Since launching 12 years ago, Bankless Times has brought unbiased news and leading comparison in the crypto & financial markets. Our articles and guides are based on high quality, fact checked research with our readers best interests at heart, and we seek to apply our vigorous journalistic standards to all of our efforts.

BanklessTimes.com is dedicated to helping customers learn more about trading, investing and the future of finance. We accept commission from some of the providers on our site, and this may affect where they are positioned on our lists. This affiliate advertising model allows us to continue providing content to our readers for free. Our reviews are not influenced by this and are impartial. You can find out more about our business model here.

OKX Review 2025

OKX is a popular cryptocurrency exchange that offers a wide range of features for all types of traders. In our OKX review, we will take a closer look at what the platform has to offer to decide whether or not it is the best exchange to use in 2025.

- What is OKX?

- OKX Platform Overview

- Pros and Cons of OKX

- OKX Key Features

- OKX Fees

- Available Assets and Trading Options

- User Experience

- Safety and Regulation

- Customer Support

- Final Thoughts

- FAQs

What is OKX?

Registered in 2017, OKX represents one of the top centralized cryptocurrency exchanges providing a broad range of services to customers worldwide. Initially founded as OKEx, the platform rebranded in January 2022. Also, OKX relocated its head office from Beijing to Seychelles at that time since China banned all crypto activities.

Not only is it possible to perform standard spot and margin trading on the platform, but the list of available services also includes a built-in OKX wallet, some tools for earning crypto by simply holding it, crypto-collateralized loans, P2P trading, an NFT marketplace, and much more.

With its clean and user-friendly interface, OKX is a great option for those just starting their journey in the world of cryptocurrencies. In this guide, we are going to provide a detailed OKX review, investigate the key features available on the platform, and also list the key picks that users should be aware of when trading or investing via OKX.

OKX Platform Overview

| #️⃣ Number of cryptocurrencies | 350+ |

| 💸 Minimum deposit | 10 USDT or any other asset of the same value |

| 🔀 Minimum trade size | 0.00001 BTC, varies for other cryptos |

| 💰 Trading Fee | 0 – 0.10% per trade depending on the customer level |

| ✅ KYC required | Yes |

| 🎧 Customer support | Help Center, Email, Web chat |

| 🖥️ Demo account | Yes |

| 👮♂️ Regulators | Hong Kong, FATF, VARA, VFAA, others |

Pros and Cons of OKX

- Low fees of 0.10% or less for most of the trading activities

- The main dashboard is easy to navigate

- Advanced traders can access the Pro trading platform

- Broad geographical coverage

- High level of security, no verified hacking events

- Doesn’t work in the US and Canada

- Mixed customer reviews on TrustPilot

- Doesn’t support fiat deposits

- Trading was shut down once due to the founder’s arrest

OKX Key Features

The OKX interface is intuitive and user-friendly which makes it an ideal starting point for beginners. At the same time, the platform offers a huge variety of trading tools meeting the needs of advanced traders and investors. Let’s take a closer look at the platform’s key features.

Trading Tools

Out of all the crypto trading platforms represented in the market, OKX is, perhaps, the one that offers the broadest variety of tools and features. Thus, the platform strives to meet the demands of all its customers since traders of any level can find here something for their needs.

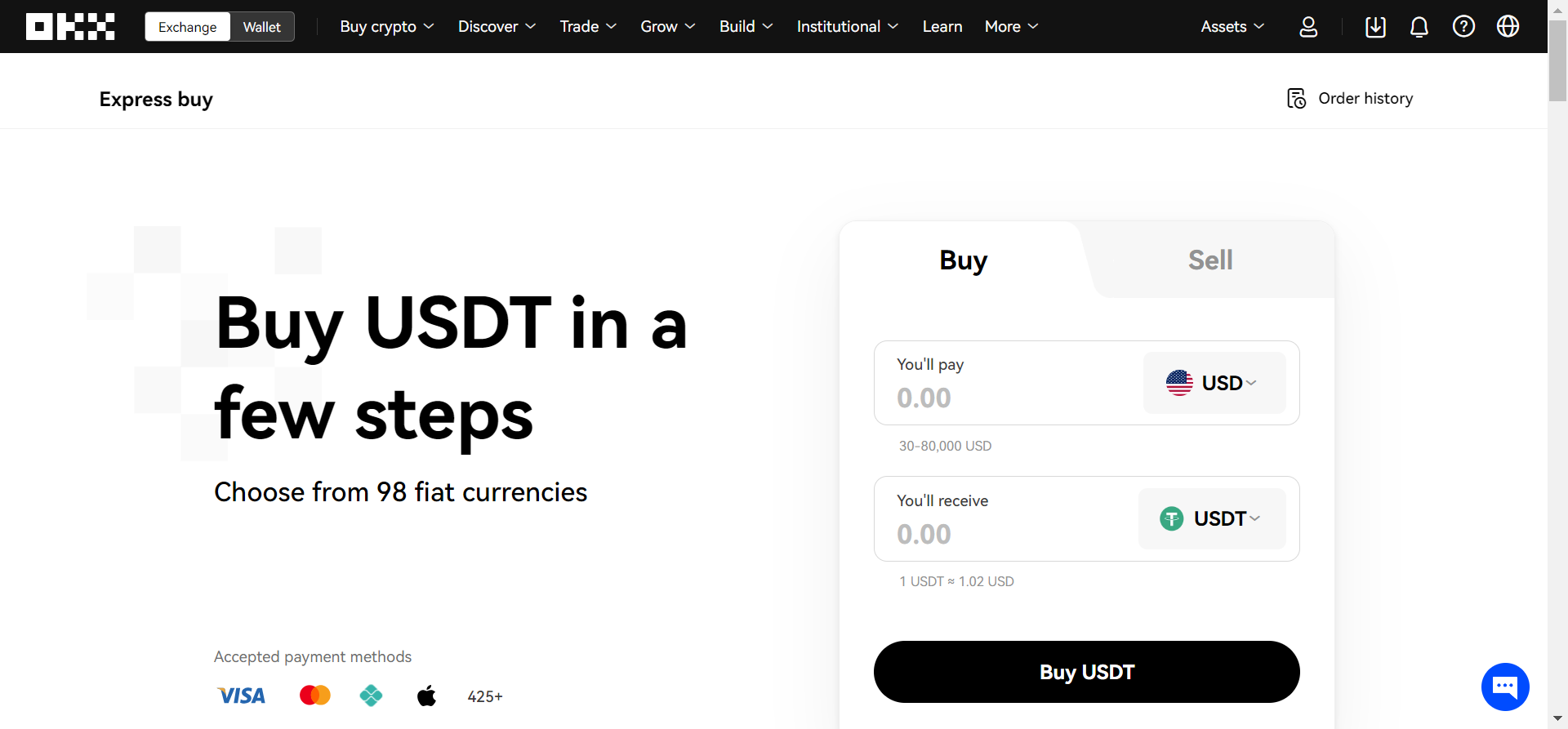

Express Buy

The Express Buy tool enables users to buy crypto for cash. The solution integrates with some of the popular fiat payment gateways such as AdvCash, Simplex, MoonPay, and Revolut. Also, it is possible to pay via Google Pay, ApplePay, or simply with a bank card.

