Pepe coin prices have plunged in the past two months, and two chart patterns point to further downsides in the near term.

The token crashed to a low of $0.00007950 on Monday, down by over 70% from its highest in December. So, what next for the third-biggest memecoin in crypto?

Pepe Coin Price Analysis: At a Significant Risk

The daily chart shows that the Pepe price peaked at $0.00002837 in December and then dropped by over 70% to the current $0.00001050. This crash happened as the coin formed a head and shoulders chart pattern, a popular bearish sign in the market.

The coin is about to form a death cross pattern when the 50-day and 200-day Weighted Moving Averages (EMA) cross. The two lines are nearing this crossover, which may lead to more downside in the near term.

Pepe’s price has also crashed below the 61.8% Fibonacci Retracement level, where assets tend to rebound in most cases. Pepe has also moved below the significant S/R level of the Murrey Math Lines tool.

Therefore, the token will likely continue falling as bears target the next key reference level at $0.000050, down by about 50% below the current level.

However, a move above the 50% Fibonacci Retracement point at $0.00001465 will yield more gains soon.

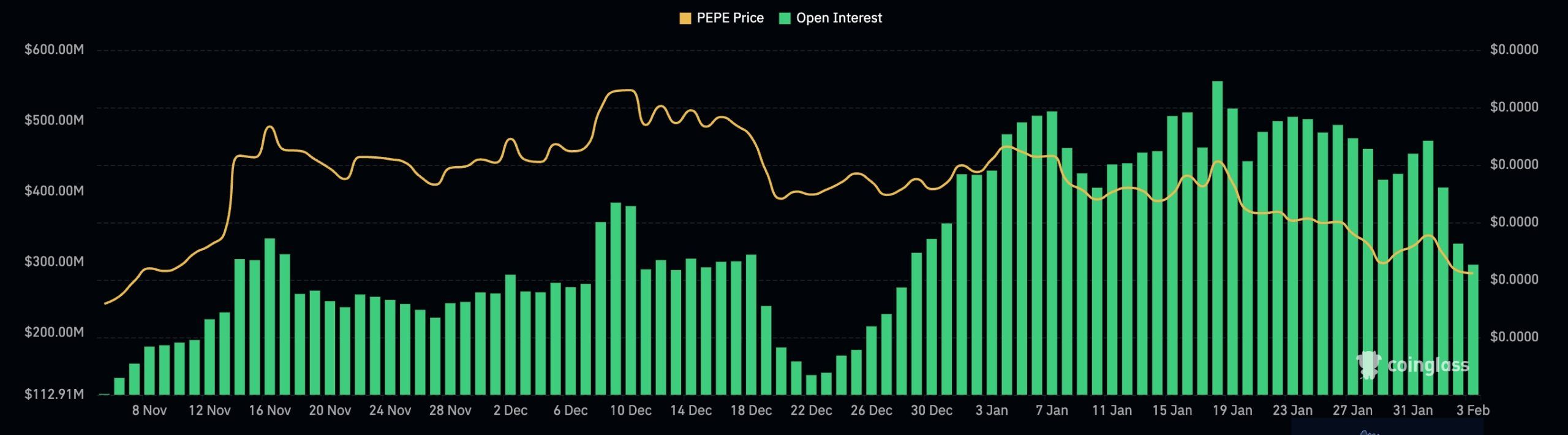

Pepe’s Open Interest Falls

The ongoing Pepe coin price crash coincided with the retreat of futures open interest. According to CoinGlass, Pepe’s open interest slipped to a low of $296 million on Monday, down from the year-to-date high of over $556 million.

Pepe has also dropped because of the ongoing demand for Solana memecoins instead of Ethereum ones. Some of the best-performing tokens this year are in the Solana ecosystem and include the likes of Official Trump, Bonk, Fartcoin, and Gigachad.

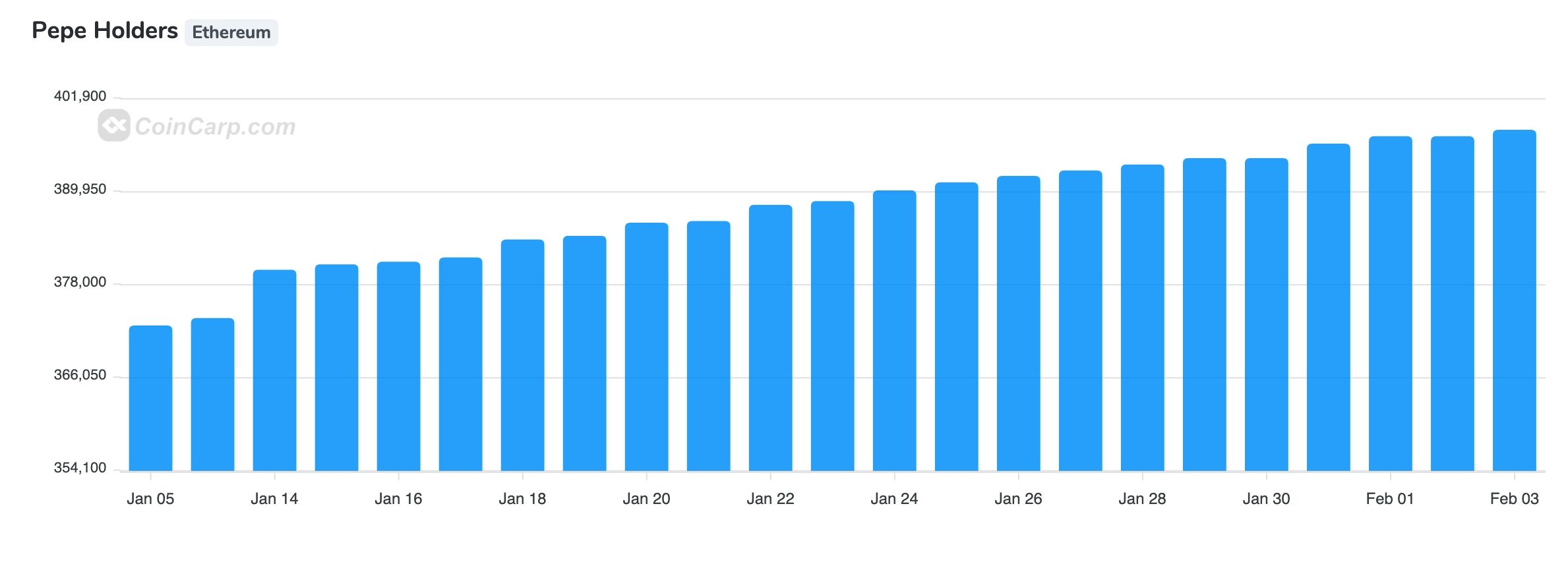

Still, on the positive side, there are signs that Pepe’s demand is rising in the spot market. Data from CoinCarp shows that the number of Pepe holders has continued to rise. It moved to almost 400k, up from 372,000 on the same day last month.

Pepe’s spot market volume is still high. Its 24-hour volume was $3.5 billion, higher than Shiba Inu’s $1.5 billion and Dogecoin’s $11 billion.

READ MORE: DWF Labs launches Trading Services for Cryptocurrency Options