Since launching 12 years ago, Bankless Times has brought unbiased news and leading comparison in the crypto & financial markets. Our articles and guides are based on high quality, fact checked research with our readers best interests at heart, and we seek to apply our vigorous journalistic standards to all of our efforts.

BanklessTimes.com is dedicated to helping customers learn more about trading, investing and the future of finance. We accept commission from some of the providers on our site, and this may affect where they are positioned on our lists. This affiliate advertising model allows us to continue providing content to our readers for free. Our reviews are not influenced by this and are impartial. You can find out more about our business model here.

What Is Bitcoin Mining and How Does It Work?

Bitcoin Mining is the process through which new Bitcoins are bought into circulation and transactions on the Bitcoin network are verified. The process uses complex blockchain technology to ensure that the release of new Bitcoins is systematic and prevents a huge influx of new tokens into the market.

Understanding the ins and outs of Bitcoin mining is no easy feat. In this guide, we will take a deeper look at what Bitcoin mining is, how it works, and the different types of mining that are used.

- What Is Bitcoin Mining?

- Different Types of Mining

- Benefits of Mining Bitcoin

- Is Bitcoin Mining Profitable?

- Final Thoughts

- FAQs

- Related Bitcoin Guides & Mining Content

Bitcoin mining is the process of creating new bitcoins and verifying transactions on the Bitcoin network. It involves powerful computers solving complex mathematical problems to confirm transactions between users.

When a computer, known as a “miner,” successfully solves one of these problems, it adds a new block of transactions to the blockchain and earns some bitcoins as a reward. This process helps keep Bitcoin secure and ensures that only valid transactions are recorded. However, mining requires a lot of energy and computing power, making it hard for individuals to do on their own.

What Is Bitcoin Mining?

Bitcoin mining is a key part of how the Bitcoin network operates. It ensures that the network can run without any third-party intervention and keeps all transactions transparent and fair. The process uses complex mathematical problems to validate transactions and release new coins into the Bitcoin network.

There are two core concepts to understand about the nature and functions of Bitcoin mining that both hold incredible value to the wider system.

These two facets are:

- The process of new Bitcoin entering the overall supply via rewards for work

- The process in which transactions become confirmed (blocks made)

