As crypto markets continue to struggle, exchanges are among the most affected. Coinbase is no exception, as its stock is down more than 50% from its yearly highs. Nevertheless, the news for the Coinbase stock has lately been positive, which has contributed to a slight rebound. Moreover, analysts believe that there is significant upside potential for COIN.

On Friday, March 14, Coinbase stock was up 3.65%, reaching 183.95. This follows a rebound in crypto prices, with Bitcoin rising 5.1% to $84,754 in the last 24 hours. However, the latest positive momentum still puts COIN down 25% year over year, and far below its highs in February.

Since February this year, when the COIN stock reached a high near $300, the stock lost more than 50% of its value. This is despite overwhelmingly positive regulatory news and growing adoption. For this reason, Nansen believes that Coinbase is significantly undervalued.

Is Coinbase Stock (COIN) Undervalued?

According to Nansen, recent stock declines are due to a mix of stock market trends and Coinbase’s declining revenues. For one, stocks continue to contract due to fears over a potential US trade war with its major partners. At the same time, declining crypto prices are hurting Coinbase’s bottom line, which Nansen expects will contract by 14% in the first quarter of 2025.

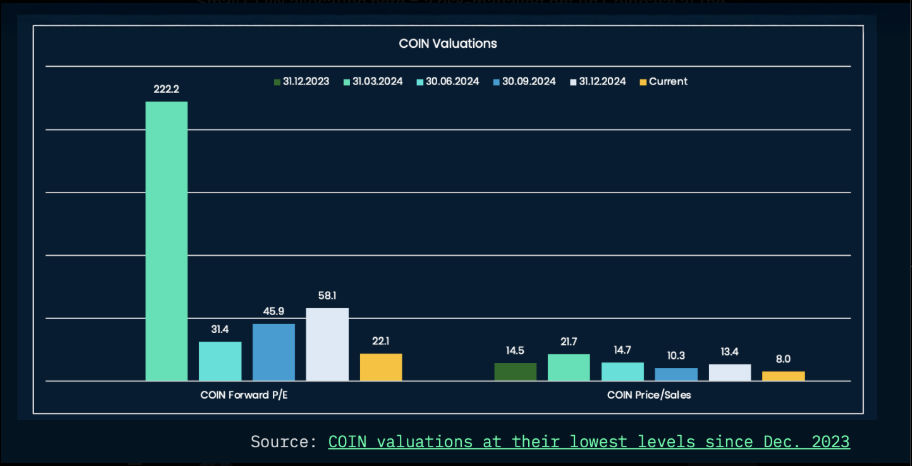

Nevertheless, the long-term outlook for the Coinbase stock (STOCK) is much more positive. While its revenues are highly volatile, with over 60% coming from crypto trading, Coinbase remains very profitable. Its profit margins are 40%, comparable to tech giants like Google and Meta. At the same time, key indicators, including Price-to-Sales and Price-to-Earnings (P/E), are at their lowest levels in years.

The regulatory outlook is also improving significantly. The Securities and Exchange Commission (SEC) has dropped its case against the exchange, eliminating a major source of uncertainty. The new pro-crypto US administration is also much more favorable to crypto exchanges.

This applies especially to Coinbase, the largest US-based centralized exchange. For this reason, Nansen believes there is a reasonable argument for betting on Coinbase’s potential to become a major crypto hub.

READ MORE: Crypto Prices Today: Why Banana Gun, Fartcoin, PNUT, Virtuals are Soaring