The Ethereum price has crashed this year, making it one of the top laggards in the crypto industry. It has slipped to $1,570, down by over 61% from its highest point in December. It is hovering near its lowest level since October of the previous year. While the ETH price remains bearish, there are three main reasons it might bounce back soon.

Ethereum Price Has Formed a Bullish Pattern

The first reason why the Ethereum price may rebound soon is that it has formed a falling wedge pattern on the daily and weekly charts. As shown below, the upper side of this pattern connects the highest swings since January 5. The lower side, on the other hand, connects the lowest levels since December 20th.

These two lines are now nearing their confluence level, which is when bullish breakouts usually happen. Therefore, if this happens, the coin will likely have a bullish breakout and potentially retest the key resistance point at $2,140, the lowest point in August and September. This target is about 35% above the current level.

ETH price chart | Source: TradingView

Ethereum DEX Network is Still Thriving

The other bullish catalyst for the Ethereum price is that its DEX network is still doing well despite the rising competition from Base and Arbitrum.

DeFI Llama data shows that dApps on the Ethereum network managed over $17.2 billion in the past week, outperforming Solana’s $15 billion and BSC’s $5.9 billion. Base handled over $5.17 billion, while Arbitrum managed $4.6 billion, respectively.

Therefore, this performance indicates that the network continues attracting users to its platform despite its substantially higher fees.

In line with this, Ethereum is the biggest crypto chain in terms of total value locked (TVL). It has over $46 billion in assets and $161 billion in bridged TVL. Also, its stablecoin market cap is $123 billion, much higher than Tron’s $68 billion.

READ MORE: Ethereum Price Prediction: Crisis Scenario Unfolds, Nears All-Time Low

ETH Price is Cheap

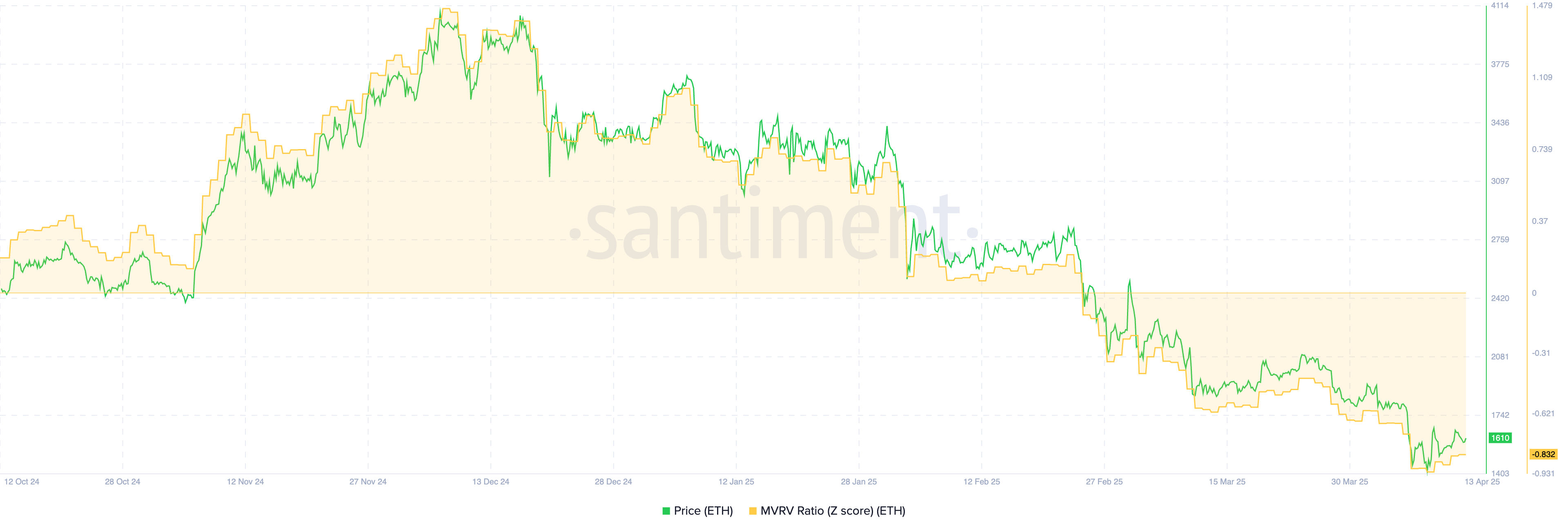

The other bullish catalyst for Ethereum is that it has become a cheap asset. One of the best metrics for valuing a coin is the Market Value to Realized Value (MVRV) Z score. It assesses a coin’s value by comparing its market value to its realized value.

This helps determine whether a coin is considered cheap or expensive. The figure is then standardized to find the Z score, which measures how far it has deviated from its historical mean.

Ethereum’s MVRV-Z score has dropped to minus 0.832, a sign that the coin is significantly cheap compared to its score of 1.5 in November. Therefore, it is possible that it will rebound as investors buy the dip.

READ MORE: Arbitrum Price in Focus Ahead of a $500B Milestone & Token Unlock