Although such integration makes purchasing crypto convenient, the fees are quite high. Even though the service claims that it’s only 2%, in reality, external services charge from 4.5% to 7.5% which may become a serious stop factor.

To use this option, one has to pass verification first. The platform requires linking your mobile number and providing “basic information”. The next step is not quite clear, though. Once you click on the “Verify” button, you will be redirected to Security Center where you will have to search for the needed options.

Anyway, submitting all the required documents wouldn’t hurt, especially if you plan to actively use the services of the platform.

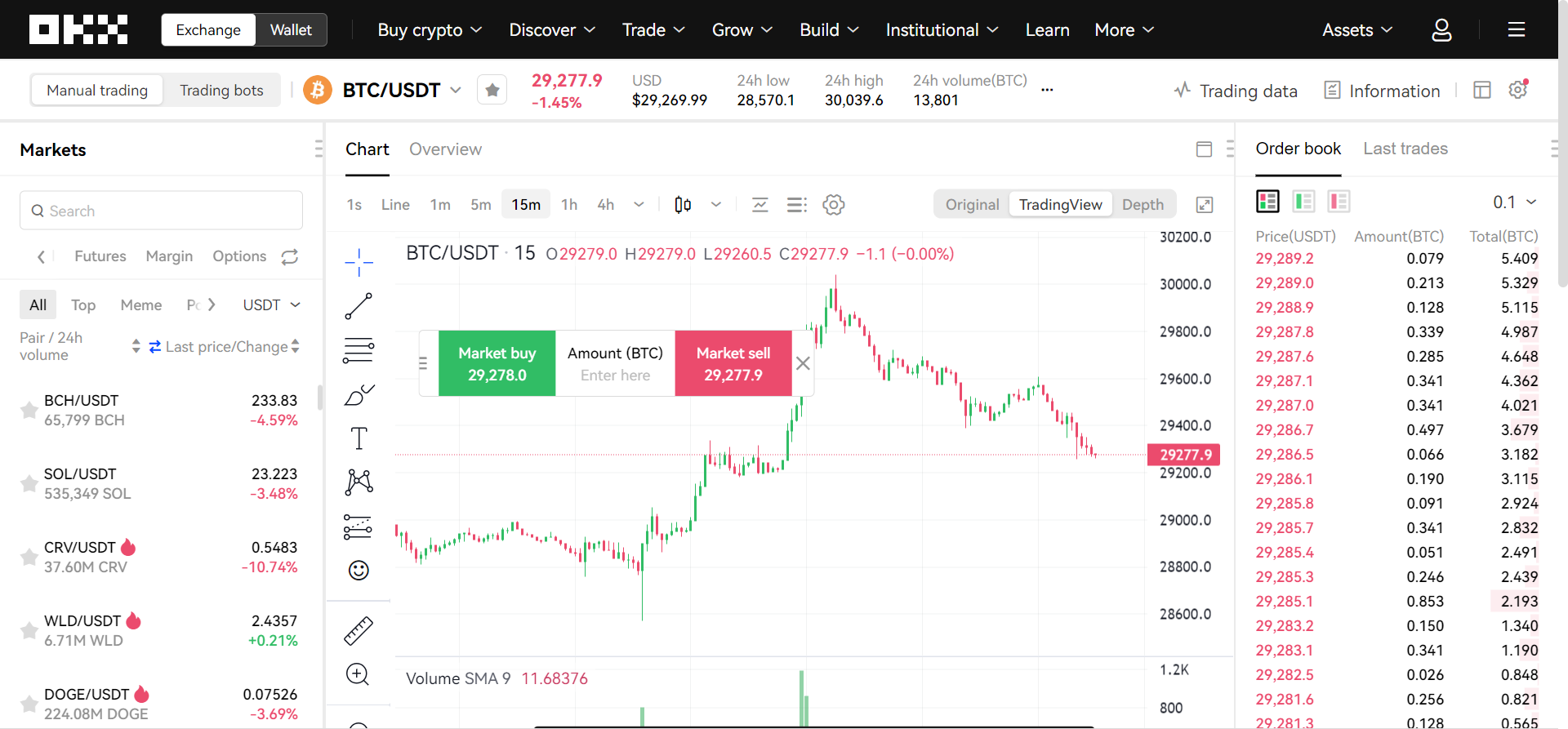

Spot trading

Spot trading on OKX is rather complicated for newbies. It comes with a large number of features and elements meeting the demands of professional traders. Therefore, if you want to engage with this type of trading you’d better improve your skills in this area first.

OKX Spot Trading offers the following features:

Built-in TradingView price charts for enhanced analysis

Spot markets that come with additional filters (Meme coins, PoW-based coins, GameFi, etc.)

Perpetual, Margin, Futures, and Options for those who prefer high-risk trades

Favorite coins for faster access to the assets you trade most

Top movers for spotting good day-trading opportunities

10+ trading bots, including those that can help you split large orders

Essential information about the coin you select for trading

An Order Book with customizable filters

As you may see, the list of tools is quite large which may be quite confusing for beginners. Out of all competitors, Binance is, perhaps, the only one that can offer a comparable set of features.

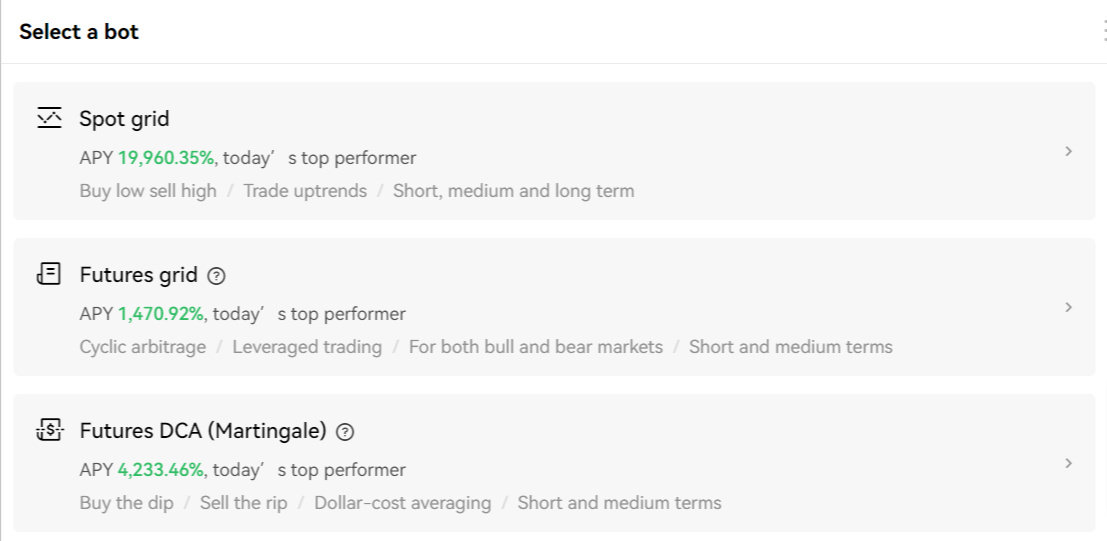

Trading Bots

Manual trading is usually quite time-consuming, not to mention the fact that it may be difficult to notice buy or sell signals in time and exchange assets profitably. OKX offers some trading bots to help traders save their time and effort by automating these activities.

