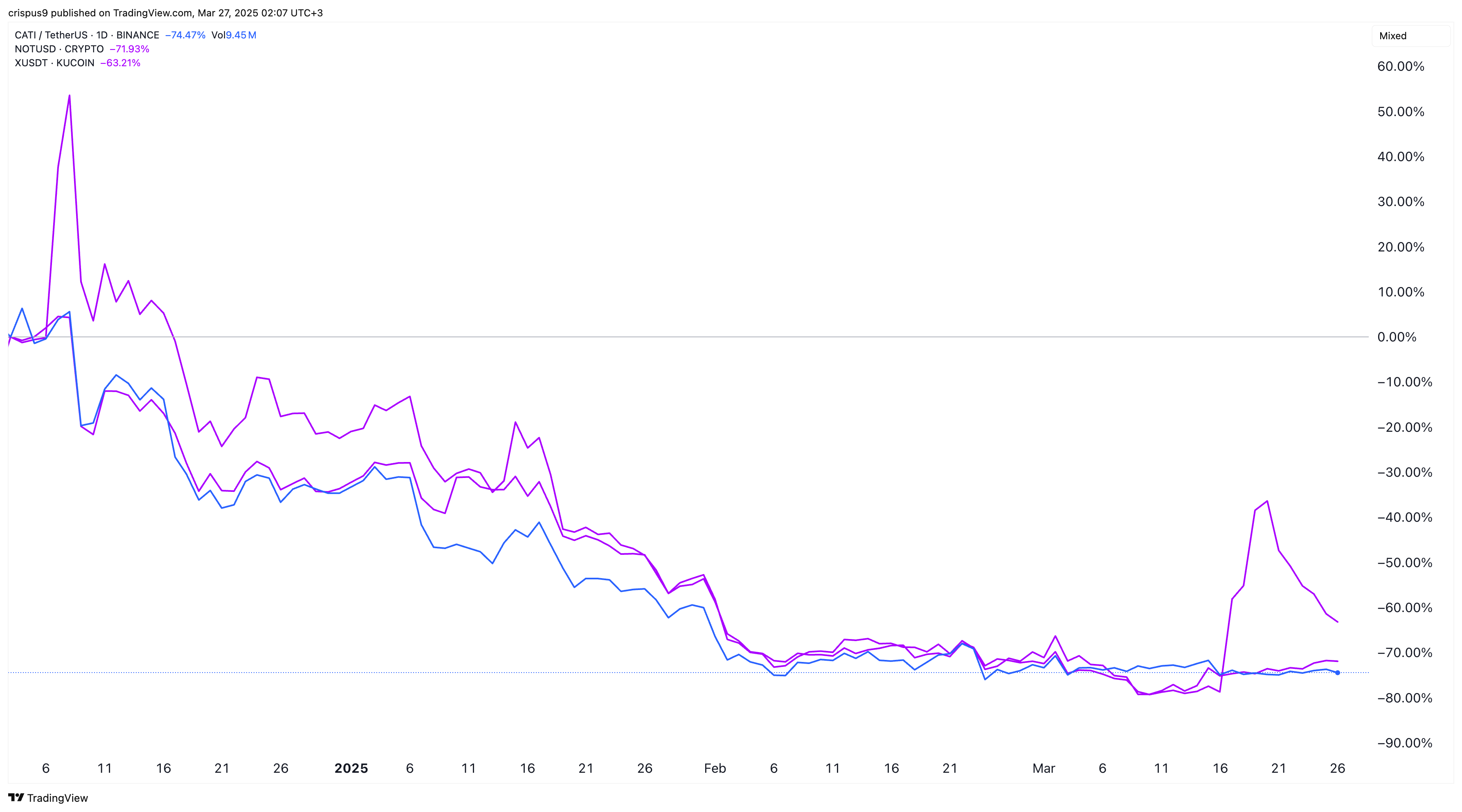

Telegram tap-to-earn and play-to-earn tokens have not lived up to their hype, with most of them being over 80% lower than their all-time highs. The Notcoin price plunged to $0.002640, down by over 90% from its highest point in 2024.

Similarly, Catizen’s price has dropped 87% from its all-time high, while X Empire and Blum prices have tumbled by over 80%. Other popular Telegram tokens like Tapswap, Yescoin, and Dotcoin have also plunged.

Why Notcoin, Catizen, X Empire, and Blum Crashed

There are three main reasons why these tap-to-earn tokens have plunged. First, while the “to earn” model has been hyped over the years, history shows it does not work well. This also explains why play-to-earn tokens like Decentraland (MANA), Gala Games (GALA), and Axie Infinity (AXS) have also plunged.

The same happened in other “to earn” sectors. Most notably, move-to-earn tokens like Sweat Economy and StepN have plunged from their all-time highs.

One reason for this is simply that many players of these tap-to-earn and play-to-earn games have a short-term outlook. In this context, their goal is to play the games, accumulate as many tokens as possible, and then convert them into fiat currencies after the token-generation event.

This explains why these tap-to-earn and play-to-earn tokens have become largely inactive chains with few players.

TON Blockchain Challenges

The other main reason tap-to-earn tokens like Notcoin, Catizen, X Empire, and Blum have crashed is that most of them were launched on the TON Blockchain. Indeed, a new Telegram rule is that all apps on the network must be built on the TON Blockchain.

The TON Blockchain ecosystem is less popular among users and developers than Solana, BNB Chain, and Ethereum. The network has only one major DEX, STON.fi, and its volume is usually limited. It has processed just $297 million in the last 30 days, while Berachain and Sonic handled over $2 billion in the same period.

Ongoing Crypto Crash

Tap-to-earn tokens like Notcoin, Hamster Kombat, Catizen, and Blum have also dropped because of the ongoing crypto crash. Cryptocurrency prices across all subsectors have declined significantly in recent months.

Bitcoin’s price has moved into a bear market after hitting a record high in January. Tokens in industries like meme coins, layer-1, layer-2, and DeFi plunged this year.

So, will these tokens bounce back? If the crypto market recovers, they are likely to bounce back later this year.

READ MORE: Toncoin Price Shows Strong Bullish Momentum: Can It Reach $100?