The crypto markets have recently seen bearish momentum, with altcoins being hit the hardest. Despite dropping to $94,000, Bitcoin retained and expanded its dominance. Still, analysts are seeing several signs of an upcoming altcoin season in the charts.

On Monday, February 24, Bitcoin’s dominance in the crypto market rose 1.15%, reaching 61.58% of the total crypto market cap. This comes as many major altcoins posted significant losses in the same period, continuing weekly declines.

For instance, both Ethereum and XRP dropped 5% on Monday, as well as 4.5% and 9.6% last week, respectively. Solana was down 8.9% daily and nearly 16% over seven days, while Cardano decreased 6.5% daily and 12.5% weekly.

In comparison, Bitcoin only dropped 1.1% and currently trades at $94,106. This continues the trend of increasing Bitcoin dominance since December. Specifically, Bitcoin’s dominance has risen from less than 55% to its current level of 61% during that period.

Despite this trend, analysts have suggested that there is a significant sign of reversal. Notably, one analyst stated that the altcoin season has already started.

Bitcoin Headed for a Dip as Altcoin Season Starts

Last week, Crypto Quant founder and CEO Ki Young Ju suggested that the altcoin season already started. However, he suggested that traders look at volumes instead of dominance by total market cap.

The lack of Bitcoin-to-altcoin rotation further strengthens the case for trading volumes. This means that traders no longer buy Bitcoin when their tokens are down.

According to Young Ju, this is a result of Bitcoin gradually drifting away from the crypto ecosystem. While Bitcoin appeals to institutional traders, crypto native investors still dominate altcoins. These traders are now driving volume, with altcoin volumes currently being 2.7 times bigger than Bitcoin’s.

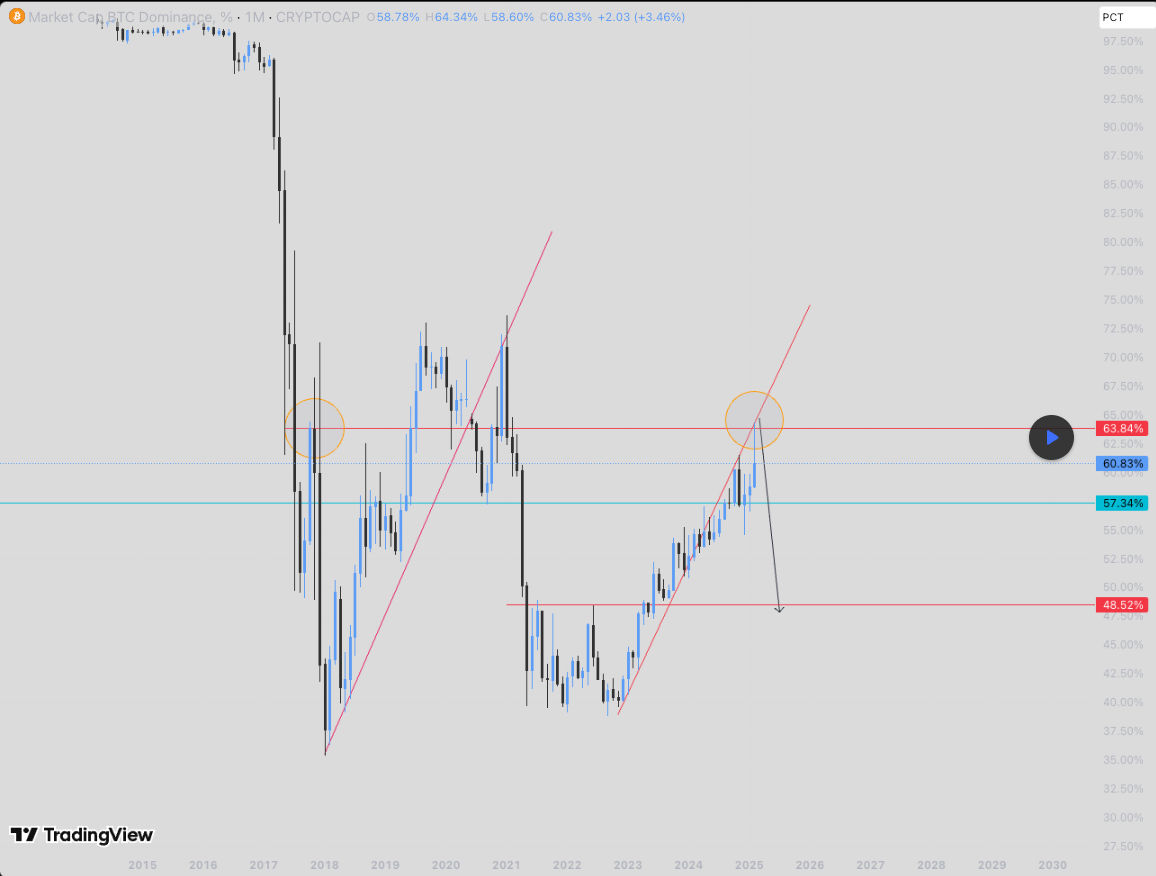

There are also signs that Bitcoin is reaching a critical point where it could see a major drop. One trader noted that Bitcoin’s dominance is approaching a historical resistance level, which was first observed in 2017.

At the same time, Bitcoin’s price, forming a wedge pattern, is reaching a critical level near its confluence point. This suggests a potential for significant volatility in the coming days.

READ MORE: 2 Risks May Crash Bitcoin, Cardano, Polkadot, Pepe, and Altcoin Prices