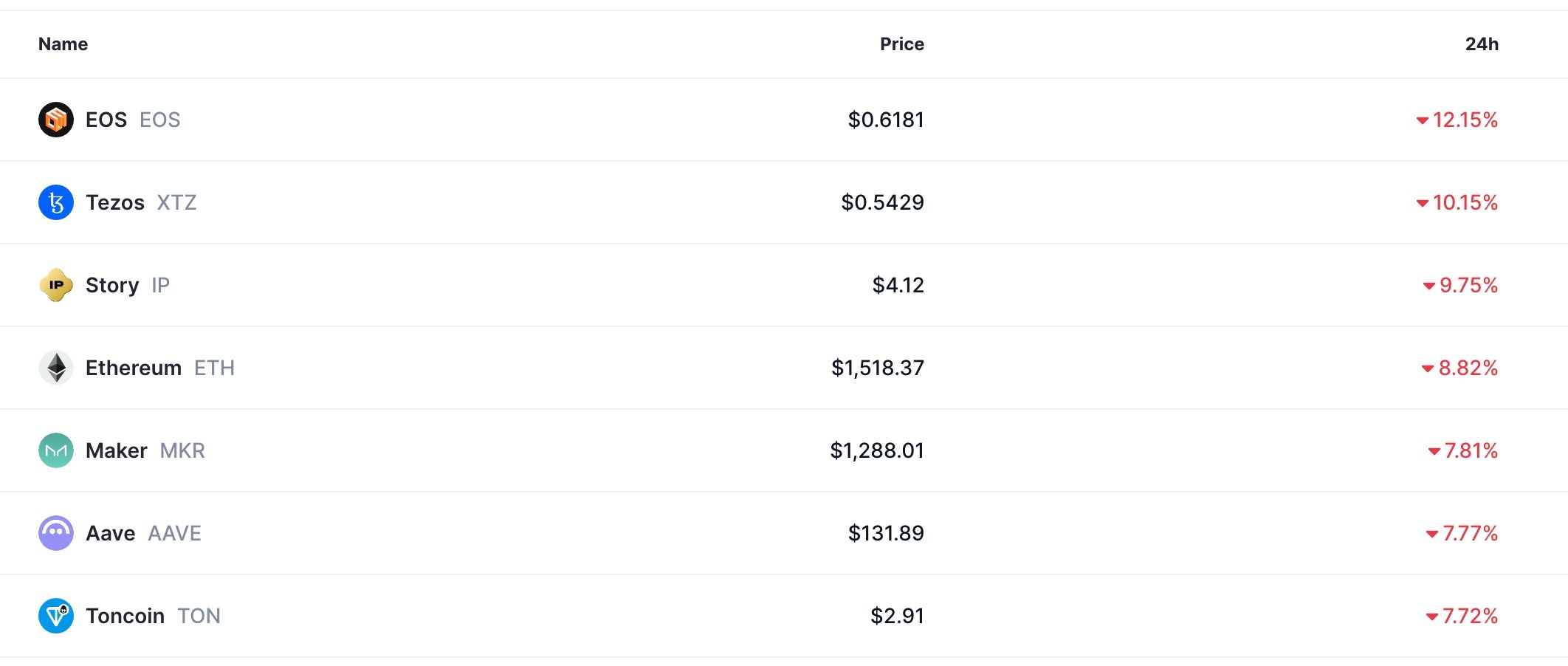

The crypto market suffered a harsh reversal on Friday, erasing gains made earlier when Donald Trump paused certain tariffs. The Bitcoin price crashed from over $82,000 to $79,000, while tokens like EOS, Tezos, Ethereum, and AAVE plunged by over 10%. All these altcoins remain in a deep bear market after falling by over 50% from their year-to-date high.

Why EOS, Tezos, Ethereum, AAVE, and Other Altcoins Crashed

These tokens are crashing as the sentiment in the financial market remains weak. Indeed, the drop mirrored the stock market’s performance, where US equities erased some of the gains made after the tariff pause.

The Dow Jones index plunged by over 1,000 points, while the S&P 500 and the Nasdaq 100 indices dived by 200 and 740 points, respectively. At the same time, the top volatility gauge in Wall Street, known as the VIX, surged by over 21% to $40.

Stocks and cryptocurrencies like EOS, Tezos, Ethereum (ETH), and AAVE tumbled as concerns over trade and recession remain. In an X post, Mark Zandi, the top economist at Moody’s, reiterated that the US was heading towards a recession, citing its high tariffs and falling consumer confidence.

Zandi noted that while Trump paused some tariff measures, he simultaneously increased tariffs on Chinese goods to 145%, much higher than in other countries, as the game of chicken continues.

At the same time, Trump still maintains the 25% tariff on autos, steel, and aluminum. Zandi believes that the average tariff rate in the US is over 10%, which is higher than in other countries.

Zandi has also noted that his number one recession indicator was about to be triggered. He believes a recession is usually triggered when consumer confidence falls by over 20 points within three months, which it has fallen three times in recent months.

READ MORE: 1 Crypto to Buy This Week, 1 to Sell: Pi Network, Hyperliquid

Silver Lining on the Ongoing Crypto Crash

There is still a big silver lining to the ongoing crypto crash: US consumer inflation has plunged and is nearing the Fed target of 2.0%. Core inflation moved downwards and fell below the 3% level for the first time in years.

Therefore, falling inflation means that the US may avoid stagflation and, instead, move into a recession. Such a recession would push the Fed to start cutting interest rates, which would help to stimulate the economy and boost asset value.

At the same time, Congress voted in favor of Trump’s tax cut bills, which will slash taxes by over $4.5 trillion and cut costs by about $1.5 trillion. These tax cuts may provide a catalyst for the crypto market.

READ MORE: Mantra Price Has Stalled: Can OM Realistically Surge to $10?