On the exchange, there are ten simple trading bots based on the most common trading strategies such as:

Buy low sell high

Buy the dip

Triggered by indicators

Recurring buy for multi-crypto portfolio, etc.

For some of these bots, the platform also offers short video guides to help newbies navigate these tools. All that users need to do is to select the trading strategy, put in the price limits, the investment amount, and other aspects required by the bot. After that, the trades will be performed automatically.

Professional traders can also make use of an advanced bot for arbitrage to exploit price discrepancies in different markets. In addition, there are two other bots for splitting large orders which can be particularly useful for institutional investors.

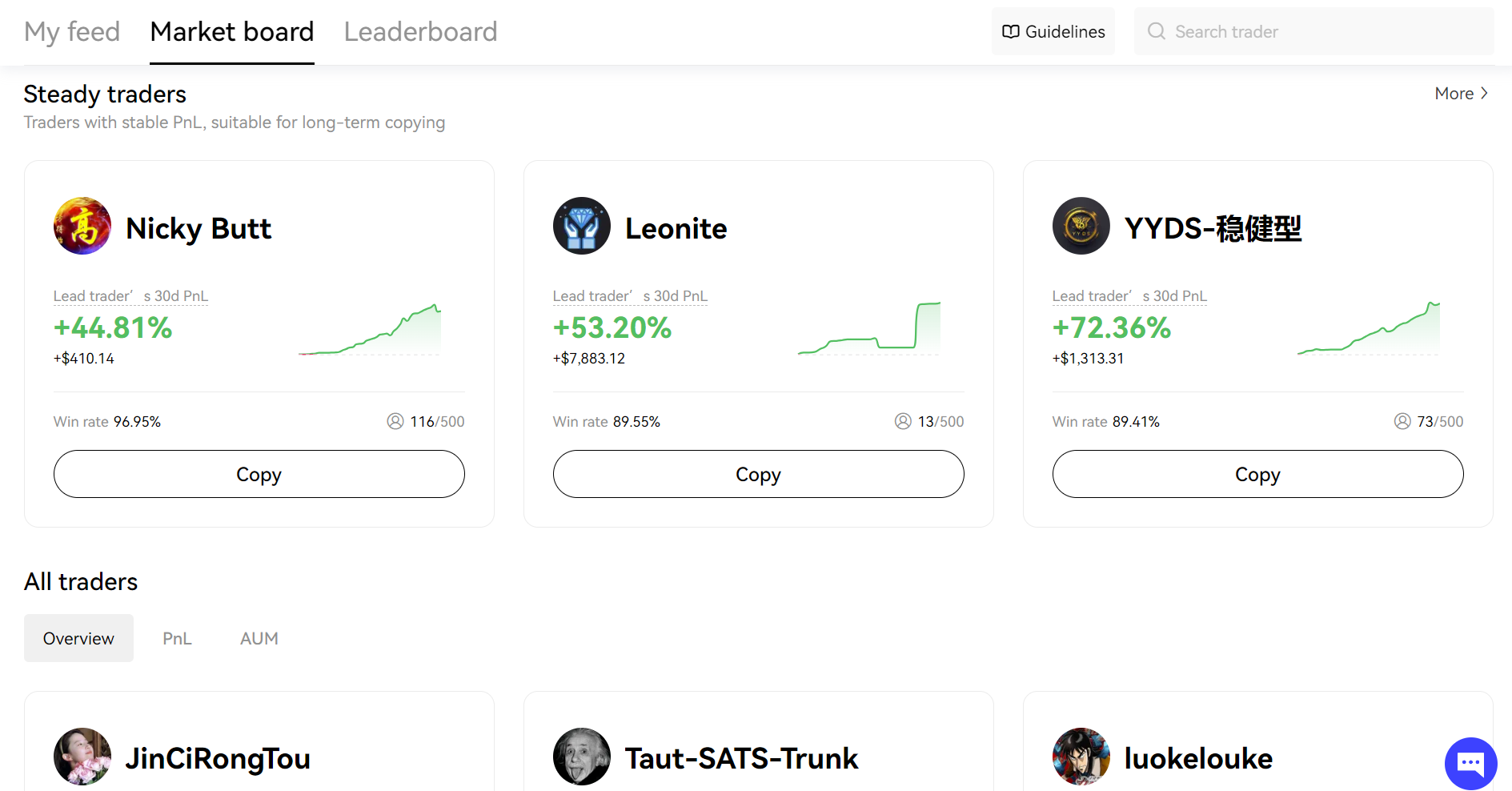

Copy Trading

OKX users who want to follow the strategies of top-performing traders have the option to do that via the Copy Trading feature. With its help, they can monitor which traders on the market board perform the best or simply select any of the 16 traders from the leaderboard to follow.

For each of these traders, the platform provides their current portfolio, position history, the bots they use, their monthly performance, and the overall risk level of their investments. By following these traders, users can get notifications about their activities and then simply copy them.

Such an approach may be beneficial for beginners who haven’t worked out their own strategies yet. If the traders they follow are successful, they may also get a share of their luck and make profitable investments.

However, it still doesn’t guarantee success. Even top traders may sometimes make mistakes that result in money losses. Also, the overall market volatility may play a dirty trick on you. If you don’t copy their strategies fast enough, your risks significantly increase.

Demo Trading Mode

Another OKX tool that can be particularly useful for newbies is the demo trading account. This is a full copy of the Spot Trading tool that provides users with fake assets that they can use for testing their strategies in a risk-free environment.

Thus, users get 9,000 USD in virtual funds and a corresponding amount of all other assets at their disposal. They can test their strategies manually as well as use all the available trading bots to see how they perform.

Advanced traders, in turn, can find this feature useful as well in cases when they want to test some new approach to managing their funds.

