Since launching 12 years ago, Bankless Times has brought unbiased news and leading comparison in the crypto & financial markets. Our articles and guides are based on high quality, fact checked research with our readers best interests at heart, and we seek to apply our vigorous journalistic standards to all of our efforts.

BanklessTimes.com is dedicated to helping customers learn more about trading, investing and the future of finance. We accept commission from some of the providers on our site, and this may affect where they are positioned on our lists. This affiliate advertising model allows us to continue providing content to our readers for free. Our reviews are not influenced by this and are impartial. You can find out more about our business model here.

Bitpanda Review 2025

Bitpanda is a reputable cryptocurrency broker that offers services to traders in Europe. In this Bitpanda review, we aim to uncover why the platform is popular amongst traders and whether or not it is the best option for your trading in 2025.

Keep reading to find out our take on the platform, what Bitpanda offers and how to use the cryptocurrency exchange.

- Bitpanda Review Summary

- Pros and Cons of Using Bitpanda

- What We Liked About Bitpanda

- What We Didn’t Like

- Bitpanda Accessibility and Safety

- How to Get Started With Bitpanda

- Final Thoughts

- FAQs

Bitpanda Review Summary

Before we continue, it is important to note that Bitpanda is not available in the US or UK. For readers who reside in these countries, we recommend checking out our top 10 cryptocurrency brokers that are available in these regions.

For users who live in approved countries, Bitpanda is a popular cryptocurrency exchange that is known for its user-friendly interface and simple processes. You can trade over 400 cryptocurrencies on Bitpanda and access a good range of research and analysis tools to trade with confidence.

However, during our Bitpanda review, we came across numerous reports of poor customer service. A few users have also complained about issues with withdrawals. Although this is certainly something to be aware of, other reviews have suggested that these issues are most likely case-by-case.

Bitpanda caters to both investors and traders. If you fit into the latter group, the exchange supports cryptocurrency CFDs which allow you to trade with leverage.

Bitpanda Overview

| 💼 Provider Type: | Exchange |

| 💸 Minimum Deposit: | Varied based on currency |

| 💰 Trading Fees: | 1.49% for buying and 1.29% for selling cryptocurrency |

| 💰 Deposit Fees: | Varied based on cryptocurrency |

| 💰 Withdrawal Fees: | Varied based on cryptocurrency |

| 💰 Management Fees: | $0 |

| 🔀 Minimum trade order | Varied based on cryptocurrency |

| ⌛ Withdrawal Timeframe: | Up to 3 business days |

| #️⃣ Number of Cryptocurrencies Supported: | 400+ |

| #️⃣ Number of Crypto Pairs Supported: | 50+ |

| 💱 Top supported Cryptocurrencies: | BTC, ETH, XRP, ADA, LTC |

| 📊 Leverage: | Up to 2x |

| 📱 Native Mobile App: | Yes |

| 🖥️ Free Demo Account: | No |

| 🎧 Customer Support: | Contact form, Telegram channel |

| ✅ Verification required: | KYC, AML |

| 📈 CFD Available | Yes |

| 📊 Software: | Website, web app, mobile app |

| ⚽ Social Trading: | No |

| ✂️ Copy Trading: | No |

| 👮♂️ Regulators | Austrian FMA, Swedish FSA, Italian OAM, Bank of Spain, and German BaFin. |

Pros and Cons of Using Bitpanda

- Simple and intuitive user interface that is easy to use

- A wide array of payment and withdrawal options, including SEPA, Giropay, and EPS

- Deposits are possible using fiat currencies such as USD and EUR.

- High liquidity

- Relatively low fees

- Verification required for fiat deposits and withdrawals

- Not widely available outside the EU

What We Liked About Bitpanda

Let’s start our review by taking a look at the positive aspects of the platform that we discovered.

Note that the opinions provided in the review are based on our individual experiences with the broker and your own experience may differ.

Bitpanda Cryptocurrencies and Trading Options

One aspect that stood out during our assessment was the wide variety of coins and trading options that are available on Bitpanda. Compared to other brokers, such as eToro and Gemini, the range of trading products that are available on Bitpanda is very impressive.

This makes it possible to implement a diverse trading strategy and experiment with different corners of the market, all in one place.

What cryptocurrencies can you trade on Bitpanda?

