The Turbo crypto token surged this week as the cryptocurrency market gained momentum. It soared to a high of $0.005560, its highest level since February, up by almost 300% from its lowest level this year.

Turbo’s surge happened as Bitcoin and other altcoins rebounded. Bitcoin retested the crucial resistance level at $94,000 for the first time in over a month. Other meme coins like Fartcoin, Pepe, Official Trump, and Dogecoin also soared. As a result, the market cap of all meme coins tracked by CoinGecko jumped by 16.5% to $58 billion.

Turbo price jumped as the futures open interest rose to $63 million, its highest level since December 17. It has risen from this month’s low of $13 million, indicating increased demand in the futures market.

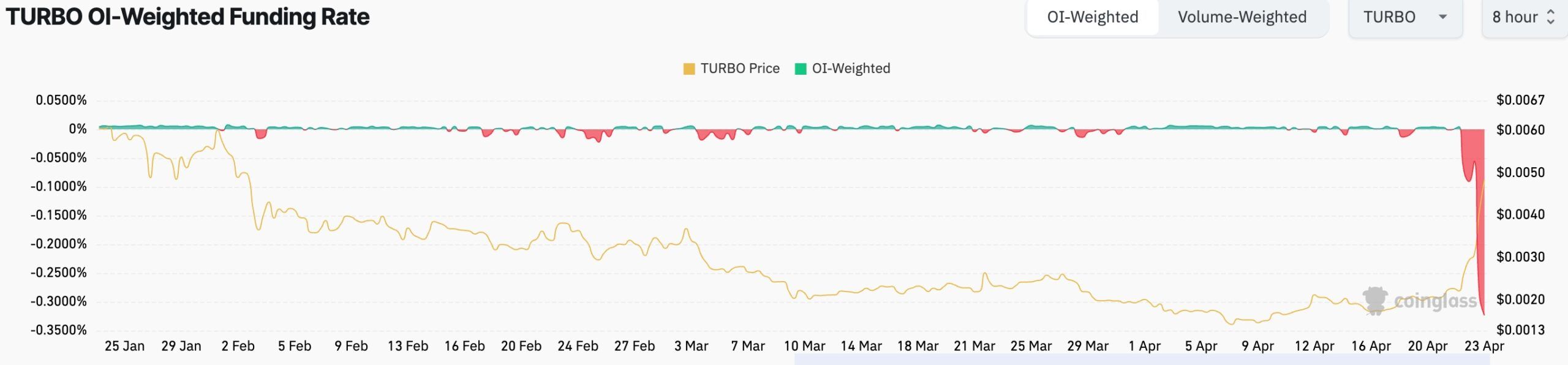

The risk, however, is that the coin’s funding rate fell to minus 0.3235%, its lowest level on record. A negative rate indicates a higher demand for shorting the asset, reflecting traders’ expectations of a price decline. The falling negative funding rate is a sign that the surge may end soon.

Read more: Shiba Inu Price: Coiled Spring Ready to Pounce as Whales Buy

Turbo Crypto Price Technical Analysis

The daily chart indicates that the Turbo token reached its bottom at $0.0001366 this month. It then bounced back and has reached a high of $0.005560 on Wednesday.

It has surpassed the key resistance level at $0.003045, which was its lowest swing in June and August of last year.

The coin has moved above the 50-day moving average, indicating that bulls are currently in control. Oscillators such as the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) have been pointing upwards.

Therefore, the coin will likely drop to retest the support at $0.0030, aligning with the robust pivot and reversal indicated by the Murrey Math Lines tool. More gains will be confirmed if the price rises above the key resistance point at $0.005560. Such a move would push it to the resistance at $0.007735.

Read more: Dogecoin Price May Surge as Chart Patterns and Open Interest Align