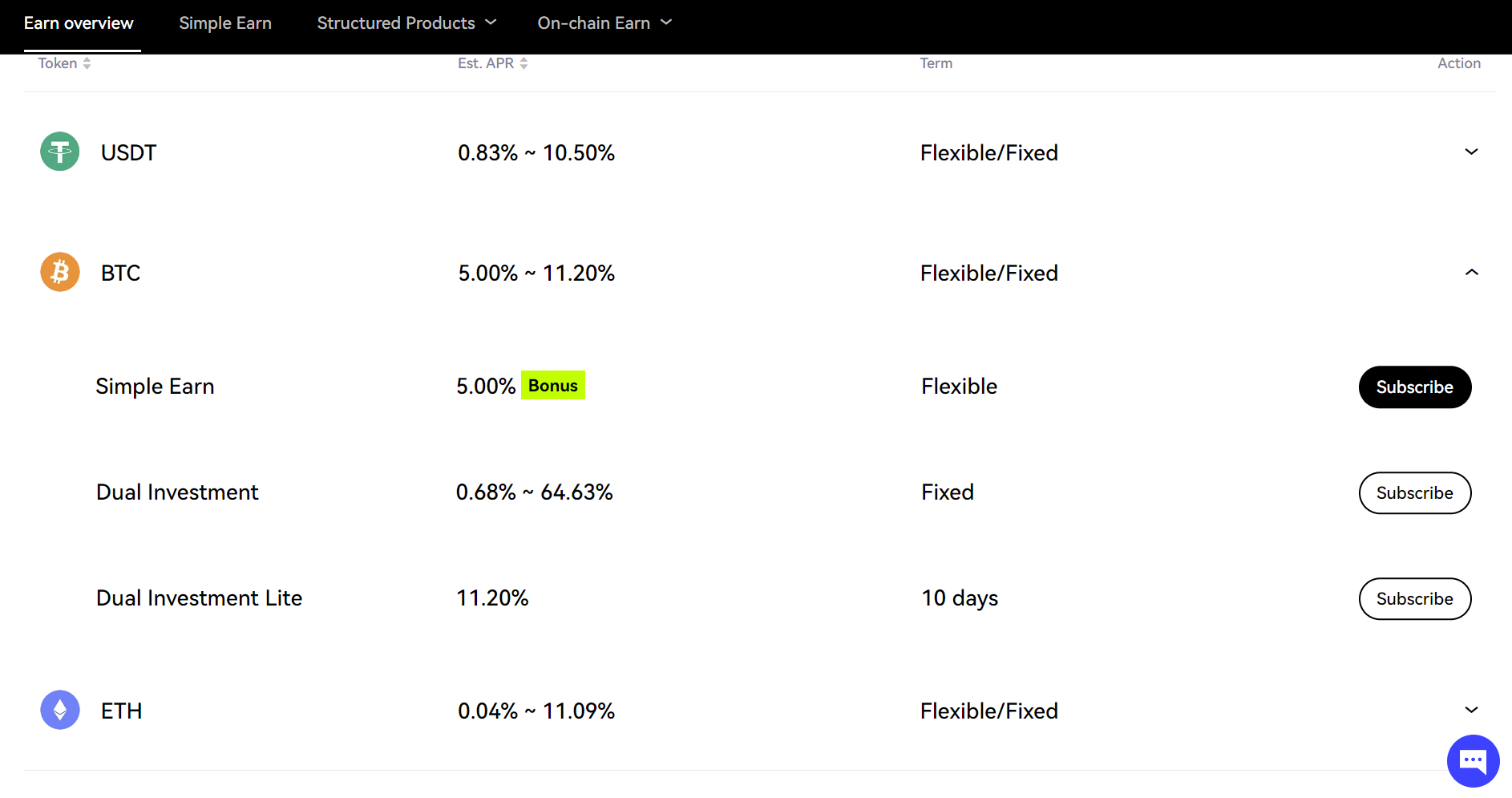

OKX Earn

OKX Earn is a set of tools that helps cryptocurrency investors put their idle assets to work and earn interest on them by simply holding them in dedicated accounts. Thus, the platform offers three key products:

Simple Earn

This product is similar to traditional savings accounts that centralized banks offer to their customers. The platform supports a few dozen assets. All that users need to do is to select the asset with the interest that meets their expectations, specify their terms and watch their deposit grow by the day.

Structured products

This is an innovative product that helps investors earn interest from the derivatives market. The rewards that this product offers are much higher. For example, one can expect to earn up to 105% APY on BTC. However, it’s worth remembering that the associated risks are much higher as well.

On-chain Earn

Finally, it is possible to make passive income on OKX via Proof-of-Stake (PoS) staking and DeFi protocols. The platform stakes users’ assets in various protocols and shares the profit it gains.

All these products are pretty easy to use while offering a safe and reliable method of earning interest on your crypto assets. The downside of this approach refers to the overall volatility of the market. As users have to lock their assets for a predefined period of time, they are not able to cash them out if the asset prices drop.

