The crypto market has seen a major bearish turn, with most assets in the red. Solana (SOL) was among the most affected, taking a major hit. Troubles in Solana’s memecoin sector saw investors opt for safer bets, including Ethereum.

On Tuesday, February 18, Solana dropped to $163.77, its lowest level since November 2024. Currently trading at $168.00, it is down 8.48% over the past 24 hours. Now, traders are asking how fast the Solana price can recover or how low it can drop before it bounces back.

Unfortunately, short-term technical indicators don’t paint a rosy picture. For one, Solana fell from its critical support level at $180 after defending it both in December and January. Some traders interpret this as a sign that Solana will likely fall to its pre-November levels. Notably, the next key support levels are around $140 and then at $120.

Whether or not Solana maintains these support levels will depend on market sentiment around a few key narratives. A key narrative is trader fatigue with memecoins and competition from other players.

Overreliance on Memecoins Backfires for Solana

Last year, Solana cemented its position as the leader in the memecoin space. It dominated both the total number of memecoin launches and high-profile cases. Celebrities and politicians, including Donald Trump, also launched their memecoins on the Solana blockchain.

The main reason for Solana’s dominance was the popularity of Pump.fun. This platform makes it very easy to launch memecoins, meaning almost everyone can do it. However, this accessibility also comes with costs, as it has led to low-effort launches and outright scams.

One recent example is LIBRA, which rose to $4.5 billion in market cap after getting an endorsement from the Argentine president Javier Milei. However, hours later, it crashed by 95%, leading to rug-pull accusations against Milei.

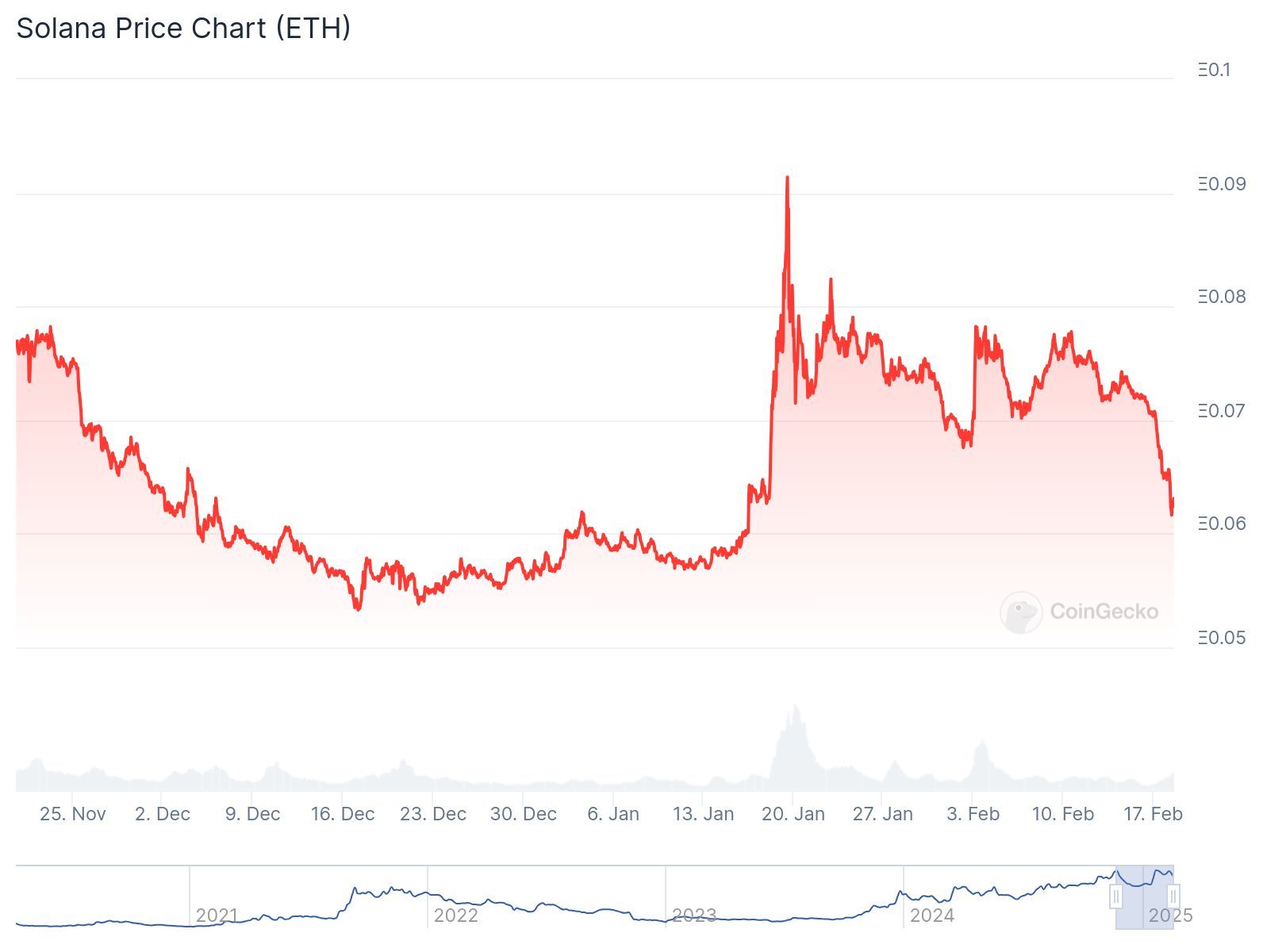

Cases like these make traders increasingly skeptical of Solana memecoins, who opt for safer bets, including Ethereum. Notably, after the LIBRA scandal, SOL’s price relative to Ethereum dropped to 0.06317, its lowest point since January.

Unless the narrative around its memecoins changes, SOL is unlikely to bounce back any time soon.

READ MORE: Melania Team Exposed As Owners of Libra Token in Latest Investigation