The crypto market has been in a strong sell-off this month as the fear and greed index tumbled to 25. The price of the Pi Network was among the top laggards, plummeting to a low of $0.80, its lowest level since February 2022. It has plunged by over 74% from its peak following the mainnet launch. This article explains the three main reasons why the Pi coin may surge.

Pi Network Price Has Strong Technicals

The four-hour chart shows that the Pi coin price has slumped in the past few weeks as most coins plunged and many holders dumped their tokens. It also dropped amid rising concerns about its dilution as the network is set to unlock over 1.6 billion tokens in the next 12 months.

Still, the value of Pi has bullish technicals, pointing to a surge in the coming weeks. First, there are signs that Pi has formed a double-bottom pattern at $0.7663. This is one of the most bullish reversal patterns in the market in most periods.

Second, analyzing the highest swings since February 25 with the lowest levels since March 2 reveals that it has formed a giant wedge pattern. These two lines are now nearing their confluence levels, pointing to a potential rebound.

Further, the Pi Network has settled at the 78.60% Fibonacci Retracement level. Oscillators like the Relative Strength Index (RSI) and the MACD have formed a bullish divergence pattern.

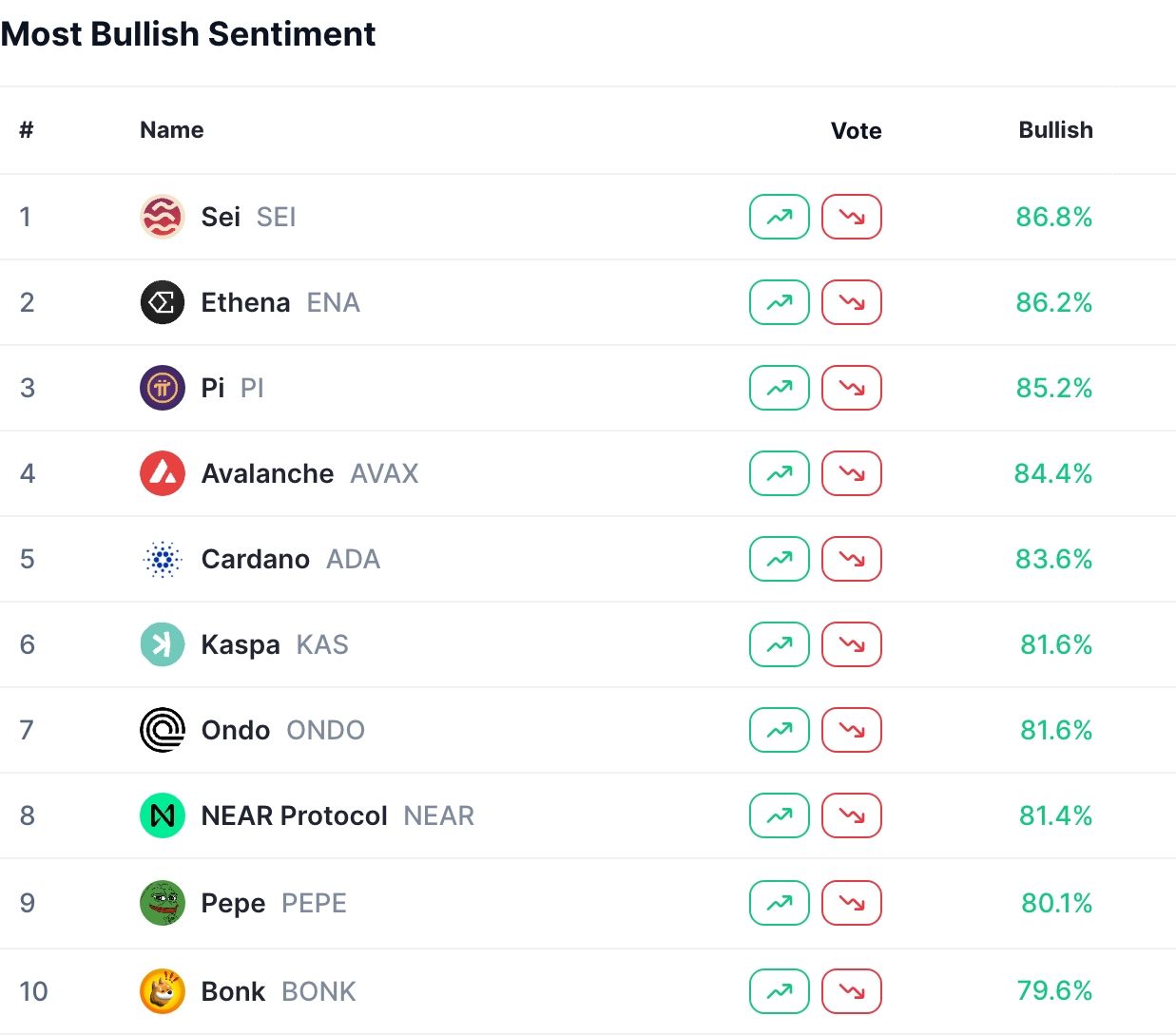

These patterns suggest more upside potential, with the next key level to watch at $1.80, which was its peak on March 13. This price is about 135% above the current level, partially explaining why it is the third most bullish token in terms of sentiment.

Pi Coin Exchange Listings

One reason the Pi coin price has plunged is that centralized exchange listings have remained elusive. Some exchanges, such as Bybit, have cautioned that they consider it a scam, while others have cited weak disclosures.

However, there are signs that some large-scale exchanges will list it in the coming months. Binance users have already voted overwhelmingly to list the coin. With a market cap exceeding $7 billion and a daily volume of over $300 million, Pi ranks among the most widely traded cryptocurrencies. As such, at some point, exchanges will want to join in.

Potential Pi Network Token Burn

One reason the Pi Network price has crashed is the ongoing fear of dilution. There are now 6.7 billion Pi coins in circulation against a maximum supply of 100 billion.

Developers are likely to announce a significant token burn soon. The most obvious burns will be the mined tokens that have not been migrated to the network. Burning these tokens could remove billions of tokens from future circulation.

Pi Network will likely introduce fee burns as its ecosystem applications become more popular in the long term.

READ MORE: Pi Network Price Prediction for April: Will Pi Coin Rise or Fall?