more than $10 worth of crypto to complete a trade

How to Get Started

-

Step 1: Create an account on the official Kraken website and complete the KYC process

-

Step 2: Next, deposit money into your account using one of the options provided

-

Step 3: Open the trading platform and select the token you want to acquire

-

Step 4: Lastly, input the number of coins you wish to purchase and click “buy” to complete the trade

Bybit

|

Minimum Deposit |

$10 |

|

Deposit Fee |

Up to 1.22% |

|

Withdrawal Fee |

Up to £2 |

|

Trading Fee |

Up to 1% |

Bybit is a platform that facilitates crypto trading for Bitcoin and altcoins. The trading fees are exceptionally low at 0.1% on buy and sell orders. Also, the platform has excellent staking options and promotions. Lastly, Bybit is multilingual, and support is available 24/7.

Key Features

-

Its powerful API helps conduct multiple trades and quickly updates market prices

-

Bybit uses a 100k TPS matching engine to acquire the best prices

-

Friendly user interface

-

Excellent variety of investment options

-

Bybit supports a huge selection of coins

- Customer support is excellent and works 24/7

- Low fee structure

- Accurate crypto prices

- A limited number of trading pairs

- Not available in the US

How to Get Started

-

Step 1: Open an account with Bybit and complete the verification process

-

Step 2: Deposit funds and open the trading interface

-

Step 3: Select the crypto you want to buy and input the amount

-

Step 4: Click the buy button, and the platform will automatically apply the low fees

Cheapest Bitcoin Exchanges Compared

|

Trading Fee |

Deposit Fee |

Withdrawal Fee |

|

|---|---|---|---|

|

Binance |

0 to 0.1% |

0 to 1.8% |

0 to 1.8% |

|

Coinbase |

0 to 0.6% |

0 to 2.5% |

0 to 2.5% |

|

KuCoin |

-0.005% to 0.1% |

1 GBP/EUR |

1 GBP/EUR |

|

Kraken |

0 to 0.26% |

0 to 5 USD |

4 to 35 USD |

|

Bybit |

0 to 0.1% |

0 to 1.22% |

0 to 2 GBP |

What to Consider When Choosing the Cheapest Crypto Exchange?

Fees:

-

This is the most obvious thing to consider when you’re looking for the cheapest Bitcoin exchanges, but it’s not always clear which platform has the lowest fees. You might find the platform with the lowest trading fees, only to find its high deposit and withdrawal fees cancel out your cost savings. What’s more, with some platforms charging a flat fee and some a percentage, the cheapest option may depend on your amount of funds.

Ease of Use:

-

The platform should be easy to use with a user-friendly interface. Nobody wants to waste time looking for essential features, so why should you? We’ve mentioned a few platforms have a straightforward design, making them accessible for all investors.

Security:

-

Before depositing money, ensure that the exchange has excellent security. Usually, a dedicated page showcases what services they use for protecting their clients. Also, the platform should allow whitelisting wallet addresses and 2-step authentication. When it comes to protecting your funds, you ideally want to pick a platform that stores the majority of crypto in cold wallets, has insurance or an emergency fund for the portion in hot wallets, and keeps fiat in insured bank accounts.

Coins:

-

Coin variety means you can diversify your investments. If you want to buy new and obscure coins, you’ll need a platform with a wide selection. What’s more, some platforms only offer crypto-crypto trading pairs, some only crypto-fiat trading pairs, and some both, so it’s worth thinking about what you want to trade before selecting a platform.

Investment Options:

-

Ways to invest, trade, and earn can vary from one exchange to the next, so you should check what opportunities are available on each platform. A number of exchanges offer derivatives trading in eligible jurisdictions. Other options you might have include staking, lending, and trading robots.

How to Get Started With a Cryptocurrency Exchange?

Joining a crypto exchange, depositing, and making a purchase is usually very straightforward and can even be done in a matter of minutes in some cases. The steps provided below illustrate how to get started with Binance, but the process is very similar for other crypto platforms.

Sign up

Head over to the official Binance website, click “Get Started”, and fill out your email address and password.

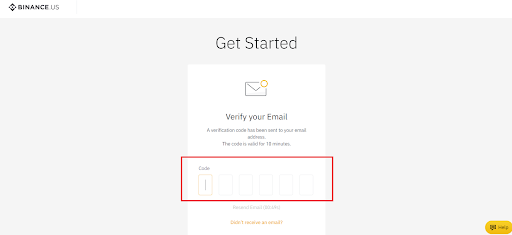

Verify your identity

Before you can start trading you’ll need to complete the KYC process by verifying your email and uploading an image of your photo ID.

