The crypto market is abuzz with mixed signals; however, for renowned trader and analyst Michaël van de Poppe, the path to clarity is simple: Watch Bitcoin (BTC) closely because the next Altcoin Season won’t begin until Bitcoin surpasses $85,000.

In a series of tweets, Van de Poppe explained why the crypto market is now at a critical juncture. While many investors remain confused amid global economic uncertainty, Van de Poppe insists the charts tell a clearer story than the headlines.

Altcoin Season Paused Until Bitcoin Surpasses $85K Resistance, Says Van de Poppe

He believes the macro environment is setting the stage for a major crypto breakout. He suggests that the conclusion of gold’s ongoing bullish run, potential quantitative easing (QE) from central banks, a weakening U.S. dollar, and lower oil prices could all push risk assets like Bitcoin higher.

Van de Poppe explained that if these economic factors unfold as anticipated, Bitcoin could surge to new all-time highs. He suggested that Bitcoin reclaiming $85,000 is essential before Ethereum ($ETH) and the rest of the altcoin market can follow.

His argument is straightforward: Confidence returns to the crypto space when Bitcoin gains strength. This confidence will initially elevate Bitcoin, then Ethereum, and ultimately the broader altcoin market.

According to data, Bitcoin is currently trading around $83,381, showing a slight recovery after a steep decline from its recent highs of over $100,000. The daily technical analysis summary from TradingView paints a mixed picture for Bitcoin. Oscillators remain mostly neutral while moving averages still indicate a bearish tendency.

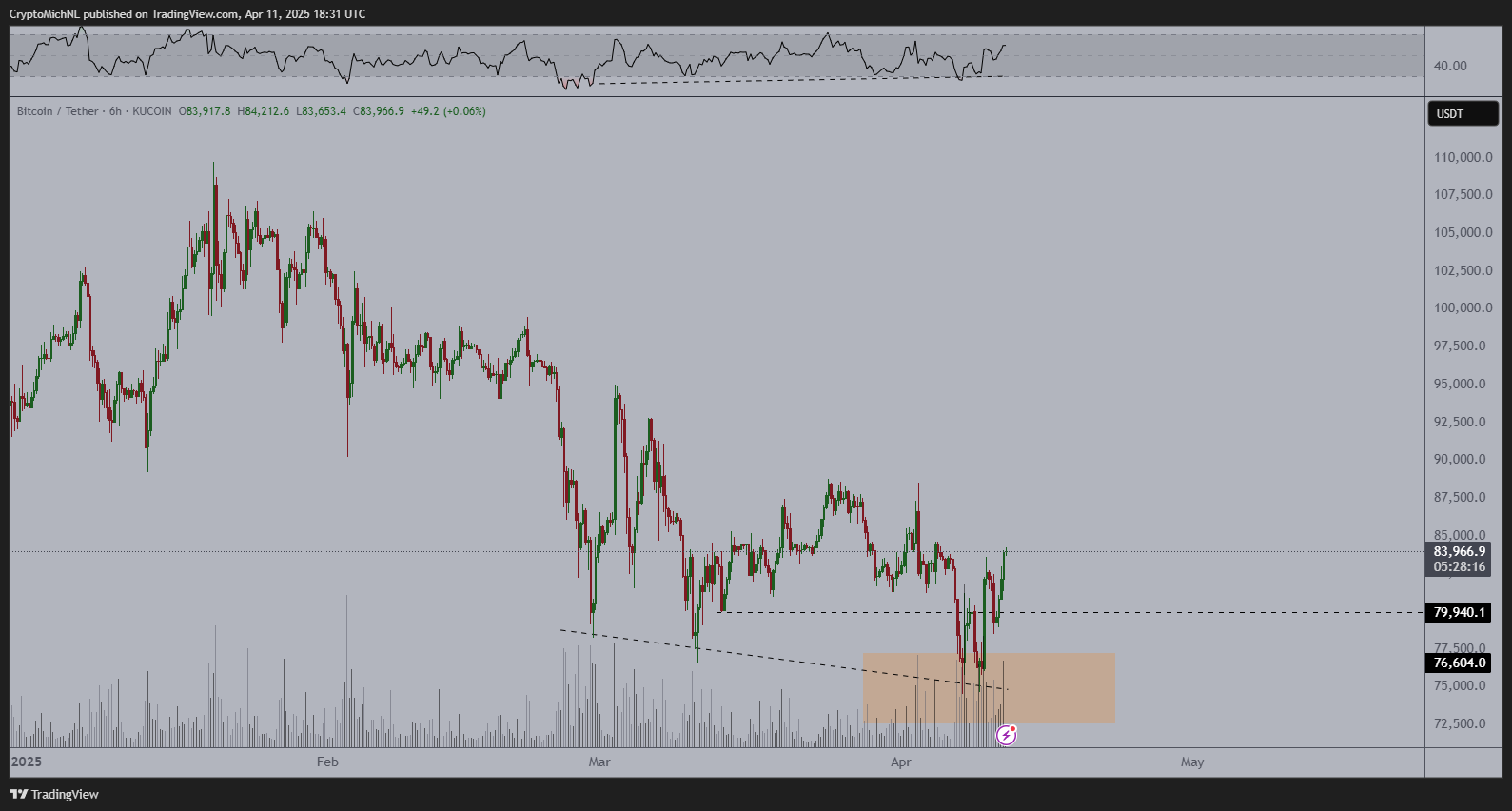

However, the latest tweet from Van de Poppe shows a strong bullish divergence on Bitcoin’s price chart. He points out that the $80,000 level was key support and provided a solid bounce upwards.

He suggests that this confirmation opens the door for Bitcoin (BTC) to push toward $85,000 and potentially beyond.

He noted that Bitcoin could quickly accelerate towards that target within the coming week if a deal is struck on the macroeconomic front — possibly related to central bank intervention or a bounce in the Yuan against the dollar.

Ethereum Price Will Follow Bitcoin’s Breakout

Van de Poppe does not stop with the Bitcoin price prediction. He also drew attention to Ethereum’s current situation, particularly its performance against Bitcoin. In another tweet, he shared the $ETH/$BTC chart on the weekly timeframe, highlighting that Ethereum has now hit its lowest Relative Strength Index (RSI) level since its existence.

This exceptionally low RSI indicates that Ethereum is significantly oversold in comparison to Bitcoin, signaling that a trend reversal may be near.

However, according to Van de Poppe, the trigger for the Ethereum price recovery will only come after Bitcoin completes its next leg up.

Ethereum has struggled in recent months, trading well below its highs. The ETH/BTC ratio has declined sharply, reflecting Bitcoin’s dominance in the current market cycle. This scenario aligns with Van de Poppe’s thesis — Bitcoin must lead the rally.

Once it stabilizes or consolidates after a breakout, capital will rotate into Ethereum and then flow into smaller altcoins. This sequence has historically played out in crypto bull markets.

READ MORE: NEAR Price Forms Bullish Reversal Pattern as Breakout Targets $2.40