Since Donald Trump’s election, crypto has rapidly become mainstream in investment circles. The latest example is a major brokerage firm, Interactive Brokers, expanding its crypto offerings. Namely, it will now add Solana (SOL), Cardano (ADA), XRP, and Dogecoin to its platform.

On Wednesday, March 26, online trading platform Interactive Brokers expanded its crypto offerings. Simultaneously, Interactive Brokers added Solana, Cardano, XRP, and Dogecoin, which are associated with Donald Trump’s crypto reserve plans.

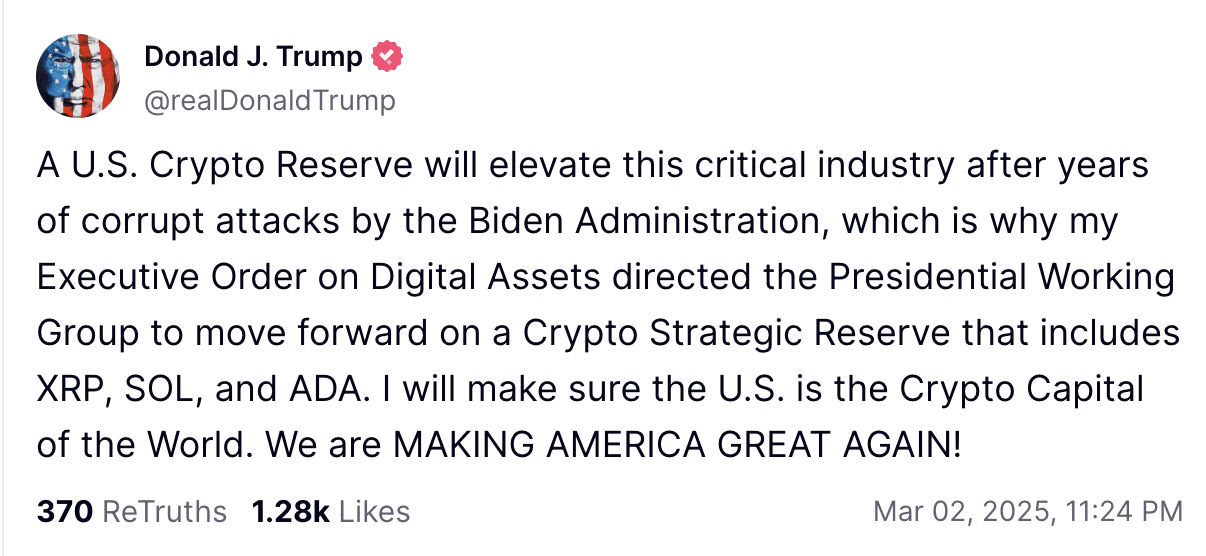

For one, Trump included Solana, Cardano, and XRP in his plans for a crypto reserve. At the same time, Elon Musk, who is closely associated with Trump’s administration, has been a major promoter of Dogecoin.

Why Interactive Brokers Added Solana, Cardano, XRP, and Dogecoin

So far, the platform has offered Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Bitcoin Cash (BCH) through a partnership with Paxos. This expansion effectively doubles the number of crypto assets available on its platform.

The original offering included less risky tokens from a regulatory compliance standpoint. Notably, former Securities and Exchange Commission (SEC) Chair Gary Gensler stated that he did not consider some proof-of-work tokens, like Bitcoin, as securities. However, the new administration has significantly shifted crypto policy.

This applies specifically to the tokens Trump mentioned in his crypto reserve announcement. This move could be understood as an official stamp of approval for these assets. Additionally, Trump is involved in crypto ventures personally through World Liberty Financial.

Interactive Brokers operates the largest digital trading platforms in the US, processing an average of 3 million daily trades. Unlike platforms like Robinhood, which are more retail-oriented, Interactive Brokers caters to sophisticated traders. These traders also command more capital, potentially increasing token liquidity.

Despite the announcement, these specific altcoins have declined over the last 24 hours, with Solana down 4.85%, XRP 3.05%, Cardano 2.52%, and Dogecoin 4.77%.

READ MORE: MOVE Price Rises 23% in 24 Hours as Bitso Enters Stablecoin Market