Last week’s slump in crypto markets has decreased memecoin prices, with Solana-based tokens among the most affected. Despite this, Pump.fun’s DEX, PumpSwap, has grown steadily and recently surpassed $2.5 billion in volume.

On Monday, March 24, PumpSwap’s all-time volume reached $2.55 billion, according to Dune Analytics. The platform, launched by Solana-based Pump.fun, reached this figure just 10 days after its launch, showcasing the continued appeal of memecoins.

PumpSwap is a Solana-based decentralized exchange that complements the Pump.fun memecoin launchpad. Its goal is to enable Pump.fun tokens to access liquidity more easily. Previously, these tokens launched on the Raydium exchange after reaching enough volume.

The continued interest in memecoins is also shown in PumpSwap’s user figures. Since its launch, users have registered a total of 729 thousand wallets and performed 32.74 million token swaps. This activity also generated $5.16 million in trading fees for the DEX, as it quickly became one of the most profitable exchanges on Solana.

PumpSwap Metrics On the Rise

These figures are despite a slowdown in the memecoin markets last week, especially for Solana memecoins. Official Trump token lost 13.28% in seven days, Bonk lost 19.49% while Fartcoin dropped 24.38% in the same period. Ongoing uncertainty over the effects of Donald Trump’s tariffs on Bitcoin weighs on all crypto assets.

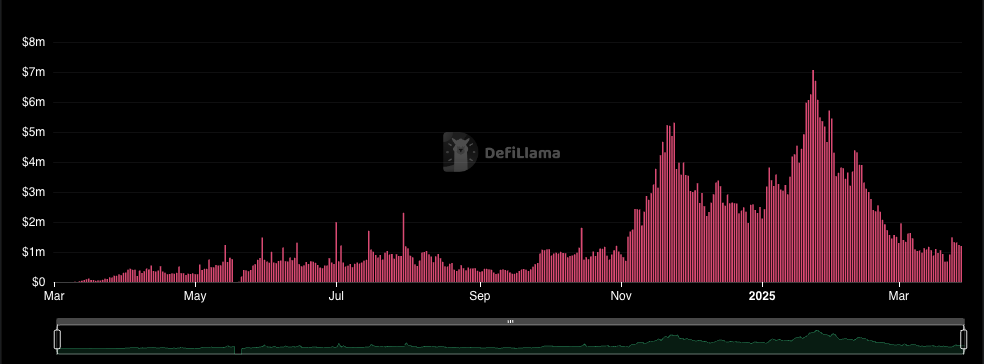

Still, traders continue to engage with small-cap memecoins that launch on Pump.fun and make it to PumpSwap. While daily revenues have dropped to an average of $1 million, down from $7 million in the January highs, this reflects overall market conditions.

Interest in Pump.fun continues despite ongoing criticism of the platform, with some claiming it tolerates unfair practices and outright scams. The platform became notorious since its launch due to a high number of rug pulls and abandoned projects.

The most high-profile of these incidents involved the Libra token, which collapsed after reaching $4.5 billion in market cap. More recently, the platform became the target of a lawsuit, which alleged the prevalence of pump-and-dump schemes and a lack of investor protections.

READ MORE: TRON Price Gears Up for Breakout as On-Chain Activity Surges