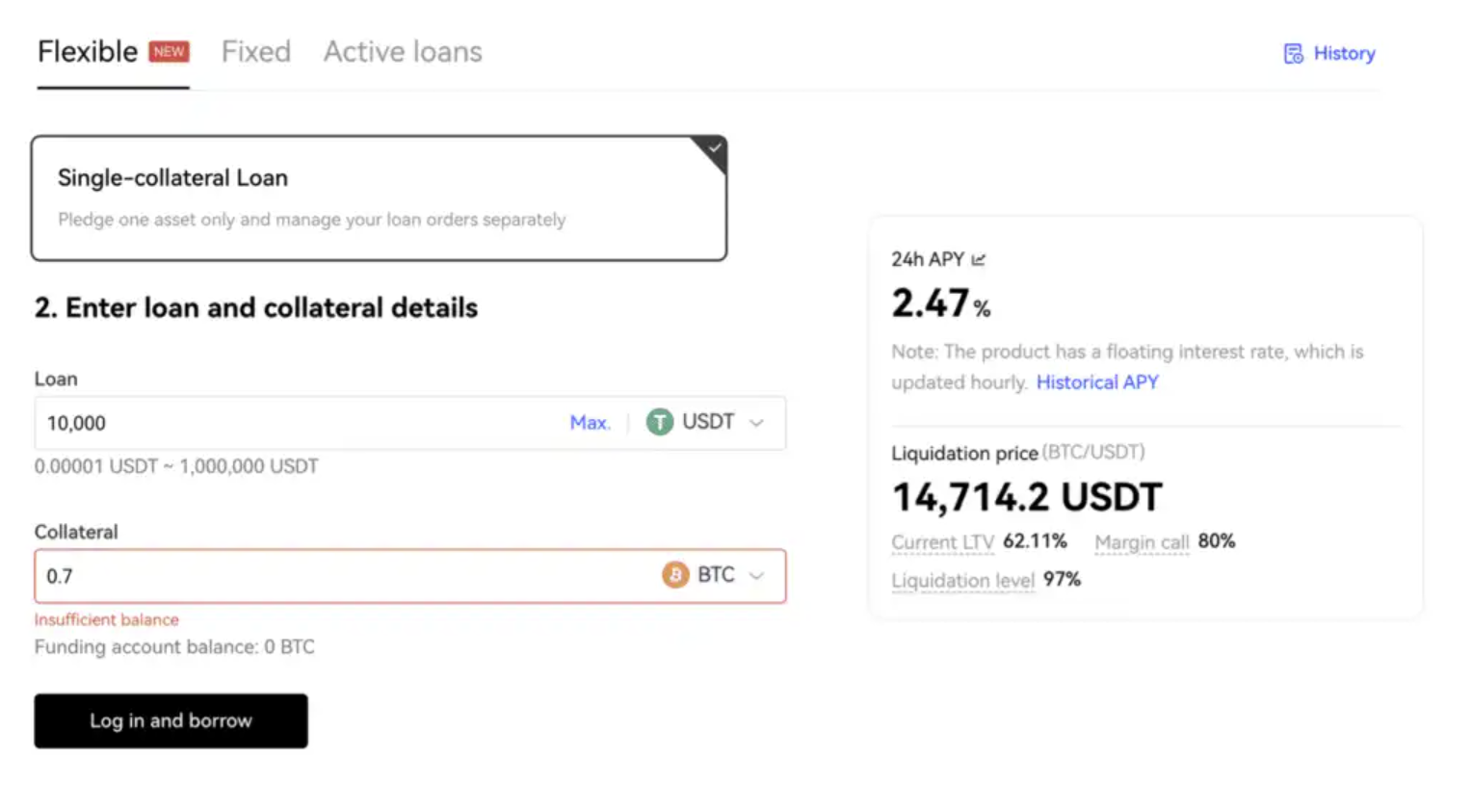

Loan

OKX Flexible Loan enables users to increase their cash flow without selling their crypto holdings. It is possible to pledge your assets as collateral and get a corresponding amount of another currency that you can further use for trading activities or for staking in OKX Earn products. The platform offers more than 20 assets for borrowing.

It is important to note, though, that the crypto loan is always overcollateralized. This means that the collateral you provide must be worth more than the actual loan you get. This helps to reduce the effect of market fluctuations and to avoid the liquidation of your debt.

Also, keep in mind that the loan APR may change together with the market conditions. Therefore, you should always carefully monitor your debt and act quickly in case of an emergency.

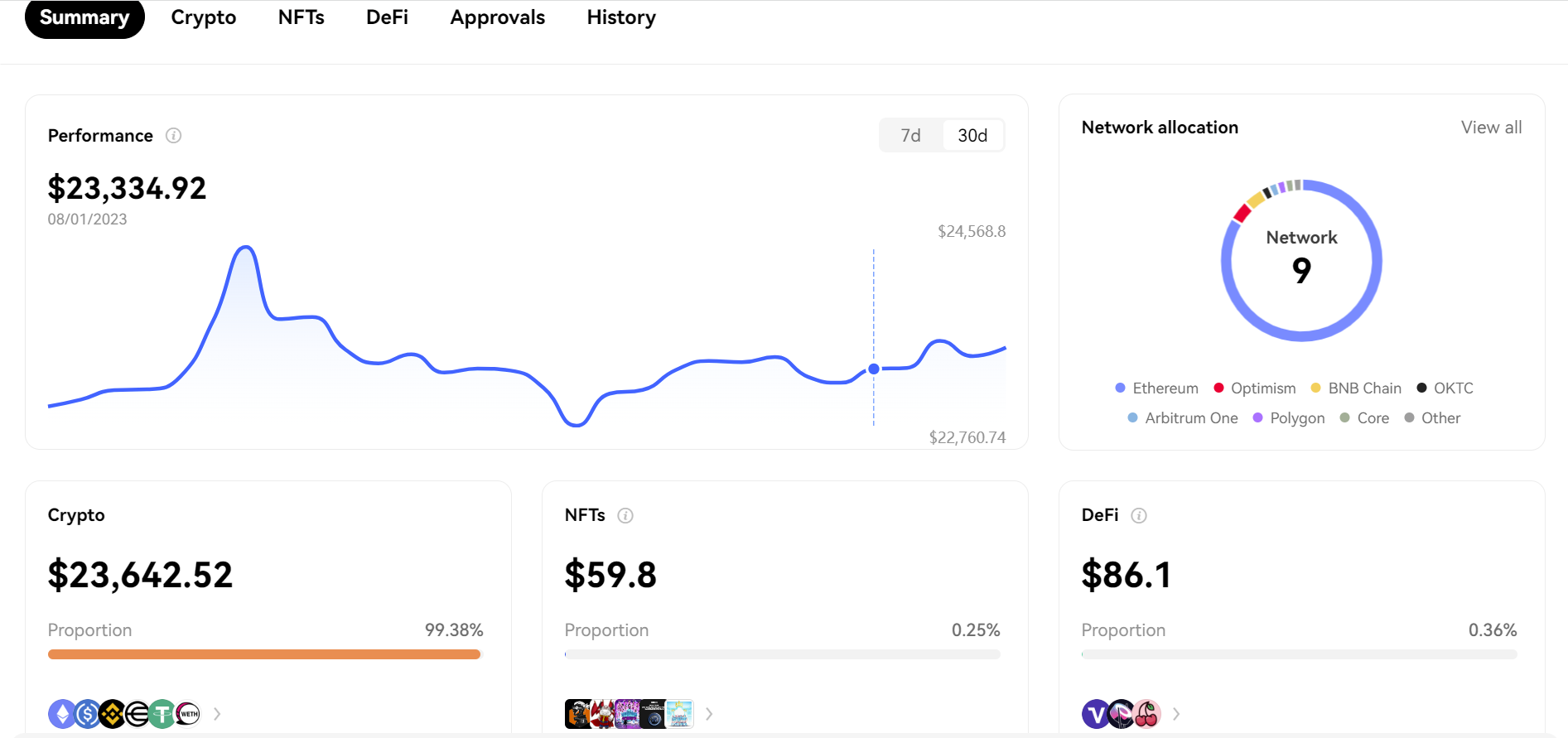

OKX Wallet

OKX offers a convenient way to store all your crypto assets in one place and explore Web3. The self-custody OKX Wallet can easily be downloaded as an app or added as a browser extension and supports over 60 networks. It can also be used to create and trade NFTs, swap tokens on DEXs, and earn yields through DeFi protocols.

Those who don’t want to use the OKX Wallet can connect their own wallets to the platform. At the time of writing, OKX supports four options:

Metamask

Phantom wallet for Solana

Unisat wallet for storing BItcoin-based NFTs

WalletConnect which aggregates a few dozen of different wallets under a single hood

In case none of the options fits your requirements, you can connect your wallet in the “watch only” mode. By entering your address, you will be able to monitor your assets and transaction history without leaving OKX.

