Dogecoin price remained in a tight range on Tuesday as the crypto market focused on the upcoming Federal Reserve meeting. DOGE also wavered as on-chain data showed that the number of daily active addresses had crashed recently. It was trading at $0.1745, a few points above its lowest point this year.

DOGE Active Addresses and Transactions Crash

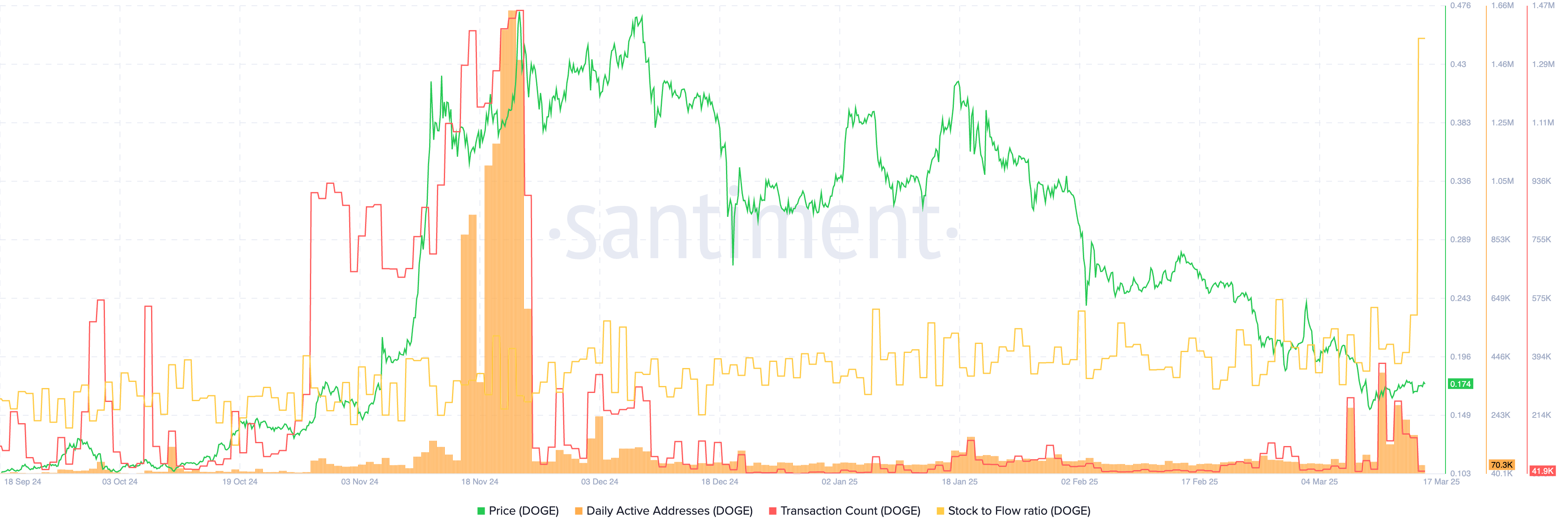

Data by Santiment shows that daily active addresses have dropped sharply recently.

The daily addresses crashed to just 70.3k on Tuesday after soaring to over 355k last week, indicating a decline in momentum. Similarly, the number of DOGE transactions has continued falling recently, moving to just 41k, down from last week’s high of 374k.

On the positive side, Dogecoin’s stock-to-flow ratio has surged to the highest level in months. That is a sign that DOGE is becoming scarcer as the number of tokens entering circulation is smaller than those in circulation.

READ MORE: Dogecoin and Dogelon Mars Prices at Risk as Tesla Stock Implodes

The falling number of addresses and transactions is a sign that investors and DOGE holders are staying on the sidelines as the coin remains in a bear market. Historically, these metrics usually drop when a crypto coin is steeped downward.

The next important catalyst for the DOGE price is the upcoming Federal Reserve meeting, which kicks off its two-day meeting on Tuesday.

The Federal Reserve meeting comes as the U.S. stares at a self-inflicted recession because of Donald Trump’s policies like tariffs and reduced government spending. This performance means that the SEC may embrace a more dovish tone in this meeting, which could boost the DOGE price because it could encourage investment in riskier assets, including cryptocurrencies like DOGE.

The other potential catalyst for the DOGE price is the rising odds that the SEC will approve a DOGE ETF. These odds have jumped to 73%, a trend that may keep rising now that the agency has been more open to the crypto industry. Besides, Dogecoin is similar to Bitcoin because it is a proof of work (PoW) token.

Dogecoin Price Forecast

DOGE chart by TradingView

The daily chart shows that the DOGE price has been in a strong bearish trend in the past few months. It has formed a falling wedge pattern, which is made up of two descending and converging trendlines.

These lines are now close to converging, indicating a potential upside in the coming days. Such a move will lead to more gains, potentially to the resistance level at $0.25, about 45% above the current level. A drop below the year-to-date low of $0.1446 will invalidate the bullish view.

READ MORE: 3 Reasons Why Dogecoin Price May Not Hit $1 in 2025