The crypto fear and greed index moved to the greed zone on Monday as Bitcoin’s consolidation gained steam. BTC price remains below $95,000, while the total market cap of all coins dropped to $3.18 trillion. Some of the top cryptos to watch this week include Pi Network (PI), Mantra (OM), and Maker (MKR).

Crypto to Watch This Week

The cryptocurrencies to keep an eye on this week include Pi Network, which launched its mainnet last week; Mantra, which has seen a surge in momentum; and Maker, the popular DeFi network.

Pi Network (PI)

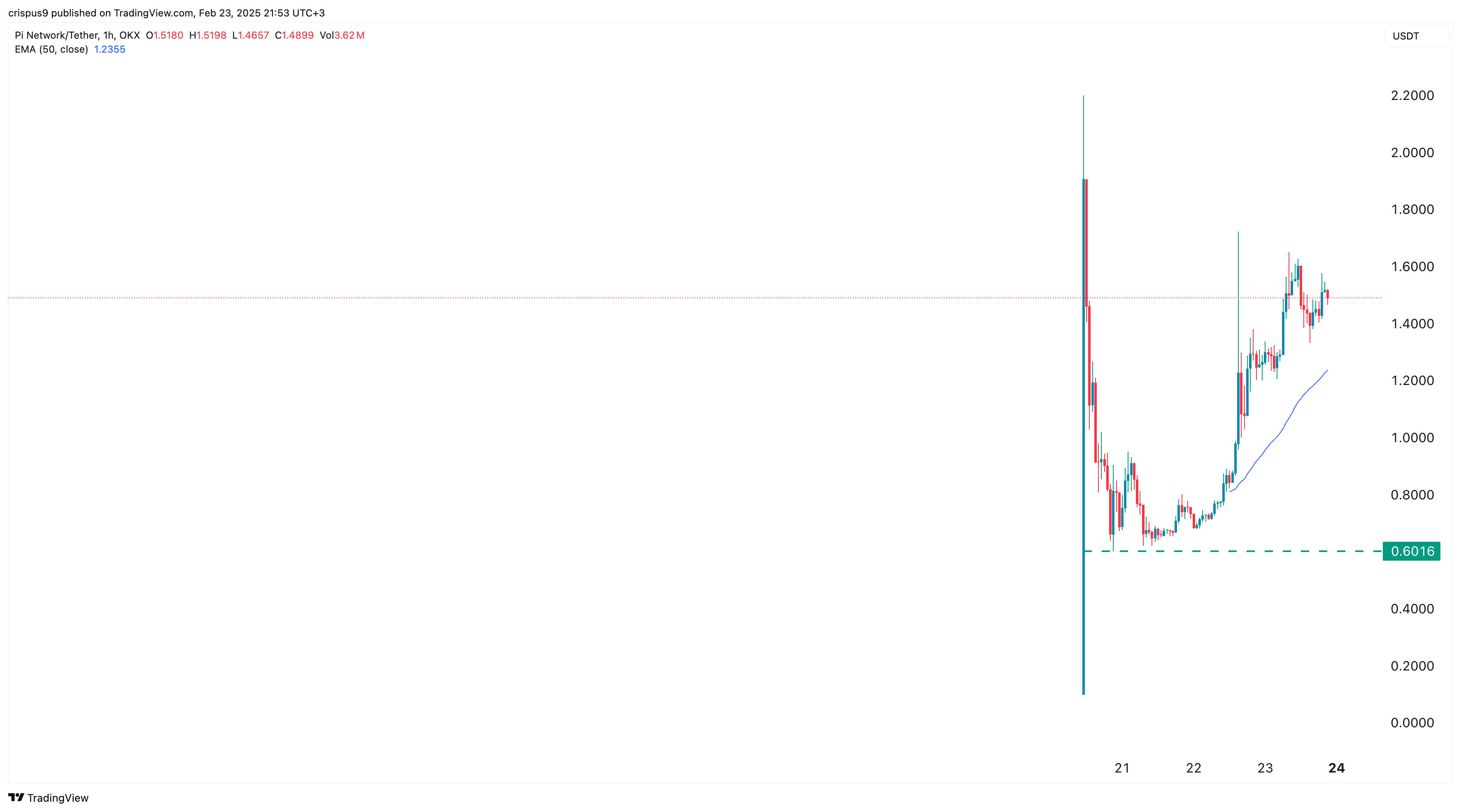

The Pi Network launched its mainnet last week, leading to an initial pop followed by a crash. It plunged to a low of $0.60, erasing billions of dollars in value. This crash occurred as many pioneers sold their coins, and sentiment in the crypto industry worsened. It also dropped after being labeled a scam by Bybit’s CEO before his exchange was hacked.

Pi Network has now bounced back and is trading at $1.50, a few dollars below the psychological level of $2. This rebound could gain momentum this week as Binance, the leading crypto exchange, considers listing it. The company has been running a poll on whether to list it, with most people voting in favor.

A Binance listing would be a significant development for the Pi Network because of Binance’s strong market share in the crypto industry and the fact that it has over 250 million registered users globally. The listing may also prompt other exchanges like Crypto.com and Coinbase to list it.

As the Pi Network price forms a series of higher highs and higher lows, there is a likelihood that it will rise to $2.2.

READ MORE: “Pi Network vs Bitcoin: Will Pi Coin Dethrone BTC as the Crypto King?”

Mantra (OM)

Mantra is another top crypto to watch this week due to its recent strong performance. OM has been in a strong upward move in the past few months, rising from below $1 in 2024 to nearly $10 today. This surge happened as demand for the Real World Asset (RWA) tokenization industry increased.

Still, there are three risks why the Mantra price may retreat in the coming weeks, especially when it tests the crucial resistance at $10. Historically, crypto assets usually drop after retesting an important resistance level.

Additionally, Mantra has become highly overbought and has deviated substantially from moving averages. That indicates that the Mantra price may retreat sharply as part of a mean reversion. It may also decline as it enters the distribution phase of the Wyckoff Theory.

Maker (MKR)

Maker, the leading DeFi protocol on Ethereum, has soared for the last seven consecutive days and is hovering at its highest level since January 7. This rally occurred as the network’s revenue, now known as Sky, jumped to $50 million this year, making Maker one of the most profitable players in the DeFi industry.

Maker’s price has jumped above the 50-day moving average after forming a double-bottom pattern at $1,000. Therefore, there is potential for further upside as bulls target the neckline at $2,427, up by about 55% from the current level.

READ MORE: 2 Risks May Crash Bitcoin, Cardano, Polkadot, Pepe, and Altcoin Prices