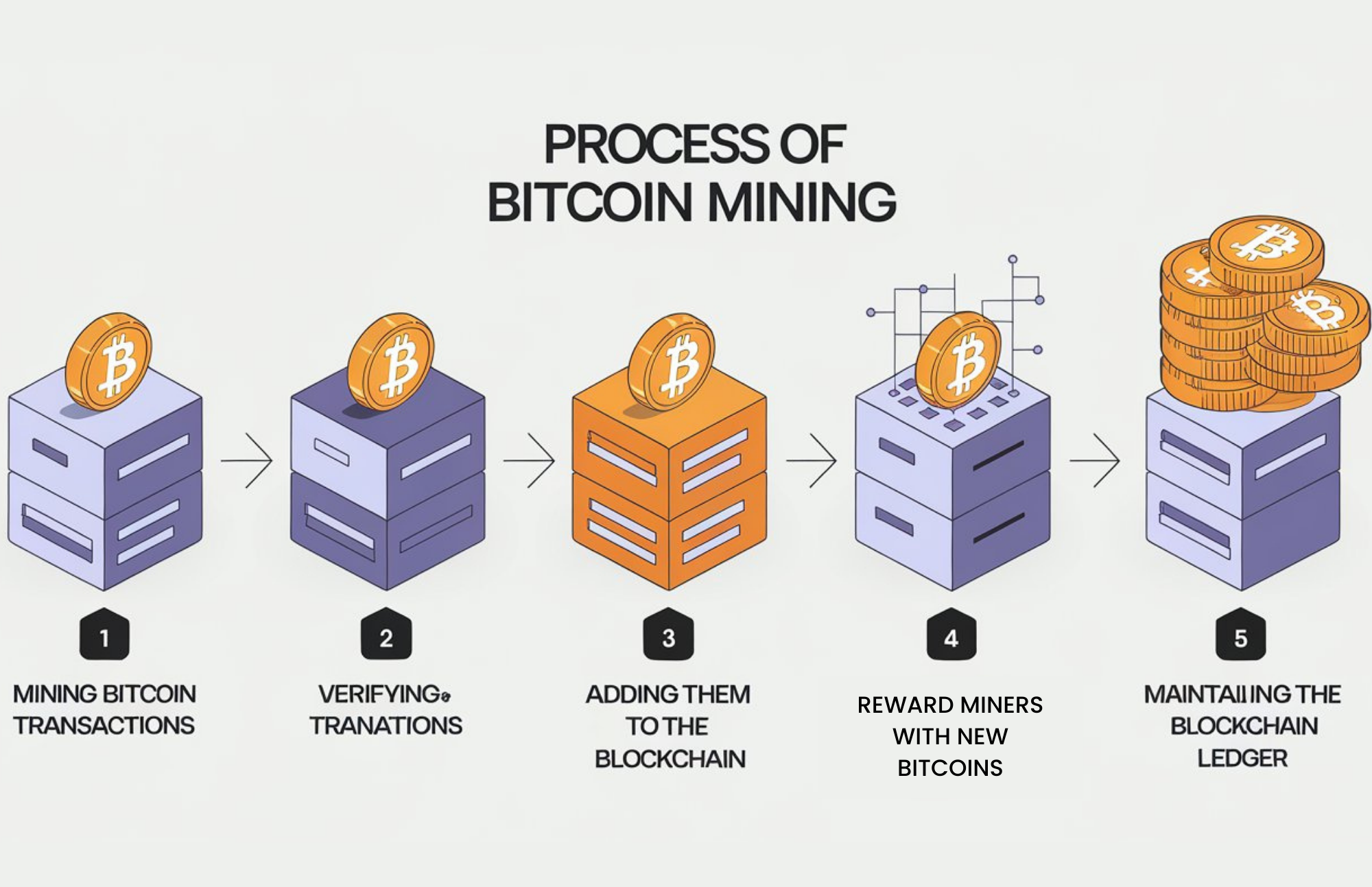

The Bitcoin Mining Process

The Bitcoin mining process is an intricate journey that involves solving complex mathematical equations to validate transactions on the Bitcoin blockchain. This process begins with the creation of a new block, which is essentially a collection of unconfirmed transactions waiting to be verified. Miners then compete to solve a mathematical equation, known as a hash function, which requires significant computational power.

Here are the key steps involved in the Bitcoin mining process:

- Transaction Verification: Miners start by verifying the transactions in the block to ensure they are valid and adhere to the rules of the Bitcoin network. This step is crucial for maintaining the integrity of the blockchain.

- Hash Function: Next, miners use a hash function to create a unique digital fingerprint, known as a hash, for each block. This hash is a critical component that links blocks together in the blockchain.

- Proof-of-Work: Miners then compete to solve a mathematical equation that requires substantial computational power. This process, known as proof-of-work, is energy-intensive and demands specialized mining hardware.

- Block Addition: The first miner to solve the equation gets the privilege of adding the block to the blockchain. As a reward for their efforts, the miner receives newly minted Bitcoins, contributing to the overall supply.

- Network Update: Finally, the Bitcoin network is updated to reflect the new block and the transactions it contains. This update ensures that all participants in the network have a consistent and accurate record of transactions.

The Bitcoin mining process is essential for maintaining the security and functionality of the Bitcoin blockchain, making it a cornerstone of the entire Bitcoin network.

Supply and Rewards

When users send transactions to one another they are entered into an unconfirmed transactions pool to be sorted and verified by the network’s miners. This verification process is called mining and essentially consists of computers solving complex mathematical equations. You need a lot of computer power to complete these problems so miners are required to have special hardware to do so. But it’s the utility within this complex problem-solving process that holds the key to Bitcoin’s success.

Essentially, once a problem is solved it means a block has been created. A block represents a collection of verified and confirmed transactions that give the network security of trade. Miners all work on these problems to create verified blocks, and once connected to a chain they form the Bitcoin ledger and its blockchain network.