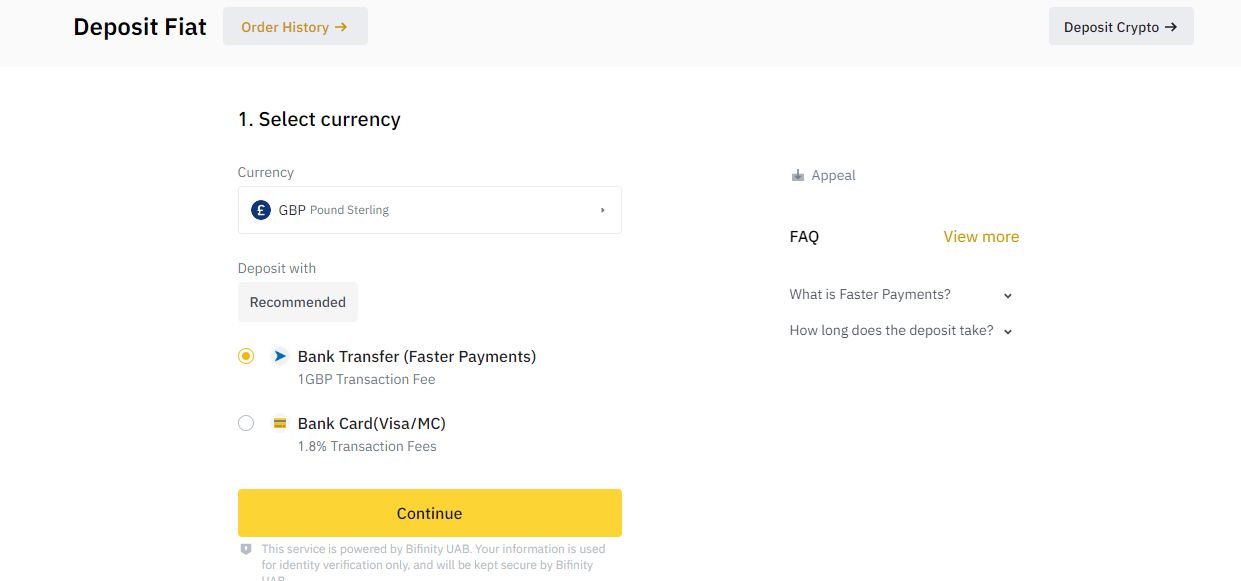

Deposit funds

The verification process should be pretty quick. Then you can go to the deposit page and choose your currency and preferred payment method.

Buy crypto

Once your funds arrive, you can open the spot trading interface and search for the coin you want. Create a buy order by entering an amount and selecting whether to use a market order or a limit order.

Where Can I Use Cryptocurrency Exchanges?

Buying and trading crypto is perfectly legal in the US, Europe, and most countries around the world. This means that you can sign up to and use crypto exchanges, though the exchanges may require a license to operate in your country.

However, there are some countries with severe crypto restrictions that may make it very difficult or even illegal to access a cryptocurrency exchange.

Can I use a crypto exchange in China?

No. China has banned cryptocurrencies outright and clamped down hard on miners and exchanges. Major exchanges have stopped accepting Chinese users. Those who want to buy crypto in China use P2P trading, VPNs, and intermediaries in foreign countries.

Can I use a crypto exchange in Algeria?

No, cryptocurrencies have need banned in Algeria since 2018, so Algerians aren’t permitted to use crypto exchanges.

Can I use a crypto exchange in Bangladesh?

No, Bangladesh made using crypto a jailable offence in 2014, and financial institutions are banned from enabling Bitcoin transactions.

Can I use a crypto exchange in Egypt?

It is illegal to use crypto exchanges in Egypt as Bitcoin transactions are prohibited under Islamic law.

Can I use a crypto exchange in Bolivia?

Using a crypto exchange in Bolivia would be illegal as the country has implemented an absolute ban on unregulated currencies.

Alternative Ways to Buy Cryptocurrencies

Brokers:

-

A straightforward method of investing in crypto is with a broker. They can be more accessible due to the easy buying process and user-friendly interfaces. Some brokers enable you to speculate on the price of crypto without actually buying it.

Crypto ATMs:

-

This method is great for buying coins anonymously. However, crypto ATMs have a limited variety of coins and larger fees.

Decentralized Exchanges:

-

DEXs are brilliant for buying coins without ID since there is no KYC process. These platforms have excellent trading fees, coin variety, and investment options. However, gas fees can get pretty high and you can’t use fiat currencies on DEXs.

Final Thoughts

Selecting the cheapest exchange to buy crypto comes down to your requirements. The platform should contain everything you need, from investment opportunities to a large coin variety. Therefore, you shouldn’t hesitate to use a crypto exchange with slightly higher fees if it delivers a premium service.

Nowadays, there are plenty of options for investors at different levels. Coinbase is great for beginners, while Binance is a good choice for advanced traders. Remember that crypto is highly volatile, so only invest what you can afford to lose.

FAQs

Is it possible to buy crypto without fees?

Unless you have a large 30-day trading volume, you’ll usually have to pay fees for buying crypto. However, the platforms we’ve mentioned have ultra-low fees, so you’ll save a lot of money. Binance even offers fee-free trading on certain trading pairs and during promotions.

How do I select a low-fee cryptocurrency exchange?

First, you can check the fee structure page and see if it aligns with your requirements. Then ensure the exchange contains all the features you require.

What are the cheapest cryptocurrency exchanges?

The crypto marketplace has many low-fee exchanges that offer various trading interfaces and investment options. We believe the best options are Binance, Coinbase, Kraken, and KuCoin.

Is it safe to use the cheapest Bitcoin exchanges?

You should check the security features before you sign up. Our top pick for safety is Coinbase as it uses cold storage, 2FA, and crypto insurance.

Do all crypto exchanges charge fees?

Yes. All crypto exchanges cover their operational costs by charging fees, but the type and amount varies.

Are Coinbase fees high?

The trading fees for using Coinbase’s Advanced Trade feature are pretty competitive, but the fees for making instant purchases are notoriously high.

Read More About Crypto Trading & Exchanges

Contributors