Pepe coin price has remained in a strong bearish market this year as demand for most cryptocurrencies waned. After surging to a record high of $0.00002827 in December, the third-biggest meme coin has plunged by over 74% to the current $0.0000071.

The easiest Pepe price prediction at this stage is bearish since it has formed a death cross pattern. It has also remained below all moving averages, indicating that the downtrend will continue. However, after plunging by 60% in the first quarter, there are reasons to believe that the value of Pepe will surge in April.

Pepe Coin Price to be Supported by Strong Technicals

The Pepe coin price will stage a strong comeback in April, mainly because of its strong technicals. The daily chart shows that the coin formed a falling wedge in the first quarter of this year. This is a popular chart pattern comprising two descending and converging trendlines.

In Pepe’s case, the convergence happened in the last days of the quarter. It also happened near the key support level at $0.000005835, its lowest point since 2024.

The MACD indicator has formed a bullish divergence pattern, and the two lines are nearing their crossover above zero. Also, the BBTrend indicator has formed a bullish divergence, pointing to a rebound to the resistance point at $0.000017, the 50% Fibonacci Retracement point, about 140% above the current level.

READ MORE: Pi Network Price Prediction for April: Will Pi Coin Rise or Fall?

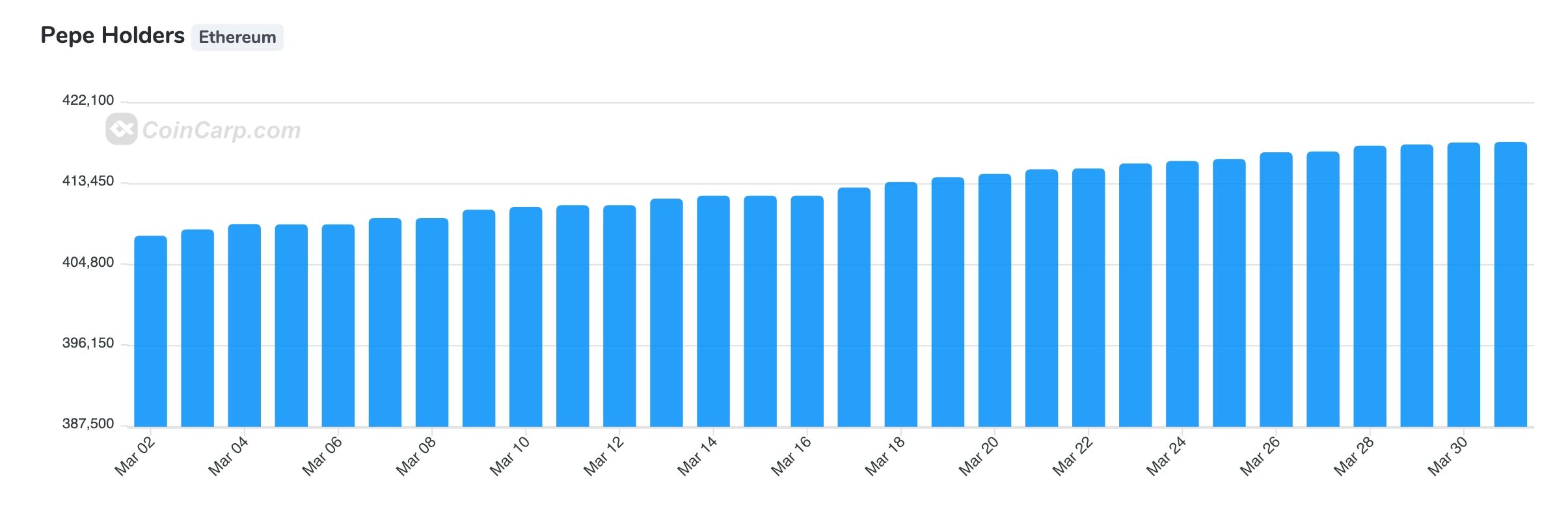

Pepe Holders Are Still Rising

In most cases, crypto investors dump their coins when the price drops. In Pepe’s case, the opposite has happened, a sign that investors anticipate the coin to rebound in the coming months.

Pepe now has over 417,000 holders, up from 406,000 on the same day in March. The top ten holders account for about 38.8%, while the top 20 account for about 50%. This is a notable feature since it signals holders are spread across the board. It also means that a few addresses cannot manipulate the token.

Dovish Federal Reserve Because of Trump Tariffs

Further, from a macro perspective, the Pepe coin price will likely benefit from the potential intervention by the Federal Reserve. BanklessTimes believes that Trump’s tariffs will likely lead to a recession in the United States. On Monday, analysts at Goldman Sachs raised their odds of a recession.

A recession would benefit the Pepe coin by forcing the Federal Reserve to cut interest rates and the Federal government to implement stimulus. In their note, Goldman Sachs analysts said:

“We have pulled the lone 2026 cut in our Fed forecast forward into 2025 and now expect three consecutive cuts this year in July, September, and November, which would leave our terminal rate forecast unchanged at 3.5%-3.75%.”

Talking of stimulus, the New York Times reported that Trump may be considering stimulus for the agricultural sector. A combination of fiscal and monetary policy stimulus would lead to a crypto comeback, including the Pepe coin.

READ MORE: Top 4 Crypto to Buy With the Most Bullish Crowd Sentiment