Once a miner successfully creates a block they are rewarded with Bitcoin and the overall market supply is slightly increased. These rewards are halved every four years as a deflationary measure to ensure the integrity and value of the Bitcoin supply. It is designed in this way to be a direct antagonist to the current financial system.

Transaction Confirmations

Bitcoin confirmations are one of the core pillars providing security to the financial ecosystem. When a user signifies that they want to make a payment in Bitcoin this is sent to an unconfirmed transaction pool and miners undergo the verification process. Once this verification process is complete the block is constructed – we can describe this as one confirmation. Once this group of transactions is confirmed and grouped into a block miners then begin working on the next block. Blocks are constructed, or chained, on top of one another so every time a new block is added to the chain it becomes harder to manipulate or change an old transaction. If a new block is built on top of an older block then the community can have faith that the transactions they are built on are valid and verified.

The degree of security you enjoy depends on how many Bitcoin confirmations there have been. Also, another influencing factor can be the value the transaction represents. Manipulating blocks requires an extreme amount of computing power, much more than just mining which is already energy-intensive, so it is unlikely to be undertaken for a small amount for example.

Different Types of Mining

Proof-of-Work

The blockchain consensus mechanism for Bitcoin. Requires miners to solve complex mathematical problems with extensive levels of computing power.

- Very energy consuming

- Requires specialist hardware

- Mining is ongoing and indefinite in order to solve problems and verify blocks

Large-scale operations known as mining farms are designed for cryptocurrency mining, primarily utilizing powerful hardware like ASICs. These farms emphasize the importance of energy efficiency and are often situated near affordable energy sources to maximize profitability.

Proof-Of-Stake

Proof-of-Stake is supposedly the future of blockchain consensus mechanisms. The Ethereum network transitioned to this mining process in 2022. PoS does not require intensive energy consumption or computing power but instead a volume of the token native to the blockchain – for example on the Ethereum network this would be ETH.

In this system, there are no miners but validators. Validators are paid with all or part of the transaction fees that reside within the block they have validated. Validators are selected for the most part on how much ETH they hold. When they hold a certain amount they may apply to be a validator and begin to earn rewards for their services.

- Requires 99.95% less energy than Proof-of-Work

- Validators are chosen based on their token holdings

- No specialized hardware

- Doesn’t require ongoing and indefinite work

Hybridized Consensus Mechanisms

Each decentralized network can function in its own unique way as developers play around with different decentralized consensus mechanisms.

One example of this is the Solana network which is currently one of the fastest and cheapest networks in the crypto space because of its Proof-of-Stake and Proof-of-History combination. PoH is a new technology that tries to incorporate time within its chain management. Adding in this variable can dramatically cut time and cost when having to do the labor of confirming blocks and organizing a chain.

There are also a host of other types of blockchain consensus mechanisms, some of the most significant are:

- Delegated Proof-Of-Stake

- Proof-Of-Capacity

- Proof-Of-Elapsed-Time

- Proof-Of-Identity

- Proof-Of-Authority

- Proof-Of-Activity

Benefits of Mining Bitcoin

Mining Bitcoin offers several significant benefits, both for individual miners and the broader Bitcoin network. Here are some of the key advantages:

- Securing the network: One of the primary benefits of mining Bitcoin is that it helps secure the Bitcoin network. By verifying transactions and preventing double-spending, miners play a crucial role in maintaining the integrity and security of the blockchain.

- Validating transactions: Mining also involves validating transactions on the Bitcoin blockchain. This process ensures that all transactions are legitimate and follow the rules of the network, contributing to the overall trustworthiness of the system.

- Creating new Bitcoins: Mining is the process by which new Bitcoins are created and added to the circulating supply. This controlled issuance of new coins helps maintain the scarcity and value of Bitcoin.

- Supporting the Decentralized network: By participating in the mining process, individuals help support the decentralized nature of the Bitcoin network. This decentralization is a key feature that distinguishes Bitcoin from traditional centralized financial systems.

- Potential for profit: For those who can solve the mathematical equations quickly and efficiently, mining can be a profitable venture. Successful miners are rewarded with newly minted Bitcoins, providing a financial incentive to participate in the network.

