The crypto market is not performing well. Bitcoin and most cryptocurrencies remain in a technical bear market after declining by over 20% from their recent highs. All cryptocurrencies tracked by CoinGecko lost over $1 trillion in value in the first quarter of the year.

BTC, XRP, HBAR, JASMY, and Other Altcoins Crashed

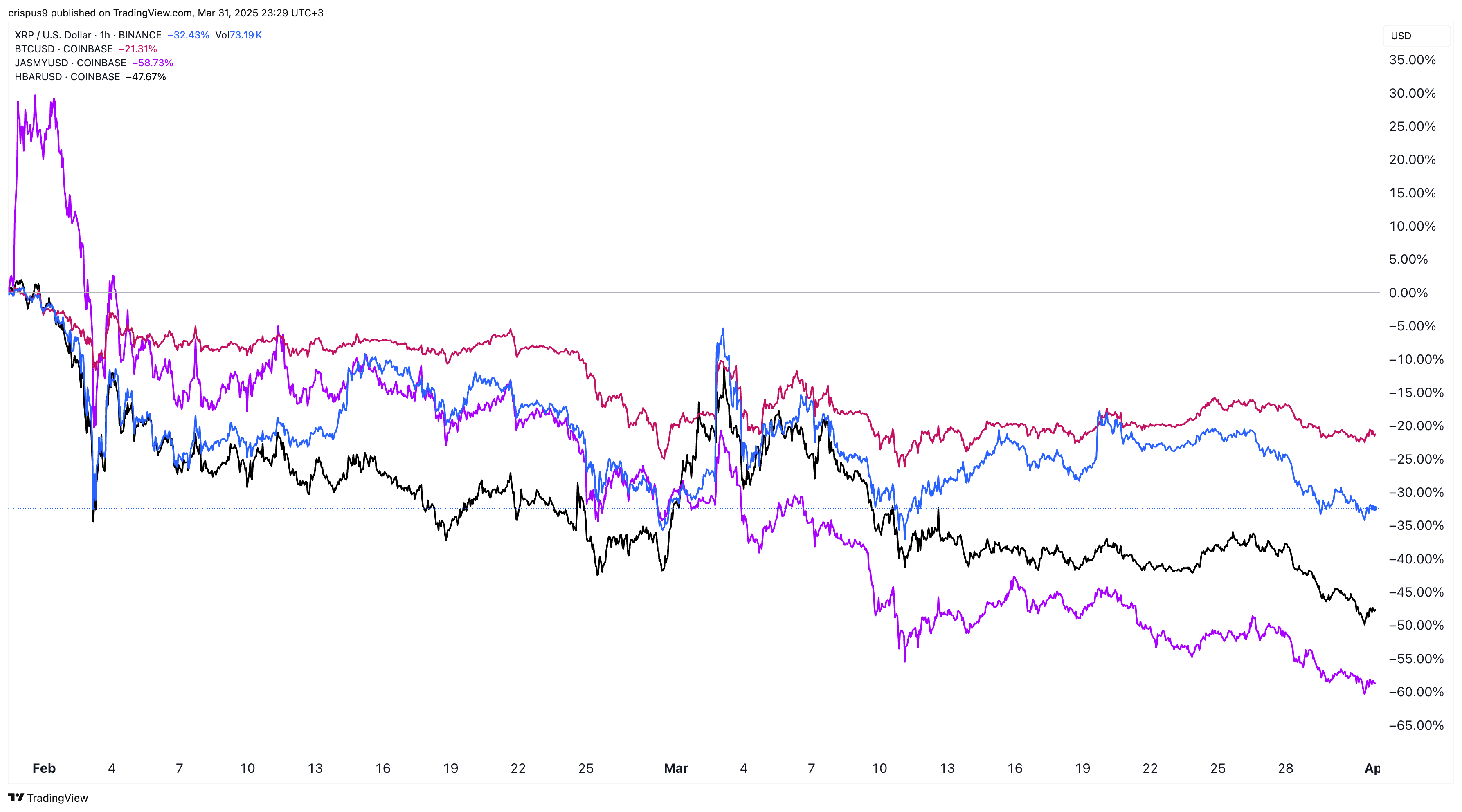

Bitcoin (BTC) has plunged from its all-time high of $109,200 in January to $82,000. Similarly, the XRP price has crashed by over 38% from its 2025 highs, while other popular coins like Hedera Hashgraph (HBAR), JasmyCoin (JASMY), and Ethena (ENA) have plunged by over 50% from their November 2021 highs.

The main reason for the ongoing crypto decline is investor concern over Donald Trump’s economic policies, including government cost cuts and tariffs. In these contexts, the relationship with Elon Musk’s DOGE remains unclear.

He has announced numerous tariffs this year. He imposed a 25% tariff on all imported steel and aluminum last week and a 25% tariff on all vehicles imported to the US.

Trump has also increased tariffs on Canadian and Mexican goods from near zero to 25%. On Wednesday, he will announce his Liberation Day reciprocal tariffs on goods from other countries.

These tariffs are unpredictable and have significant consequences. Due to their implications for the US and the global economy, they are often referred to as a “black swan event.” For one, there is a risk that these tariffs will lead to a recession by affecting consumer confidence. Data released last week showed that consumer confidence plunged in March.

READ MORE: Top 4 Crypto to Buy With the Most Bullish Crowd Sentiment

Impact of Trump’s Liberation Day Tariffs on Bitcoin and Altcoins

In context, the most likely scenario involves these Trump tariffs leading to a strong decline in stocks and cryptocurrencies. Indeed, the S&P 500, Nasdaq 100, Dow Jones, and Russell 2000 indices have moved into a correction. The tech-heavy Nasdaq 100 index has even formed a death cross, indicating a strong bearish breakdown.

Similarly, in the crypto market, currencies like BTC, HBAR, and XRP have entered a bear market.

However, crypto and stocks are likely to rebound when the reciprocal tariffs come into effect. This is because these tariffs might trigger a recession in the US, which can be advantageous for risky assets.

A recession in the US will likely motivate the Federal Reserve to intervene by reducing interest rates and implementing quantitative easing (QE). Quantitative easing is a scenario where the Fed prints cash and buys bonds and mortgage-backed securities.

Historically, Bitcoin and other cryptocurrencies, such as XRP and HBAR, perform well when the Fed reduces rates. A notable example occurred in 2020 when the economy entered a recession following the COVID-19 pandemic.

The Fed’s rate cuts post-Global Financial Crisis (GFC) IN 2009 led to a stock market boom.

READ MORE: Will Ripple Reach $5? Latest XRP Price Prediction Says ‘Probably’