Crypto prices have made a strong comeback this week, resulting in substantial liquidations for short sellers. Bitcoin has broken the key resistance level at $90,000, while the market valuation of all cryptocurrencies is nearing the crucial $3 trillion mark. This article examines two coins, Jasmy and Onyxcoin, and provides their forecasts.

Crypto to Buy: Jasmy

Jasmy, popularly known as Japan’s Bitcoin in crypto circles, has bounced back, as we had predicted. The main bullish catalyst for JasmyCoin is that it has formed a falling wedge pattern on the daily chart. This pattern consists of two falling and converging trendlines, often leading to a strong bullish breakout.

The bullish breakout above the falling wedge pattern has already occurred, and the coin has moved above the key resistance level at $0.0160, which was the lowest swing in August and November of last year. Moving above that level is a sign that bulls are powering on ahead.

The coin has surpassed the 50-day moving average, while the RSI has shifted upward. Therefore, the coin is likely to continue rising as buyers target the resistance level at $0.025, which is approximately 55% above the current level. A drop below the support at $0.013 will invalidate the bullish outlook.

Altcoin to Sell: Onyxcoin (XCN)

Onyxcoin is one of the top altcoins to sell now, as it has surged by over 1,200% from its lowest point in 2024. There are a few reasons for selling the token. First, the chart above shows that the token is forming a slow double-top pattern, with its neckline at $0.0166.

A double-top pattern often leads to a bearish breakdown over time. If this happens, it will likely drop to the psychological point at $0.010.

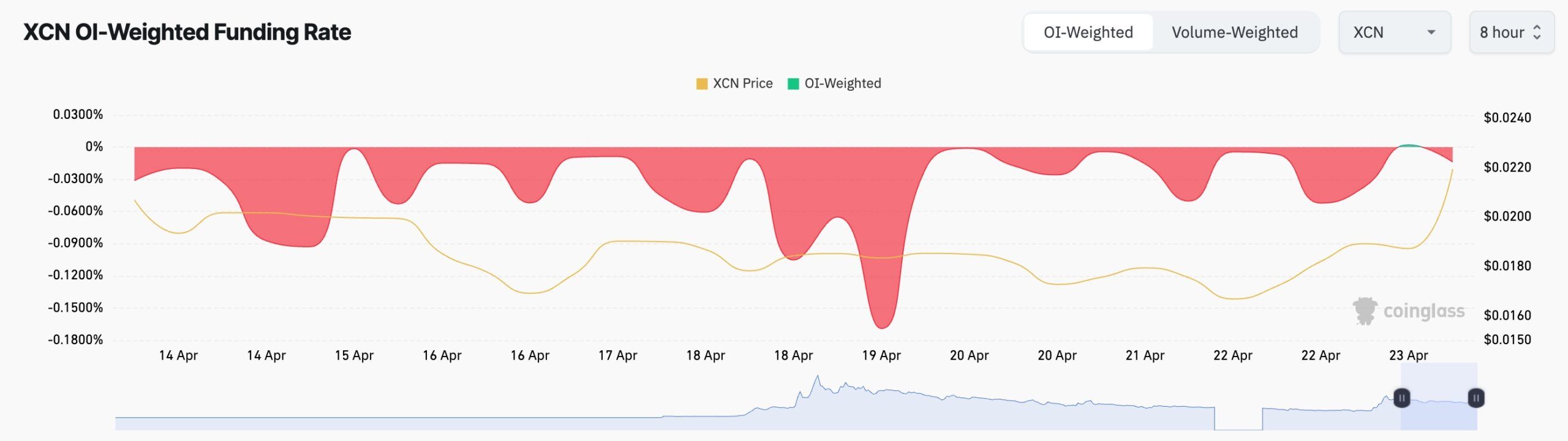

Second, CoinGlass data shows that the token has negative funding rates. A negative funding rate means that short traders are paying long traders. This means that the price of a perpetual futures contract is lower than the spot price. In most periods, this performance signals a bearish sentiment.

Furthermore, the Onyx Protocol is performing poorly, with a total value locked in the network of only $93 million, significantly lower than its all-time high of nearly $700 million.

Finally, the ongoing Onyxcoin price rally is happening without a clear catalyst, raising concerns about market manipulation.

READ MORE: Onyxcoin Price Goes Parabolix: Can XCN Sustain the Rally?