Bitpanda supports over 400 coins, including over 50 trading pairs. Some of the top ones have been outlined below:

- Bitcoin (BTC) – BTC/EUR, BTC/CHF, BTC/GBP

- Ethereum (ETH) – ETH/EUR, ETH/CHF

- XRP(XRP) – XRP/EUR, XRP/CHF

- Cardano(ADA) – ADA/EUR

- Litecoin(LTC) – LTC/EUR

Different Trading Options Offered by Bitpanda

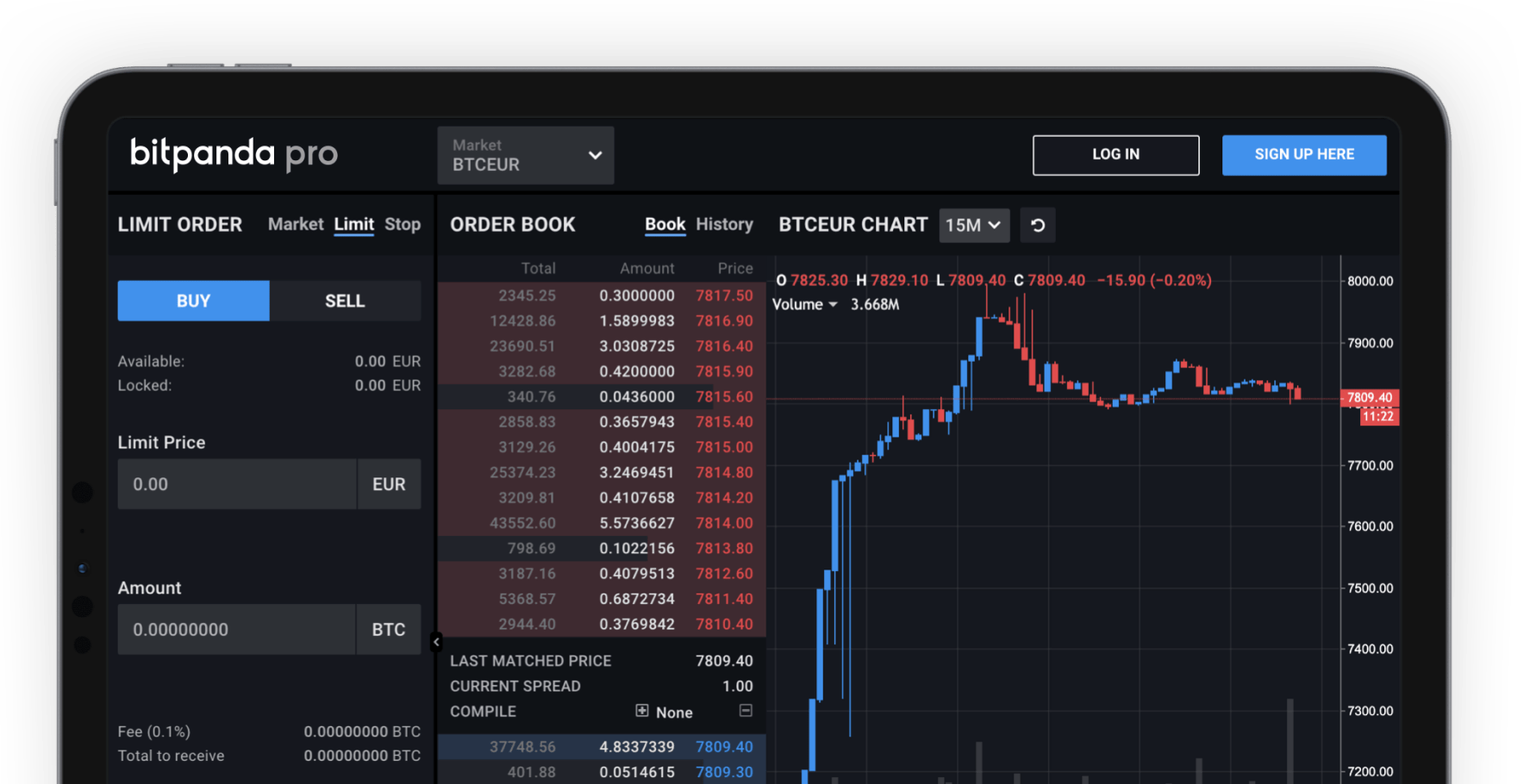

Spot markets and crypto indices are the main trading options on Bitpanda. Spot markets are found on the Bitpanda Pro, while the crypto indices are available on the main Bitpanda trading platform. You can also use Bitpanda to trade cryptocurrency CFDs and the platform stands as one of the best Bitcoin CFD brokers to consider.

