The Solana price is on the verge of a big breakdown as the network fees drop. After rising to nearly $300 earlier this year, the coin dropped to $129 and has hovered near its lowest level since September 18 last year.

Solana Chain Fees Have Plunged

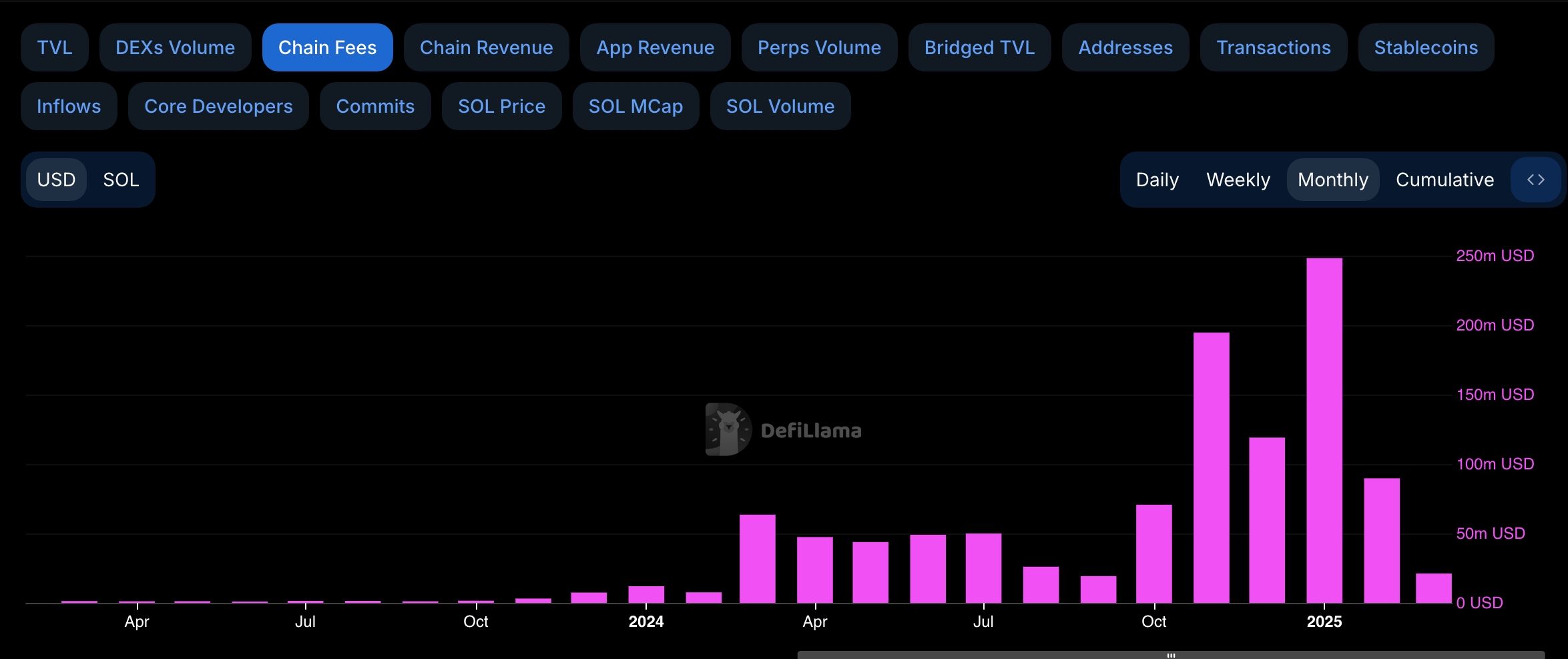

Data compiled by DeFi Llama shows that the fees generated in the Solana ecosystem have dropped sharply this year.

Solana has earned just $21 million this month, its worst performance since October last year. This is a big drop from the $90 million it earned in February and the $250 million it earned in January this year. Cumulatively, Solana has generated over $1.2 billion in fees.

Solana’s fees have gone down because of the ongoing meme coin crash. According to CoinGecko, the market value of all meme coins in the ecosystem has dropped from over $30 billion in January to $7.7 billion today.

In January, several meme coins had a market cap of over $1 billion. Today, only Official Trump has a valuation over that milestone. TRUMP has a valuation of $2.2 billion, down from over $14 billion after its launch.

There are concerns that the Solana meme coin ecosystem has peaked, with many participants accusing it of numerous rug-pull scams. This occurred after many meme coins were launched, soared, and then crashed as insiders cashed out.

More data shows that the number of transactions on Solana has continued to fall this year. On March 21, the network handled 43.5 million transactions, down from the year-to-date high of almost 77 million.

Solana’s revenue crash has also coincided with the drop in its DEX volume. The network handled $38 billion in DEX volume this month, down from $258 billion in January. This decline has affected popular DEX networks like Raydium, Orca, and Meteora in its ecosystem.

Solana Price Technical Analysis

There are signs that the SOL price may have a bearish breakdown soon. The chart above shows that it has formed a bearish flag pattern, a popular bearish continuation signal. This pattern consists of a vertical line and a consolidation. It resembles an upside-down hoisted flag.

The Solana price has remained below all the moving averages, while most oscillators like the RSI and the MACD have pointed downwards. Therefore, a drop below the key support at $120 will increase the likelihood of Solana’s price falling towards $100.