Such a flexible approach gives OKX a serious advantage over its competitors. Binance, as well as Coinbase and Kraken, only offer their in-house solutions with no third-party integrations.

OKX NFT

OKX features an NFT Marketplace where collectors can choose from a huge variety of non-fungible assets. On the platform, one can find unique assets from some of the most popular collections such as CryptoPunks and Bored Apes Yacht Club.

In its essence, the marketplace represents a decentralized trading platform supporting 10 different blockchains including Solana, BNB Chain, and Polygon.

OKX NFT for end-users

The purchasing process is quite simple and includes just a few steps. Users should select their preferred collection, set up the order through the Order book, enter the number of NFTs they wish to buy, and finalize the purchase.

What makes OKX special is the possibility to receive and store NFTs directly in your personal wallet such as Metamask. This reduces the counterparty risk as users get full control over their private keys and, consequently, over their assets.

OKX NFT for creators

Creators get a chance to launch their own collections on the platform, too. To do that, they should select any of the four supported chains (OKTC, Ethereum, BNB Chain, or Polygon). After that, they must upload an image, specify the name, the collection, and the description.

The minting process is free and doesn’t require any network or platform fee. Also, it is possible to mint a few identical NFTs at once. However, minting a large collection of different items would require a lot of manual work which is not very convenient.

How Does OKX Compare on Features?

| Simple purchases | ✔️ | ✔️ | ✔️ | ✔️ |

| Recurring buys | ✔️ | ✔️ | ✔️ | ✔️ |

| Advanced trading | ✔️ | ✔️ | ✔️ | ✔️ |

| Customizable charts | ✔️ | ✔️ | ✔️ | ✔️ |

| P2P trading | ✔️ | ❌ | ✔️ | ❌ |

| Automated strategies/bots | ✔️ | ❌ | ✔️ | ❌ |

| Demo account | ✔️ | ❌ | ✔️ (Futures only) | ✔️ (Futures only) |

| Staking/interest accounts | 100+coins | 7+ coins | 350+ coins | 19+ coins |

| Crypto loans | ✔️ | ❌ (Feature terminated) | ✔️ | ❌ |

| NFT marketplace | ✔️ | ✔️ | ✔️ | ✔️ |

| Web3 wallet | ✔️ | ✔️ | ✔️ | ❌ |

| Crypto card | ❌ | ✔️ | ✔️ | ❌ |

OKX Fees

OKX is renowned for its exceptionally low fees, making it an appealing choice for cryptocurrency traders. Let’s delve into the details of its fee structure and discover the cost-effective advantages it offers to users.

Trading Fees

Express Buy and Convert

OKX features a solution named Express Buy and Convert that offers a convenient and easy way for users to quickly purchase and exchange cryptocurrencies.

The official website asserts that users can purchase cryptocurrencies using a credit/debit card or a third-party payment provider, typically incurring a fee of 1-2%. However, the real fees may be much higher than that, with payment providers potentially adding on their own processing fees for various payment methods. While the exact spread percentage is not explicitly mentioned, users can observe the real-time exchange rates on the platform during their transactions.

Anyway, the platform fees for Express Buy are generally considered to be competitive for simple purchases, but much more expensive and less transparent than spot trading.

Spot Trading Fees

Spot trading on OKX entails various trading fees based on the maker/taker fee structure, which is determined by the amount held of OKX’s proprietary OKB token for regular users and the daily asset balance or 30-day trading volume for VIP users.

VIP users are those who have at least $100,000 in assets or a 30-day trading volume of at least $5 million. Those who don’t meet these criteria are classed as regular users and will pay the following spot trading fees:

| Total OKB holding | Maker fee | Taker fee |

| < 500 | 0.080% | 0.100% |

| ≥ 500 | 0.075% | 0.095% |

| ≥ 1,000 | 0.070% | 0.090% |

| ≥ 1,500 | 0.065% | 0.085% |

| ≥ 2,000 | 0.060% | 0.080% |

The VIP spot trading fees range from 0.060% to -0.005% for makers and 0.080% to 0.020% for takers.

The trading fees for all users are different if you want to trade USDC pairs, for which you’ll pay up to a 0% maker fee and up to a 0.7% taker fee.

OKX provides transparent information on its fee schedule, allowing users to assess the cost of their trades easily. The spot trading fees are highly competitive—they’re much lower than rivals such as Coinbase and Gemini, but roughly on par with Binance, which also charges up to 0.1%. You’ll find slightly lower fees on the Crypto.com Exchange (up to 0.075%), but if you’re looking to trade against USDC, there’s nowhere cheaper than OKX.

Makers are traders who add liquidity to the order book by placing limit orders to be filled in the future, while takers are traders who take liquidity from the order book by placing market orders that are filled immediately.

Deposits & Withdrawals

Unfortunately, OKX doesn’t support fiat deposits and withdrawals. Although you can convert fiat to crypto and vice versa with the Express Buy feature, you can’t hold fiat on the exchange. This means that for users who don’t already hold crypto, adding funds or cashing out on OKX is a bit more expensive than many competitors which support cheap or free fiat deposits/withdrawals.

However, the platform offers favorable terms for crypto deposits and withdrawals due to their cost efficiency. The withdrawal fee varies depending on the cryptocurrency, but regardless of the asset it usually remains quite competitive.

OKX offers two withdrawal methods for users:

On-chain withdrawal: This method involves transferring cryptocurrencies through the blockchain network to an external wallet or another exchange.

Internal transfer: Users can make instant crypto transfers to other OKX users without paying any fees.

When it comes to on-chain withdrawal transactions, users only have to pay the network fee which serves as a miners’ reward. However, internal withdrawal transfers and deposits on OKX are totally free. The minimum withdrawal amount is 0.001 BTC.

Other Fees

Aside from the unclear fee structure for the Express Buy and Convert tools, OKX doesn’t feature any other hidden taxes on transactions. It’s worth adding, though, that futures, perpetual contracts, and options are subject to fees with a similar fee structure to spot trading. They are up to 0.05% for futures and perpetual swaps, and up to 0.03% for options. You can see a full breakdown of the fees here.

How Does OKX Compare on Fees?

| Simple crypto purchase | Unspecified fee + spread | Unspecified fee + spread | 0.5% + spread |

| Simple crypto swap | Free + spread | Unspecified fee + spread | Free + spread |

| Spread | Unspecified | 1% | Unspecified |

| Maker/taker fees | Up to 0.1% | Up to 0.6% | Up to 0.1% |

| Bank transfer deposit | n/a | Free | Free |

Available Assets and Trading Options

Cryptocurrencies

OKX exchange provides users with the opportunity to trade 350+ different cryptocurrencies. At the same time, it also offers passive income opportunities through crypto staking and crypto savings accounts. This allows users to actively participate in the dynamic crypto market and grow their holdings through staking and savings options.