Let’s briefly look at how these trading instruments work.

Spot trading: Bitpanda and Bitpanda Pro allow users to buy, sell and swap cryptocurrency. Institutional traders get over 50 trading pairs on Bitpanda pro, including BTC/EUR and ETH/EUR.

Crypto indices: Bitpanda offers the option to invest in the whole crypto market. Bitpanda Crypto index 5 (BCI5) enables investors to trade the top 5 cryptocurrencies by market share and liquidity. Traders also have the options of BCI10 and BCI25.

Can I trade with leverage on Bitpanda?

Bitpanda offers moderate leverage trading options of up to 2x. If you are looking to trade with higher leverage, we recommend checking out Plus500 or Pepperstone.

Fees, Limits, and Payment Options on Bitpanda

Another appealing feature of Bitpanda that stood out during our review was the platform’s competitive fee structure and wide range of payment/deposit options.

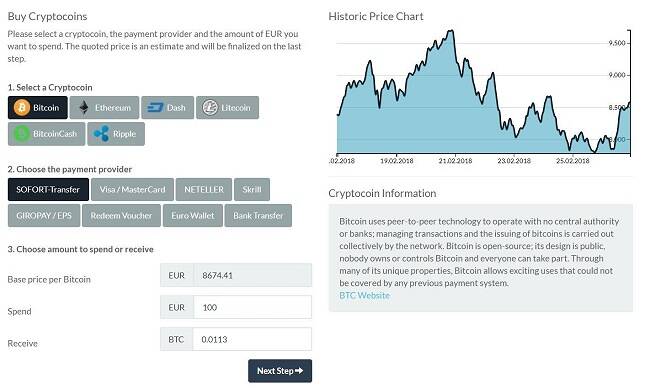

Bitpanda allows traders to deposit different currencies, including GBP, USD, CHF, and EUR. Traders have a healthy variety of funding options for each of these currencies.

Maker and taker fees are present on the Bitpanda Pro trading platform. There are also other fees associated with buying and selling crypto on the platform. Expect to pay 1.49% of your transaction amount when purchasing crypto.

The charges are included in the buy and sell price on the order confirmation page.

Crypto buyers can reduce their fees on the platform by owning the BEST tokens, which guarantee a 20% reduction in costs.

Deposit Methods

There is a wide range of funding options available for traders. Here is the list:

- SEPA

- Neteller

- Mastercard

- Visa

- Sofort

- Giropay/EPS

- Bitpanda To Go

- Skrill

- Cryptocurrency deposits

The deposit methods available depend on the currency that you will use to fund your account. For instance, you can use all the above options to deposit Euros while only having three options to deposit USD(Skrill, Mastercard, and Visa).

Payment limits on Bitpanda depend on your verification status and the funding option. Here are the maximum daily limits for select deposit methods in Euros:

- Credit card – €2,50

- Online Payments – €10,000

- Bank transfer(SEPA) – €500,000

The minimum deposit depends on the currency that you use but starts as little as €1 (or GBP 1.00/CHF 1.50/USD 1.50/TRY 10. However, bank transfers have a minimum deposit amount of $25.

As for transfer speeds, these largely depend on the deposit method. Online deposit methods such as Giropay, Neteller, Visa, and Mastercard happen instantly. Bank transfers are processed within one business day.

Prospective traders on Bitpanda have to complete Know Your Customer (KYC) verification before trading. Different verifications levels exist and are instituted depending on your trading activities.

If you would prefer to skip this process, take a look at our list of 10 non-kyc cryptocurrency exchanges.

Withdrawal Methods

Here is a list of withdrawal options available on Bitpanda:

- Skrill

- Neteller

- Bitpanda payments

- SEPA

Withdrawal options depend on the currency in question. For instance, SEPA, Neteller, and Skrill are available for GBP withdrawals, while only Skrill is available for USD withdrawals.

Here are the daily withdrawal limits in USD:

- Online payment – $112,675

- SEPA – $5,633,737

Withdrawals are only possible for verified users. The speed of the transaction will depend on your preferred payout options. Bank transfer will take considerably longer compared to alternatives like Neteller and Skrill.

Bitpanda has provided minimum withdrawal amounts but based on each crypto. For instance, the minimum number for BTC is 0.00057000 BTC; this is exclusive of the fees.

How Much Are Bitpanda Fees and Commissions?