Overall, mining Bitcoin not only supports the network’s security and functionality but also offers potential financial rewards for those involved.

Is Bitcoin Mining Profitable?

The profitability of Bitcoin mining can vary widely based on several factors, including the cost of electricity, the efficiency of mining hardware, and the current price of Bitcoin. Here are some of the key considerations that affect mining profitability:

- Electricity costs: The cost of electricity is one of the most significant factors influencing mining profitability. Miners who have access to cheap electricity are more likely to be profitable, as mining is an energy-intensive process.

- Mining difficulty: The mining difficulty is a measure of how challenging it is to solve the mathematical equations required to mine Bitcoin. As the difficulty increases, the amount of computational power needed also rises, which can reduce profitability.

- Bitcoin price: The current price of Bitcoin plays a crucial role in determining mining profitability. When the price of Bitcoin is high, miners can earn more from their rewards, making mining more lucrative.

- Mining hardware: The efficiency of mining hardware is another critical factor. Miners who use more efficient hardware can solve equations faster and at a lower cost, increasing their chances of profitability.

While mining Bitcoin can be profitable, it requires careful consideration of these factors and a strategic approach to maximize returns.

Risks and Challenges

Mining Bitcoin is not without its risks and challenges. Here are some of the key issues that miners may face:

- Regulatory Uncertainty: The regulatory environment for Bitcoin mining is still evolving in many countries. This uncertainty can create risks for miners, as changes in regulations could impact their operations.

- Security Risks: Miners are vulnerable to security risks, such as hacking and theft. These risks can result in the loss of Bitcoins and mining equipment, posing a significant threat to profitability.

- Environmental Impact: The energy-intensive nature of Bitcoin mining has raised concerns about its environmental impact. Miners who want to operate sustainably may face challenges in balancing profitability with environmental responsibility.

- Market Volatility: The price of Bitcoin can be highly volatile, which can affect the profitability of mining. Sudden drops in Bitcoin’s price can make mining less profitable or even unprofitable.

- Competition: The Bitcoin mining market is highly competitive. New miners may find it challenging to enter the market and compete with established mining operations, which often have access to more efficient hardware and cheaper electricity.

Despite these challenges, many miners continue to participate in the Bitcoin network, driven by the potential rewards and the role they play in supporting the decentralized financial system.

Final Thoughts

The Bitcoin decentralized network completely relies upon mining to keep its ecosystem running and verified. It is a complex and intricate way of removing any centralized authority from a financial system and works very well. Although it is often criticized for its taxes on physical resources like energy and specialized computing hardware.

There are now other consensus models being developed, like Ethereum’s Proof-Of-Stake model that would dramatically reduce resource consumption by 99.95%, but this is proving a stark challenge for the Ethereum team as spectators wait for the eventual release of a fully PoS Ethereum 2.0.

For now, PoW mining seems the most valid option when objectively assessing how to run a decentralized network. But equally, it seems that perhaps the PoW model’s days are numbered and that it is only a matter of time before a network solves the puzzle of a more efficient, secure, and less resource-intensive blockchain consensus mechanism.

FAQs

Does Ethereum use the Proof-Of-Stake consensus mechanism?

Yes, Ethereum moved to the proof-of-stake consensus mechanism in 2022.

Is Proof-Of-Work more secure than Proof-Of-Stake?

This is debatable, with hardline Bitcoiners arguing it is and Ethereum advocates suggesting that there are solutions to the PoS complications.

How much energy does Bitcoin mining consume?

Bitcoin mining has been reported by the BBC as consuming more energy than the entire country of Argentina.

Can anyone mine Bitcoin?

Anyone who has access to powerful computers can participate in the Bitcoin mining process. However, the computational power required is huge which makes it inaccessible for most investors.

How long does it take to mine 1 Bitcoin?

Supposedly, it takes around 10 minutes to mine 1 block. At the time of writing, this equates to 3,125 Bitcoins every 10 minutes.

Related Bitcoin Guides & Mining Content

Contributors