The price of Litecoin has crashed in the past few weeks as the hype surrounding the potential LTC ETF has diminished. On Friday morning, LTC coin was trading at $92.85 and is hovering near its lowest level since February. It has dropped by over 37% from its highest point in November last year.

Key On-Chain Metrics Sending Mixed Signals on LTC Price

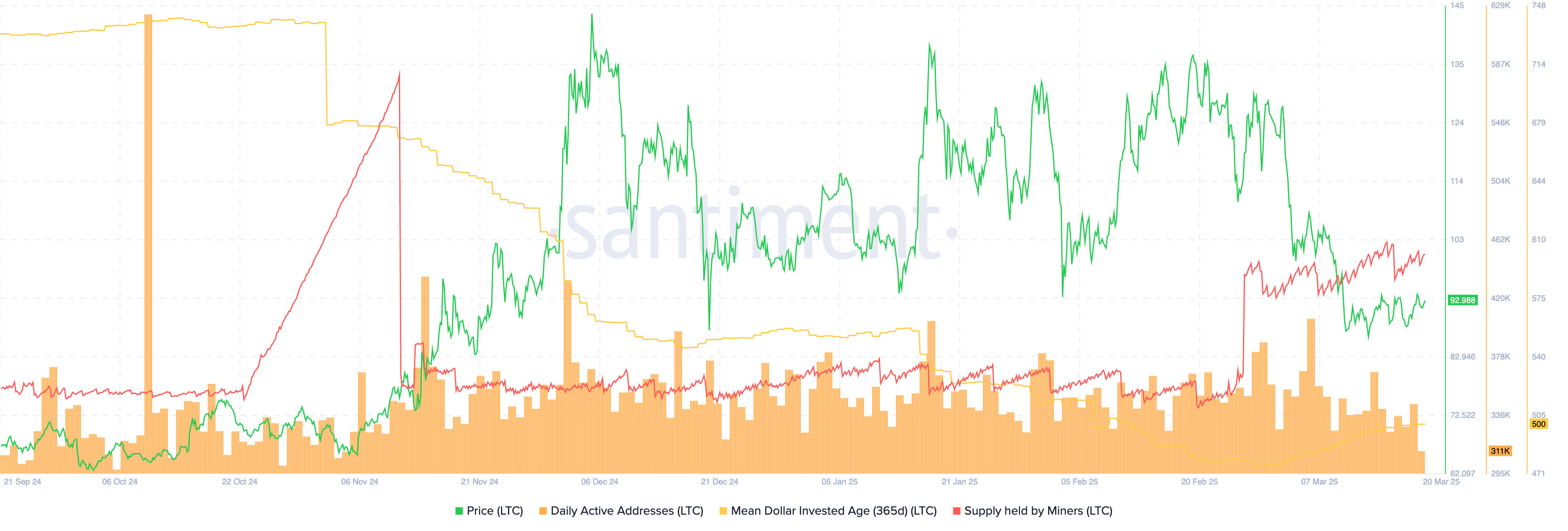

The price of Litecoin has crashed as the number of active addresses has continued to fall. Data by Santiment shows that the number of active addresses in the last 365 days has dropped to 311k from a high of 401k earlier this year. That is a sign that a good number of investors, potentially retail ones, have continued selling their tokens this year.

However, on the positive side, the 365 Mean Dollar Invested Age (MDIA) has risen gradually after bottoming in February. The MDIA is an important metric that calculates how long each Litecoin has stayed in its current address. It establishes the average age of the cash used to buy the coin. A rising MDIA is a sign of increased accumulation by investors.

More data shows that the number of Litecoin tokens held by miners has continued to rise. Miners now hold over 530k coins, up from a low of 520K in February. Miners holding more coins is positive because it signals low selling pressure.

Meanwhile, the likelihood that the Securities and Exchange Commission (SEC) will approve numerous spot LTC ETFs this year is increasing. The odds have soared to over 75% as many users draw parallels between Litecoin and Bitcoin.

The SEC approved spot Bitcoin ETFs in 2024, leading to over $40 billion in inflows. Litecoin is similar to Bitcoin in that it is a proof-of-work coin with no staking features. As such, there is no reason for the agency not to approve these funds.

Litecoin Price Technical Analysis

Technicals suggest that the price of Litecoin may be at risk. The coin has dropped below the important support level at $112.75, its highest swing on April 1, 2024.

It is slowly forming a bearish flag chart pattern, comprising a long vertical line and some consolidation. This pattern is one of the most bearish ones in the market.

Litecoin is about to form a death cross as the spread between the 50-day and 200-day Weighted Moving Averages (WMA) narrows. Historically, a death cross has led to a major bearish breakdown. A further downside will be confirmed if the Litecoin price drops below the key support level of $80.75, marking its lowest point this year.

READ MORE: Litecoin Price Prediction: Is LTC On the Verge of a Parabolic Move?