It’s commonplace for crypto platforms to charge various fees and commissions depending on their economic model. Like many other platforms, Bitpanda includes all buy and sell fees in the offer price. Clients should note that these offer prices are dynamic in reaction to real-time crypto price movements. This type of market order is pretty standard in most crypto exchanges.

Like Binance’s BNB coin, Bitpanda has a coin known as BEST, which incentivizes trading on the platform. For instance, traders get 20% off fees when users pay in BEST.

Here are the fees to look out for on Bitpanda.

- Transaction fees: There is a 1.49% for buying and 1.29% for selling cryptocurrency

- Deposit and withdrawal fees: Bitpanda charges for deposit and withdrawals of currencies on their platform.

- Maker/taker fees: Bitpanda Pro charges a maximum of 0.1% maker fees and 0.15 taker fees. The higher the trading volume, based on a 30 day average of an account, the lower the fees.

Sending crypto from one account to another is free of charge. There are no inactivity, convenience, or account maintenance fees.

Bitpanda trade sizes and limits

The minimum amount to buy and sell crypto is EUR 1.00 (or GBP 1.00/CHF 1.50/USD 1.50/TRY 10). The platform goes further to give a breakdown of minimum deposit amounts for each crypto. For instance, the minimum trade for BTC is 0.00050000 BTC.

Limits are available for a 24h trading period and monthly. They are also dependent on the verification level of an account.

The Bitpanda trading platform

During our Bitpanda review, we found that the platform is available on both desktop and mobile. This is ideal for traders who may want to manage their trades on the go.

The Bitpanda mobile app is a mirror of the web-based application. The mobile app is available on both IOS and Google app stores. You can use the app to buy, sell, swap deposit withdraw, and set price alerts for crypto assets you’re interested in. Apps are backed with adequate servers, robust APIs, and secure offline wallets.

Although the platform is available on mobile, we recommend using the desktop version to access charting tools and place trades.

There are two versions of the Bitpanda trading platform that you can use:

- Bitpanda: This is the basic exchange platform that is suitable for beginners. Here, you can access simple features for buying, selling and swapping crypto as well as a selection of educational resources.

- Bitpanda Pro: This is the advanced version of the platform that offers comprehensive price charts, customizable trading dashboards and access to more complex instruments.

If you’re looking for a reliable platform to buy and sell crypto, the basic Bitpanda exchange should work fine. However, advanced traders may want to consider signing up for Bitpanda Pro to access more complex features.

Both platforms are easy to navigate and work intuitively. We were impressed with how the Pro platform functions on a smaller screen, which is a limitation for many Bitcoin brokers.

What We Didn’t Like

For the most part, we had a very positive experience with Bitpanda. However, no crypto exchange comes without drawbacks. Here are some features of Bitpanda that we weren’t as impressed with.

Bitpanda is a centralized exchange

The main drawback of using Bitpanda is that the exchange is centralized which means that it is controlled by a third-party authority. Technically speaking, Bitpanda can access your funds at any time and restrict your account if they feel obliged to.

This won’t affect many traders who use the platform. However, some argue that centralized exchanges take away from the point of cryptocurrency (which was made to be decentralized).

One way to work around this is to move your crypto into an external decentralized wallet for safekeeping away from the exchange.

If you would prefer to use a decentralized exchange, you could look into options such as UniSwap or Pancakeswap.

Customer Support

In case you require assistance, you can reach customer support by submitting your request on the contact form available on the platform. This will trigger an email alert, and you should expect a response within 72 hours. Another option is the Telegram channel, where admins can assist you with issues.

Reputation for their customer support has, however, not been that great. Clients complain of slow responses and unsatisfactory answers to their queries. Unlike some other cryptocurrency exchanges, Bitpanda does not offer live chat or offer a phone number that could be contacted.

Bitpanda Accessibility and Safety

In the next part of our Bitpanda review, we will take a look at the platform’s accessibility, security and regulation.

Can I use Bitpanda in any country?

Bitpanda primarily serves EU residents. The exchange is available in 37 countries, including Austria, the Italy, and the UAE.

We recommend that prospective traders check the existing laws in their countries before signing up to Bitpanda. For example, the exchange is not available in the US or the UK (according to the website, Bitpanda will start allowing UK traders to register in the foreseeable future).

Is Bitpanda available in my language?

Apart from English, there are other six languages on Bitpanda. Major ones include French, Spanish, Turkish, and German.

How easy is it to use Bitpanda?

Bitpanda provides a simple and easy way to purchase crypto on web and mobile applications. The ease of use is comparable to Coinbase, meaning the user interface is intuitive, ensuring the trading experience is better even for beginners.