In addition, OKX regularly lists new cryptocurrencies, staying up-to-date with the evolving cryptocurrency market and offering its users access to the latest and most innovative projects. Thus, Its willingness to add new tokens promptly allows users to access a broad spectrum of investment opportunities.

In comparison with its key competitors, OKX has one of the most comprehensive and diverse offerings in the industry. It offers significantly more coins than competitors such as Coinbase, Gemini, and Crypto.com, and is roughly on par with Binance. However, OKX’s crypto selection is still significantly smaller than KuCoin’s, which comprises over 900 coins.

Types of Trading

On OKX, users have various trading options to suit their preferences and strategies. As mentioned earlier, OKX offers simple purchases and swaps for straightforward transactions. Additionally, users can engage in spot trading. Also, OKX provides a Peer-to-Peer (P2P) trading platform, facilitating direct transactions between users.

Trading Pairs

OKX boasts an extensive selection of 500+ trading pairs. Thus, users get a chance to trade cryptocurrencies against stablecoins and other digital assets.

Leverage

The platform provides a robust margin trading solution for users seeking amplified trading opportunities. At the time of writing, OKX offers leverage options of 10x and 20x under full liquidation mode, along with leverages ranging from 1x to 100x under partial liquidation mode.

These leverage choices provide users with varying degrees of risk and potential rewards to suit their trading preferences and risk tolerance. Thus, users can increase their exposure to the market and potentially enhance their profits.

Crypto derivatives

OKX offers a wide array of crypto derivatives, including futures, perpetual swaps, and options contracts. These derivatives allow users to speculate on the price movements of various cryptocurrencies without owning the underlying assets.

Also, OKX is at the forefront of supporting futures contracts for a wide range of crypto assets. With the help of these contracts, users can specify weekly, biweekly, quarterly, and biquarterly settlements. Each contract creatively combines the assets traded with their corresponding settlement date while giving them unique names.

How Does OKX Compare on Assets?

| Cryptocurrencies | 340+ | 350+ | 80+ |

| Trading pairs | 500+ | 1300+ | 80+ |

| Crypto-crypto trading | ✔️ | ✔️ | ❌ |

| Crypto-fiat trading | ❌ | ✔️ | ✔️ |

| Leverage | Up to 20x | ✔️ | ✔️ (in some non-US countries) |

| Crypto futures | ✔️ | ✔️ | ❌ |

| Crypto options | ✔️ | ✔️ | ❌ |

| NFTs | ✔️ | ✔️ | ❌ |

| Non-crypto assets | ❌ | ❌ | Stocks and ETFs (currencies, commodities, and indices in some non-US countries) |

User Experience

As a customer-driven platform, OKX does its best to meet its users’ expectations and to make their trading experience smooth and convenient. Let’s take a closer look at some of the key aspects of the solution it provides.

Ease of Use

OKX strives to make its interface as convenient as possible aiming to facilitate the onboarding process for newcomers. At the same time, professional-oriented trading tools feature an intuitive and convenient structure as well.

Thus, OKX represents an ideal solution for those who are just beginning their journey in the crypto world and who have a mind to become professionals in this area.

While the overall platform isn’t as beginner-friendly as Coinbase, the newbie-oriented features such as Express Buy and Convert are no doubt highly intuitive.

Device Compatibility

One may access OKX via a web browser from any device that has access to the internet. In addition, it offers a mobile app that is fit both for Android and iOS devices. Thus, users can easily access the platform on the go regardless of their current location.

What’s more, OKX also has a desktop application designed for Windows and MacOS. This makes the platform one of the most accessible solutions among its competitors.

Geographic Availability

OKX operates across 100+ countries worldwide. Although it covers quite a broad set of regions, there are also some restricted locations that include Malaysia, Singapore, France, Ireland, Japan, and the Netherlands. Meanwhile, users in the UK and Hong Kong are unable to access OKX’s derivatives-related services.

As for the US, OKX itself does not have a license to operate in this country. However, its parent company OK Group has launched a dedicated subsidiary OKCoin specifically for this region.

Customer Satisfaction

On TrustPilot, OKX has received mixed reviews with an average rating of 2.9 out of 5. The key factors that users complain about fall into the following categories:

- Regular changes in the Terms of Service

- The necessity to reverify your account

- Blocked trades and cash withdrawals

- Blocked accounts with large sums

Although some of the bad reviews seem to be driven by pure emotions, there are others that calmly explain in detail what went wrong. Also, they give a full description of how the platform let them down, especially those who complain about scams and lost funds.

Therefore, we recommend being cautious and not depositing large sums to OKX before you fully test all its functionality properly.

How Does OKX Compare on User Experience?

| Ease of use | 7/10 | 9/10 | 6/10 |

| App Store rating | 4.7 | 4.7 | 4.7 |

| Google Play rating | 4.8 | 4.5 | 4.1 |

| Trustpilot rating | 2.9 | 1.5 | 2.0 |

Safety and Regulation

OKX places a strong emphasis on its security. Thus, it has implemented different measures to safeguard user funds and data. The security measures that the platform implements are considered robust and reliable, earning the trust of millions of users worldwide.

Security Features

OKX has designed a dedicated program to prevent money laundering and terrorist financing through a risk-based, multi-layer control system. The first layer includes a stringent customer identification program, including customers’ identity and verification as it applies both to individuals and companies. Thus, the platform appears to be one of the safest cryptocurrency exchanges as it has never suffered a major breach.

In addition, the platform combats fishing attacks effectively. To protect users from fraud, the exchange has launched OKX channel verification, where members of the community can enter the details to verify the authenticity of the communication channel.

Apart from the login-password system, the platform implements the following security methods to secure users’ accounts:

- Email verification

- Advanced encryption

- Google Authenticator

- Mobile verification

- Mandatory 2-Factor Authentication

- Anti-phishing code

Address whitelisting

Users should take all necessary precautions, including the methods mentioned above, to protect their devices from viruses and malware. By doing so, they can significantly reduce the chances of hackers’ and fraudsters’ attacks, ensuring a safer and more secure trading experience on OKX.

Asset Protection

OKX employs a range of security features to safeguard the assets it holds on behalf of users, ensuring a secure and reliable environment:

Cold Storage. A significant portion of users’ funds is kept in cold storage, which means they are stored offline and are not directly connected to the internet. This practice minimizes the risk of cyberattacks targeting hot wallets and provides an added layer of protection against unauthorized access.

Semi-Offline Multisig for managing private keys. Multisig requires multiple authorizations to access funds, reducing the potential risk of single points of failure and enhancing the security of transactions.

Transaction Monitoring. The exchange employs sophisticated transaction monitoring systems to detect and prevent suspicious activities, such as unusual or unauthorized fund transfers. Such a proactive approach helps to protect users’ assets from potential security threats.

