The Swiss franc and gold have emerged as the top safe havens as the crypto fear and greed index remained in the fear zone. The USD/CHF exchange rate has fallen sharply by 12% from its highest point this year, while gold has soared to a record high of $3,243. The price of gold has jumped by over 37.50% in the last 12 months.

Bitcoin Price Falls As Gold and Swiss Franc Rise

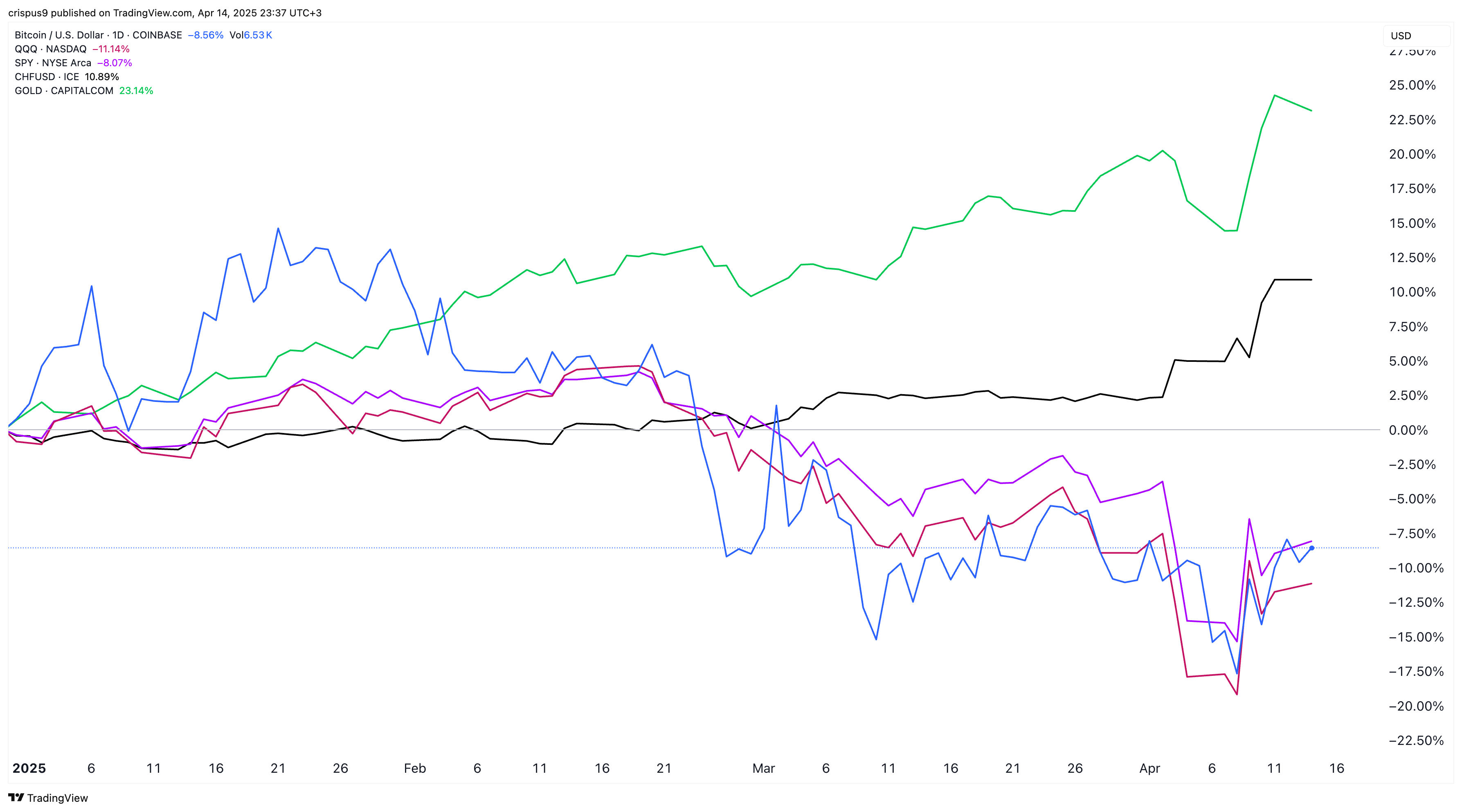

In contrast, Bitcoin, which has often been considered a safe haven, has fallen sharply by almost 10% this year. Its performance has mirrored that of other risky assets like the S&P 500 and Nasdaq 100 indices.

Most notably, the US dollar and bonds have not become the safe havens they were in the past. The US dollar index has plunged in the last three consecutive days and is hovering at its lowest swing since September 2022. It has fallen by almost 10% from its highest level this year, indicating that it is nearing a correction.

US bond yields, which move in the opposite direction as prices, have increased to a high of 4.585%, up from 3.85% this month.

READ MORE: Bitcoin Price Shows Bottoming Signs as BTC ETF Outflows Continue

The Swiss franc has become a better safe haven than Bitcoin because of the strength and stability of the country’s economy. Unlike the US and countries in the European Union, Switzerland is neutral on many issues. Switzerland also has one of the strongest economies with little debt.

Therefore, analysts expect that the currency is a better alternative to the US dollar and other risky assets. In a note to BanklessTimes, an analyst from Cube Exchange said:

“The Swiss franc is one of the best currencies to have. Switzerland has a GDP of almost $900 billion and less than $300 billion in debt. It also holds almost $300 billion of US debt, which it can easily liquidate.”

Gold Has a Long History as a Safe Haven

Gold is considered a superior safe haven due to its long-standing historical role. It has been a safe haven for centuries and has experienced robust demand from institutional investors and central banks in countries like Russia and China. In a note, an analyst at Goldman Sachs enhanced its gold price forecast, stating:

“Recent flows have surprised to the upside, likely reflecting renewed investor demand in hedging against recession risk and declines in risk asset prices.”

Still, some analysts note that Bitcoin is holding well while risks rise and the fear and greed index tumbles. Besides, the Bitcoin price dropped by 8.5% this year compared to the Nasdaq 100 index, which dropped by 11.15%. It has also beaten the S&P 500 index, which has dropped by 9%.

Some analysts consider Bitcoin a safe haven because of its substantial institutional demand as Blackrock and Strategy continue buying. They note its limited supply and rising mining difficulty.

READ MORE: ‘Buckle Up’ – Altcoins Like Kaspa, Onyxcoin, Pepe Wait for a Fed ‘Bailout’