To give a better user experience, the trading engine leverages on speed, security, and reliability. Additionally, the exchange has attempted to offer many funding and withdrawal options as well as a mobile app that works like the web version.

Reviews from users concur with the simplicity of the platform. However, there are mixed reviews when it comes to user experience. Many users have reported a delay in deposits, withdrawals, and customer support.

Security and regulation

We have already mentioned that Bitpanda is not available in all countries. However, in the countries where the exchange can be used, it is regulated by several authorities. As a result, the exchange follows strict security protocols to protect its users.

Is Bitpanda Safe?

Bitpanda provides a moderate suite of features to protect personal data and assets stored on its platform. For instance, users have to activate 2-factor authentication for their accounts.

Bitpanda also offers cold storage, meaning crypto assets are stored offline. Other features put in place to prevent unauthorised access to your account include:

- Implementation of session management

- User verification through reCAPTCHA methods

- Email confirmations

- Spot checks

The exchange also implements SSL and DDOS protection to prevent external intrusion.

Is Bitpanda Regulated?

The Austrian regulatory authority (Austrian FMA) regulates Bitpanda payments, a subsidiary of Bitpanda. Bitpanda Pro is regulated in the EU.

The exchange is also regulated by the Swedish FSA, Italian OAM, Bank of Spain, and German BaFin.

Do I Have to Verify My Account With Bitpanda?

Yes, everyone who signups on the platform must complete KYC verification in line with AML5D laws in the EU.

Passports from all countries are accepted as verification documents. ID cards are not universally accepted bar for several countries like Austria and Bulgaria. Driving licenses and residence permits are not acceptable.

How to Get Started With Bitpanda

If Bitpanda seems like it could be a suitable exchange for you, here’s how to get started.

Step 1 – Visit Bitpanda’s official site & Sign up

Go on the official Bitpanda website and sign up for an account. You will need to provide some basic personal information so make sure that you have an email address and phone number available.

Step 2 – Verify your identity

Enter your details and provide ID for KYC/AML for verification purposes. The platform accepts passports, birth certificates and proof of address. The documents that you provide must be in date.

Step 3 – Make a deposit

Connect a payment method to your account to deposit funds. We recommend starting with the minimum deposit before putting any more money on the line.

Step 4 – Select a crypto pair

Use the search function to find a crypto that you would like to trade or use the main dashboard to view coins that are available.

Step 5: Execute and order

Fill out the order form and complete the order to buy crypto. The coins will appear in your balance after a few minutes.

Always make sure to check the details of the order carefully before you hit buy.

Here is how you sell crypto using either your desktop or mobile application:

Step 1: After logging into your Bitpanda account, click trade.

Step 2: Click sell.

Step 3: Select the cryptocurrency you want to sell.

Step 4: Choose the wallets where your funds will be transferred.

Step 5: Enter the number of crypto assets you want to sell.

Step 6: Check the transaction details and click on “sell now”.

Step 7: Confirm if funds are credited to the fiat wallet you selected.

Final Thoughts

Bitpanda is a top crypto exchange in Europe, offering a large number of cryptocurrencies and crypto indices. Bitpanda Pro is an offshoot exchange that caters to professional and institutional traders. This platform offers over 50 trading pairs, with most pairs involving the Euro.

The native tokens associated with the Bitpanda ecosystem aim to incentivize the use of the exchange. For instance, BEST token holders can get a 20% fee reduction. Fees on Bitpanda can be rated as moderate. The crypto selection on the platform is also healthy, with about 400 cryptocurrencies available for purchase.

Bitpanda users enjoy several advantages, including high liquidity and a wide variety of funding options. On the downside, the fact that US residents cannot use the exchange and the complaints from clients as a result of unsatisfactory customer support ruin the stellar review of this exchange.

Overall, Bitpanda stands as a great option for EU traders who want to access a simple exchange and advanced trading platform in one place.

FAQs

Is Bitpanda trustworthy?

Yes, Bitpanda is a trustworthy crypto exchange that is registered with several regulatory bodies in Europe.

Is Bitpanda better than Coinbase?

If you are looking to trade crypto with leverage, Bitpanda might be a better option than Coinbase. However, Coinbase is the best crypto exchange in terms of usability and reputation.

Who owns Bitpanda?

Bitpanda is based in Vienna and was founded by Eric Demuth, Paul Klanschek and Christian Trummer in 2014.

Contributors