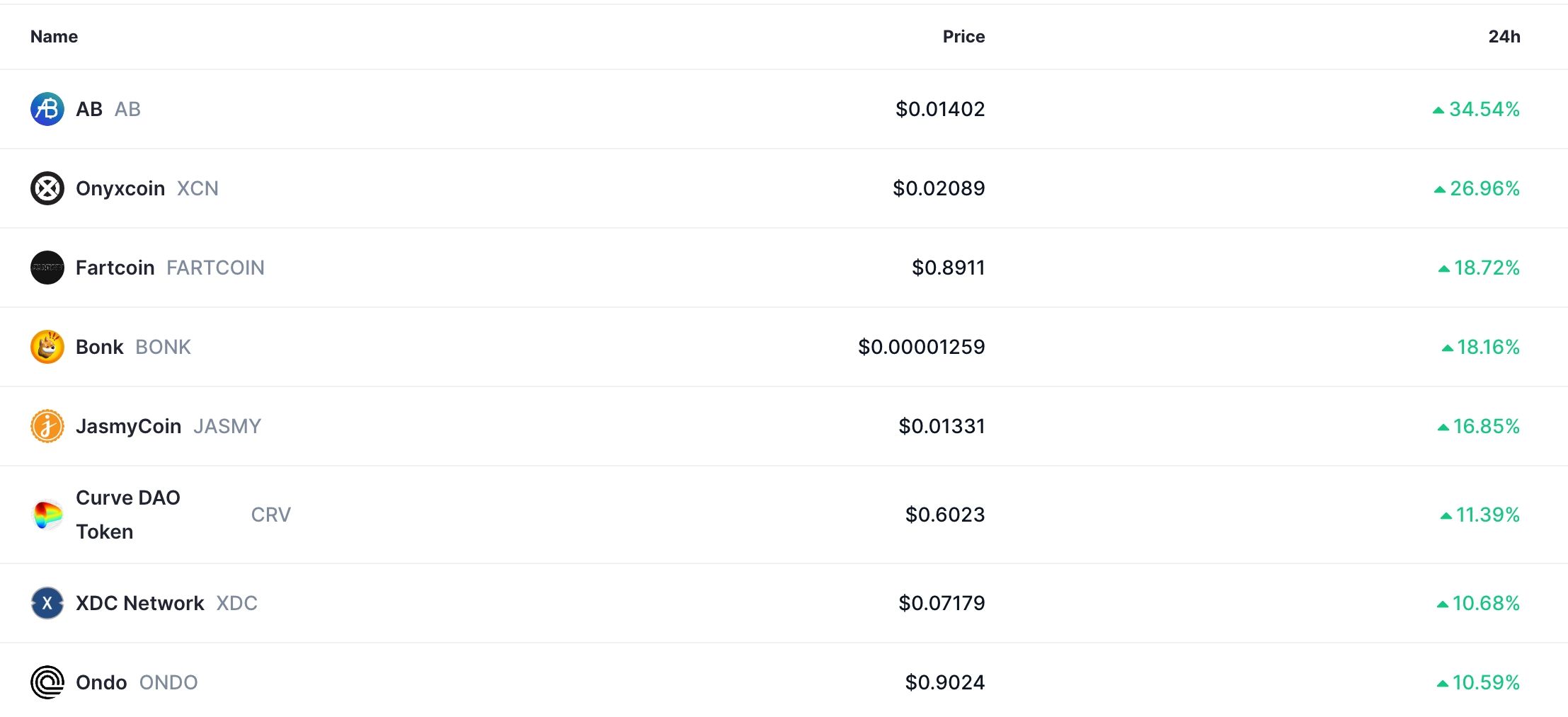

Top cryptocurrencies like Fartcoin, Bonk, Jasmy, and Ondo Finance prices surged on Friday as the U.S. Dollar Index (DXY) plunged to its lowest point in over three years.

The Fartcoin token jumped to $0.8910, marking its highest point since January and representing a 365% increase from its lowest point this year. Bonk, the second-biggest Solana meme coin, rose to $0.00001245, while Jasmy and Ondo prices were up by 10%.

Fartcoin, Bonk, Jasmy, Ondo rise as the DXY Index Plunges

These tokens soared as the U.S. Dollar Index, commonly referred to as the DXY, plunged to a low of $99, its lowest level since 2022. It had imploded by over 11% from its highest level this year.

The dollar plunged as bond market and trade war turmoil intensified. Data shows that the ten-year government bond yield soared to 4.6% from this month’s low of 3.85%. Bond yields and prices move in different directions.

Historically, a falling U.S. Dollar Index has been a good thing for cryptocurrencies like Fartcoin, Bonk, Jasmy, and Ondo because it is usually a sign that the Federal Reserve may decide to cut interest rates soon.

Additionally, these tokens also jumped as American stock indices soared. The Dow Jones, S&P 500, and Nasdaq 100 indices jumped by over 1.5% as some investors started to predict that stocks had bottomed.

Read more: Hedera Price Prediction: HBAR Rare Pattern Signals a Surge

Odds of Fed Cuts Jumped

Odds of Fed Cuts rose this week after the U.S. published encouraging inflation data on Wednesday. The headline Consumer Price Index (CPI) dropped from 2.8% in February to 2.4% in March, while the core CPI moved from 3.1% to 2.8%.

Falling inflation and rising recession risk because of the trade war are catalysts for a Fed cut. Historically, cryptocurrency prices rise whenever the Fed is slashing rates, as was observed during the COVID-19 pandemic, when Bitcoin and other altcoins saw significant price increases.

The other potential catalyst for these altcoins is Donald Trump’s tax policy that passed in the House of Representatives. That bill will make the 2017 tax policy permanent and cut some more taxes, like those on tips and overtime pay.

The other major fiscal policy to watch is on bailouts on key industries because of Donald Trump’s trade war. Media reports suggest that he is expected to request stimulus checks for farmers as tariffs from China and other countries. Stimulus checks often lead to more demand for risky assets.