Private Key Backups. OKX implements robust private key management procedures, ensuring that private keys are securely backed up and stored in separate and secure locations. In the case of any emergencies, these backups enable users to recover their assets.

Reserve Fund. OKX maintains a reserve fund to further enhance the security of users’ funds. This reserve acts as an additional safety net, providing an extra layer of protection against unforeseen events or market fluctuations.

The combination of all these security measures helps OKX maintain a high level of security. Thus, the platform has managed to create a robust defense against potential breaches and unauthorized access to users’ assets.

Regulation

OKX has been officially registered and regulated by various regulatory bodies in different countries. Some of the regions where OKX operates and holds licenses include:

- Malta (Malta Financial Services Authority, MFSA)

- Gibraltar (Gibraltar Financial Services Commission, GFSC)

- Seychelles (Financial Services Authority, FSA)

At the same time, there have been no reported sanctions or major regulatory issues involving OKX.

Kraken received a lawsuit from the SEC in November 2023 but has recently denied all allegations that were made.

Reputation

OKX is a reputable crypto exchange with 50+ million users. It has not experienced any major security breaches, but there have been some episodes of compromised user accounts.

Also, the platform faced accusations of falsely reporting trading volumes. Thus, OKX faced scrutiny in an investigation in 2018 which was initiated by crypto trader Sylvain Ribes.

In addition, its founder Mingxing Xu, also known as Star Xu, was reportedly arrested in October 2020. The exchange stopped withdrawals for a while after the incident.

Despite these concerns, OKX maintains a strong reputation as a secure and trustworthy exchange. With its user-friendly interface and commitment to security, OKX continues to be a preferred choice for cryptocurrency enthusiasts of all levels.

How Does OKX Compare on Security?

| 2FA | ✔️ | ✔️ | ✔️ |

| Encryption | ✔️ | ✔️ | ✔️ |

| Biometric authentication | ✔️ | ❌ | ✔️ |

| Address whitelisting | ✔️ | ✔️ | ✔️ |

| Cold storage for crypto | For vast majority of crypto | For vast majority of crypto | For vast majority of crypto |

| Crypto insurance | ❌ | ✔️ | ❌ |

| Emergency fund | ✔️ | ❌ | ✔️ |

| Bug bounty program | ✔️ | ✔️ | ✔️ |

| Regulated | ✔️ | ✔️ | ✔️ |

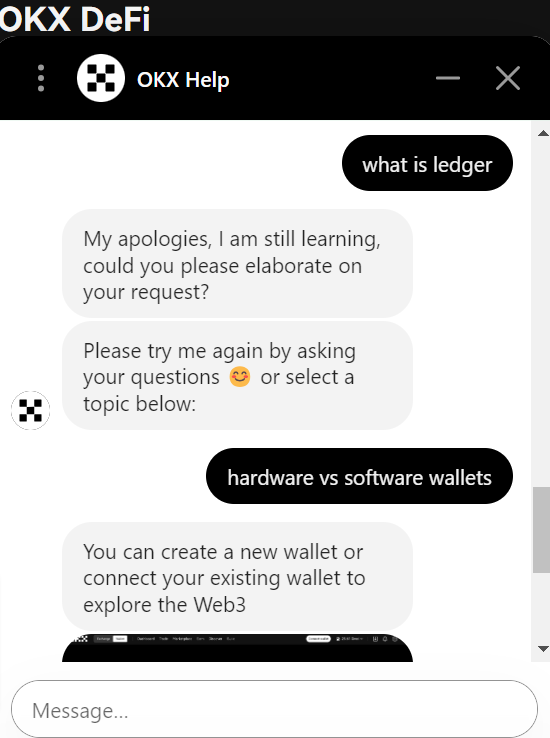

Customer Support

The AI chatbot is the first and the most obvious channel that users may reach out to should they face any issues on OKX. Also, there are many detailed guides in the help center for self-support.

There is no dedicated page where a user can submit a ticket, but there is a page “My tickets” which points to such a possibility. Presumably, the tickets are created automatically once you send an email to a generic support email address for the exchange. Yet, there is no clean and convenient way to report an issue. The lack of phone support is also a big minus.

Judging by reviews on TrustPilot, the support team is usually quite responsive. However, there are also many negative reviews about the support team being unable to resolve disputes and refund lost transactions.

Resources

OKX Learn provides a plethora of educational resources to help new users get started. However, it’s not that easy to navigate them. Unlike Coinbase, OKX cannot boast of a convenient educational portal where any newbie can find comprehensive guidance on any questions.

There is no structure in the Tutorials section, it is only possible to filter them by topic. The same applies to the Glossary where the platform reviews some of the most basic questions related to the blockchain industry.

Finally, there is also a Chatbox that comes as a part of the educational section, too. However, finding an answer to your question is a hard quest since the bot cannot provide any meaningful information even to the simplest requests.

How Does OKX Compare on Customer Support?

| Help center | ✔️ | ✔️ | ✔️ |

| Web chat | ✔️ | ✔️ | ✔️ |

| ✔️ | ✔️ | ✔️ | |

| Phone | ❌ | ✔️ | ✔️ |

| Account manager | ❌ | ❌ | For eToro Club members only |

Final Thoughts

OKX is a nice solution for beginners who aim to grow their experience over time and become more advanced traders. The interface of the platform is intuitive and user-friendly while the wide choice of trading tools and available assets fits both beginners and professionals.

However, be prepared to solve all the questions you come across on your own. The level of customer support leaves much to be desired on OKX, especially when it comes to such serious questions as scams and hacks. Therefore, weigh up your risks wisely and only operate with amounts that you can afford to lose.

FAQs

Is OKX a legit exchange?

Yes, OKX is a legit organization. It holds licenses in some regions including Malta, Gibraltar, and the Seychelles.

What is OKX for?

OKX is the best tool for trading various assets. Also, it offers a broad set of crypto-earn products that can help you put your idle assets to work.

How to withdraw from OKX?

Click on “Assets” in the top menu and select “Withdraw” from the drop-down menu. Specify the coin you want to withdraw, the withdrawal method, and the network. Enter the address where you want to send your funds to, specify the amount, and confirm the transaction.

What is the withdrawal limit on OKX?

The withdrawal limits on OKX are different for different KYC levels. The minimum verification level allows withdrawing up to $5,000 per day.

Does OKX have a wallet?

OKX provides a built-in exchange wallet where users can store assets for trading on the platform. Alternatively, there is OKX, which is a self-custody Web3 wallet.

Can OKX be trusted?

Yes, OKX is a globally-recognized exchange that is registered with a number of authorities including the UK’s FCA.

Is OKX a Chinese company?

Although the exchange was founded in China, OKX is currently based in San Fransisco.

Contributors